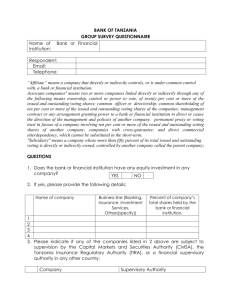

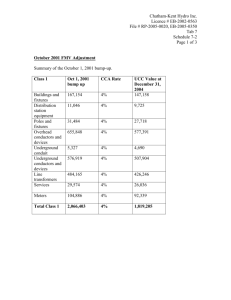

the article

advertisement

canadian tax journal / revue fiscale canadienne (2013) 61:1, 229 - 56 Corporate Tax Planning Co-Editors: Derek Alty,* Brian Carr,** Michael R. Smith,*** and Christopher J. Steeves**** RECENT LEGISLATION AFFECTING PARTNERSHIPS AND FOREIGN AFFILIATES— SUBSECTION 88(1) AND SECTION 100 Kevin Yip***** Recent amendments to the Income Tax Act (Canada) affect the availability of the bump applicable to shares of foreign affiliates and interests in partnerships, as well as the determination of the taxable capital gain in respect of dispositions of interests in partnerships to certain persons and partnerships. This article reviews in detail the amendments in subsection 88(1) and section 100. The author provides an overview of the legislation; describes the application of the rules, using examples; and considers how the subsection 88(1) bump rules could interact with the section 100 amendments. KEYWORDS: ANTI-AVOIDANCE RULES n BUMP n FOREIGN AFFILIATES n PARTNERSHIPS n WINDUPS n CAPITAL GAINS CONTENTS Introduction Overview of the Bump Rules in Subsection 88(1) Determining the Bump Amount Amendments to Subsection 88(1) and Related Anti-Avoidance Rules Shares of a Foreign Affiliate Transitional Rules Surplus Reduction and Prescribed Amount Partnership Interest 230 231 233 234 234 235 236 240 * Of Couzin Taylor LLP, Toronto (affiliated with Ernst & Young LLP). ** Of Moskowitz and Meredith LLP, Toronto. *** Of Deloitte & Touche LLP, Calgary. **** Of Fasken Martineau DuMoulin LLP, Toronto. ***** Of Fasken Martineau DuMoulin LLP, Toronto. I would like to thank Bill Bies, Ron Nobrega, and Christopher Steeves of Fasken Martineau DuMoulin LLP, Toronto, for their valuable comments on earlier drafts of this article. Any errors are my own. 229 230 n canadian tax journal / revue fiscale canadienne (2013) 61:1 Partnership Bump Rule Meaning of “May Reasonably Be Regarded as Being Attributable” Anti-Avoidance Rules Transfers Before Acquisition of Control Transfers After Acquisition of Control Amendments to Section 100 Application of the New Bump Rules and Section 100 Acquisition of Control Winding Up Disposition of Interest in a Partnership Observations and Conclusions 242 243 244 244 245 247 251 253 253 254 255 INTRODUCTION This article discusses three sets of related amendments to the Income Tax Act (Canada)1 applicable to partnerships and foreign affiliates. The proposed legislation was presented in two bills: Bill C-45, tabled on October 18, 2012 and since passed into law,2 and Bill C-48, tabled on November 21, 2012.3 The first two sets of amendments are the partnership measures originally announced in the March 2012 budget proposing to amend the subsection 88(1) bump and the rules in section 100 governing certain dispositions of interests in a partnership.4 The third set of amendments is the limitation in subsection 88(1) to the bump amount in respect of shares of a foreign affiliate or an interest in a partnership that holds shares of a foreign affiliate, introduced in August 2010;5 these measures are generally implemented by proposed amendments to regulations 5905 and 5908.6 The article starts with a brief overview of the subsection 88(1) bump. The discussion that follows is not a complete treatment of the technical issues relating to 1 RSC 1985, c. 1 (5th Supp.), as amended (herein referred to as “the Act”). Unless otherwise stated, statutory references in this article are to the Act. 2 Bill C-45, Jobs and Growth Act, 2012, royal assent December 14, 2012; SC 2012, c. 31. 3 Bill C-48, Technical Tax Amendments Act, 2012, first reading November 21, 2012. 4 Canada, Department of Finance, 2012 Budget, Budget Plan, March 29, 2012, at 414. Draft legislation to implement the proposed measures was issued in the summer of 2012: Canada, Department of Finance, Legislative Proposals Relating to the Income Tax Act and Regulations (Ottawa: Department of Finance, August 14, 2012). 5 Canada, Department of Finance, Legislative Proposals Relating to the Income Tax Act, the Air Travellers Security Charge Act, the Excise Act, 2001, and the Excise Tax Act (Ottawa: Department of Finance, August 27, 2010). 6 Canada, Department of Finance, Notice of Ways and Means Motion To Amend the Income Tax Act, the Excise Tax Act and Related Legislation, October 24, 2012 (herein referred to as “the October 24, 2012 legislation”), part 2, sections 44 through 47. Also see the accompanying explanatory notes: Canada, Department of Finance, Explanatory Notes Relating to the Income Act, the Excise Tax Act and Related Legislation (Ottawa: Department of Finance, October 2012) (herein referred to as “the October 24, 2012 explanatory notes”). corporate tax planning n 231 these provisions; rather, the focus is on the changes to the determination of the available bump amount where the property being bumped is a share of a foreign affiliate of a Canadian subsidiary or where the property is a partnership interest.7 The amendments to section 100 are also discussed. Examples are provided to illustrate the application of the new rules. OVERVIEW OF THE BUMP RULES IN SUBSECTION 88(1) Tax issues relating to a bump in subsection 88(1) have been addressed in previous Canadian Tax Foundation literature.8 Here, I will briefly review some of the rules as background for the discussion of the recent amendments. Subsection 88(1) generally allows a taxable Canadian corporation (“the parent”) that has acquired control of another taxable Canadian corporation (“the subsidiary”) to increase (or “bump”) the cost of certain capital assets acquired by the parent on a winding up of, or a vertical amalgamation with, the subsidiary.9 The bump generally allows the parent to transfer the adjusted cost base (ACB) that will disappear on the winding up of the subsidiary to the ACB of certain types of property owned by the subsidiary prior to the winding up. Paragraph 88(1)(c) provides, as a starting point, that the cost to the parent of each property of the subsidiary distributed on the winding up is generally deemed to be the amount determined pursuant to paragraph 88(1)(a) to be the proceeds of disposition to the subsidiary or, where the property is an interest in a partnership, the cost to the parent of the property. Pursuant to paragraph 88(1)(a), the proceeds of disposition to the subsidiary of each property (other than an interest in a partnership) on the winding up is generally n n the ACB of the property to the subsidiary, or where the property is a Canadian resource property, a foreign resource property, or a right to receive production to which a matchable expenditure relates (as defined in subsection 18.1(1)), nil. 7 This article will not discuss the proposed amendments to paragraphs 88(1)(c.2) through (c.4) announced by the Department of Finance on December 21, 2012. See Canada, Department of Finance, Legislative Proposals Relating to the Income Tax Act and Regulations (Ottawa: Department of Finance, December 21, 2012). 8 See, for example, Manjit Singh, “An Introduction to the ‘Bump’ Rules,” in Report of Proceedings of the Fifty-Fifth Tax Conference, 2003 Conference Report (Toronto: Canadian Tax Foundation, 2004), 51:1-31; and Manu Kakkar, “An Overview of the Technical Aspects and the New Legislative and Administrative Issues Involving Wind-Ups and Amalgamations,” in 2005 Ontario Tax Conference (Toronto: Canadian Tax Foundation, 2005), 4B:1-26. 9 This article focuses on two types of corporate reorganizations: a tax-deferred vertical amalgamation of a wholly owned subsidiary corporation pursuant to section 87, and a subsection 88(1) tax-deferred windup. In this article, the term “winding up” (or “windup”) in the context of the bump rules refers to a winding up pursuant to subsection 88(1) or to an amalgamation to which subsection 87(11) applies. 232 n canadian tax journal / revue fiscale canadienne (2013) 61:1 Paragraph 88(1)(c), in conjunction with paragraph 88(1)(d), may entitle the parent to bump the ACB of the non-depreciable capital property received from the subsidiary on the windup. Examples of non-depreciable capital property include shares of a corporation or an interest in a partnership. The new rules discussed in this article affect the availability of a bump where the property is a share of a corporation that is a foreign affiliate of the subsidiary or where the property is a partnership interest. There are three basic conditions for the availability of a subsection 88(1) bump: 1. The property to be bumped must be non-depreciable capital property of the subsidiary at the time the parent acquires control of the subsidiary (“the acquisition time”). 2. The property to be bumped must have been continuously owned by the subsidiary from the time of the acquisition of control of the subsidiary, and without interruption, until distributed to the parent on the winding up.10 3. The property cannot be ineligible property. Ineligible property is described in subparagraphs 88(1)(c)(iii) through (vi) and includes n n n depreciable property;11 property transferred to the parent on the winding up where the transfer is part of a distribution commonly referred to as a butterfly transaction;12 and property acquired by the subsidiary from the parent or from any person or partnership not dealing at arm’s length with the parent (other than as a consequence of a right referred to in paragraph 251(5)(b)), or any other property acquired in substitution for such property where the acquisition was part of the same series of transactions and events in which the parent acquired control of the subsidiary.13 Subparagraph 88(1)(c)(vi) sets out a fourth type of ineligible property and is generally referred to as the bump denial rule. Where this subparagraph applies, the bump for all property distributed on the winding up is denied.14 10 See, for example, CRA document no. 2002-0169725, November 14, 2002. 11 Subparagraph 88(1)(c)(iii). Paragraph 88(1)(c.7) provides that “for the purpose of subparagraph [88(1)](c)(iii), a leasehold interest in a depreciable property and an option to acquire a depreciable property are depreciable properties.” 12 Subparagraph 88(1)(c)(iv): a transfer that “is part of a distribution (within the meaning assigned by subsection 55(1)) made in the course of a reorganization in which a dividend was received to which subsection 55(2) would, but for paragraph 55(3)(b), apply.” 13 Subparagraph 88(1)(c)(v). 14 A discussion of the bump denial rule is beyond the scope of this article. For further discussion, see, for example, Marc N. Ton-That, “The Bump Denial Rules: In History and in Practice,” in corporate tax planning n 233 Determining the Bump Amount The amount by which the parent can increase or bump the ACB of non-depreciable capital property acquired by it on the winding up of the subsidiary (“the bump room”) is set out in paragraph 88(1)(d). Generally, the aggregate bump room for the parent is the excess of the cost of its shares in the subsidiary over the tax cost of the net assets of the subsidiary. More specifically, the aggregate available bump room is the amount by which the ACB to the parent of shares of the subsidiary immediately before the winding up exceeds the aggregate of 1. the amount, if any, by which a. the total cost amount to the subsidiary of any property owned by the subsidiary immediately before the winding up, plus any money on hand immediately before the winding up, exceeds b. the amount of any debt or other obligation of the subsidiary outstanding immediately before the winding up and the amount of any reserve (other than certain reserves)15 deducted in computing the subsidiary’s income for its taxation year during which its assets were distributed to the parent on the winding up; and 2. the total of all taxable dividends and capital dividends received by the parent, or by a corporation with which the parent was not dealing at arm’s length (otherwise than because of a right referred to in paragraph 251(5)(b)), on the shares of the subsidiary disposed of by the parent on, or in contemplation of, the winding up or on any share for which the share was substituted or exchanged to the extent, in respect of taxable dividends, that such dividends were deductible under section 112 or subsection 138(6).16 The amount of the excess determined under paragraph 88(1)(d) is designated by the parent as being attributable to one or more capital properties in the tax return for the taxation year in which the subsidiary is wound up (or the tax return for the first taxation year of the amalgamated entity in the case of a vertical amalgamation). Report of Proceedings of the Fifty-Second Tax Conference, 2000 Conference Report (Toronto: Canadian Tax Foundation, 2001), 27:1-66; Singh, supra note 8; and Catherine Craig, “Corporate Retail Therapy: Tax Considerations in the Purchase of a Business,” in 2007 Atlantic Provinces Tax Conference (Toronto: Canadian Tax Foundation, 2007), 7:1-51. See also the draft amendments released in December 2012, supra note 7. 15 More specifically, “(other than a reserve referred to in paragraph 20(1)(n), subparagraph 40(1)(a)(iii) or 44(1)(e)(iii) of this Act or in subsection 64(1) or (1.1) . . . as those two provisions read immediately before November 3, 1981)”: clause 88(1)(d)(i)(C). 16 Clauses 88(1)(d)(i.1)(A) and (B). 234 n canadian tax journal / revue fiscale canadienne (2013) 61:1 However, the amount designated cannot exceed the bump amount as determined pursuant to subparagraph 88(1)(d)(ii). The recent legislative amendments provide for two new limitations in the rules for determining the bump amount, by way of a revision to subparagraph 88(1)(d)(ii) (proposed in Bill C-48) and the addition of new provisions in subparagraph 88(1)(d)(ii.1) (enacted by Bill C-45). These amendments, along with examples to illustrate their application, are described in detail below. AMENDMENTS TO SUBSECTION 88(1) AND RELATED ANTI-AVOIDANCE RULES Shares of a Foreign Affiliate Proposed subparagraph 88(1)(d)(ii) provides that the designated bump amount for a particular capital property cannot exceed the amount, if any, by which the fair market value (FMV) of the particular property at the time the parent last acquired control of the subsidiary exceeds the cost amount to the subsidiary of the property immediately before the winding up plus a prescribed amount.17 The prescribed amount is determined pursuant to proposed regulation 5905(5.13) or (5.4), applicable to property that is a share of a foreign affiliate or an interest in a partnership that holds one or more shares of a foreign affiliate.18 These regulations, which can be considered “bump grind” rules and are intended to work with the “surplus reset” rules, reflect the policy of the Department of Finance that where shares of a foreign affiliate are the property subject to a bump, the foreign affiliate’s surplus balances should be adjusted to take into account the “duplication” of tax attributes. The result is that certain tax attributes of the 17 On December 21, 2012, the Department of Finance announced draft legislation further amending subparagraph 88(1)(d)(ii) (see supra note 7). Generally, the proposal amends subparagraph 88(1)(d)(ii) to provide that the bump amount in respect of property eligible for a bump cannot exceed the amount, if any, by which (1) the FMV of the property at the time the parent last acquired control of the subsidiary exceeds the sum of (2) the greater of the cost amount of the property to the subsidiary at the time the parent last acquired control of the subsidiary and the cost amount of the property to the subsidiary immediately before winding up, and (3) the prescribed amount pursuant to regulations 5905(5.13) and (5.14). This amendment is a response to transactions in which the bump amount is increased by reducing the cost of the particular property between the time of the acquisition of control of the subsidiary and the time of its winding up. This amendment applies to windups that begin, and amalgamations that occur, on or after December 21, 2012, with grandfathering for certain windups. The examples in this article will assume, for simplicity, that the cost amount is the same at both times. 18 For a general discussion of the foreign affiliate regime, see Raj Juneja and Drew Morier, “Foreign Affiliates: A Primer,” in Report of Proceedings of the Fifty-Seventh Tax Conference, 2005 Conference Report (Toronto: Canadian Tax Foundation, 2006), 40:1-48; and Firoz K. Talakshi and James Samuel, “Foreign Affiliate Surplus: What You See Isn’t Always What You Get,” in Report of Proceedings of the Sixtieth Tax Conference, 2008 Conference Report (Toronto: Canadian Tax Foundation, 2009), 28:1-34. corporate tax planning n 235 foreign affiliate are reduced on the acquisition of control of the subsidiary and will reduce the available bump room in respect of shares of the foreign affiliate on the winding up of the subsidiary. Proposed regulation 5905(5.13) is the transitional rule that applies where the winding up begins, or the amalgamation occurs, after February 27, 2004 and before December 19, 2009. Proposed regulation 5905(5.4) applies to windups preceded by an acquisition of control that occurs after December 18, 2009.19 Transitional Rules The transitional rules in proposed regulation 5905(5.13) are a revision of proposals introduced in 2004.20 The current version provides that for the purposes of proposed subparagraph 88(1)(d)(ii), the prescribed amount is generally the proportionate amount of 1. the total of all dividends received by the subsidiary after the acquisition of control that were deductible pursuant to paragraph 113(1)(a) or (b) by the subsidiary or by a corporation not dealing at arm’s length with the subsidiary (otherwise than because of a right referred to in paragraph 251(5)(b)) minus 2. the portion of such dividends that may reasonably be considered to have reduced the exempt surplus or taxable surplus of the foreign affiliate in respect of the subsidiary that arose after the acquisition of control (determined in the reverse order to that in which that surplus of the foreign affiliate in respect of the subsidiary arose).21 Regulation 5905(5.13) acts in conjunction with the surplus reset rule in proposed regulation 5905(5.12), which applies if shares of the foreign affiliate are bumped on a winding up. The reset rule will reset to nil the surplus balances of foreign affiliates (including lower-tier affiliates) with respect to the subsidiary and restate the surplus balances of the relevant affiliate to reflect only the amount of surplus that it had immediately before the winding up, not including any surplus balances accrued prior to the acquisition of control that preceded the winding up.22 19 October 24, 2012 legislation, supra note 6, sections 44(15) through (19). 20 Canada, Department of Finance, Legislative Proposals and Draft Regulations Relating to Income Tax (Ottawa: Department of Finance, February 2004). 21 The foregoing describes variable A in the formula A × B/C in proposed regulation 5905(5.13). The formula apportions the prescribed amount on the basis of the proportion that the FMV of the property being designated is of the FMV of all the shares, or the interest in the partnership, as the case may be. 22 For examples of the application of these provisions, see Penny Woolford and Francis Favre, “The Latest Foreign Affiliate Proposals: Selected Aspects” (2010) 58:4 Canadian Tax Journal 791-843, at 824-25. 236 n canadian tax journal / revue fiscale canadienne (2013) 61:1 Surplus Reduction and Prescribed Amount For acquisitions of control that occur after December 18, 2009, proposed regulation 5905(5.4) applies along with the surplus reset rule in proposed regulations 5905(5.2) and (5.3).23 Regulation 5905(5.4) is conceptually different from regulation 5905(5.13) in that it references the attributes of the foreign affiliate at the time of the acquisition of control rather than at the time of the winding up.24 The prescribed amount under proposed regulation 5905(5.4) for the purposes of proposed subparagraph 88(1)(d)(ii) is generally the foreign affiliate’s tax-free surplus balance 25 (TFSB) at the acquisition time multiplied by the subsidiary’s surplus entitlement percentage26 (SEP) in the affiliate. Proposed regulation 5905(5.4) also applies where the property is an interest in a partnership based on the formula set out in proposed regulation 5908(7).27 The prescribed amount for the purposes of proposed subparagraph 88(1)(d)(ii) for each share of a foreign affiliate (“FA”) is determined pursuant to proposed regulation 5905(5.4) as follows:28 A × B, where A is the TFSB of FA in respect of the subsidiary at the acquisition time; and B is the percentage that would be the subsidiary’s SEP in respect of FA if the subsidiary owned no shares of the affiliate other than the subject share. Accordingly, the bump amount in respect of a share of a foreign affiliate (or an interest in a partnership that holds a share of a foreign affiliate, as discussed below) is effectively 23 Specifically, unless the acquisition of control results from an acquisition of shares made under an agreement in writing entered into before December 18, 2009: October 24, 2012 legislation, supra note 6, section 44(18). 24 October 24, 2012 explanatory notes, supra note 6, at 113. 25 The term “tax-free surplus balance” is defined in proposed regulation 5905(5.5) to mean the total of the amount by which the foreign affiliate’s exempt surplus exceeds the taxable deficit plus the lesser of the gross-up amount of underlying foreign tax and the affiliate’s taxable surplus net of its exempt deficit (if any). Proposed regulation 5905(5.6) provides that for the purposes of regulation 5905(5.5), the surplus balances of the particular affiliate include that affiliate’s share of the surplus balances of any foreign affiliates in which the particular affiliate has a direct or indirect interest (pursuant to proposed regulation 5902(1)(a)(i)). Finance refers to this as the “good” surplus inherent in the particular affiliate: October 24, 2012 explanatory notes, supra note 6, at 115. See, for example, Amanda Heale, “Recent Proposed Amendments Impact Acquisition of Control of Canadian Corporations Holding Foreign Affiliates” (2010) 12:1 Corporate Structures and Groups 655-58. See also Woolford and Favre, supra note 22; and Geoffrey Turner, “The Acquisition of Control Surplus/ACB Trade-Off in the August 27, 2010 Foreign Affiliate Proposals,” Tax Topics no. 2026, January 6, 2011. 26 See the definition of “surplus entitlement percentage” in subsection 95(1) and regulation 5905(13). 27 Pursuant to proposed regulation 5905(5.4)(b). 28 Proposed regulation 5905(5.4)(a). corporate tax planning n 237 reduced by the “good” surplus, if any, of the top affiliate (the foreign affiliate held directly by the subsidiary or the partnership) and any affiliate in which the top affiliate has a direct or indirect interest at the time of the acquisition of control after the application of the surplus reset rule in proposed regulations 5905(5.2) and (5.3).29 The surplus reset rules in proposed regulation 5905(5.2) apply where there is an acquisition of control of a Canadian-resident corporation that owns shares of a foreign affiliate. This regulation also applies to foreign affiliate shares held by a partnership of which such a corporation is a member, in accordance with the formula set out in proposed regulation 5908(6). Proposed regulation 5905(5.2) is conceptually similar to paragraph 111(4)(c), which reduces the ACB of certain capital property of a Canadian corporation to the extent that the ACB exceeds the FMV of the property immediately before an acquisition of control.30 Proposed regulation 5905(5.4) is applied after any subsection 111(4) adjustment to the ACB of the foreign affiliate’s shares.31 Regulation 5905(5.2) will reduce the exempt surplus of the top FA by the following formula: (A + B − C)/D, where A is FA’s TFSB multiplied by the subsidiary’s SEP in FA; B is the cost amount of the shares of FA, including those held through a partnership, determined under proposed regulation 5908(6)(a); C is the FMV of the shares of FA owned by the subsidiary, plus the amount (if any) determined under proposed regulation 5908(6)(b); and D is the subsidiary’s SEP in FA. The result is generally that the TFSB will be reduced (by virtue of a reduced exempt surplus or increased exempt deficit) to the FMV of the foreign affiliate shares at the time of the acquisition of control. Proposed regulations 5905(5.2) and (5.4) are intended to interact such that where regulation 5905(5.2) has applied to a foreign affiliate on an acquisition of control to reduce its TFSB, it should be the case that no bump amount would be available in respect of such shares pursuant to proposed regulation 5905(5.4).32 Note that proposed regulation 5905(5.2) applies whether or not there is a subsequent bump pursuant to paragraph 88(1)(d). Example 1 illustrates the application of these rules in the fact situation described below and shown in figure 1.33 29 October 24, 2012 explanatory notes, supra note 6, at 112. 30 Ibid., at 111. 31 Proposed regulation 5905(5.3). 32 October 24, 2012 explanatory notes, supra note 6, at 113. However, an exception to this could be the situation where the shares are held through a partnership, as shown below. 33 This example is based on the one provided in the October 24, 2012 explanatory notes, supra note 6, at 111-15. 238 n canadian tax journal / revue fiscale canadienne FIGURE 1 (2013) 61:1 Example 1 Parent Subsidiary FA (100 shares) ACB: $300 FMV: $1,200 ES: $1,400 ACB = adjusted cost base FMV = fair market value ES = exempt surplus Example 1—Facts Subsidiary is a corporation resident in Canada and owns 100 shares of FA. Parent is a corporation resident in Canada and deals with Subsidiary at arm’s length. At the acquisition time, Parent acquires all the shares of Subsidiary. The ACB of the shares of FA to Subsidiary is $300, and the FMV of the shares is $1,200. At the acquisition time, FA has exempt surplus of $1,400. There are no lower-tier foreign affiliates and no other surplus balances. At the acquisition time, the formula (A + B − C)/D in proposed regulation 5905(5.2) will apply as follows: n n n n A (FA’s TFSB) is $1,400 (exempt surplus of $1,400 × 100% [Subsidiary’s SEP in FA]). B (the cost amount, or ACB, of the shares of FA) is $300. C (the FMV of the shares of FA) is $1,200. D (Subsidiary’s SEP) is 100 percent. Therefore, a reduction in the exempt surplus of FA will be deemed to be $500 ($1,400 + $300 − $1,200). Assume that there is a winding up of Subsidiary into Parent immediately after the acquisition time. To determine the bump amount for the purposes of proposed subparagraph 88(1)(d)(ii), the formula A × B in proposed regulation 5905(5.4) will apply as follows: n n is $900 (the TFSB after the application of regulation 5905(5.2), which reduces the exempt surplus in FA [$1,400 − $500]). B is 1 percent (1/100 shares of FA). A corporate tax planning n 239 Therefore, the prescribed amount is $9 per share. The result is that there will be no bump available since there is no excess of the FMV per share ($1,200/100 = $12) over the cost amount of each share ($300/100 = $3) plus the prescribed amount ($9 per share). The reduction of the bump amount for the purposes of the subsection 88(1) bump by the TFSB will significantly affect and, likely increase, the due diligence requirements and administrative burden in situations where a Canadian corporation that holds shares of a foreign affiliate is acquired and a potential subsection 88(1) bump in respect of such shares is part of the tax planning. The rules do provide some relief by allowing taxpayers to amend their tax cost bump designations in respect of foreign affiliate shares up to 10 years after the original filing-due date.34 Proposed subsections 88(1.8) and (1.9) apply where the corporation has made reasonable efforts to determine the TFSB that was relevant in computing the amount available pursuant to proposed subparagraph 88(1)(d)(ii). For the amended designation to be valid, the minister must be of the opinion that it would be “just and equitable” to permit the initial designation to be amended.35 Examples in the explanatory notes of where the “just and equitable” standard would be met include the situation where the TFSB calculation requires adjustment because of a foreign tax assessment or an adjustment on audit by the minister.36 Furthermore, the explanatory notes state that the “just and equitable” standard could also be met where the relevant information was not available at the time that the designation was filed, but they emphasize that there is always a requirement for “reasonable efforts” to have been made in the initial determination of the TFSB.37 Further relief has been provided administratively by the Canada Revenue Agency (CRA) in situations where the surplus balances do not ultimately have any tax consequences after the acquisition of control and windup. At the 2011 International Fiscal Association CRA round table, the CRA provided its administrative position when responding to a question about the application of proposed clause 88(1)(d)(ii)(B).38 34 Proposed subsections 88(1.8) and (1.9). 35 Ibid. 36 October 24, 2012 explanatory notes, supra note 6, at 96. 37 Ibid. Guidance from the transfer-pricing regime may be helpful in interpreting the meaning of “reasonable efforts.” The transfer-pricing penalty in subsection 247(3) is mitigated where, generally, the taxpayer has made “reasonable efforts” to determine and use arm’s-length transfer prices or allocations. However, subsection 247(4) generally deems reasonable efforts not to have been made unless the taxpayer has prepared contemporaneous documentation. See Canada Revenue Agency, Transfer Pricing Memorandum TPM-09, “Reasonable Efforts Under Section 247 of the Income Tax Act,” September 18, 2006. Among other factors, TPM-09 acknowledges the impact of the administrative burden in making reasonable efforts for the purposes of the transfer-pricing regime. See CRA document no. 2012-0445661C6, December 19, 2012, for a discussion of “just and equitable” in the context of the late eligible dividend designation in subsection 89(14.1). 38 CRA document no. 2011-0404521C6, May 19, 2011. 240 n canadian tax journal / revue fiscale canadienne (2013) 61:1 The question posed a hypothetical scenario in which a non-resident corporation, Forco, incorporates Holdco, a Canadian corporation, which then acquires all the issued and outstanding shares of Canco from arm’s-length persons. Canco owns all of the shares of a foreign affiliate, FA. The acquisition of Canco is followed by a windup of Canco, and all the shares of FA received by Holdco on the winding up are transferred by Holdco to Forco on a reduction of paid-up capital of Holdco. The question noted that FA’s surplus balances become irrelevant once Forco takes ownership of the shares of FA. The CRA stated that it would not challenge the paragraph 88(1)(d) bump in respect of the shares of FA by raising an issue with FA’s TFSB calculation or lack thereof, provided that the FA shares were transferred to Forco by Holdco within a reasonable time after the takeover of Canco and provided that neither Canco nor Holdco received, or was deemed to receive, any dividends from FA after the takeover. The CRA recognized that in some circumstances, the requirement to compute FA’s TFSB for the purposes of proposed regulation 5905(5.4) can create an administrative burden, and that such burden should be alleviated where the calculation does not affect the tax consequences to the taxpayer. Partnership Interest Where the property being bumped is an interest in a partnership that holds foreign affiliate shares, proposed regulation 5908(7) applies instead of proposed regulation 5905(5.4)(a).39 Whereas proposed regulation 5905(5.4)(a) determines the prescribed amount for a single share of a foreign affiliate, proposed regulation 5908(7) determines the prescribed amount for the partnership interest. Proposed regulation 5908(1) generally deems a partnership’s share of a foreign affiliate to be owned by the partnership members on the basis of each member’s proportionate interest in the partnership. Proposed regulation 5908(7) sets out the following formula for determining the prescribed amount: A × B, where A is the TFSB of FA in respect of the subsidiary, at the acquisition time; and B is the percentage that would be the subsidiary’s SEP in respect of FA if the only shares of FA that were owned at the time by the subsidiary were the shares of FA deemed by proposed regulation 5908(1) to be owned by the subsidiary at the acquisition time. Example 2 illustrates the application of these rules in the fact situation described below and shown in figure 2. 39 Proposed regulation 5905(5.4)(b). corporate tax planning n 241 FIGURE 2 Example 2 Parent Subsidiary 50% ACB: $500 FMV: $1,500 Partnership FA (100 shares) ACB: $600 FMV: $2,400 ES: $2,800 ACB = adjusted cost base FMV = fair market value ES = exempt surplus Example 2—Facts Subsidiary is a corporation resident in Canada and holds a 50 percent interest in Partnership. Partnership owns all of the 100 shares of FA. Parent is a corporation resident in Canada and deals with Subsidiary at arm’s length. At the acquisition time, Parent acquires all the shares of Subsidiary. Partnership’s ACB in FA is $600, and the FMV of the shares of FA is $2,400. At the acquisition time, FA has exempt surplus (a TFSB) in respect of Subsidiary of $2,800. FA has never paid a dividend. On the acquisition of control of Subsidiary, proposed regulation 5905(5.2) will apply to reset the surplus balance of FA. The formula (A + B − C)/D in proposed regulation 5905(5.2) will apply as follows: n A (FA’s TFSB) n B n n is $1,400 ($2,800 × 50% [Subsidiary’s SEP in FA]). (the cost amount of the shares of FA) is $300 ($600 × 50/100), pursuant to proposed regulation 5908(6)(a). C (the FMV of FA’s shares deemed to be owned) is $1,200 ($2,400 × 50/100) (since FA has never paid a dividend, and therefore regulation 5908(6)(b) does not apply). D (Subsidiary’s SEP in FA) is 50 percent (50/100). The reduction to FA’s exempt surplus is $1,000 ([$1,400 + $300 − $1,200]/0.50), but Subsidiary effectively has a reduction of only 50 percent of that amount ($500). 242 n canadian tax journal / revue fiscale canadienne (2013) 61:1 Assume that there is a winding up of Subsidiary into Parent immediately after the acquisition of control. The ACB to Subsidiary of the 50 percent interest in Partnership is $500, and the FMV of the 50 percent interest in Partnership is $1,500. For the purposes of proposed subparagraph 88(1)(d)(ii), the prescribed amount in respect of the interest in Partnership is determined by the formula A × B in proposed regulation 5908(7), as follows: n n is $1,800 ($2,800 − $1,000), pursuant to proposed regulation 5905(5.2) as determined above. B is 50 percent (50/100), since Subsidiary is deemed to own 50 shares of FA, pursuant to proposed regulation 5908(1). A The amount determined by the formula in proposed regulation 5908(7) is $900. The bump amount pursuant to proposed subparagraph 88(1)(d)(ii) is the excess of the FMV of the partnership interest ($1,500) over the aggregate of the cost amount of the partnership interest ($500) and the prescribed amount ($900). The bump amount is therefore $100. While the surplus grind under proposed regulation 5905(5.2) in example 2 was determined using the ACB and FMV of the foreign affiliate shares in respect of the partnership, the bump amount in proposed subparagraph 88(1)(d)(ii) is determined on the basis of the cost amount and the FMV of the interest in the partnership. Accordingly, the bump amount would not necessarily be nil in cases where the FMV and the ACB of the partnership interest differ from the FMV and ACB of the underlying foreign affiliate shares. Partnership Bump Rule New subparagraph 88(1)(d)(ii.1) is intended to ensure that the bump amount available in respect of a subsidiary’s interest in a partnership does not reflect unrealized gains and recapture income in respect of property that would not be eligible for a bump if it were held directly by the subsidiary.40 Where subparagraph 88(1)(d)(ii.1) applies, it will reduce the FMV of an interest in a partnership, for the purposes of the calculation in subparagraph 88(1)(d)(ii), by the portion of the gain in respect of the partnership interest that “may reasonably be regarded as being attributable” to the gains in respect of depreciable property, Canadian resource property, foreign resource property, and any other non-capital property (“ineligible property”).41 40 These new rules generally will apply to amalgamations that occur, and windups that begin, on or after March 28, 2012, subject to certain exceptions: Canada, Department of Finance, Explanatory Notes Relating to the Income Act, the Excise Tax Act and Related Acts and Regulations (Ottawa: Department of Finance, October 2012) (herein referred to as “the October 15, 2012 explanatory notes”), at 22. 41 Specifically, the ineligible property described in clauses (A) to (C) of the description of B in subparagraph 88(1)(d)(ii.1). corporate tax planning n 243 More specifically, the FMV of a partnership interest held by the subsidiary at the time the parent last acquired control of the subsidiary is reduced to the amount generally determined by the following formula, set out in subparagraph 88(1)(d)(ii.1): A − B, where A is the FMV of the partnership interest at the time the parent last acquired control of the subsidiary, and B is the portion of the amount by which the FMV of the partnership interest at the time the parent last acquired control of the subsidiary exceeds its cost amount as may reasonably be regarded as being attributable to the total of all amounts each of which is, n n n for depreciable property, the FMV (determined without reference to liabilities) of depreciable property minus the cost amount; for Canadian resource property or foreign resource property, the FMV of the property (determined without reference to liabilities); and for other non-capital property, the FMV (determined without reference to liabilities) minus the cost amount. Finance has confirmed that subparagraph 88(1)(d)(ii.1) is not intended to apply in respect of ineligible property held by the partnership through a taxable Canadian corporation.42 Meaning of “May Reasonably Be Regarded as Being Attributable” While subparagraph 88(1)(d)(ii.1) does not specify how taxpayers are to determine the portion of the amount that “may reasonably be regarded as being attributable” to ineligible property, the explanatory notes illustrate an important principle in calculating this amount. Specifically, the explanatory notes state that reference should be made to what Finance refers to as the “outside” gain, which is the accrued gain in the partnership interest, and the aggregate “inside” gain, which is the total gain in respect of either the partnership’s assets or only the ineligible property, depending on the context.43 Where the outside gain is less than or equal to the inside gain in respect of all property of the partnership, the FMV of the partnership interest is reduced for the purposes of subparagraph 88(1)(d)(ii.1) by the outside gain in respect of the partnership 42 See the October 15, 2012 explanatory notes, supra note 40, at 26: “It is recognized that a subsidiary may wish to transfer ineligible property to a taxable Canadian corporation before there is an acquisition of control of the subsidiary in order to preserve the bump room that would otherwise be, but for subparagraph 88(1)(d)(ii.1), available in respect of the partnership interest. Consequently, subparagraph 88(1)(d)(ii.1) does not reduce the fair market value of a partnership interest by the unrealized gains and recapture income existing in respect of shares of a taxable Canadian corporation held by the partnership, even if properties held by the corporation are ineligible properties.” 43 Ibid., at 23-26. 244 n canadian tax journal / revue fiscale canadienne (2013) 61:1 multiplied by the proportion that the inside gain in respect of the ineligible property held by the partnership is of the inside gain in respect of all the property of the partnership.44 However, where the outside gain is greater than the inside gain in respect of all the property of the partnership, the FMV will be reduced only by the amount of the inside gain in respect of the ineligible property. The explanatory notes confirm that the reference to “may reasonably be regarded as being attributable” to gains in respect of ineligible property means that, “in normal circumstances,” the FMV reduction is not expected to exceed the total of all gains attributable to ineligible property held directly or indirectly by the partnership.45 While this interpretation makes intuitive sense, it would have been preferable had this interpretation been set out in the legislation rather than in the form of examples in the explanatory notes. Anti-Avoidance Rules Bill C-45 has also introduced two new anti-avoidance rules, which are intended to ensure that subparagraph 88(1)(d)(ii.1) is effective.46 Transfers Before Acquisition of Control The first anti-avoidance rule is set out in new paragraph 88(1)(e). It applies to certain transfers of ineligible property to a partnership where the partnership interest is held directly or indirectly by the subsidiary, and such transfer occurs before the parent acquires control of the subsidiary.47 Paragraph 88(1)(e) applies where 1. the subsidiary holds an interest in a particular partnership at the time control of the subsidiary is acquired by the parent; 2. as part of a series of transactions or events in which control is so acquired, the subsidiary, on or before the acquisition of control, transfers a property to the particular partnership (or to any other partnership) under subsection 97(2) or the subsidiary acquires an interest in the particular partnership (or any other partnership) in a non-arm’s-length transfer 48 to which section 85 applies; and 44 Where the inside gain in respect of all the property of the partnership is equal to the outside gain in respect of the partnership, the multiplier in the formula reduces to the inside gain in respect of the ineligible property. 45 October 15, 2012 explanatory notes, supra note 40, at 26. It is not clear, without further guidance, what would be considered not to be “normal circumstances.” 46 See ibid., at 21. 47 Paragraph 88(1)(e) will generally apply after August 13, 2012 except for dispositions that occur before 2013 pursuant to an obligation under a written agreement entered into before August 14, 2012 by parties that deal with each other at arm’s length, provided that no party to the agreement may be excused from the obligation as a result of amendments to the Act. 48 Otherwise than because of a right referred to in paragraph 251(5)(b). corporate tax planning n 245 3. at the time of the acquisition of control, the particular partnership holds directly, or indirectly through one or more other partnerships, ineligible property. If applicable, paragraph 88(1)(e) will deem the FMV of the subsidiary’s interest in the particular partnership for the purposes of element A in the formula in subparagraph 88(1)(d)(ii.1) to be determined without reference to the FMV of the property transferred to a partnership by the subsidiary under subsection 97(2), or of the partnership interest where such partnership interest is acquired pursuant to a section 85 rollover. Although paragraph 88(1)(e) applies only where the particular partnership holds ineligible property, the provision can apply even if no ineligible property was transferred pursuant to the rollover, since subparagraph 88(1)(e)(ii) only requires that the partnership holds ineligible property (whether directly or indirectly) at the time of the acquisition of control. Finance emphasizes the anti-avoidance nature of paragraph 88(1)(e), and states that this provision is intended to apply in circumstances where the “transfers are made to change the factors that may be relevant when applying the formula in subparagraph 88(1)(d)(ii.1).”49 However, there is no requirement in paragraph 88(1)(e) indicating that the rule will apply only where there is an anti-avoidance purpose or where there would be a difference in the amount determined under subparagraph 88(1)(d)(ii.1). Thus, this new provision appears to apply whether or not a series of transactions that included a subsection 97(2) or section 85 rollover was actually intended to affect the bump amount. Although taxpayers can take some comfort in the purpose of the rule set out in the explanatory notes, if Finance intended paragraph 88(1)(e) to be an anti-avoidance provision in respect of subparagraph 88(1)(d)(ii.1), setting this out in the statute would provide more certainty to taxpayers. Transfers After Acquisition of Control The second anti-avoidance rule is in new subsection 97(3). It applies to certain transfers of ineligible property to a partnership where an interest in the partnership is held directly or indirectly by the subsidiary, and where such transfer occurs after the parent acquires control of the subsidiary.50 Generally, subsection 97(3) will preclude a tax-deferred transfer under subsection 97(2) in respect of a disposition of property to a particular partnership where, 1. as part of a series of transactions or events that includes such disposition, a. control of the subsidiary is acquired by the parent, b. the subsidiary is wound up pursuant to subsection 88(1) or amalgamated pursuant to subsection 87(11), and 49 October 15, 2012 explanatory notes, supra note 40, at 27. 50 Subsection 97(3) applies in respect of a disposition made after March 28, 2012. 246 n canadian tax journal / revue fiscale canadienne (2013) 61:1 c. the parent makes a designation under paragraph 88(1)(d) in respect of an interest in a partnership;51 2. the disposition occurs after the acquisition of control of the subsidiary; 3. the particular partnership acquires property that is ineligible property or is an interest in a partnership that holds such property; and 4. the subsidiary is the taxpayer or has, before the disposition of the property, directly or indirectly, an interest in the taxpayer. Again, Finance emphasizes the anti-avoidance nature of the new provision, stating that subsection 97(3) was introduced to ensure that property that is not eligible for a bump is not transferred on a tax-deferred basis in circumstances that would frustrate the purpose of new subparagraph 88(1)(d)(ii.1).52 The explanatory notes provide two examples of transactions that would frustrate subparagraph 88(1)(d)(ii.1):53 n n The first example describes a situation where the subsidiary has an interest in a particular partnership at the time the parent acquires control of the subsidiary, and the subsidiary seeks to transfer ineligible property on a tax-deferred basis under subsection 97(2) to the particular partnership after the acquisition of control. The second example describes a situation where the subsidiary has an interest in partnership ABC, which in turn has an interest in corporation Y at the time the parent acquires control of the subsidiary. Corporation Y, either prior to the acquisition of control or after that time, has an interest in partnership XYZ (which is the taxpayer in this example). Partnership XYZ seeks to transfer ineligible property on a tax-deferred basis under subsection 97(2) to partnership ABC after the acquisition of control. Although these examples are helpful to taxpayers in determining when subsection 97(3) may apply, the broad wording of the provision creates uncertainty for taxpayers who are planning to use subsection 97(2) in the context of reorganizations involving target companies that are members of partnerships where any partnership interest is intended to be the subject of a bump pursuant to paragraph 88(1)(d). 51 Subparagraph 97(3)(a)(iii) refers to the designation under paragraph 88(1)(d) in respect of an interest in “a partnership.” However, the October 15, 2012 explanatory notes, supra note 40, at 28, refer to the designation under paragraph 88(1)(d) in respect of an interest in “the partnership.” Accordingly, it is not clear whether this anti-avoidance rule can apply where the particular partnership that is the subject of subsection 97(2) is not the same as the partnership the interest in which is the property being designated pursuant to paragraph 88(1)(d). This issue was noted in a submission to the Department of Finance: see infra note 64, at 28. 52 See the October 15, 2012 explanatory notes, supra note 40, at 28. 53 Ibid. corporate tax planning n 247 AMENDMENTS TO SECTION 100 The second partnership measure announced in the 2012 budget was the proposed amendment of section 100.54 The new rules were subsequently enacted by Bill C-45. Formerly, subsection 100(1) applied to prevent a taxpayer who disposed of a partnership interest to a tax-exempt person55 from claiming the 50 percent capital gain inclusion rate in respect of the disposition where the sale of the underlying assets of the partnership would normally have given rise to ordinary income subject to full inclusion. Subsection 100(1) is intended to prevent the situation where, for example, a taxpayer could otherwise transfer income assets to a partnership on a tax-deferred basis in exchange for a partnership interest and then dispose of the partnership interest to a tax-exempt person, realizing a capital gain on the entire amount. The tax-exempt person could then wind up the partnership and acquire the income assets tax-free. The amendments have broadened the application of this provision. Under new subsection 100(1), where, as part of a series of transactions or events, a taxpayer disposes of a partnership interest to a person or partnership described in new paragraphs 100(1.1)(a) through (d), the taxpayer’s taxable capital gain in respect of the disposition is deemed to be the total of (a) 1⁄ 2 of such portion of the taxpayer’s capital gain for the year from the disposition as may reasonably be regarded as attributable to increases in the value of any partnership property of the partnership that is capital property other than depreciable property held directly by the partnership or held indirectly by the partnership through one or more other partnerships, and (b) the whole of the remaining portion of that capital gain. The inclusion of the reference to “a series of transactions or events” is new.56 The expansive interpretation of this phrase could result in significant broadening of the application of the rule.57 New subsection 100(1) also expands the category of persons or partnerships that are caught by the provision when such persons or partnerships acquire an interest in a partnership from the taxpayer. As provided by new subsection 100(1.1), these 54 See the 2012 budget, supra note 4, at 414. 55 Specifically, “any person exempt from tax under section 149” (preamble of former subsection 100(1)). 56 Interestingly, the 2012 budget stated that new subsection 100(1) would “clarify” that section 100 applies to dispositions made directly or indirectly as part of a series of transactions to a tax-exempt or non-resident person: 2012 budget, supra note 4, at 415. However, the explanatory notes state that the preamble to subsection 100(1) is “amended”: October 15, 2012 explanatory notes, supra note 40, at 28. 57 See Copthorne Holdings Ltd. v. Canada, 2011 SCC 63. 248 n canadian tax journal / revue fiscale canadienne (2013) 61:1 persons or partnerships include a tax-exempt person, as before; a non-resident person; and (pursuant to certain lookthrough rules) certain partnerships and trusts where a tax-exempt or non-resident person is a direct or indirect member of the partnership or where a tax-exempt person is a beneficiary of the trust (other than a mutual fund trust). Where the acquiror is a partnership, the lookthrough rules will apply to the extent that the partnership interest acquired can reasonably be considered to be held indirectly through one or more partnerships by a person that is tax-exempt under section 149 or a non-resident person.58 Where a trust resident in Canada (other than a mutual fund trust) holds the interest through one or more partnerships, the lookthrough rules apply if a tax-exempt person or another trust (other than a mutual fund trust) is a beneficiary and the total FMV of those interests exceeds 10 percent of the FMV of all the interests of beneficiaries under the trust.59 Where the acquiror is a trust resident in Canada (other than a mutual fund trust), the lookthrough rules will apply to the extent that the trust can reasonably be considered to have a beneficiary that is a tax-exempt person under section 149, a partnership, or another trust.60 If the trust has a beneficiary that is a partnership, the lookthrough rule will apply if the interest in the partnership is held directly, or indirectly through one or more other partnerships, by one or more persons that are tax-exempt under section 149 or are trusts (other than mutual fund trusts), and the total FMV of the interests held by such persons exceeds 10 percent of the FMV of all the interests in the partnership.61 If the trust has a beneficiary that is another trust (other than a mutual fund trust), the lookthrough rule will apply if one or more beneficiaries under the other trust are tax-exempt persons under section 149, a partnership, or a trust (other than a mutual fund trust), and the total FMV of the interests as beneficiaries under the other trust held by such beneficiaries exceeds 10 percent of the FMV of all the interests as beneficiaries under the other trust.62 New subsection 100(1.2) provides a de minimis exception in respect of the application of the lookthrough rule to a disposition of a partnership interest to a partnership or trust (other than a discretionary trust) described in paragraph 100(1.1)(c) or (d). The lookthrough rule does not apply if the extent to which subsection 100(1) would, but for new subsection 100(1.2), apply to the taxpayer’s disposition does not exceed 10 percent of the taxpayer’s interest. Example 3 illustrates the application of subsection 100(1) under the new rules in the fact situation described below and shown in figure 3.63 58 New subparagraphs 100(1.1)(c)(i) and (ii). 59 New subparagraph 100(1.1)(c)(iii). 60 New paragraph 100(1.1)(d). 61 New subparagraph 100(1.1)(d)(ii). 62 New subparagraph 100(1.1)(d)(iii). 63 This example is based on the one provided in the October 15, 2012 explanatory notes, supra note 40, at 31. corporate tax planning n 249 FIGURE 3 Taxable persons in Canada Tax-exempt/ non-resident persons 50% 50% Example 3 Tax-exempt persons 50% Partnership MNO 50% Trust T Taxpayer A Tax-exempt/ non-resident persons X% 30% 30% Partnership ABC 40% Assets Partnership XYZ Example 3—Facts Taxpayer A disposes of an interest in partnership ABC to partnership XYZ and realizes a capital gain of $100,000 from the disposition. All of the assets of partnership ABC are depreciable property. Partnership XYZ has the following ownership structure: Forty percent of the interests in partnership XYZ are held directly by tax-exempt or non-resident persons, 30 percent are held by partnership MNO, and 30 percent are held by trust T. n Fifty percent of the interests in partnership MNO are held directly by tax-exempt or non-resident persons and 50 percent are held by taxable persons in Canada. n Fifty percent of the beneficial interests in trust T are held by tax-exempt persons and 50 percent are held by taxable persons in Canada. Trust T is a resident of Canada and is not a mutual fund trust. n The taxable capital gain of taxpayer A pursuant to the application of new subsection 100(1) is calculated by determining the extent to which the interest in partnership ABC disposed of by taxpayer A is held, through partnership XYZ, by the persons or partnerships listed in new subsection 100(1.1) as follows: 250 n canadian tax journal / revue fiscale canadienne n n n (2013) 61:1 Forty percent of the interest is held through partnership XYZ by tax-exempt or non-resident persons. Fifteen percent (30% × 50%) is held by persons or partnerships listed in subsection 100(1.1) pursuant to the lookthrough rule in paragraph 100(1.1)(c). Thirty percent of the interest is held by trust T. The trust has at least one beneficiary that is a tax-exempt person, and the beneficiary holds more than 10 percent of the FMV of the interests under trust T. Given the above, 85 percent (40% + 15% + 30%) of the interest in partnership ABC is subject to paragraph 100(1)(b). The remainder is subject to paragraph 38(a). The taxable capital gain is $92,500, which is the sum of $7,500 (50% × [15% × $100,000]) and $85,000 (100% × [85% × $100,000]). Now assume that partnership ABC holds assets other than depreciable property. Taxpayer A will need to determine the extent to which the capital gain from the disposition can reasonably be attributed to increases in the value of depreciable property or property that is not capital property (that is, resource property or inventory). If, for example, the increase in the value of the depreciable property held by partnership ABC were $50,000, it might be reasonable that paragraph 100(1)(b) would apply to only $50,000 of the $100,000 capital gain. If the rest of the property held by partnership ABC were non-depreciable capital property, then paragraph 100(1)(a) would apply to the balance of the capital gain. As above, 15 percent of the capital gain would not be subject to subsection 100(1) but would be subject to paragraph 38(a). Under these assumed facts, the taxable capital gain would be $71,250, which is the sum of $7,500 (50% × [15% × $100,000]) and $21,250 (50% × [85% × $50,000]) and $42,500 (100% × [85% × $50,000]). New subsection 100(1.3) contains an exception to the application of subsection 100(1) for an acquisition of a partnership interest by a non-resident person where the partnership used all of its property, immediately before and immediately after the acquisition, in carrying on business through one or more permanent establishments in Canada and where the total FMV of such property equals at least 90 percent of the total FMV of all property of the partnership. Commentators have suggested that this exception should be broader.64 The section 100 amendments also add a “dilution” anti-avoidance rule in new subsection 100(1.5). According to the explanatory notes, this rule is intended to 64 See Joint Committee on Taxation of the Canadian Bar Association and the Canadian Institute of Chartered Accountants, “Re: August 14, 2012 Draft Legislative Proposals To Amend the Income Tax Act (Canada),” submission to Brian Ernewein, general director, Tax Policy Branch, Tax Legislation Division, Department of Finance, September 13, 2012. The joint committee submitted that subsection 100(1.3) should apply regardless of the assets of the partnership and that there should be an exception for other forms of Canadian property that is taxable to non-residents on disposition, such as real property in Canada (whether or not held as part of a business) and Canadian resource property. corporate tax planning n 251 ensure that subsection 100(1) applies where partnership interests are created or changed in a way that is “economically equivalent” to a direct disposition of a partnership interest without a disposition of the interest having been made.65 New subsection 100(1.4) provides that subsection 100(1.5) will apply if it is reasonable to conclude that one of the purposes of a dilution, reduction, or alteration of the partnership interest (collectively, a “dilution”) is to avoid the application of subsection 100(1) in respect of the partnership interest, and as part of a transaction or event or a series of transactions or events that includes the dilution, there is an acquisition of, an increase in, or an alteration of, the partnership interest by a person or partnership described in paragraphs 100(1.1)(a) through (d) (“the deemed acquiror”). Notably, an anti-avoidance purpose is a requirement that is set out in the provision for the dilution rule to apply, in contrast to the new anti-avoidance provisions under the bump amendments discussed above. Where subsection 100(1.5) applies, the result is that the taxpayer is deemed, for the purposes of subsection 100(1), to have disposed of an interest in the relevant partnership at the time of the dilution, and to have a capital gain from the disposition equal to the amount by which the FMV of the partnership interest immediately before the dilution exceeds its FMV immediately thereafter.66 The deemed acquiror is deemed to have acquired an interest in the partnership as part of the transaction or event or series of transactions or events that includes the deemed disposition.67 As a result, the acquisition will generally be brought within the ambit of new subsection 100(1). APPLIC ATION OF THE NEW BUMP RULES AND SECTION 100 The following example illustrates the application of the new rules in subsection 88(1) and section 100 discussed above. Example 4—Facts Subsidiary is a corporation resident in Canada with the following holdings: land ABC, which is non-depreciable capital property; a wholly owned foreign affiliate, FA 1; and a 50 percent interest in partnership XYZ. Land ABC has an FMV of $2,000 and a cost amount to Subsidiary of $1,000. FA 1 has an FMV of $1,000 and a cost amount to Subsidiary of $800. FA 1 has exempt surplus (a TFSB) in respect of Subsidiary of $700. The FMV of partnership XYZ is $10,000, and the ACB of the 50 percent partnership interest held by Subsidiary is $2,900.68 65 October 15, 2012 explanatory notes, supra note 40, at 33. 66 New paragraphs 100(1.5)(a) and (b). 67 New paragraph 100(1.5)(c). 68 To simplify the calculations, the example and accompanying figure 4 use an ACB of $5,800 for all interests in the partnership. 252 n canadian tax journal / revue fiscale canadienne (2013) 61:1 FIGURE 4 Example 4 Tax-exempt/ non-resident person Parent Taxable persons in Canada 70% Subsidiary 50% Land ABC FA 1 ACB: $5,800 FMV: $10,000 ACB: $800 FMV: $1,000 ES: $700 30% Partnership MNO Partnership XYZ ACB: $1,000 FMV: $2,000 Land XYZ ACB: $3,000 FMV: $5,000 FA 2 ACB: $800 FMV: $1,000 ES: $700 Building XYZ UCC: $2,000 FMV: $4,000 ACB = adjusted cost base FMV = fair market value ES = exempt surplus UCC = undepreciated capital cost Partnership XYZ holds land XYZ as non-depreciable capital property; building XYZ as depreciable property; and FA 2, a foreign affiliate of Subsidiary held through partnership XYZ. Land XYZ has an FMV of $5,000 and a cost amount to partnership XYZ of $3,000. Building XYZ has an FMV of $4,000 and an undepreciated capital cost to partnership XYZ of $2,000. FA 2 has an FMV of $1,000 and a cost amount to partnership XYZ of $800. FA 2 has exempt surplus (a TFSB) in respect of Subsidiary of $700. Partnership MNO intends to acquire the 50 percent interest in partnership ABC. Seventy percent of the interest in partnership MNO is held directly by tax-exempt or non-resident persons. Thirty percent of the interest is held by taxable persons in Canada. Parent is a corporation resident in Canada that deals with Subsidiary at arm’s length. Parent acquires control of Subsidiary on November 1, 2012 (the acquisition time in this example). Immediately thereafter, Parent winds up Subsidiary and bumps the property owned by Subsidiary. corporate tax planning n 253 Figure 4 illustrates the ownership structures and relationships described above prior to the windup of Subsidiary. The application of the new rules in this situation is summarized below. Acquisition of Control At the acquisition time, regulation 5905(5.2) applies to the shares of FA 1 and FA 2 to reduce the exempt surplus as set out below. With respect to FA 1, the formula (A + B − C)/D applies as follows: is $700, B is $800, and C is $1,000. D is the SEP, which is 100 percent. exempt surplus is reduced by $500; thus, FA 1’s new TFSB is $200 ($700 − $500). n A n FA 1’s With respect to FA 2, the formula (A + B − C)/D applies as follows: n is $350 ($700 × 0.5), B is $400 ($800 × 0.5), and C is $500 ($1,000 × 0.5). is the SEP, which is 50 percent. FA 2’s exempt surplus is reduced by $500, so that FA 2’s new TFSB is $200 ($700 − $500). A D n Winding Up On the winding up of Subsidiary, Parent can designate the bump amount for land ABC and FA 1, pursuant to subparagraph 88(1)(d)(ii) (and regulation 5905(5.4) in respect of FA 1), as follows: n n land ABC: $1,000 ($2,000 − $1,000); FA 1: nil ($1,000 − [$800 + $200]).69 With respect to the 50 percent interest in partnership XYZ, reference must be made to subparagraph 88(1)(d)(ii.1). Subparagraph 88(1)(d)(ii.1) determines the amount by which to reduce the FMV of partnership XYZ for the purposes of determining the bump amount in subparagraph 88(1)(d)(ii). The outside gain of partnership XYZ is $4,200 ($10,000 − $5,800). The inside gain of all property of partnership XYZ is $4,200 ($2,000 + $200 + $2,000). Therefore, the FMV is reduced by the gain in respect of building XYZ, which is $2,000 ($4,000 − $2,000), the amount attributable to ineligible property. 69 The amount by which the FMV of FA 1 ($1,000) exceeds the sum of the ACB ($800) and the prescribed amount of all shares of FA 1 ($200) determined pursuant to regulation 5905(5.4) after adjustment by regulation 5905(5.2). (The per share prescribed amount determined pursuant to regulation 5905(5.4) is $2 [$200 × 1/100].) 254 n canadian tax journal / revue fiscale canadienne (2013) 61:1 The prescribed amount pursuant to subparagraph 88(1)(d)(ii) in respect of FA 2 is determined pursuant to regulations 5905(5.4)(b) and 5708(7), and is $100 ($200 × 0.5). Accordingly, the bump amount for the 50 percent interest in partnership XYZ is $1,000 ([$10,000 − $2,000] × 0.5 − [$5,800 × 0.5 + $100]). The FMV of the 50 percent interest in partnership XYZ is $5,000, and the ACB is $3,900 (the original ACB of $2,900 plus the bump amount of $1,000). Disposition of Interest in a Partnership Assume that subsequent to the winding up of Subsidiary, Parent disposes of the 50 percent interest in partnership XYZ to partnership MNO. As determined above, the FMV of the 50 percent interest in partnership XYZ is $5,000, and the ACB is $3,900. The capital gain is $1,100. Subsection 100(1) applies to determine the taxable capital gain since partnership MNO is a person or partnership described in subsection 100(1.1). n n Sixty percent of the FMV of the assets of partnership XYZ is from non-depreciable capital property and 40 percent from depreciable property.70 However, of the accrued gain of the property held by partnership XYZ prior to the bump of the partnership interest, $2,000 (48 percent) was from depreciable property and $2,200 (52 percent) was from non-depreciable capital property.71 The 50 percent partnership interest is acquired by partnership MNO from Parent, and 70 percent of the interests in partnership MNO are held directly by tax-exempt persons or non-residents of Canada. An issue arises as to what may “reasonably be regarded” as attributable to the increase in the value of any capital property that is not depreciable property. The bump amount of $1,000 determined above could reasonably be considered to be attributable to land XYZ and is therefore already taken into account in the ACB. Accordingly, of the $1,100 capital gain, $1,000 (91 percent of the total amount) could be considered to be attributable to the increase in value of building XYZ, a depreciable property, so that the remaining $100 would be attributable to non-depreciable capital property. 70 Section 100 appears to ignore the fact that a capital gain could also be realized on the disposition of depreciable property sold for more than its original cost. The gain would be taxed at capital gains rates if the partnership itself sold the assets, but will be taxed in full to the extent that the gain is recognized on the sale of a partnership interest to a person listed in subsection 100(1.1). Therefore, it appears that the capital cost of building XYZ is not relevant in this example. 71 Similar to the calculation in subparagraph 88(1)(d)(ii.1), the relevant amount appears to be the portion that “may reasonably be regarded as attributable to increases in the value of any partnership property” that is depreciable property. This appears to require a determination of the inside gain in respect of each property of the partnership. corporate tax planning n 255 Under this interpretation, 63.7 percent (91% × 70%) of the capital gain arising from the disposition of the 50 percent interest in partnership XYZ would be subject to paragraph 100(1)(b). The remainder is subject to paragraph 38(a) or 100(1)(a). The taxable capital gain would be approximately $900 ($200 [50% × 36.3% × $1,100] + $700 [100% × 63.7% × $1,100]). OBSERVATIONS AND CONCLUSIONS The amendments to the bump rules and section 100 raise several policy concerns. First, the introduction of these complex rules will likely increase the due diligence and compliance burdens for taxpayers in the context of determining the bump amount. The eventual enactment of proposed subparagraph 88(1)(d)(ii), along with regulations 5905 and 5908, and the recent introduction of subparagraph 88(1)(d)(ii.1) will significantly increase the complexity of the rules and the due diligence requirements for acquisitions of taxable Canadian corporations that own shares of a foreign affiliate and/or hold an interest in a partnership, where the subsection 88(1) bump is contemplated as part of the overall tax planning. With respect to shares of a foreign affiliate held directly or through a partnership, the ability to file an amended designation to adjust the TFSB amount is helpful relief. However, it is not clear why the minister should necessarily have discretion over whether such amendments would meet the “just and equitable” standard. Also welcome is the CRA’s position that where, very generally, there is an administrative burden and where surplus balances do not affect the tax consequences, the CRA will not take issue with the foreign affiliates’ surplus calculations. However, it is not clear what the limits of this administrative relief are, and further guidance from the CRA would be helpful. The requirement to look through to the property of the partnership in transactions where subparagraph 88(1)(d)(ii.1) or section 100 could potentially apply will also complicate such transactions, especially given the range of transactions that may be brought in through an expansive definition of “a series of transactions or events.” Second, it appears that Finance is increasing its reliance on the explanatory notes that accompany legislation to set out limitations and exceptions to the legislative provisions in the Act. Examples include the meaning of “may reasonably be regarded as being attributable to” in respect of ineligible property under subparagraph 88(1)(d)(ii.1), and the anti-avoidance nature of paragraph 88(1)(e) and subsection 97(3). While taxpayers and their advisers should be able to take comfort in such interpretive aids, explanatory notes are not proper substitutes for legislation and do not provide the degree of certainty for taxpayers that should be a goal of Canadian tax policy makers. The explanatory notes are useful in assisting taxpayers and their advisers in understanding complex tax provisions and are useful extrinsic evidence of the object, spirit, and purpose of particular provisions (for example, for the purposes of applying the general anti-avoidance rule). However, where limitations or exceptions 256 n canadian tax journal / revue fiscale canadienne (2013) 61:1 are set out in the explanatory notes, the concern is that too much discretion is given to the minister in applying those limitations or exceptions, thus eroding the potential usefulness of such statements in many situations. Finally, it should be noted that the anti-avoidance rules in paragraph 88(1)(e), subsection 97(3), and subsections 100(1.4) and (1.5) all potentially encompass transactions or events that are part of a series. The inclusion of this language in the new rules and the recent Supreme Court jurisprudence setting out the broad application of the series test72 means that taxpayers will have to be careful to ensure that transactions are not inadvertently caught within these rules. 72 Copthorne, supra note 57.