BUS 301 – Financial Management - Lewis

Instructor:

Phone:

Fax:

Office:

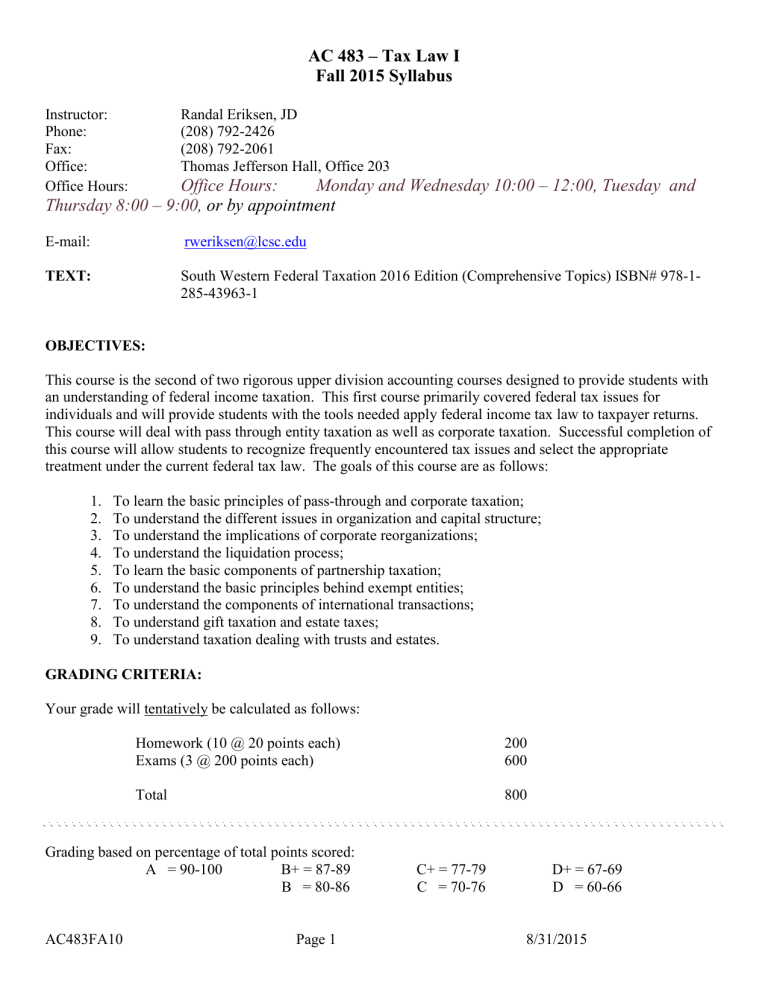

AC 483 – Tax Law I

Fall 2015 Syllabus

Randal Eriksen, JD

(208) 792-2426

(208) 792-2061

Thomas Jefferson Hall, Office 203

Office Hours:

Office Hours: Monday and Wednesday 10:00 – 12:00, Tuesday and

Thursday 8:00 – 9:00, or by appointment

E-mail:

TEXT: rweriksen@lcsc.edu

South Western Federal Taxation 2016 Edition (Comprehensive Topics) ISBN# 978-1-

285-43963-1

OBJECTIVES:

This course is the second of two rigorous upper division accounting courses designed to provide students with an understanding of federal income taxation. This first course primarily covered federal tax issues for individuals and will provide students with the tools needed apply federal income tax law to taxpayer returns.

This course will deal with pass through entity taxation as well as corporate taxation. Successful completion of this course will allow students to recognize frequently encountered tax issues and select the appropriate treatment under the current federal tax law. The goals of this course are as follows:

1.

To learn the basic principles of pass-through and corporate taxation;

2.

To understand the different issues in organization and capital structure;

3.

To understand the implications of corporate reorganizations;

4.

To understand the liquidation process;

5.

To learn the basic components of partnership taxation;

6.

To understand the basic principles behind exempt entities;

7.

To understand the components of international transactions;

8.

To understand gift taxation and estate taxes;

9.

To understand taxation dealing with trusts and estates.

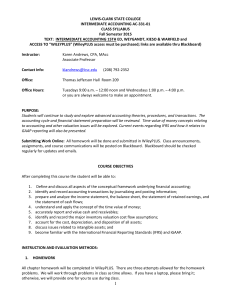

GRADING CRITERIA:

Your grade will tentatively be calculated as follows:

Homework (10 @ 20 points each)

Exams (3 @ 200 points each)

Total

200

600

800

Grading based on percentage of total points scored:

A = 90-100 B+ = 87-89

B = 80-86

C+ = 77-79

C = 70-76

D+ = 67-69

D = 60-66

AC483FA10 Page 1 8/31/2015

Homework – Homework will be assigned for each chapter and is worth 20 points per assignment. Students will be allowed to make up homework with extra credit from comprehensive problems assigned as extra credit. Homework will be graded on accuracy and substantiation of calculations. Homework is also graded on professionalism which is based on legibility and presentation of the work turned in. Since this is an upper division accounting course intended to prepare students for work in the accounting profession, students are expected to work independently and to write or type his or her own assignments.

Late homework will not be accepted (this includes homework that is left at home, in the car, or in another backpack). Please do not ask for exceptions to this rule. Any student with a pre-arranged LCSC excused absence must submit homework prior to the day in which he or she will be absent.

Exams - There will be four regular exams and one final exam. Each exam is worth 200 points and will cover the chapters identified in the schedule. NO LATE EXAMS WILL BE GIVEN . A student that must miss an exam can prearrange with the instructor, with a valid reason (LCSC excused absence, illness, business travel, etc.), to take the exam prior to the test day.

Students must have a calculator for the exams. Under no circumstances will students be allowed to share a calculator. Be sure to check your batteries before coming to class and keep a spare on hand. Students suspected of cheating will receive an “F” on the exam. You will be responsible for monitoring your own behavior as well as deterring others from having access to your answers.

Special Accommodations – If you need course adaptations or accommodations because of a disability, if you have emergency medical information to share with me, or if you need special arrangements in case the building must be evacuated, please make an appointment with me or drop by my office during office hours as soon as possible to discuss your situation with me.

Prerequisites – The prerequisites for this course are: AC232 or consent of the instructor.

DATE TOPIC

M 8/24 Introduction to Class

W 8/26 Introduction to Taxation

M

W

W

M

8/31 Tax Research

Computing the Tax

9/2

Computing the Tax

9/9

Gross Income: Concepts and Inclusions

9/14

READING ASSIGNMENT DUE

Chapter 1

Chapter 2

Chapter 3

Chapter 3

PR 25, 47, 53, EXTRA CREDIT

PR #54

W 9/16 Gross Income: Concepts and Inclusions

Chapter 4

Chapter 4 PR 43, 55, 58

AC483FA10 Page 2 8/31/2015

M 9/21 Gross Income: Exclusions Chapter 5

W

M

9/23 Gross Income: Exclusions

9/28

Exam #1: (Chapters 3-5)

Chapter 5 PR 48, 56, 58

W 09/30 Deductions Chapter 6

Chapter 6

PR 45, 50, 54 EXTRA

CREDIT PR #56 M

W

M

10/5 Deductions

10/7

Deductions and Losses: Certain Business

Expenses and Losses

10/12

Deductions and Losses: Certain Business

Expenses and Losses

Chapter 7

Chapter 7 PR 27, 31, 36, 45

W 10/14 Depreciation

M 10/19 Depreciation

W 10/21 Employee and Self Employed Deductions

M 10/26 Employee and Self Employed Deductions

W 10/28

EXAM # 2: (Chapters 6-9)

M

W

11/2 Itemized Deductions

11/4 Itemized Deductions

M 11/09 Investor Losses

W 11/11 Investor Losses

M 11/16 Tax Credits

W 11/18 Tax Credits

M-

W

11/23 –

11-27

THANKSGIVING BREAK

M 11/30 Property

W 12/2 Property

M 12/07 Property Capital Gains/Losses

W 12/09 Property Capital Gains/Losses

AC483FA10 Page 3

Chapter 8

Chapter 8 PR 32, 35, 45

Chapter 9

Chapter 9

PR 33, 42, 47, 56 EXTRA

CREDIT PR #61

Chapter 10

Chapter 10 PR 22, 28, 41, 45

Chapter 11

Chapter 11 PR 36, 42, 55, 52, 58

Chapter 12

Chapter 12 PR 27, 41,

Chapter 13

PR 54, 70, 84

Chapter 13

Chapter 14

Chapter 14

PR 61, 73, 78 EXTRA CREDIT

PR # 88

8/31/2015

W 12/14

FINAL EXAM: Chapters 10-14

AC483FA10 Page 4 8/31/2015

Syllabus Addendum

Consumer Information

In 2008, the federal government required all post-secondary institutions offering federal financial aid programs to provide key data to both prospective and current students. To comply with this requirement, Lewis-Clark State College has developed a consumer information page, which may be accessed at http://www.lcsc.edu/student-consumer-information/

Disability Accommodations

Students requiring special accommodations or course adaptations due to a disability and/or a health-related issue should consult their course instructors and the LCSC Student Counseling Center immediately (RCH 111, 792-2211). Official documentation may be required in order to provide an accommodation and/or adaptation.

Student Rights and Responsibilities

Students have the responsibility for knowing their program requirements, course requirements, and other information associated with their enrollment at LCSC. Students should review the LCSC General Catalog ( http://webdev.lcsc.edu/catalog and the LCSC Student

Handbook ( http://www.lcsc.edu/media/1152314/13-14-Student-Handbook-Revised.pdf

) for more information.

Accidents/Student Insurance

Students participating in LCSC classes normally must look to their personal health insurance policy (Student Health Insurance Plan or comparable private coverage) should an accident occur. In the event of an accident, please seek medical help, if necessary, and report the incident to LCSC Security (792-2226). Fieldtrips or other special student activities may also require students to submit a signed participation waiver (forms can be obtained from the supporting Division Office).

Enrollment Verification/Attendance

Students who are not actively pursuing their classes may have to repay part or all of their financial aid awards depending upon the circumstances.

Academic Dishonesty

Academic dishonesty, which includes cheating and plagiarism, is not tolerated at LCSC. Individual faculty members will impose their own policies and sanctions regarding academic dishonesty. Students who are accused of being academically dishonest may be referred to the VP for Student Affairs for official disciplinary action.

Illegal File Sharing

Students using LCSC’s computers and/or computer network must comply with the college’s appropriate use policies and are prohibited from illegally downloading or sharing data files of any kind. Specific information about the college’s technology policies and its protocols for combating illegal file sharing may be found on the VP for Student Affairs’ web page

( http://www.lcsc.edu/student-affairs/student-code-of-conduct/ ).

Diversity Vision Statement

Regardless of race, color, age, sex, religion, national origin, disability, veteran status, or sexual orientation, you will be treated and respected as a human being.

Disclosures

During this course, if you elect to discuss information with me which you consider to be sensitive or personal in nature and not to be shared with others, please state this clearly. Your confidentiality in these circumstances will be respected unless upholding that confidentiality could reasonably put you, other students, other members of the campus community, or me in danger. In those cases or when I am bound by law to report what you have told me, such as incidents involving sexual assault or other violent acts, I will submit a report to appropriate campus authorities.

AC483FA10 Page 5 8/31/2015

Component

A. Accounting (ACT)

B. Marketing (MKT)

C. Finance (FIN)

D. Management

1. Management Principles (MGT)

2. Organizational Behavior (OB)

3. Human Resource Management (HRM)

4. Operations Management (OM)

Total Management

E. Economic/Social/Legal Environment

1. Legal Environment of Business (LAW)

2. Economics (ECN)

3. Business Ethics (ETH)

Total Economic/Social/Legal Environment

F. Decision-Support Tools

1. Information Systems (IS)

2. Quantitative Methods/Statistics (QM)

Total Decision-Support Tools

G. Global Dimensions of Business (GLOB)

H. Integrative Experience (INT)

Total Contact Hours

AC483FA10 Page 6 8/31/2015

0

4

4

1

0

45

1

1

0

0

Hours

30

0

4

2

2

0

1

5