Advanced Accounting and Controlling

advertisement

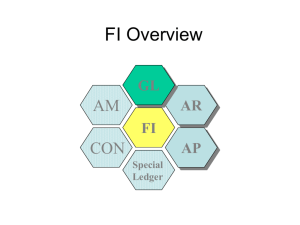

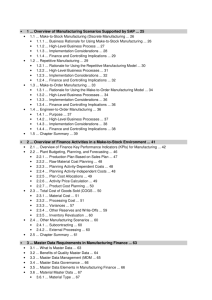

AUSFÜLLHILFE: BEWEGEN SIE DEN MAUSZEIGER ÜBER DIE ÜBERSCHRIFTEN. AUSFÜHRLICHE HINWEISE: LEITFADEN MODULBESCHREIBUNG Advanced Accounting and Controlling Module code 1 Workload Credits/CP Semester 180 h 6 1 Module Teaching Language Advanced Accounting and Controlling 2 English Frequency of module Summer Semester Contact hours Self-study 4 SWS / 45 h 135 h Duration 1 Semester Class size 15 Learning outcomes After the module is successfully completed, the student is able to: Knowledge (1): explain the main instruments of financial reporting describe the main elements of a cost accounting system Comprehension (2): explain how business transactions are recorded with the technique of double entry book keeping illustrate the common tools of cost accounting and their differences Application (3): prepare a Balance Sheet and an Income Statement based on given business transactions apply the different tools of cost accounting in order to provide the necessary information for economic decisions within a company Analysis (4): analyze a Balance Sheet and an Income Statement carry out a cost deviation analysis Synthesis (5): work out the links between the different instruments of financial reporting compare different cost accounting tools and assess their advantages and disadvantages Evaluation (6): assess the economic meaning of certain accounting standards assess more recent development in cost accounting (e.g. activity based costing, target costing) 3 Individual component content Financial accounting fundamentals Recording business transactions and their impact on the Balance sheet Asset side of the Balance sheet Equity and Liability side of the Balance sheet Income Statement Statement of changes in equity Version 1.3 Erstellt von jr Freigabe (Datum/Kürzel) QM-Board 11.4.2012, 16.01.2013 04.06.2013/jr Gültig ab 04.06.2013 4 Cash-flow statement Basic structure of a cost accounting systems Cost allocation Absorption costing versus Variable costing Normal Costing Cost-volume-profit relationship Information for decision making Budgeting and variance analysis Strategic versus Operational Controlling Strategic controlling tools Teaching methods Lecture and exercises, group discussions, short presentations 5 Prerequisites 6 Methods of assessment 7 Basic principles in Financial Accounting Basic principles in Management Accounting Final written exam Case studies to be presented during the lecture Applicability of module Compulsory in Business Consulting Masters course 8 Person responsible for module Prof. Dr. Thomas Marx Lecturer Prof. Dr. Frank Kramer 9 Reading list (Core texts and recommended texts) Atrill, P./McLaney, E., Management accounting for decision makers, 7th edition, 2012 Atrill, P./McLaney, E., Financial accounting for decision makers, 6th edition, 2011 Bhimani, A./Horngren, Ch./Datar, S./Rajan, M.; Management and Cost Accounting, 5th edition, 2012 Harrison, W./Horngren, Ch./Thomas, C./Suwardy, T.; Financial Accounting, 8th edition, 2011. Horngren, Ch. et al., Introduction to Management Accounting, 16th edition, 2014 Libby, R./Libby, P./Short, D., Financial accounting, 7th edition, 2011 Version 1.3 Erstellt von jr Freigabe (Datum/Kürzel) QM-Board 11.4.2012, 16.01.2013 04.06.2013/jr Gültig ab 04.06.2013