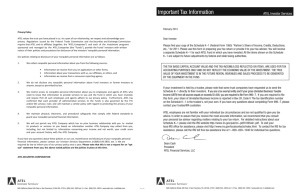

THREE PILLARS OF SUCCESS ATEL'S CASH FLOW OBJECTIVE

advertisement

: A Cash Flow Solution ATEL FUND 16, LLC FAST FACTS ATEL’S CASH FLOW OBJECTIVE ATEL 16, LLC OBJECTIVES 7% monthly distributions paid during the funding and operating periods. * Inception Date November 2013 Investment Minimums $5,000 for all investors Fund Offering Size $150,000,000 The Fund’s objective is to select and structure investments that will generate sufficient net cash flow to permit regular cash distributions and, potentially, subject to the Fund making prior distributions for the year of at least 7% of capital, reinvestment of additional cash flow through its funding and operational periods. * THREE PILLARS OF SUCCESS 1. Select the right companies 2. Lease the right equipment The Fund’s objective is to preserve and return invested capital, provide regular cash distributions through its operating period and additional cash distributions through liquidation. The Fund intends to diversify by equipment type, industry, lessee, geographic location, and asset class. ATEL’S COMMITMENT TO YOU Joint marketing efforts: Client Seminars, Meetings and ePresentations 3. Structure the leases to protect investors INVESTOR SUITABLITY $70,000 Annual Income plus $70,000 Net Worth or $250,000 Net Worth in most states. Please see the Fund Prospectus for specific suitability requirements for your State. LIFE CYCLE MANAGEMENT TEAM ATEL has a well tenured and experienced management team comprised of highly specialized and knowledgeable professionals. Our team averages over 25 years of industry experience, and over 15 years average tenure with ATEL. 800.543.2835 ext. 2 The Transamerica Pyramid • 600 Montgomery Street, 9th Floor • Member: FINRA • San Francisco, CA 94111-2711 • atel.com FOR BROKER DEALER AND REGISTERED INVESTMENT ADVISOR USE ONLY. THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED HEREIN. THE OFFERING IS MADE ONLY BY THE PROSPECTUS. : Solutions for a World Seeking Cash Flow POTENTIAL INVESTOR BENEFITS Consistent Cash Flow 1 Tax Advantaged Cash Flow Potential Hedge against Inflation High Quality Corporate Credits Not Correlated to the Equity/Debt Markets PRIOR ATEL LEASING CLIENTS 1 2 What We Do Why It’s Good For You Over $500 million of lease payments received in the last 5 years (no material lease defaults)2 Protection of capital Asset depreciation passed through to investors Tax advantaged cash flow Backed by hard assets Inflation protection Lease rates may correlate with changes in interest rates Potential interest rate hedge 27 plus years protecting your portfolio and paying regular distributions Experience matters ATEL programs have consistently met their operating period cash flow objectives. Note however that past performance is no assurance of future results. Prior program results for true lease portfolios from 2007 - 2012. The Transamerica Pyramid • 600 Montgomery Street, 9th Floor • Member: FINRA • San Francisco, CA 94111-2711 • atel.com FOR BROKER DEALER AND REGISTERED INVESTMENT ADVISOR USE ONLY. THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED HEREIN. THE OFFERING IS MADE ONLY BY THE PROSPECTUS. FASTFACTS11202013 800.543.2835 ext. 2