Chapter 6 - Comparison and Selection among Alternatives

advertisement

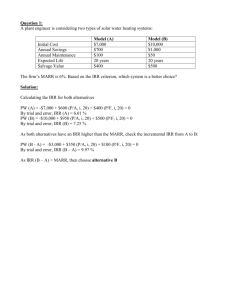

Chapter 6 - Comparison and Selection among Alternatives SEEM2440A/B 1 Comparing Alternative Projects In Chapter 5, we learned how to evaluate the economic profitability (acceptability) of a single alternative using various measures (PW, AW, FW, IRR, ERR). In Chapter 6, we will learn how to use these profitability measures to evaluate and compare multiple alternatives. If we have mutually exclusive alternatives, then we need to compare the alternatives against each other, and we can select at most one alternative. (Do-nothing may be an implicit alternative.) If we have independent alternatives, then we need to compare each alternative separately against the do-nothing alternative and decide whether it is acceptable or not. We can select more than one alternative. We will focus on mutually exclusive alternatives. SEEM2440A/B 2 Example 6.1: A company is considering two investment alternatives (A and B) with the following cash flows: Investment Revenue next year A 10,000 12,500 B 50,000 61,500 Suppose that the company uses an MARR of 20% and there is no budget restriction. If the alternatives are mutually exclusive what should the company do? Let’s find the PW and IRR of each alternative. IRR PW A 25% 416.67 B 23% 1,250 IRRA =25%≥ 20%, IRRB =23%≥ 20%, both alternatives are profitable. A has higher return. PW(MARR)B ≥ PW(MARR)A ≥ 0, both alternatives are profitable. B has higher present worth. Which one to select? SEEM2440A/B 3 Remember the fundamental goal of capital investment: You should invest an additional dollar only if it can obtain at least the MARR. So, if the investment of the additional dollar has a PW(MARR) greater than or equal to 0, then it is acceptable. Alternative B requires higher investment and produces higher revenue. Does this additional (incremental) next year’s revenue of $61,500-$12,500=$49,000 economically justify the additional (incremental) investment of $50,000-$10,000=$40,000 now? Find the PW(MARR) of the difference (∆(B − A)): PW(MARR)∆(B−A) =-40,000+49,000(P/F,20%,1)=833.3≥ 0. So, it is justified. The company should select alternative B. If we made the decision based on maximizing IRR, then the conclusion would have been wrong! We will learn how to correctly use the IRR method to identify the best alternative later on. SEEM2440A/B 4 Types of decisions: 1 Investment alternatives Each investment alternative requires initial investment and produces positive cash flows (revenues, savings, etc). Unless specified, we will assume there is an option of not choosing any alternative, i.e., “do nothing". 2 Cost alternatives Each cost alternative has only negative cash flows except possibly the salvage value. You must choose one of the alternatives, i.e., no “do nothing" option exists. SEEM2440A/B 5 Study period and useful lives of alternatives: Study period is the time period over which the comparison of alternatives is made. Case 1. Study period=useful life (of all alternatives) Case 2. Study period6=useful life (of at least one alternative) Rule: Compare mutually exclusive alternatives over the same period of time. SEEM2440A/B 6 Case 1: Study period=useful life We will use two different methods: Equivalent-Worth (EW) methods (PW, AW, FW) and Rate-of-Return methods (IRR). Equivalent-Worth methods: Procedure to find the best alternative using the equivalent-worth methods: 1 Find the equivalent worth (EW) of each alternative at i%=MARR. 2 Investment alternatives: select the alternative with the greatest positive equivalent worth. 3 Cost alternatives: select the alternative with the least negative equivalent worth. SEEM2440A/B 7 Remark: PW, AW, FW are equivalent measures of project acceptability (Chapter 5) because of the equivalency relationships: AW=PW(A/P,i%,N), AW=FW(A/F,i%,N), FW=PW(F/P,i%,N), etc. If PW(i%)A <PW(i%)B , then PW(i%)A (A/P,i%,N)<PW(i%)B (A/P,i%,N)⇒ AW(i%)A <AW(i%)B and PW(i%)A (F/P,i%,N)<PW(i%)B (F/P,i%,N)⇒ FW(i%)A <FW(i%)B . Therefore, all EW methods will rank the alternatives in the same order and they will find the same alternative as the best one. (Consistency of alternative selection.) SEEM2440A/B 8 Example 6.2 (investment alternatives): Which one of the following four mutually exclusive alternatives should be selected if the planning horizon and the useful lives of all alternatives are 10 years, and the MARR is 12% per year? Capital investment Annual cost savings Salvage value A 50,000 7,600 5,000 B 110,000 20,750 10,000 C 92,000 17,950 7,500 D 76,000 15,950 0 PW(12%)A = -50,000+7,600(P/A,12%,10)+5,000(P/F,12%,10)=-$5,448 PW(12%)B =$10,461.65 PW(12%)C =$11,836.1 PW(12%)D =$14,129.7 PW(12%)do nothing = 0. PW(12%)D > PW(12%)C > PW(12%)B >PW(12%)do nothing > PW(12%)A . Select Alternative D. SEEM2440A/B 9 Example 6.3 (cost alternatives): Which one of the following four machines should be selected if the planning horizon and the useful lives of all machines are 8 years, and the MARR is 12% per year? Initial cost Annual expenses I 65,000 14,600 II 70,000 12,600 III 87,000 9,500 IV 68,000 16,950 Eliminate Machine IV since it has higher initial cost and higher annual expenses than Machine I. We can use any EW method. AW(12%)I =-65,000(A/P,12%,8)-14,600=-$27,684.5 AW(12%)II =-$26,691.2 AW(12%)III =-$27,013.4 Select the alternative with the least negative AW: Alternative II. SEEM2440A/B 10 Rate-of-Return methods: Question: Can we select the alternative with the maximum IRR as the best alternative? Answer: No! Look at Example 6.1: Investment Revenue next year IRR PW A 10,000 12,500 25% 416.67 B 50,000 61,500 23% 1,250 If we maximize the IRR, then Alternative A is preferred. But, the EW method selects Alternative B. Here, rate-of-return method is not correctly used. How to correct it? SEEM2440A/B 11 SEEM2440A/B 12 Rules: Compare an IRR only to MARR. Never compare the IRRs of alternatives. Never simply select the alternative that maximizes IRR. Guidelines: Each additional (incremental) capital must justify itself (i.e., must produce a rate of return greater than or equal to MARR). We need to look at the increments; incremental investment and incremental benefits. Compare a higher investment alternative against a lower “acceptable" investment alternative and check whether the incremental investment is justified. To do this, we can analyze the difference between the two alternatives, which is usually an investment alternative by itself. Select the alternative that requires largest capital investment as long as the incremental investment is justified. This will maximize EW(MARR). SEEM2440A/B 13 Back to Example 6.1: Investment Revenue next year IRR PW(20%) A 10,000 12,500 25% 416.67 B 50,000 61,500 23% 1,250 ∆(B-A) 40,000 49,000 22.5% 833.3 Alternative A is acceptable since 25%>MARR, and Alternative B is a higher investment alternative. Analyze the difference between the two alternatives, ∆(B-A). IRR of the difference (incremental cash flow) is 22.5% >MARR. Additional $40,000 is justified and Alternative B is the preferred alternative. This is consistent with the EW method conclusion: PW(20%)∆(B−A) = 833.3 ≥ 0, therefore Alternative B is preferred. SEEM2440A/B 14 If PW(MARR)∆ ≥ 0 then IRR∆ ≥ MARR. It is because PW(i)∆ is an decreasing function of i. So, the EW method and the IRR method give consistent rankings of alternatives if we compare the IRR of the incremental cash flow against the MARR. Generalize this idea to a procedure. SEEM2440A/B 15 The incremental analysis procedure Step 1. Order the alternatives by increasing capital investment. Step 2. Find a base alternative (current best alternative) Cost alternatives: the first alternative in the ordered list (the one with the least capital investment). Investment alternatives: the first acceptable alternative in the ordered list (EW≥ 0, or IRR≥MARR). The IRR of the DN is assumed to be the MARR. Step 3. Evaluate the difference between the next alternative and the current best alternative. If the incremental cash flow is acceptable, choose the next alternative as the current best alternative. Otherwise, keep the current best alternative and drop the next alternative from further consideration. Step 4. Repeat Step 3 until the last alternative is considered. Select the current best alternative as the preferred one. SEEM2440A/B 16 Example 6.4: Four mutually exclusive alternatives are considered for constructing an office building near a parking lot. The company determined a study period of 15 years. If the MARR is 10%, which alternative should the company select? Use the incremental analysis with the IRR method. Investment Annual income Salvage value P 200,000 22,000 100,000 B1 4,000,000 600,000 2,000,000 B2 5,500,000 720,000 2,775,000 B3 7,500,000 960,000 3,750,000 Step 1. DN-P-B1-B2-B3. (Alternatives are in the order of increasing investment.) SEEM2440A/B 17 Step 2. We have investment alternatives. IRR of DN alternative is 10%, so it is the first acceptable alternative. Step 3. IRR of ∆(P-DN) is 9.3%, so it is unacceptable. IRR of ∆(B1-DN) is 13.8%, so B1 is the current best alternative. SEEM2440A/B 18 Step 3 (cont.). Compare alternatives B2 and B1. ∆ Investment ∆ Annual income ∆ Salvage value IRR∆ ∆(B2-B1) 5,550,000-(4,000,000)=1,550,000 720,000-600,000=120,000 2,775,000-2,000,000=775,000 5.5% (IRR∆ is the i’% such that -1,550,000+120,000(P/A,i’%,15)+775,000(P/F,i’%,15)=0.) Is the incremental cash flow acceptable? No, because 5.5%<10%. Keep Alternative B1 as the current best alternative and drop Alternative B2 from further consideration. Go back to Step 3 and compare alternatives B3 and B1. SEEM2440A/B 19 ∆ Investment ∆ Annual income ∆ Salvage value IRR∆ ∆(B3-B1) 7,500,000-(4,000,000)=3,500,000 960,000-600,000=360,000 3,750,000-2,000,000=1,750,000 8.5% Is the incremental cash flow is acceptable? No, because 8.5%<10%. Keep Alternative B1 as the current best alternative and drop Alternative B3 from further consideration. We considered all alternatives, therefore stop. Select Alternative B1, which is the current best alternative. SEEM2440A/B 20 Perform the PW analysis (Example 6.4) : PW(10%)P = -200,000+22,000(P/A,10%,15)+100,000(P/F,10%,15)=-$8,726. PW(10%)B1 =$1,042,460 PW(10%)B2 =$590,727 PW(10%)B3 =$699,606 Select Alternative B1. PW method is computationally easier than IRR method. We can perform the incremental analysis using the PW method to decide whether the incremental investment is justified: PW(10%)∆(B2−B1) = −$451, 733 < 0, increment is not justified. PW(10%)∆(B3−B1) = −$342, 854 < 0, increment is not justified. Select Alternative B1. Note: When there are multiple IRRs for some alternatives (more than one sign changes in the cash flow), we can perform the incremental analysis using the ERR method. SEEM2440A/B 21 Example (6.5) Useful life of each alternative is 10 years and the MARR=10%. Capital Investment Annual net income A 900 150 B 1,500 276 C 2,500 400 D 4,000 925 E 5,000 1,125 F 7,000 1,425 Which project should be selected? SEEM2440A/B 22 Solution The incremental analysis proceeds as follows: Find the IRRs: IRR A 10.6% B 13% C 9.6% D 19.1% E 18.3% F 15.6% The alternatives are already ranked in the order of increasing capital investment. We can eliminate alternative C (9.6%<10%). The incremental analysis starts with the current best alternative as Alternative A. (The first acceptable project.) SEEM2440A/B 23 Compare A and B: Consider ∆(B-A). Incremental investment for alternative B is justified. Current best alternative is B. Compare D and B: Consider ∆(D-B). Incremental investment for alternative D is justified. Current best alternative is D. Compare E and D: Consider ∆(E-D). Incremental investment for alternative E is justified. Current best alternative is E. Compare F and E: Consider ∆(F-E). Incremental investment for alternative F is not justified. Current best alternative is E. Select the current best alternative: Alternative E. ∆ Capital Investment ∆ Annual net income IRR∆ SEEM2440A/B ∆(B-A) 600 126 16.4% ∆(D-B) 2,500 649 22.6% ∆(E-D) 1,000 200 15.1% ∆(F-E) 2,000 300 8.1% 24 How to perform the incremental analysis for cost alternatives? (All cash flows are negative except possibly the salvage values.) Very similar to the analysis of investment alternatives. Example (6.6): We consider four design alternatives each with a useful life of 5 years. The MARR is 20%. Capital Investment Annual expenses Salvage value D1 100,000 29,000 10,000 D2 140,600 16,900 14,000 D3 148,200 14,800 25,600 D4 122,000 22,100 14,000 Increasing capital investment leads to decreasing annual expenses. Which project should be selected? SEEM2440A/B 25 Solution Start the incremental analysis: D1-D4-D2-D3. Choose the first alternative, D1, as the current best alternative. Compare D4 and D1. ∆ Capital Investment ∆ Annual expenses (savings) ∆ Salvage value IRR∆ ∆(D4-D1) 122,000-(100,000)=22,000 22,100-(29,000)=-6,900 14,000-10,000=4,000 20.5% ∆(D4-D1) is an investment alternative. (An initial investment produces positive cash flows.) The question is whether the incremental capital investment can produce enough cost savings to justify itself, i.e., lead to a return equal to or greater than MARR. The answer is yes since 20.5%>20%. SEEM2440A/B 26 The incremental analysis proceeds as follows: Compare D2 and D4. IRR∆(D2−D4) = 12.3% < 20%. Increment is not justified. Compare D3 and D4. IRR∆(D3−D4) = 20.4% > 20%. Increment is justified. Select Alternative D3. ∆ Capital Investment ∆ Annual expenses (savings) ∆ Salvage value IRR∆ SEEM2440A/B ∆(D2-D4) 18,600 -5,200 0 12.3% ∆(D3-D4) 26,200 -7,300 11,600 20.4% 27 Case 2: Study period6= useful life (of at least one alternative) So far, we looked at situations where study periods are equal to the useful lives of the alternatives. When the alternatives have different useful lives, we need to make some modifications to compare the alternatives over the same period of time, which is needed for a fair comparison. Example 6.7: Investment Annual revenues Useful life (years) A 5,250 1,882.5 4 B 7,500 2,220 6 We want to find the best alternative when the MARR=10%. Let’s assume that we can repeat the same cash flow of each alternative during its initial useful life span in its succeeding life spans. This can be done by identical replacements of alternatives at the end of their useful life spans. SEEM2440A/B 28 Based on this assumption, we can use a study period of 12 years (the least common multiple (LCM) of 4 and 6) where Alternative A repeats itself 3 times and Alternative B repeats itself twice during the entire period. This assumption is called “repeatability", and it is useful for situations where the study period is very long (can be assumed infinity) the study period is equal to a common multiple of the alternatives’ lives. SEEM2440A/B 29 Let’s use the PW method to find the best alternative: (study period=12 years) PW(10%)A =-5,2505,250[(P/F,10%,4)+(P/F,10%,8)]+1,882.5(P/A,10%,12)=$1,542. PW(10%)B =-7,5007,500(P/F,10%,6)+2,220(P/A,10%,12)=$3,393. Select Alternative B. Let’s find the AW(MARR) of each alternative using the PW(MARR): AW(10%)A =1,542(A/P,10%,12)=$226.5 AW(10%)B =3,393(A/P,10%,12)=$498. (Select Alternative B. Conclusion is consistent with PW method as it should be.) SEEM2440A/B 30 What is the AW(MARR) of each alternative over its single useful life span? AW(10%)A =-5,250(A/P,10%,4)+1,882.5= $226.5 AW(10%)B =-7,500(A/P,10%,6)+2,220=$498 The AW of each alternative over its single life cycle is equal to its AW over the entire study period. (The detail mathematical proof is omitted.) When repeatability assumption holds and the study period is a common multiple of the alternatives’ lives, it is sufficient to compare the AW values of the alternatives over their own useful life. SEEM2440A/B 31 In Example 6.7, what if the study period of 12 years is not acceptable and/or the repeatability assumption does not hold in practice? Suppose we are given a study period of 6 years. (Study period > Useful life of A) We need to adjust the cash flow of Alternative A to terminate at the end of 6 years. Let’s assume that all cash flows of Alternative A can be reinvested at the MARR from year 4 to year 6. Let’s use the FW method: FW(10%)A = [-5,250(F/P,10%,4)+1,882.5(F/A,10%,4)](F/P,10%,2)= $1,270.5 FW(10%)B =-7,500(F/P,10%,6)+2,200(F/A,10%,6)= $3,841.5 Alternative B is still preferred. This was an investment alternatives situation. What if we have cost alternatives? Contract for the service or lease the equipment (at some cost) for the remaining years. SEEM2440A/B 32 So far, we looked at alternatives with useful lives < study period. What if the useful life of an alternative is longer than the study period? The strategy is to truncate the alternative at the end of the study period. We need to find the market value of the alternative at the end of the study period, and we use the imputed market value technique to do this. SEEM2440A/B 33 Let T denote the study period (T< useful life), and let MVT denote the market value at time T. Then, MVT = PW at the end of year T of remaining capital recovery amount + PW at the end of year T of original market (salvage) value at end of useful life. Formally, let I be the initial investment and S be the salvage value of a project with a useful life of U time periods where U>T. Let i%=MARR, MVT =[I(A/P,i%,U)-S(A/F,i%,U)](P/A,i%,U-T)+S(P/F,i%,U-T). SEEM2440A/B 34 S MVT CR CR CR U–1 U … 0 T T+1 CR = I(A/P, i%, U) – S(A/F, i%, U) SEEM2440A/B 35 Example 6.8: Consider a project with a capital investment of $47,600, useful life of 9 years, annual expenses of $1,720, and market (salvage) value of $5,000 at the end of its useful life. What is the estimated market value of this project at the end of year 5? The MARR is 20%. MV5 =[47,600(A/P,20%,9)5,000(A/F,20%,9)](P/A,20%,4)+5,000(P/F,20%,4)=$32,361. SEEM2440A/B 36 How do we use the imputed market value in the comparison of alternatives? Example 6.9: Which of the following alternatives should be selected if the study period is 5 years and the MARR is 20%? Investment Annual expenses Useful life (years) Salvage value A 33,200 2,165 5 0 B 47,600 1,720 9 5,000 Alternative B is identical to the project in Example 6.8. The imputed market value of Alternative B at the end of year 5 was found to be $32,361. We can use the AW method to compare the alternatives: AW(20%)A = -33,200(A/P,20%,5)-2,165=-$13,267. AW(20%)B = -47,600(A/P,20%,5)-1,720+32,361(A/F,20%,5)=-$13,288. Select Alternative A. SEEM2440A/B 37