Executive Summary

advertisement

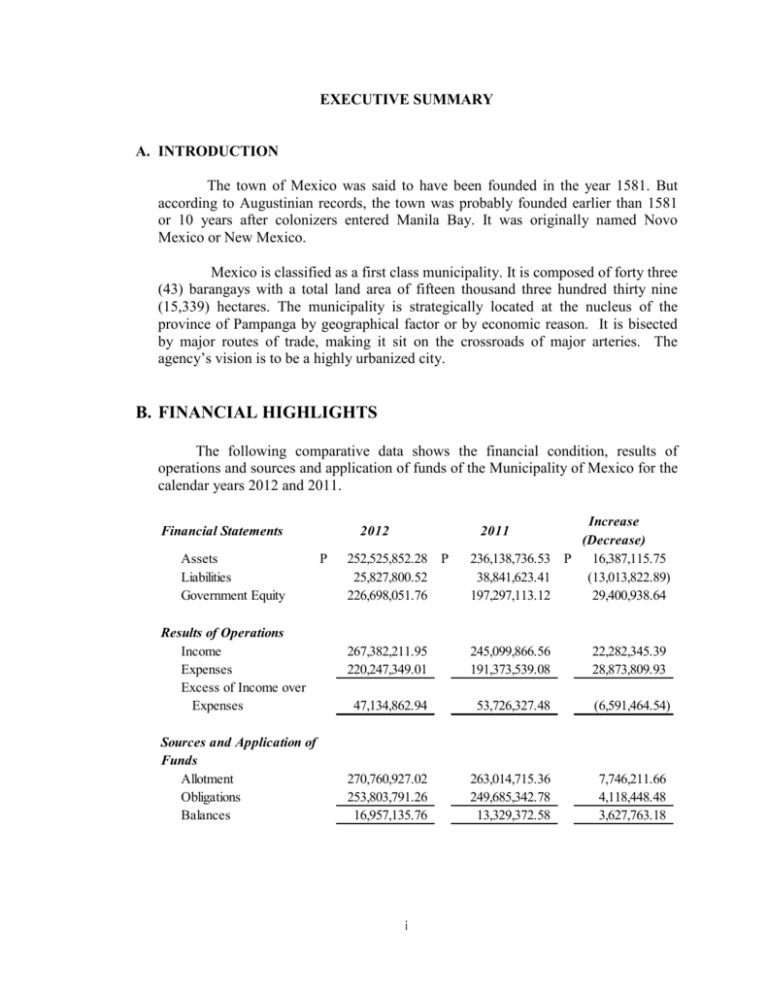

EXECUTIVE SUMMARY A. INTRODUCTION The town of Mexico was said to have been founded in the year 1581. But according to Augustinian records, the town was probably founded earlier than 1581 or 10 years after colonizers entered Manila Bay. It was originally named Novo Mexico or New Mexico. Mexico is classified as a first class municipality. It is composed of forty three (43) barangays with a total land area of fifteen thousand three hundred thirty nine (15,339) hectares. The municipality is strategically located at the nucleus of the province of Pampanga by geographical factor or by economic reason. It is bisected by major routes of trade, making it sit on the crossroads of major arteries. The agency’s vision is to be a highly urbanized city. B. FINANCIAL HIGHLIGHTS The following comparative data shows the financial condition, results of operations and sources and application of funds of the Municipality of Mexico for the calendar years 2012 and 2011. Financial Statements Assets Liabilities Government Equity Results of Operations Income Expenses Excess of Income over Expenses Sources and Application of Funds Allotment Obligations Balances 252,525,852.28 P 25,827,800.52 226,698,051.76 Increase (Decrease) 236,138,736.53 P 16,387,115.75 38,841,623.41 (13,013,822.89) 197,297,113.12 29,400,938.64 267,382,211.95 220,247,349.01 245,099,866.56 191,373,539.08 22,282,345.39 28,873,809.93 47,134,862.94 53,726,327.48 (6,591,464.54) 270,760,927.02 253,803,791.26 16,957,135.76 263,014,715.36 249,685,342.78 13,329,372.58 7,746,211.66 4,118,448.48 3,627,763.18 2011 2012 P i C. OPERATIONAL HIGHLIGHTS The municipality’s major accomplishments vis-à-vis targets for calendar year 2012 are as follows: PARTICULARS a) Removing, hauling and disposal of collected residual waste at MRF b) Expansion/Improvement of the MRF Suclaban c) Procurement Mechanical or Hydraulic Baller Compactor for residual/non-biogradable d) Partial rehab of open dumpsite Suclaban e) Improvement/Construction of Parian-Sto. Cristo Cementery Road f) Development Projects at various barangays g) Rehabilitation with raising of grade of Tinajero Road at San Antonio h) Desilting with hauling and disposal of spoils of San Carlos Creek i) Acquisition of lot at Suclaban as site for warehouse mechanical dryers, rice mill and shellers j) Restoration to original capacity of Parian-Lagundi Creek k) Provision for streetlighting, beautification and clean up drive l) Desilting and rechaneling of the Abacan River at Culubasa and Cawayan m)Desilting and rechanneling of Abacan River at San Jose Malino/repair of Irrigation facility n) Construction of concrete slope protection of Aling Nena Creek at San Jose Malino o) Concreting of brgy road at San Jose Malino p) Improvement of Interior road at Laug q) Improvement of San Vicente brgy road GRAND TOTAL Approp. Allotment Obligation Balances 25,838.00 474,162.00 1,500,000.00 600,000.00 276,345.00 323,655.00 500,000.00 1,500,000.00 500,000.00 1,500,000.00 600,000.00 600,000.00 600,000.00 600,000.00 5,000,000.00 2,150,000.00 5,000,000.00 2,150,000.00 4,999,587.34 2,100,000.00 412.66 50,000.00 1,000,000.00 1,000,000.00 896,454.11 103,545.89 400,000.00 400,000.00 384,731.63 15,268.37 1,250,000.00 1,250,000.00 1,237,720.00 12,280.00 3,000,000.00 3,000,000.00 2,991,941.10 8,058.90 1,000,000.00 1,000,000.00 994,781.20 5,218.80 4,000,000.00 4,000,000.00 3,993,037.85 6,962.15 4,000,000.00 4,000,000.00 3,989,385.09 10,614.91 2,500,000.00 2,500,000.00 2,499,433.91 566.09 525,676.80 525,676.80 525,676.80 250,000.00 250,000.00 249,997.16 2.84 605,329.60 605,329.60 536,665.51 68,664.09 28,881,006.40 28,881,006.40 25,701,594.70 3,179,411.70 ii D. SCOPE OF AUDIT The audit covered the financial transactions and operations of the Municipality of Mexico for CY 2012. The objectives of the audit were to: a) ascertain the degree of reliance that may be placed in management’s assertions on the fairness of presentation of the financial statements; b) recommend agency improvement opportunities; and c) determine the extent of implementation of prior year’s audit recommendations. E. AUDITOR’S REPORT The Auditor rendered a qualified opinion on the fairness of presentation of the financial statements of the Municipality of Mexico, Province of Pampanga for the year ended December 31, 2012 because (a) Total Receivables which constitute 1.19% of Total Assets were understand due to non-set up of RPT/SET Receivables at the beginning of the year which also resulted in the understatement of the Deferred Charges accounts (Observation No.10) Moreover, management was unable to establish the existence and correctness of the balances of the accounts under the Property, Plant and Equipment (PPE) totaling P178,637,216.57, which constitute 70.74% of Total Assets because of the failure of the General Services Office to conduct the physical inventory of PPE and the Accounting Office to maintain the PPE Ledger Cards and Property Cards. (Observation No.08). Errors and accounting deficiencies affecting financial statements are discussed in detail in Part II of this Report and summarized as follows: AOM Nature of Error No. I. Errors affecting asset accounts 1 Unsubstantiated Land account Total Errors affecting asset accounts Total Assets % Total Assets II. Errors affecting liability accounts 2 Error in classification of accounts Total Errors affecting liability accounts Total Liabilities % Total Liabilities III. Errors affecting equity accounts 3 Error in classification of accounts Total Errors affecting equity accounts Total Government Equity % Tota Equity iii Accounts Affected Land-PPE Subsidy from NGAs Due to LGU Due to NGAs Due to Philhealth Effect on the FS Under (Over) (858,523.38) (858,523.38) 252,525,852.28 (0.34%) 2,000,000.00 559,145.00 (4,433,763.39) 4,994,908.39 (1,998,000.00) 25,827,800.52 (7.74%) 1,998,000.00 1,998,000.00 0.88% AOM No. 1 2 Accounting Deficiencies Failure to record RPT/SET Receivables, resulting in understatement of receivables and deferred charges accounts. Unreliable PPE accounts due to management’s failure to conduct year-end physical inventory and nonmaintenance of PPE Ledger Cards and Property Cards by the Accounting Office and General Services Section. Accounts Affected Amount Involved Receivables and Amount not Deferred Charges determined PPE 178,637,216.57 For the errors and accounting deficiencies, we recommended that management: For unsubstantiated Land account: a) require the Municipal Treasurer and Municipal Assessor to make proper representations with concerned agencies such as the Bureau of Lands, Register of Deeds, and Bureau of Internal Revenue, to facilitate the processing of titles to convey real ownership of land in the name of the Municipality; and b) require the Municipal Accountant to ensure that proper documentation is attached to the claim before payment, pursuant to the provisions of COA Circular No. 2012-001 which prescribes the documentary requirements for government transactions. For errors in classification of accounts: a) require the Municipal Accountant to strictly adhere to the provisions of the NGAS Manual for LGUs, in order to record the transactions in the appropriate accounts, for a fair presentation in the financial statements; and b) require the Municipal Accountant to make the necessary adjustments in the books to fairly present the accounts in the financial statements. For the understatement of RPT/SET Receivables: a) require the Municipal Treasurer to exert effort in updating the Real Property Tax Account Register (RPTAR) which is necessary in setting up the RPT/SET Receivables at the beginning of the year; and iv b) require the Municipal Accountant to recognize/set up at the beginning of the year RPT/SET Receivables based on the RPTAR/Taxpayer’s Index Card pursuant to Section 20 of the Manual on NGAS in order to ensure collection of taxes and increase collection efficiency. For Property, Plant and Equipment accounts: a) create an inventory committee to conduct the physical inventory of property to determine actual existence of properties and submit the appropriate inventory report on the RPCPPE. b) consider assigning a personnel from each department/office to act as property custodian/officer who will be in charge of the annual inventory-taking of all PPE assigned to the department. c) require the Municipal Accountant to maintain PPELC for each category of assets and the General Service Officer or the Municipal Treasurer to maintain Property Cards per category of Property, Plant and Equipment; and d) require the Inventory Committee to reconcile the results of the count with the property and accounting records. F. OTHER SIGNIFICANT OBSERVATIONS AND RECOMMENDATIONS Summarized below are the other significant audit observations noted during the year and the corresponding recommendations which are discussed in detail in Part II of this report: 1. Specific duties were not stipulated in the appointment of casual personnel, while services to be performed by job order personnel were not also clearly indicated in the contract, except for contractual and job order personnel assigned at the Mexico Community Hospital, contrary to Section 1 of CSC Resolution No. 020790, thus, measurement of desired work output versus actual output was not determined by the Municipality. We recommend that Management: a) assess the actual need for additional manpower per office, taking into consideration the costs and benefits attached to the job; and b) request for the creation of additional regular plantilla positions to avoid assignment of job order personnel to regular plantilla positions. 2. Receipt of funds transferred by DSWD Region III amounting P559,1455.00 was erroneously classified as Due to LGU, contrary to Sections 153 and 154 of the v NGAS Manual for LGUs, resulting in misclassification of accounts in the financial statements. We recommend that the Municipal Accountant be guided by the applicable provisions of the NGAS Manual, particularly on trust liability accounts, for a proper recording of transactions in the appropriate accounts, and make the necessary adjustment in the books for a fair presentation of the accounts in the financial statements. 3. Advances granted to officers and employees for salaries, wages, petty cash, and official travels totaling P402,154.97 remained unliquidated as of December 31, 2012, contrary to Section 4 and 5 of COA Circular No. 97-002 dated February 10, 1997. We recommend that management strictly adhere to the provisions of COA Circular No. 97-002 which specifically prescribes the period within which all cash advances granted to officers and employees be liquidated. 4. Parcels of land acquired by the Municipality totaling P858,523.38 as of December 31, 2012 were not supported with legal documents of ownership, contrary to Section 39 of P.D. 1445, while a parcel of lot costing P1,237,720.00 was already registered under the name of the LGU, but lacked some documents to support the validity of the claim, contrary to provisions of COA Circular No. 2012-001 dated June 1, 2012. We recommend that the: a) Municipal Treasurer and Municipal Assessor make proper representations with concerned agencies such as the Bureau of Lands, Register of Deeds and Bureau of Internal Revenue to facilitate the processing of titles to convey real ownership of land in the name of the Municipality; and b) Municipal Accountant ensure that proper documentation is attached to the claim before payment, pursuant to the provisions of COA Circular No. 2012-001 which prescribes the documentary Other audit observations not included in this summary are contained in Part II of this report. An exit conference was held on February 27, 2013, wherein all findings and recommendations were discussed to agency officials. Management’s comments were incorporated in the report, where appropriate. vi G. IMPLEMENTATION OF PRIOR YEAR’S RECOMMENDATIONS Of the fifteen recommendations contained in the 2011 Annual Audit Report, four were fully implemented, seven were partially implemented, and four were not implemented. vii