Wiley Plus - Belk College of Business

advertisement

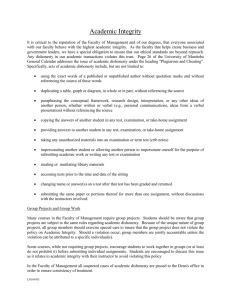

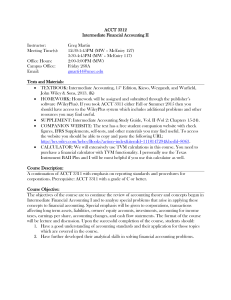

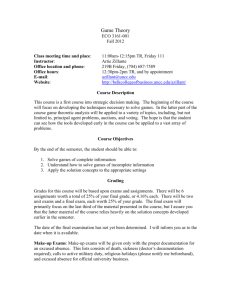

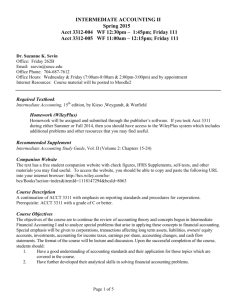

Page 1 of 6 Accounting 3312-002 and 090 Intermediate Accounting II Spring 2014 Instructor: Name: Dr. Robert E. Guinn Office: 268A Friday Ph. #: 704-687-7671: E-mail: reguinn@uncc.edu; Fax Number: 704-687-1382 Website: http://www.belkcollegeofbusiness.uncc.edu/reguinn/ Classes 3:30 - 4:45 p.m. 5:00 - 6:15 p.m. TR. TR. Room Friday 122 Friday 122 Office Hours 2:00 -3:30 p.m., TR Or by appointment Course Description - ACCT 3312. Intermediate Financial Accounting II. (3) Prerequisite: ACCT 3311 with a grade of C or better. A continuation of ACCT 3311 with emphasis on financial reporting for liabilities and stockholders equity. Also a number of special topics including the accounting for investments and the statement of cash flows. Enrollment limited to majors in the College of Business. (Spring, Summer) (Evenings). Textbook: Intermediate Accounting, Kieso, Weygandt and Warfield. 15th ed., John Wiley & Sons, Inc., 2013 – ISBN-13 978-1-118-14729-0 Companion Website The text has a free companion website for students with check figures, IFRS Supplements, self tests, and other materials you may find useful. Wiley Plus If you (1) took Acct 3311 during either Summer 2013 or Fall 2013 and (2) bought the text at either the on-campus or Grays bookstores, then you should have access to the Wiley Plus system which includes additional problems and other resources that you may find useful. Recommended Supplement Intermediate Accounting Study Guide for textbook, (Vol. 2: Chapters 15-24), 15th edition Class Notes for Intermediate Accounting II, Acct. 3312 (Chapter Outlines, Demo. Problems, etc.) will be placed on the instructor’s Moodle website throughout the semester.. Page 2 of 6 Objectives and Scope of Course: The objectives of the course are to continue the review of accounting theory and concepts, begun in Intermediate Accounting I, and to analyze special problems that arise in applying these concepts to financial accounting. Special emphasis will be given to corporations, transactions affecting current and long-term liabilities, owners' equity accounts, investments, accounting for long-term contracts and installment sales, income tax allocation, leases, accounting changes, and cash flow statements .IFRS and international accounting practices will be compared to GAAP through assigned problems and class discussion. The format of the course will be lecture and discussion. Upon the successful completion of the course, students should: 1. 2. Have a good understanding of accounting standards and their application for those topics which are covered in the course. Have further developed their analytical skills in solving financial accounting problems. Determination of Grade Course activities will carry the following weights: Points Examination #1 Examination #2 Examination #3 Final (Comprehensive) Homework and special problems Total Grading Scale (% of total pts.) 90 – 100% (450-500 pts.) 80 - 89% (400-449 pts) 70 - 79% (350-399 pts) 60 - 69 % (300-349 pts) Below 60% (299-0) Dates 100 100 100 150 50 Feb. 4 Feb. 27 Apr. 8 May 6 or 8 Daily 500 Grade A B C D F Class Policies, Homework, Etc. 1. Homework- Homework assignments are a part of the course requirements. Homework assignments consist of exercises, problems or cases assigned from the textbook. At least 35 to 40 exercises, problems, or cases will be taken up at the end of the class period. Chapter assignments are collected in the following class period after the chapter is completed. A grade of S (Satisfactory) or U (Unsatisfactory) will be assigned to each item turned in. Honest attempts must be made to complete each part of the assignment. Those elements of homework which receive a grade of S and are Page 3 of 6 2. turned in on a timely basis will be worth 1 point each. Homework assignments put in my mailbox, emailed, or slipped under my door will not be graded. Credit will not be given for copied solutions. At least 30 of the assignments must receive a grade of S in order to receive the maximum points (30) allocated to homework. Late homework will not be accepted. One or more special problems will be assigned during the semester and will count up to 20 points. Solutions to these problems are not available until after they have been graded. 2. No make-up tests will be given. If a student misses a test without a satisfactory excuse, the grade will be recorded as a zero. If you give me a satisfactory written excuse within 7 days of the test, your percentage grade on the final examination will be substituted for the missed test. Also, those students who take all three examinations during the semester will have their percentage grade on the final substituted for the lowest grade if it raises their average. 3. Misconduct in class. Students are expected to be attentive in class. This means that talking among students is prohibited while the instructor is lecturing or presenting solutions to homework assignments. Cell phones and beepers must be turned off. Talking during a lecture is not allowed. Misconduct of a student in class (example – sleeping during class) is considered discourteous to other students and to the instructor and thus may cause the student's grade to be reduced by a letter grade, according to my discretion. 4. Conduct during examinations. All books, notes, scratch paper, etc., must be left outside the classroom or placed in the front of the room before the test. Eyes should not wander to other test papers. Action will be taken against a student suspected of academic dishonesty, which may cause an F to be received in the course. See UNCC's policy concerning Academic Integrity, which is noted as item 9. 5. Use of calculators. Students may use but not share calculators during the examinations. 6. Class policy prevents smoking, food, or drink in the classroom. Please observe this policy. 7. Class attendance. Class attendance. Students are expected to attend punctually all scheduled sessions and to complete the work assigned. Arriving to class late or leaving early counts as an absence. Attendance is taken daily and excessive absences may affect the final grade and recommendations for scholarships, graduate school and employment. Page 4 of 6 8. Diversity: The Belk College of Business strives to create an inclusive academic climate in which the dignity of all individuals is respected and maintained. Therefore, we celebrate diversity that includes, but is not limited to ability/disability, age, culture, ethnicity, gender, language, race, religion, sexual orientation, and socio-economic status. 9. Academic Integrity: Students have the responsibility to know and observe the requirements of The UNCC Code of Student Academic Integrity . This code forbids cheating, fabrication or falsification of information, multiple submission of academic work, plagiarism, abuse of academic materials, and complicity in academic dishonesty. Any special requirements or permission regarding academic integrity in this course will be stated by the instructor, and are binding on the students. Academic evaluations in this course include a judgment that the student's work is free from academic dishonesty of any type; and grades in this course therefore should be and will be adversely affected by academic dishonesty. Students who violate the code can be expelled from UNCC. The normal penalty for a first offense is zero credit on the work involving dishonesty and further substantial reduction of the course grade. In almost all cases the course grade is reduced to F. Copies of the code can be obtained from the Dean of Students Office. Standards of academic integrity will be enforced in the course. Students are expected to report cases of academic dishonesty to the course instructor. Page 5 of 6 Accounting 3312-002 & 090 Schedule Spring 2014 T. R. Date Jan. Feb. Topic 9R Homework Orientation Current Liabilities Chapter 13 E2,E3,E5, 14 T Current Liabilities Chapter 13 E11,E12,P7,P10 IFRS 4,7,9 & Self-Test Quests. 16 R Long-Term Liabilities Chapter 14 E4,E5,E12,E14 17 F Last day to register, add, drop course with no record, or change grade type 21 T Long-Term Liabilities Chapter 14 E16,E26,P1,P2 P9, IFRS 1,5,6 23 R Stockholders' Equity: Contributed Capital Chapter 15 E5,E12,E14,E15, 28 T Stockholders' Equity: Contributed Capital 30 R Review 4 T Examination # 1, Chapters 13, 14 & 15 6 R Dilutive Securities and Earnings per Share 11 T Mar. Reading Assignment " " E18,E21,P2,P3 Chapter 16 E2,E9,E10,E29 Chapter 16 E18,P5,P8 13 R Investments Chapter 17 E3,E7,E9 18 T Investments Chapter 17 E16,P7 20 R Investments Chapter 17 P10 25 T Review 27 R Examination # 2, Chapters 16 and 17 4&6 Spring Break 11 T Revenue Recognition Chapter 18 E12,E15,E18 Page 6 of 6 T. R. Date Mar Apr. May Topic Reading Assignment Homework 13 R Revenue Recognition Chapter 18 P6,P7,P8 18 T Revenue Recognition Chapter 18 E19,E21,E23,P11 IFRS 1,2 20 R Accounting for Income Taxes Chapter 19 E1,E5,E11 26 M Last day to withdraw with W And retain other courses 25 T Accounting for Income Taxes Chapter 19 E13,E17,P4 27 R Accounting for Income Taxes Leases Chapter 19 Chapter 21 E18, E23 E3,E8,E11 1 T Leases Chapter 21 P4,P5,P6,E14 3 R Review 8 T Examination # 3, Chapters 18, 19 & 21 10 M Last day to withdraw from all Courses with a W 10 R Accounting changes and error analysis Chapter 22 E11,E13,E18 15 T Accounting changes and error analysis Chapter 22 E19,P8 15 T Last day to withdraw from all courses with “W” grades 17 R Cash flow Statement Chapter 23 E1,E5,E9 22 T Cash flow statements Chapter 23 E11,E12 24 R Cash flow statements Chapter 23 E13,P6,P8 29 T Review (Last day of class) 6 T Comprehensive final Exam (For 5 pm class –ACCT 3312-090) 5-7:30 pm 8 R Comprehensive final exam (For 3:30 pm class – ACCT 3312-002) 2-4:30 am