BL9305/AC313 Advanced Taxation Course Description and

BL9305/AC313

Advanced Taxation

_________________________________________________________________________

Course Description and Scope

AC313 Advanced Taxation focuses on the tax-efficient structuring and undertaking of business activities from both local and, especially, international tax perspectives. Students will be exposed to important tax issues/considerations, techniques and strategies for the planning and arranging of local and cross-border transactions, including in areas such as personal/ executive taxation, corporate re-organisations, use of tax incentives, application of tax treaties, structuring inbound and outbound investments, transfer pricing and scope of anti-avoidance provisions, etc.

Course Learning Objectives

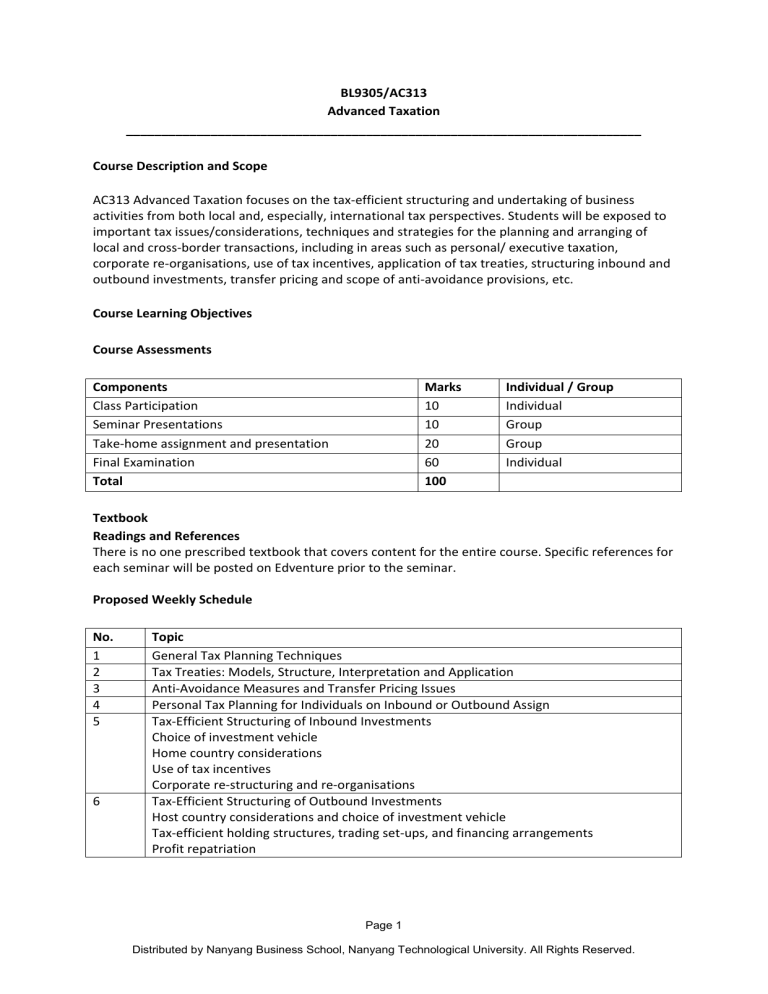

Course Assessments

Components

Class Participation

Seminar Presentations

Take-home assignment and presentation

Marks

10

10

20

Individual / Group

Individual

Group

Group

No.

1

2

3

4

5

Final Examination

Total

60

100

Individual

Textbook

Readings and References

There is no one prescribed textbook that covers content for the entire course. Specific references for each seminar will be posted on Edventure prior to the seminar.

Proposed Weekly Schedule

6

Topic

General Tax Planning Techniques

Tax Treaties: Models, Structure, Interpretation and Application

Anti-Avoidance Measures and Transfer Pricing Issues

Personal Tax Planning for Individuals on Inbound or Outbound Assign

Tax-Efficient Structuring of Inbound Investments

Choice of investment vehicle

Home country considerations

Use of tax incentives

Corporate re-structuring and re-organisations

Tax-Efficient Structuring of Outbound Investments

Host country considerations and choice of investment vehicle

Tax-efficient holding structures, trading set-ups, and financing arrangements

Profit repatriation

Page 1

Distributed by Nanyang Business School, Nanyang Technological University. All Rights Reserved.