Turkey - TENLAW

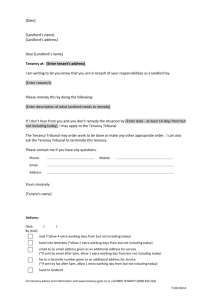

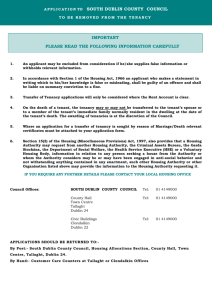

advertisement