Electronic Payments

advertisement

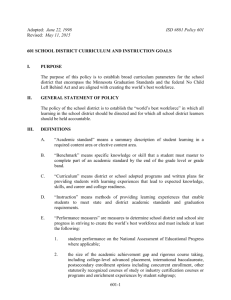

1/26/2015 Getting Online with Electronic Payment Requirements and Other Compliance Issues DAVID KENNEY, JD OFFICE OF THE STATE AUDITOR MASBO WINTER CONFERENCE FEBRUARY 6, 2015 Electronic Payments AUTHORITY FOR SCHOOL DISTRICTS TO USE ELECTRONIC PAYMENT FOUND IN MINN. STAT. SECTION 471.38 SUBD. 3 FOR THE FOLLOWING PURPOSES: (1) FOR A CLAIM FOR A PAYMENT FROM AN IMPREST PAYROLL BANK ACCOUNT OR INVESTMENT OF EXCESS MONEY; (2) FOR A PAYMENT OF TAX OR AID ANTICIPATION CERTIFICATES; (3) FOR A PAYMENT OF CONTRIBUTIONS TO PENSION OR RETIREMENT FUND; (4) FOR VENDOR PAYMENTS; AND (5) FOR PAYMENT OF BOND PRINCIPAL, BOND INTEREST AND A FISCAL AGENT SERVICE CHARGE FROM THE DEBT REDEMPTION FUND. Electronic Payments Statute Requires Policy Controls In order to use electronic funds transfer Minn. Stat Section 471.38 subd. 3a, requires that a school district enact “all of the following policy controls: (a) the school board shall annually delegate the authority to make electronic funds transfers to a designated business administrator; (b) the disbursing bank shall keep on file a certified copy of the delegation of authority; (c) the initiator of the electronic transfer shall be identified; (d) the initiator shall document the request and obtain an approval from the designated business administrator before initiating the transfer; 1 1/26/2015 Electronic Payments (e) a written confirmation of the transaction shall be made no later than one business day after the transaction and shall be used in lieu of a check, order check or warrant required to support the transaction; (f) a list of all transactions made by electronic funds transfer shall be submitted to the school board at its next regular meeting after the transaction.” (These requirements are part of checklist on p.5-6 of Compliance Manual) Electronic Payments Statutory Requirements Applicable to All Claims: Subd.1 of Minn. Stat. Section 471.38 requires that all claimants sign a declaration “to the effect that such account, claim, or demand is just and correct and that no part of it has been paid.” Minn. Stat. Section 471.391 allows public entities including school districts to put this required declaration on the back of checks How does the district obtain a declaration from claimant in the electronic fund transfer process? If not on back of check, then claimant must sign declaration before claim is processed. Electronic Payments Declaration requirement only required for vendors. Counties have developed electronic payment program where individual vendors sign declaration in advance as part of the agreement that permits them to receive electronic payment. Agreement also provides that if there is a mistake, funds can be withdrawn directly from the vendor’s account to the county’s account. If not practical for vendors to sign declaration electronically (or otherwise) for each claim, then this may provide an alternative. 2 1/26/2015 Electronic Payment and Credit Cards With credit cards, the credit card company advances funds on card holder’s behalf then seeks reimbursement at the end of the month. The credit card company presents the claim for payment. State Auditor has taken the position that the point of sale receipt along with the credit card bill is needed to fulfill the written itemization requirement of Minn. Stat. Section 471.38. see SOP entitled : Credit Card Use and Policies on Auditor’ Website Both electronic transfer and credit cards provide greater opportunity for fraud and mistake - review internal controls – start with agreement with bank – does bank offer any additional safeguards? Periodic review of internal controls by the District and its auditor will enhance the electronic fund payment process. Electronic Payment and Credit Cards Issues: Does payroll paid electronically need to be presented to the Board under Minn. Stat. Section 471.38 Subd. 3a (f)? Can District use electronic fund transfer to pay credit card bills? No. Even though 471.38 refers to “imprest payroll” account these payments are made pursuant to contract. Yes, if credit card company complies with declaration requirement. Gifts that are not Permissible Investments Position of the state auditor is: - Government entities can accept gifts that are not permissible investments, and can hold these securities in the form received. Language of investment statute; 118A.04 Subd. 1 is “Any public funds, not presently needed for other purposes …, may be invested in the manner and subject to the conditions provided for in this section.” District board should be aware that securities are not legally permissible investment. District board has to accept gift Minn. Stat Section 123B.02 Subd.6. 3 1/26/2015 Investment Downgrade Many public investments require a rating from nationally recognized rating agency. Sometimes securities are downgraded after purchase Position of the state Auditor’s office that public investor should make decision whether to divest or hold downgraded security. Make sure school board is aware of downgrade and, has made a decision to hold the security, or in the case of a mutual fund has adopted a plan to divest [never comes due] OPEB Trust Reporting OPEB stands for Other Post-Employment Benefits. State law permits public entities to create trusts to pay these benefits. Minn. Stat. Section 471.6175 Subd. 4 identifies the “trust administrator” as the party responsible for reporting required in 2015. Subd. 3. of Minn. Stat. Section 471. 6175 states; “The trust administrator of a trust established under this section shall be either: (1) the Public Employees Retirement Association; (2) a bank or banking association incorporated under the laws of the United States or of any state and authorized by the laws under which it is organized to exercise corporate trust powers; or (3) an insurance company or agency qualified to do business in Minnesota which has at least five years' experience in investment products and services for group retirement benefits and which has a specialized department dedicated to services for retirement investment products." OPEB Trust Reporting Reporting will involve rates of return and fees charged. District should make sure its OPEB Trust administrator is aware of the reporting requirement. Reports will be due November 2015 No requirement that State Auditor do a report. Most likely results will be posted on our website 4 1/26/2015 2013 Statutory Change to Investment Law Regarding School Bonds The 2013 Legislature added the following investment securities to the list of eligible state and local government securities: (4) any security which is an obligation of a school district with an original maturity not exceeding 13 months and (i) rated in the highest category by a national bond rating service or (ii) enrolled in the credit enhancement program pursuant to section 126C.55. (Minn. Stat. Section 118A.04 Subd. 3(4)) Confusing because bonds “rated in the highest category” are already permitted by the first three provisions of this statute. 2013 Statutory Change to Investment Law Regarding School Bonds This new language should be read as additional authority not a restriction on the school bonds eligible for investment. If a school district bond fits under any of the provisions of this statute it will be a permissible investment Internet Purchases and Sales Two internet exceptions to the Bid Law Minn. Stat. Section 471.345 Subd. 16.Reverse auction. Notwithstanding any other procedural requirements of this section, a municipality may contract to purchase supplies, materials, and equipment using an electronic purchasing process in which vendors compete to provide the supplies, materials, or equipment at the lowest selling price in an open and interactive environment. A municipality may not use this process to contract for services, as defined by section 16C.02, subdivision 17, or a service contract, as defined by section 16C.02, subdivision 16. Nothing in this subdivision must be construed to prohibit a municipality from adopting a resolution, rule, regulation, or ordinance relating to minimum labor standards under subdivision 7, or procurement from economically disadvantaged persons under subdivision 8. 5 1/26/2015 Internet Purchases Use of Ebay is not authorized (as exception to the Bid Law) by this section because on Ebay the purchasers are competing to pay the highest price. This statutory section provides an exception for use of an electronic process whereby the vendors compete to provide the lowest price. Reverse auction websites like Priceline or Orbitz are not authorized by this section because the reverse auction is limited to “supplies, materials, or equipment”. Internet Sales Minn. State. 471.345 Subd. 17.Electronic sale of surplus supplies, materials, and equipment. Notwithstanding any other procedural requirements of this section, a municipality may contract to sell supplies, materials, and equipment which is surplus, obsolete, or unused using an electronic selling process in which purchasers compete to purchase the surplus supplies, materials, or equipment at the highest purchase price in an open and interactive environment. Internet Sales This is the EBAY situation you sell something and buyers bid Would not authorize use of craigslist since there is no bidding but simply a listing of a price. So cannot use to sell District property. Now both statutes reverse auction subd. 16 and the sale in web auction under subd. 17 are both exempting you from the requirements of formal bidding or of obtaining quotes. Most purchases and sales of personal property are below the $100,000 formal bidding threshold – just need to get quotes Could use Ebay as one of the two quotes 6 1/26/2015 Surplus Property Subd. 6.Disposing of surplus school computers. Notwithstanding section 471.345, governing school district contracts made upon sealed bid or otherwise complying with the requirements for competitive bidding, other provisions of this section governing school district contracts, or other law to the contrary, a school district under this subdivision may dispose of a surplus school computer and related equipment if the district disposes of the surplus property by conveying the property and title to: (1) another school district; (2) the state Department of Corrections; (3) the Board of Trustees of the Minnesota State Colleges and Universities; or (4) the family of a student residing in the district whose total family income meets the federal definition of poverty. Surplus Property con’d Otherwise Minn. Stat. Section 471.345 applies to the “sale or purchase of supplies, materials, equipment or the rental thereof, or the construction, alteration, repair or maintenance of real or personal property.” Same rules that apply to purchasing apply to sale. Usually the value will be less that $100,000 so quotes should be enough. Remember if district employees want to purchase surplus property district must comply with Minn. Stat. 15.054 allows “employees” to buy if auction or sealed bid with public notice Contact Info David Kenney 651-297-3671 David.Kenney@osa.state.mn.us 7