Torrent Power Limited - Annual Report - 2013-14

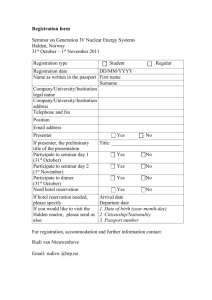

advertisement