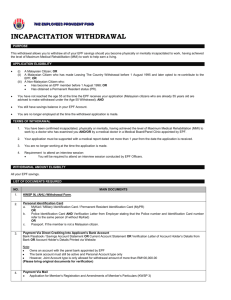

The Employment Act 1955, Socso Act 1969 & Epf Act 1991

advertisement

The Employment Act 1955 forms the basis of employment contracts between employer and certain categories of mostly non-management employees. It also serves as a guideline for employees who are not protected under the EA. The EPF Act 1991 is a retirement scheme for employees while the SOCSO Act 1969 is an insurance scheme for Malaysian employees for employment injury or invalidity. Both employer and employee are required by law to contribute to EPF and SOCSO. The programme covers all the relevant aspects of the EA, EPF and SOCSO Acts ie duties and liabilities of employers, the benefits and conditions for benefits and procedures for making claims. At the end of the programme, participants are able to: Identify employees who are covered under the Employment Act 1955; EPF Act 1991 & SOCSO Act 1961 Administer the benefits of annual leave, sick leave, maternity leave, PH, rest days Calculate OT on normal work days, rest days and PH Identify conditions for and calculate retrenchment benefits Register employees with EPF and SOCSO Know the rates of deduction & contribution for different categories of employees for EPF and SOCSO Identify the benefits to employees under the provisions of EPF & SOCSO Make claims or assist in making claims for SOCSO employment injury and invalidity schemes Assist employees to make withdrawals from EPF Explain the benefits of EPF and SOCSO to employees 1) EA: Employment Contracts What is the Employment Act? Who is covered under the Act? Types of contracts Notice of termination 2) EA: Normal Hours and OT Normal working hours & days Overtime Rates Duty Roster 3) EA: Annual / Sick / Maternity Leave / PH / Rest Days and OT No of days of entitlement Conditions for paid leave Encashment of leave Rate for work done during normal hours / OT rates 4) EA: Payment of Wages & Termination Benefits Authorised deductions from salary Limit in deductions Rate of termination / retrenchment benefits Modes of payment Payment date 5) EA: Disciplinary Procedure & Action Suspension period Payment rate during suspension before and after domestic inquiry Types of disciplinary action after domestic inquiry 6) SOCSO: Insurability Applicability Registration of Industries Age limit of contributors All HR Managers and Executives need to know the main provisions of the EA to avoid providing benefits less than the EA. They may at times need to explain to employees some of the main provisions of the EA so as to avoid misunderstanding. They also may need to know the procedure to register new employees and to inform EPF & SOCSO of terminated employees. They may need to know how to make SOCSO claims for injury and invalidity. As part of their corporate social responsibility and welfare, HR Managers and Executives may want to go even further and explain the benefits of EPF and SOCSO to employees so that employees or their families may claim the full benefit within the stipulated deadlines. Employers may also be able to help employees in this regard. Ethical employers need to know the EA, EPF and SOCSO Acts to provide maximum support to employees. Presentations, case situations, discussions Cyril Pagadala comes with more than 18 years of real hands-on work experience in Human Resource Management, Operations, Customer Service and Administration. His work experience covers various industries such as the banking, manufacturing, hospitality and other service industries He has worked for both local and multinationals and in both small and large companies. His last position was as Director of Human Resource & Administration of a group of companies. He has a BA in English and an MA in Human Resource Management. He is now a lecturer and corporate trainer for many years. He has gone through the whole gamut of HRM functions including: setting up the HR Department A-Z and company start up operations with appropriate systems in a new organization as part of start-up operations, developing policies and procedures, writing operational procedures, developing performance appraisal standards, managing recruitment and selection, setting up wage systems, payroll administration, designing motivation strategies, reducing employee turnover, training handling misconduct, taking disciplinary action, conducting the domestic inquiry, handling grievances, carrying out negotiations with trade unions and collective agreements, etc 7) SOCSO: Contributions Who needs to contribute? Recovery of contribution from immediate employer Contributions where industries or employees are not registered Returns and registers 8) SOCSO: Benefits Invalidity Grant Temporary and Permanent Disablement Benefit Total and Partial Disablement Pension Scheme Survivors’ pension Dependents’ Benefit Occupational Diseases Funeral Benefit Constant Attendance Allowance Medical Benefit Payment on death of employee Education Benefit Accidents while traveling 9) EPF: Applicability Who is an employee? Definition of wages for EPF contributions Age limit of contributors Unclaimed monies 10) EPF: Contributions Registration of employer Duty of employers regarding contribution Rates of contribution by citizens & non-citizens & non-employees Rate of contribution for employees below and above 55 years of age 11) EPF: Withdrawal of Contribution & Other Benefits Withdrawal on reaching 50 & 55 years of age Withdrawal for other reasons Re-contribution to EPF after withdrawal Full and partial withdrawal Periodic withdrawals His tenure in organizations has provided with him with deep insight and lasting exposure to various problems and solutions of different kinds. He brings this to his specialised areas of training such as job skill analysis, interview skills, HR planning, compensation, performance management, people development & motivation; Employment & Industrial Laws; Managerial & Supervisory Skills; Customer Relations; Soft Skills; English and Business Communication. He delivers and facilitates the programmes in a simple, easy-tounderstand way and willingly shares knowledge. Due to his real hard-knock work experience, he is able to provide many simple solutions to work challenges. His participants range from CEOs, managers, executives, supervisors to clerks; and professional engineers, lawyers and computer specialists both local and foreigners. He has many repeat clients. Maybe this is due to his simple philosophy: “SHARE REAL WORK KNOWLEDGE”. Perhaps a cue may also be taken from a participant: ‘I NEVER KNEW THIS WAS SO EASY!’ Certificate of Attendance awarded for those who complete the Course RM. 1,200/- per person for 2 days (Includes Lunch, Tea-Breaks, Course Notes and Certificate of Completion) Malaysian export Academy Suite 306, Block C, Glomac Business Centre, Jalan SS 6/1, Kelana Jaya, 47301 Petaling Jaya, Selangor Tel : 03 7880 0413 / Fax: 03 7880 2817 0r 7806 5913 Email : exportacademy2011@gmail.com Contact Person : Shafinaah