These Problems from Chapter 6

advertisement

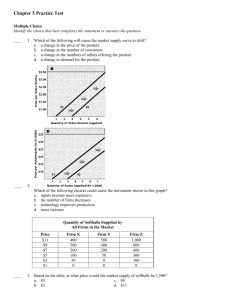

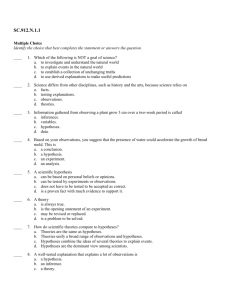

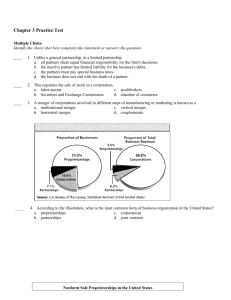

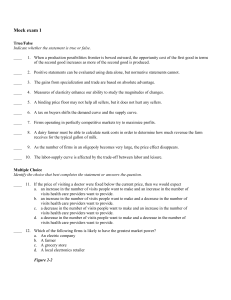

Chapter06_ProblemSession Multiple Choice Identify the choice that best completes the statement or answers the question. ____ 1. A price floor will be binding only if it is set a. equal to the equilibrium price. b. above the equilibrium price. c. below the equilibrium price. d. either above or below the equilibrium price. ____ 2. To say that a price ceiling is binding is to say that the price ceiling a. results in a surplus. b. is set above the equilibrium price. c. causes quantity demanded to exceed quantity supplied. d. All of the above are correct. ____ 3. A shortage results when a. a nonbinding price ceiling is imposed on a market. b. a nonbinding price ceiling is removed from a market. c. a binding price ceiling is imposed on a market. d. a binding price ceiling is removed from a market. ____ 4. The imposition of a binding price floor on a market causes quantity demanded to be a. greater than quantity supplied. b. less than quantity supplied. c. equal to quantity supplied. d. Both (a) and (b) are possible. ____ 5. Price ceilings and price floors that are binding a. are desirable because they make markets more efficient and more fair. b. cause surpluses and shortages to persist since price cannot adjust to the market equilibrium price. c. can have the effect of restoring a market to equilibrium. d. are imposed because they can make the poor in the economy better off without causing adverse effects. ____ 6. If a tax is levied on the sellers of a product, then the supply curve a. will shift up. b. will shift down. c. will become flatter. d. will not shift. ____ 7. If a tax is levied on the buyers of a product, then the demand curve a. will not shift. b. will shift down. c. will shift up. d. will become flatter. ____ 8. A tax imposed on the buyers of a good will a. raise both the effective price buyers pay and the effective price sellers receive. b. raise the effective price buyers pay and lower the effective price sellers receive. c. lower the effective price buyers pay and raise the effective price sellers receive. d. lower both the effectiveprice buyers pay and the effective price sellers receive. ____ 9. If the government removes a tax on sellers of a good and imposes the same tax on buyers of the good, then the effective price paid by buyers will a. increase and the effective price received by sellers will increase. b. increase and the effective price received by sellers will not change. c. not change and the effective price received by sellers will increase. d. not change and the effective price received by sellers will not change. Figure 6-9 10 price 9 S 8 7 6 5 4 3 2 D 1 D after tax 10 20 30 40 50 60 70 80 quantity ____ 10. Refer to Figure 6-9. As the figure is drawn, who sends the tax payment to the government? a. the buyers b. the sellers c. A portion of the tax payment is sent by the buyers and the remaining portion is sent by the sellers. d. The question of who sends the tax payment cannot be determined from the figure. ____ 11. Refer to Figure 6-9. The effective price that buyers pay after the tax is imposed is a. $5. b. $6. c. $7. d. $8. ____ 12. Refer to Figure 6-9. The effective price that sellers receive after the tax is imposed is a. $5. b. $6. c. $7. d. $8. Chapter06_ProblemSession Answer Section MULTIPLE CHOICE 1. ANS: NAT: MSC: 2. ANS: NAT: MSC: 3. ANS: NAT: MSC: 4. ANS: NAT: MSC: 5. ANS: NAT: MSC: 6. ANS: NAT: MSC: 7. ANS: NAT: MSC: 8. ANS: NAT: MSC: 9. ANS: NAT: MSC: 10. ANS: NAT: MSC: 11. ANS: NAT: MSC: 12. ANS: NAT: MSC: B Analytic Interpretive C Analytic Interpretive C Analytic Interpretive B Analytic Interpretive B Analytic Interpretive A Analytic Interpretive B Analytic Interpretive B Analytic Interpretive D Analytic Interpretive A Analytic Applicative D Analytic Applicative A Analytic Applicative PTS: 1 DIF: 2 LOC: Supply and demand REF: 6-1 TOP: Price floors PTS: 1 DIF: 2 LOC: Supply and demand REF: 6-1 TOP: Price ceilings | Shortages PTS: 1 DIF: 2 LOC: Supply and demand REF: 6-1 TOP: Price ceilings | Shortages PTS: 1 DIF: 2 LOC: Supply and demand REF: 6-1 TOP: Price floors | Surpluses PTS: 1 DIF: 2 LOC: Supply and demand REF: 6-1 TOP: Price ceilings | Price floors PTS: 1 DIF: 2 LOC: Supply and demand REF: 6-2 TOP: Taxes | Supply PTS: 1 DIF: 2 LOC: Supply and demand REF: 6-2 TOP: Taxes | Demand PTS: 1 DIF: 2 LOC: Supply and demand REF: 6-2 TOP: Taxes PTS: 1 DIF: 2 LOC: Supply and demand REF: 6-2 TOP: Taxes PTS: 1 DIF: 2 LOC: Supply and demand REF: 6-2 TOP: Taxes PTS: 1 DIF: 2 LOC: Supply and demand REF: 6-2 TOP: Taxes PTS: 1 DIF: 2 LOC: Supply and demand REF: 6-2 TOP: Taxes