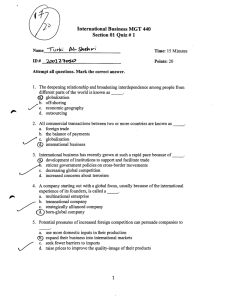

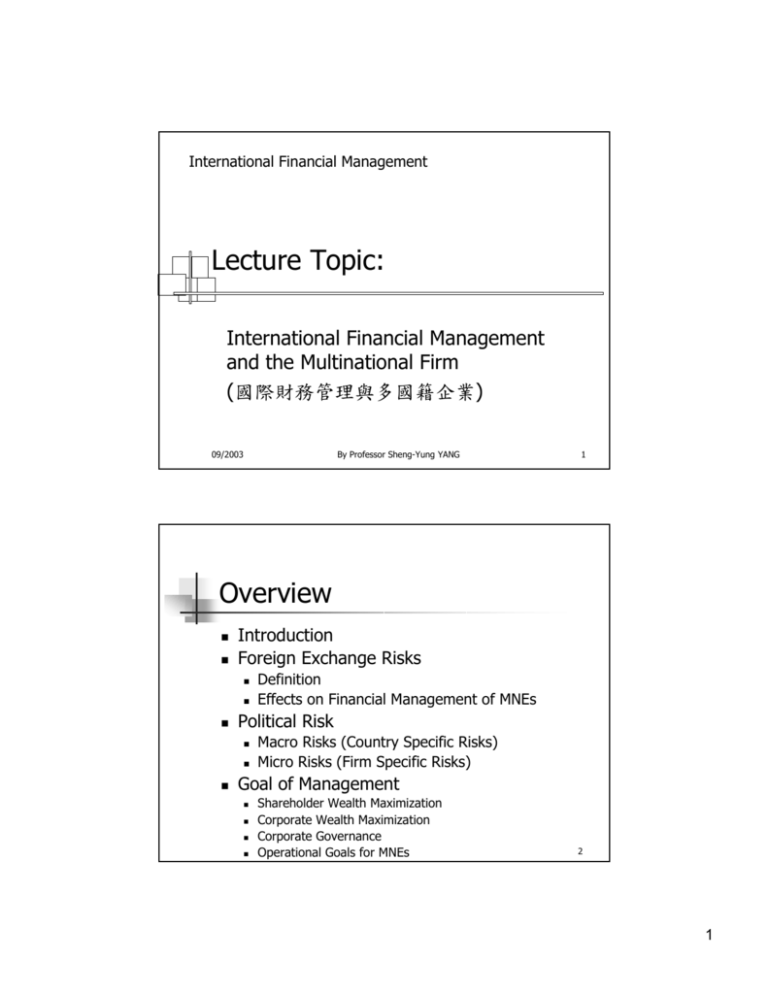

Lecture Topic: Overview

advertisement

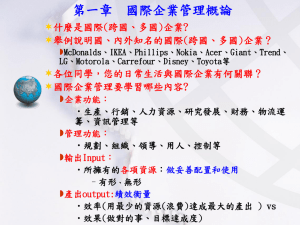

International Financial Management Lecture Topic: International Financial Management and the Multinational Firm (國際財務管理與多國籍企業) 09/2003 By Professor Sheng-Yung YANG 1 Overview n n Introduction Foreign Exchange Risks n n n Political Risk n n n Definition Effects on Financial Management of MNEs Macro Risks (Country Specific Risks) Micro Risks (Firm Specific Risks) Goal of Management n n n n Shareholder Wealth Maximization Corporate Wealth Maximization Corporate Governance Operational Goals for MNEs 2 1 Overview n n Universal Truth vs. Culturally Determined Norm Market Imperfections: Rationale for the Existence of the Multinational Firm (Opportunities of MNEs from Market Imperfection) n Why Do Firms Become Multinational? n n n n n n n n Markets Raw Materials Production Efficiency Knowledge Political Safety Market Seekers vs. Raw Material Seekers Defensive Investments Opportunities of MNEs from Market Imperfection3 Overview n n n n n n The Theory of Comparative Advantage Product Cycle Theory Globalization of the World Economy: Recent Trends Multinational Financial Management vs. General Financial Management Exposure to International Risk Valuation Model for an MNC 4 2 Introduction n n n This course is about international financial management with special emphasis on the multinational firm; why is it important to MNE? The multinational enterprise or corporation (MNE or MNC, 多國籍企業) is defined as one that has operating (production and marketing) subsidiaries, branches, and affiliates located in foreign countries; e.g. Intel, Nokia, Walt Disney, Nestlé, TSM, UMC, and Acer Group etc. Purely domestic firms also often have significant international activities including import and export, foreign competition, international relationships with customers and the suppliers, and foreign exchange 5 and credit risks of trade payments Multinational Corporations (MNCs, 多國籍企業) Multinational Corporation (MNC) Foreign Exchange Markets Exporting & Importing Product Markets Dividend Remittance & Financing Subsidiaries Investing & Financing International Financial Markets 6 3 Top 10 MNEs Ranked by Foreign Assets (1997) 1 General Electric (304 B) United States 2 Ford Motor Company (275 B) United States 3 Royal Dutch/Shell Group (115 B) Netherlands / UK 4 General Motors (228 B) United States 5 Exxon Corporation (96 B) United States 6 Toyota (105 B) Japan 7 IBM (82 B) United States 8 Volkswagen Group (57 B) Germany 9 Nestlé SA (38 B) Switzerland 10 Daimler-Benz AG (76 B) Germany 7 Unique Risks Faced by MNEs: Foreign Exchange Risks and Political Risks n n The normal domestic approach to the cost of capital, sourcing debt and equity, capital budgeting, working capital management, investment, taxation, and credit analysis, and financial instruments etc. needs to be modified to accommodate foreign complexity and risk Foreign Exchange Risk (匯率風險): The risk that foreign currency profits may evaporate in dollar (domestic) terms due to unanticipated unfavorable exchange rate movements; investors therefore require a foreign exchange risk premium when valuing the equity and debt of MNEs; how it affects the cost of capital? 8 4 Unique Risks Faced by MNEs: Foreign Exchange Risks and Political Risks n n Political Risk (政治風險): Sovereign governments have the right to regulate the movement of goods, capital, and people across their borders; these laws sometimes change in unexpected ways See, Exhibit 1.1, for the Micro-Macro decomposition of political risks (need the political risk premium) n n Most contemporary political risk for MNEs is firm-specific and affects operations rather than ownership Forecasting political risk and finding strategies to reduce its impact are major concerns of top management of MNEs 9 Exhibit 1.1: Micro-Macro Decomposition of Political Risk 10 5 Analysis of Political Risks Macro Risks n n n Expropriation (無償徵收): is defined as official government seizure of private property Ethnic Strife (種族紛爭): e.g. the 911 attack of US, tension between ethnic and religious groups in Asia Micro Risks n n n Goal Conflict (經營目標的衝突): the risk arises from a conflict between the objectives of governments (for citizens) and private firms (for stakeholders) Corruption (貪污與賄賂): Transparency International (TI) publishes monthly newsletter on corruption in international business transactions; the indices help firms determine political risk premium 11 Transparency International’s Corruption Perceptions Index for 2002 1 2 2 4 5 5 7 7 7 10 11 12 12 14 15 16 17 18 18 20 20 20 Finland Denmark New Zealand Iceland Singapore Sweden Canada Luxembourg Netherlands United Kingdom Australia Norway Switzerland Hong Kong Austria USA Chile Germany Israel Belgium Japan Spain 9.7 9.5 9.5 9.4 9.3 9.3 9.0 9.0 9.0 8.7 8.6 8.5 8.5 8.2 7.8 7.7 7.5 7.3 7.3 7.1 7.1 7.1 0.4 0.3 0.2 0.4 0.2 0.2 0.2 0.5 0.3 0.5 1.0 0.9 0.9 0.8 0.5 0.8 0.9 1.0 0.9 0.9 0.9 1.0 8.9 - 10.0 8.9 - 9.9 8.9 - 9.6 8.8 - 10.0 8.9 - 9.6 8.9 - 9.6 8.7 - 9.3 8.5 - 9.9 8.5 - 9.3 7.8 - 9.4 6.1 - 9.3 6.9 - 9.3 6.8 - 9.4 6.6 - 9.4 7.2 - 8.7 5.5 - 8.7 5.6 - 8.8 5.0 - 8.1 5.2 - 8.0 5.5 - 8.7 5.5 - 7.9 5.2 - 8.9 9.5 - 9.9 9.3 - 9.7 9.3 - 9.6 9.2 - 9.7 9.2 - 9.4 9.2 - 9.4 8.9 - 9.2 8.7 - 9.5 8.8 - 9.1 8.4 - 8.9 8.0 - 9.0 8.0 - 8.9 7.9 - 8.9 7.8 - 8.6 7.6 - 8.1 7.2 - 8.0 7.0 - 7.9 6.7 - 7.7 6.7 - 7.7 6.6 - 7.6 6.6 - 7.4 6.5 - 7.6 23 24 25 25 27 28 29 29 31 32 33 33 33 36 36 36 36 40 40 40 40 44 Ireland 6.9 0.9 Botswana 6.4 1.5 France 6.3 0.9 Portugal 6.3 1.0 Slovenia 6.0 1.4 Namibia 5.7 2.2 Estonia 5.6 0.6 Taiwan 5.6 0.8 Italy 5.2 1.1 Uruguay 5.1 0.7 Hungary 4.9 0.5 Malaysia 4.9 0.6 T rinidad & T o b 4.9 a go1.5 Belarus 4.8 1.3 Lithuania 4.8 1.9 South Africa 4.8 0.5 Tunisia 4.8 0.8 Costa Rica 4.5 0.9 Jordan 4.5 0.7 Mauritius 4.5 0.8 South Korea 4.5 1.3 Greece 4.2 0.7 5.5 - 8.1 6.4 - 7.4 5.3 - 8.9 5.6 - 7.6 4.8 - 7.8 5.9 - 6.8 5.5 - 8.0 5.8 - 6.9 4.7 - 8.9 5.3 - 6.9 3.6 - 8.9 4.3 - 7.3 5.2 - 6.6 5.4 - 6.0 3.9 - 6.6 5.2 - 6.0 3.4 - 7.2 4.6 - 5.7 4.2 - 6.1 4.6 - 5.6 4.0 - 5.6 4.6 - 5.2 3.6 - 5.7 4.6 - 5.2 3.6 - 6.9 3.8 - 5.9 3.3 - 5.8 3.3 - 5.4 3.4 - 7.6 3.7 - 5.9 3.9 - 5.5 4.5 - 5.0 3.6 - 5.6 4.1 - 5.3 3.6 - 5.9 4.0 - 5.1 3.6 - 5.2 4.0 - 4.9 3.5 - 5.5 4.0 - 4.9 2.1 - 7.1 3.9 - 5.1 3.7 - 5.5 3.8 - 4.6 12 6 Goal of Management for MNEs n n It is a culturally determined norms Two main theories in practice n n n n Shareholder wealth maximization model (US) Corporate wealth maximization model (Japan) The Shareholder Wealth Maximization Model (SWM): the firm should strive to maximize the return to shareholders, as measured by the sum of capital gains and dividends, for a given level of risk Assumptions of SWM: n n n Efficient stock market (效率市場) Risk, systematic vs. unsystematic (系統風險) Agency theory (代理人理論) 13 Goal of Management for MNEs n n The Corporate Wealth Maximization Model (CWM): the firm should treat shareholders on a part with other corporate interest groups, such as labor, management, suppliers, creditors, and government Assumptions of CWM: n n Market can be efficient or inefficient: the loyal long-term shareholder should affect influence corporate strategy, not the transient portfolio investor Total risk (financial and operating) matters; risk is measured more by product market variability than by short-term variation in earnings and share price 14 7 Corporate Governance (公司治理) n n The non-US markets are not characterized by the corporate “one-share-one-vote” rule, shareholders might not enforce their own objectives when management does not act as their agent Dual classes of voting shares (restrictions on voting shares), banking system closely involved both in crossownership and as a prime lender, and many other antitakeover defenses exist make it difficult to replace the existing management (Germany, France, and Japan) n n In some emerging market and Asia, many prominent firms are owned by the government or friends or relatives of top government officials; often overstaffed and over-financed Nokia, the Finnish tele-com company, converted all their share classes to one class with one-share-one-vote voting rights in 1999 15 Universal Truth vs. Culturally Determined Norm n n Exhibit 1.3 is a survey of takeover defenses in nine non-US countries Universal Truth vs. Culturally Determined Norm: n n n Firms are composed of competing and cooperating stakeholder groups; which group dominates is a culturally determined norm Most firms try to maximize their return; how return is measured and from whose perspective is a culturally determined norm Most firms are risk averse; how risk is measured is a culturally determined norm 16 8 Operational Goals for MNEs n n n n The primary operational goal of the MNEs is to maximize consolidated profits, after-tax Consolidated profits are the profits are the profits of all the individual units of the firm, originating in many different currencies but expressed in the currency of the parent company Consolidated financial reports, income statement, balance sheet, and cash flows statement Goals are frequently inconsistent and need tradeoff (note: environmental, regulatory, ethical constraints) 17 Opportunities of MNEs from Market Imperfection (Theories of International Business) n Market Imperfections n n n n n n n Legal restrictions on movement of goods, people, and money Transactions costs Shipping costs Tax arbitrage and tariff MNEs are a gift of market imperfections Large MNEs are better able to exploit competitive factors such as economies of scale, managerial and technological expertise, product differentiation, and financial strength than are their local competitions Arbitrage opportunities are from market imperfection not from market inefficiency in the international 18 settings 9 Opportunities of MNEs from Market Imperfection (Theories of International Business) n n The common stock of MNEs serve as a vehicle for investors who wish to hold internationally diversified portfolios (prevented from achieving diversification because of perceived and real imperfections in the market for financial assets) Motivations for Firms Becoming Multinational n n n n n Markets seeking Raw material seeking Production efficiency seeking: e.g. finding cheap labor Knowledge: Silicon Valley, Taiwan Industrial Park Political Safety 19 Opportunities of MNEs from Market Imperfection (Theories of International Business) n Industry with oligopolistic competition can further sub-classified their strategic moves as: n n n n Proactive investment: to enhance firm’s growth and profitability Defensive investment: to deny growth and profitability to the firm’s competitors Expand Opportunity Set: strategic motivation is to seek new markets, cheap raw materials, production efficiency, knowledge, and political safety Defensive Investments: product cycle theory, follow the leader and customer, creditability, growth to survival, and knowledge seeking 20 10 Opportunities of MNEs from Market Imperfection (Theories of International Business) 21 The Theory of Comparative Advantage (Theories of International Business) Without Free Trade Country A Country B Total Units of input (000,000) Food (lbs.) 40 40 Textiles (yards) 20 20 Output per unit of input Food (lbs.) 5 15 Textiles (yards) 3 4 Total output Food (lbs.) 200 600 Textiles (yards) 60 80 Consumption Food (lbs.) 200 600 Textiles (yards) 60 80 800 140 800 140 The opportunity cost of A to produce textiles is 5/3=1.67pd/y or 0.6y/pd; The opportunity cost of B to produce textiles is 15/4=3.75pd/y or 0.27y/pd; Country B has absolute advantage in producing both Food&Textiles; while country B is relative efficient in Food (lower opportunity cost) 22 11 The Theory of Comparative Advantage (Theories of International Business) With Free Trade Country A Country B Total Units of input (000,000) Food (lbs.) 20 50 Textiles (yards) 40 10 Output per unit of input Food (lbs.) 5 15 Textiles (yards) 3 4 Total output Food (lbs.) 100 750 Textiles (yards) 120 40 Consumption Food (lbs.) 225 625 Textiles (yards) 70 90 850 160 850 160 Country A can shift input (20) to produce textiles and B shift (10) to produce food; The total production will increase (50 in food & 20 in textiles); And via free trade of food (125 from B to A) and textiles (50 from A to B), both countries can achieve consumption level higher than without free trade (happy) 23 Product Cycle Theory (Theories of International Business) 24 12 Globalization of the World Economy: Recent Trends n n n Emergence of Globalized Financial Markets: deregulation of financial markets coupled with advances in technology have greatly reduced information and transactions costs, which has led to financial innovations Such as, currency futures and options, multi-currency bonds, cross-border stock listings, international mutual funds Trade Liberalization and Economic Integration: Over the past 50 years, international trade increased about twice as fast as world GDP 25 Globalization of the World Economy: Recent Trends n n n n The General Agreement on Tariffs and Trade (GATT) a multilateral agreement among member countries has reduced many barriers to trade The World Trade Organization has the power to enforce the rules of international trade The North American Free Trade Agreement (NAFTA) calls for phasing out impediments to trade between Canada, Mexico and the United States over a 15-year period Privatization 26 13 Multinational Financial Activities n Traditional areas of financial management n n n n n Capital structure (best combination of debt, equity, MM Theory) Capital budgeting (investment decisions, NPV) Long-term financing (financing decision) Working capital management (cash, receivables, inventory) For multinational finance and management activities, attentions should pay to culturally-determined norms, political issues, jurisdictional boundary, and organizational goals, and foreign exchange risk and related contract risk management 27 Managing for Value n n Like domestic projects, foreign projects involve an investment decision and a financing decision When managers make multinational finance decisions that maximize the overall present value of future cash flows, they maximize the firm’s value, and hence shareholder wealth 28 14 Valuation Model for an MNC n Domestic Model n Value = ∑ E (CF$, t ) t =1 (1 + k )t E (CF$,t ) = expected cash flows to be received at the end of period t n = the number of periods into the future in which cash flows are received k = the required rate of return by investors 29 Valuation Model for an MNC Impact of New International Opportunities on an MNC’s Value Exposure to Foreign Economies Exchange Rate Risk m E (CF j , t )× E (ER j , t ) n ∑ Value = ∑ j =1 t (1 + k ) t =1 [ ] Political Risk 30 15