Granholm v. Heald

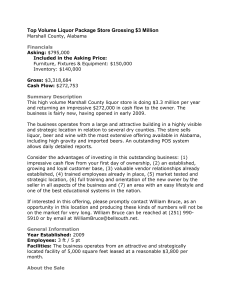

advertisement