4. Market Structure 4.1 Monopoly 4.1.1 Monopolistic Competition 5

advertisement

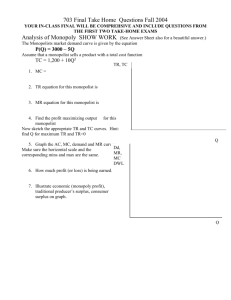

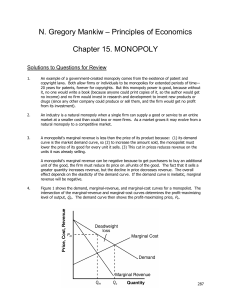

0DVWHULQ(QJLQHHULQJ3ROLF\DQG7HFKQRORJ\ 0DQDJHPHQW 0,&52(&2120,&6 /HFWXUH 4. Market Structure 4.1 Monopoly 4.1.1 Monopolistic Competition 5. Externalities 5HDGLQJV • Mandatory: Varian, H., Intermediate Microeconomics, 5th edition, Norton, 1999. Chapter 24. 1 0$5.(76758&785( 0RQRSRO\ In previous lectures we have seen how firms choose the pricequantity combination in FRPSHWLWLYH PDUNHWV , a market structure characterised by a great number of firms. We are now going to study the behaviour of a firm that faces no competition, i.e. the behaviour of a PRQRSROLVW. In the case of monopoly, the firm has control over the price of output. Therefore, it will choose the level of price and output that maximises profits. Remember that in the situation of perfect competition, firms could only choose the quantity, since the control over the price was out of their reach. Since the monopolists supplies the whole market, it can either choose the price and let consumers pick the quantity transacted in the market, or it can choose the quantity and see what price consumers are willing to pay for that quantity. Either way, we will get the same outcome. 2 0D[LPLVLQJ3URILWV • Denoting the inverse demand function by cost function by 0 5, we can write the revenue function F \ 0 5= 0 5 . U \ as 0 5 and the S \ S \ \ Thus, the monopolist’s profit- maximisation problem can be defined as: max U \ 0 5− 0 5 \ F \ • By setting the problem in this way, we immediately see that the optimality condition implies having the marginal revenue equal to the marginal cost: 05 = 0& RU GU G\ = GF G\ • Notice that the same optimality condition holds for the competitive firm. The difference is now in the marginal revenue function. For the competitive firm, the marginal revenue is just equal to the market price, which is constant and unaffected by the actions of any individual firm. • For the monopolist, the marginal revenue is not constant and that is precisely because the demand curve it faces is the market demand curve. Thus, when the monopolist increases output by G\ , there are two effects on revenues: 3 - First, it sells more output and so gets extra revenue, SG\ . - Second, because it increases the quantity of output in the market, it drives the price down, which means that it will receive less for HYHU\ unit sold, \GS . • Therefore, the total change in revenue that follows an increase in output is given by: GU = SG\ 0 5= 05 \ • Since + \GS, so that the effect on marginal revenue is: GU G\ = GS G\ S + GS G\ \ < 0 , it turns out that there are two contradictory effects. On one side, if the monopolist produces more, it sells more. On the other side, by expanding output it lowers the price on all units sold, not just the extra units produced. • Using the last expression, the optimality condition can be re-written as: 1 " 1 − 0 5 0 5 ε 0 5 # = 0 5, where ε 0 5 is the ! $ 05 \ = S \ \ 0& \ \ demand elasticity. 4 • This implies that: - Since in a competitive market, the firm faces an horizontal ε curve (infinitely elastic, 0 5 = ∞ ). Thus the optimality condition is just = 0 5. For the monopolist, if ε 0 5 < 1, then 1 ε 0 5 > 1 and \ S - demand 0& \ \ \ so MR is negative, meaning that \ cannot be a maximising level. It turns out that the monopolist will never position itself on the inelastic section of the demand curve, since in this case reducing output will increase revenues and reduce marginal costs, thereby raising profits. - It follows, that profit maximisation will occur somewhere in the curve where ε 0 5 ≥ 1. \ /LQHDU'HPDQG&XUYHDQG0RQRSRO\ • Suppose that the monopolist faces the following linear inverse demand curve: 0 5= S \ D − E\ . The revenue function is then: 5 0 5= 0 5 U \ S \ \ = D\ − E\ 2 , and the marginal revenue function is: 0 5= 05 \ D − 2 E\ • As we have seen previously, the marginal revenue curve has the same intercept, but twice the slope of the demand curve. 021232/<:,7+/,1($5'(0$1'&859( 3 0& $& 3URILWV 'HPDQG slope=-b 05 slope=-2b 4 • The optimal level of output, \ * is where the MR curve crosses the MC curve. The monopolist will charge the maximum price it can for that level of output, * 2 7. This S \ 6 costs, * 2 7 $& \ \ * * 2 7 S \ yields a revenue \ * , from which we subtract total to get profits. 0DUNXS3ULFLQJ • From the optimality condition, we can work out the price correspondent to the optimal quantity, \ * : * 0 5 = 1 − 1 2ε 0 75 , where 1 − 11ε 0 5 is the S \ 0& \ \ \ PDUNXS • Since the monopolist is operating where ε . 0 5 ≥ 1, the \ mark-up is greater than one, meaning that the price is greater than MC, a situation that contrasts with that of a competitive firm. 7KH,PSDFWRI7D[HVRQD0RQRSROLVW • Consider that a quantity tax is levied on the monopolist, which has constant MC, curve, 0 5= S \ D F , and faces a linear demand − E\ . Clearly, the MC goes up by the amount of the tax, but what happens to the price? • The optimality condition is now: 7 D − 2E\ = F + W . Solving for \, yields: \ = D −F−W . 2E Thus, the change in output is: G\ GW =− 1 . 2E Using the demand curve we find that the change in price is given by: GS GW =D−E G\ GW = −E × − 1 1 = . 2E 2 /,1($5'(0$1'$1'7$;$7,21 3 S ’ S * 0&W W 0& 05 \ ’ \ * 'HPDQG 4 • In graphical terms, this result can be explained by the fact that, since the demand curve is half as steep as the MR curve, the price goes up by half the amount of the tax. 8 • This result, however, is not general but stems from constant MC and the linearity of the demand curve. If, for example, the monopolist faces a constant-elasticity demand curve, then we have that: S = GS GW +W , and so, 1−1 ε = F 1 , which is greater than one, so that the 1−1 ε monopolist passes on PRUH than the amount of the tax. ,QHIILFLHQF\RIWKH0RQRSRO\ • Since the monopolist operates where the price is greater than MC, in general the price will be higher and output lower than in the competitive market environment. Thus, consumers are worse-off under monopoly than under perfect competition. • In contrast, the firm is better-off under monopoly, as it can manipulate price to increase profits. This naturally raises the question of how does the monopoly system compare with perfect competition for the society as a whole (consumers + producers). That is, is the monopoly Pareto efficient? 9 • The answer is NO! And that is because S > 0& , meaning that there is some consumer willing to pay more for an extra unit of output than it costs to produce. In other words, if extra output could be sold at a price lower than the market price, but still higher than MC, the utility of consumers would increase and so would the profits of the firm. • Therefore, the reason why monopoly is not Pareto efficient is that the monopolist cannot lower the price of the extra units without lowering the price of all units, which can lower it profits. 10 'HDGZHLJKW/RVVRI0RQRSRO\ • To ascertain how inefficient monopoly is, we can try to measure the difference between the consumers’ utility loss and the producers’ profit gain associated with the change from monopoly to perfect competition. • We will do that by measuring the consumers’ and producers’ surpluses variations and work out the net (or society) gain from imposing perfect competition to a monopoly situation. • The consumer surplus goes up for two reason. First, under perfect competition they pay less for the units they were already consuming under monopoly (area A). Second, 11 their utility is boosted by the fact that they are consuming extra units of the good (area B). • The producer surplus is affected in contradictory ways. First, its profits are driven downwards by the fact that it receives less for the units it was selling under monopoly (area A). However, because it is selling more, it gets extra profits (area C). • The accountancy of the effects can be made as follows: - The area A is just a transfer of the surplus from the monopolist to the consumers and so cancels out in society’s perspective. - The area B + C represents the net gain from moving from monopoly to perfect competition, since it measure the value that consumers and producers attach to the extra units that are transacted in the market because of the change from monopoly to perfect competition. • Thus, the area B + C measures the deadweight loss due to the monopoly. This deadweight loss gives the society’s cost of monopoly and is derived as the value of the forgone units of output, valued at the price consumers are willing to pay for it. 12 • Every time the government concedes monopoly rights, it has to balance the benefits that result form that with the inevitable deadweight loss that accrues from monopoly. ([DPSOH : Patents. 1DWXUDO0RQRSRO\ • Even though monopoly is inefficient, forcing the monopolist to equate price to MC will sometimes determine negative profits. That happens whenever the demand curve intersects the MC curve beneath the AC curve. • This situation often arises with public utilities, such as gas and electricity companies, motorways, telecommunication companies, etc.. These companies have huge fixed costs (in buying and maintaining its equipment) and very low marginal costs. • A situation in which the industry presents large fixed costs and low marginal costs is referred to as PRQRSRO\ QDWXUDO . It is so-called because the initial investment are so huge that they constitute a QDWXUDO barrier to entry by competitors. 13 • If the government forces the monopolist to set S = 0& the monopolist goes out of business, which is even more inefficient than letting the monopolist setting 05 = 0& . • As far as natural monopolies are concerned, the government typically has three choices: D It either let the monopolist set the price-quantity combination that maximises its profits, or S = 0& E forces the monopolist to set and gives a lump-sum subsidy in order to make up for the monopolist losses, or F the governments takes charge of the business itself. 14 :KDW&DXVHV0RQRSROLHV" • Under which circumstances should we expect the market to be organised as a monopoly rather than competitively? • The crucial factor is the PLQLPXP HIILFLHQW VFDOH 0(6 , i.e. the level of output that minimises average costs, relative to the size of demand. The MES is determined by the shape of the AC curve, which in turn depends on the technology. • If the MES, the level of output that minimises AC is small relative to the market, the conditions are laid for many firms to operate within the market. Otherwise, a situation of monopoly (or oligopoly) may arise. 15 • Since the size of the market can be influenced by government policy, the emergence of monopolies are more likely in those countries where the government pursues policies that restrict internal/external competition. • The government can also force the monopolist to act as in a competitive market. However, regulation and intervention also involves costs, implying that the government has to weight the deadweight loss of monopoly against the costs of regulation. • Monopolies can also arise in situations where the incumbent threats to reduce prices drastically so as to scare off possible entrants. • Monopolies or other forms of market-power can also be created by the strategic interaction of the incumbents, who might collude to decrease output so to increase the price and so boost joint profits. In this case, the industry is organised as a FDUWHO, which is normally unlawful. 16 0RQRSROLVWLF&RPSHWLWLRQ • We have described a monopolistic industry as one with a single large producer. However, defining an industry as consisting of all firms producing the same product, is somehow misleading. The fact that only Nokia produces Nokia mobile phones does not mean that Nokia is a monopolist. • In fact, we should view an industry as the set of firms that produce products that are viewed as close substitutes by consumers. Each firms has monopoly rights over its brand, but brands are viewed as substitutes. • In the case where an industry congregates several firms producing unique products that are close substitutes, the demand curve facing the firm depends on the output the competitors are producing and also on the degree of substitutability of brands/products. • If the products are very similar, the demand curve facing the curve is essentially horizontal, because if the firm raises its price too much, consumers will cease to buy its product. The lower the elasticity of substitution between brands/products, the steeper the demand curve facing the firm. 17 • Thus, the more successfully the firm is able to do SURGXFW GLIIHUHQWLDWLRQ , the higher the market-power it will attain, as the elasticity of the demand for its brand will be lower. • The situation we are describing is known as PRQRSROLVWLF FRPSHWLWLRQ , since each firm faces a downward sloping demand curve and so have some market-power, i.e. capacity to influence the market price of its own product. • The monopolistic competitor is a monopolist of its own product but has to endure the competition of the firms producing close substitutes. Furthermore, there are no restrictions to entry. • Monopolistic competition is the most prevalent form of industry structure. Bur unfortunately is very difficult to analyse in abstract terms as it depends on the degree of product substitution, the strategic interaction of firms, the institutional environment, etc. • But there certain conjectures we can make about the behaviour of monopolistic competition. More entrants will necessarily decrease the elasticity of substitution among products, making the demand curve facing the firm more horizontal. This implies that as more and more firms enter the market, profits (in the economic sense) are driven down to zero. 18 (;7(51$/,7,(6 • ([WHUQDOLW\ can be roughly defined as a situation in which the actions of one consumer/producer affect third parties (consumers or producers). • A FRQVXPSWLRQ H[WHUQDOLW\ obtains when one consumer cares directly about another agent’s production or consumption (e.g. neighbour’s garden). A H[WHUQDOLW\ SURGXFWLRQ can be characterised as a situation in which the production possibilities of one firm are influenced by the actions of other producers or consumers (e.g. Orchard and beekeeper). • The crucial feature of externalities is that they are goods/services which are valued by people but are not transacted in the market. Its main problem is therefore that the equilibrium allocation might not be efficient. • In what follows, we will concentrate our analysis on the production externalities, since the consumption externalities are less relevant for the topics you will be working on in this Master. 19 3URGXFWLRQ([WHUQDOLWLHV • Suppose there are two firms, S and F. Firm S produces steel, V , and also pollution, [ , which is dumped into the river. Its cost function is given by fishery that catches fish, I F V ( V, [ ) . Firm F is a , and so is adversely affected by pollution. Thus, pollution enters the cost function of F, which is given by, F ( I , [ ). I • Assuming, realistically, that pollution decreases the costs of steel production (over some range) and increases the cost of producing fish, we have: ∂F ∂F ≤ 0 and >0 ∂[ ∂[ I V • Now, profit-maximisation problems of firms F and S is given respectively by: max S V − F ( V, [ ) and V [ , V max S I I V I −F I 0,5 I [ • Notice that only firm S has control over the quantity of pollution produced, even though firm F is affected by it. This constitutes a typical case of production externalities. • The optimal conditions for firm S are: 20 S V = ∂F V 2 V * , [* ∂V 7 and 0 = ∂ 2 F V V * , [* 7 ∂[ For firm F, the optimum is found where S I = ∂F I 2 V * , [* 7 ∂I • From those conditions we can immediately identify the source of the problem. Since the price of pollution is assumed to be zero, pollution will be produced until its marginal cost is zero. The problem is that, when choosing [ * , the firm S is only evaluating its own cost function, in spite of [ * affecting the cost function of F. • In fact, the increase in the cost of fishing caused by pollution is part of the VRFLDO FRVW of producing steel, which is not being accounted for. Thus, we would expect the equilibrium amount of pollution produced to be greater than the social optimum, meaning that the market is inefficient. • To check whether the described situation is efficient or not, let’s suppose that the two firms merge to jointly produce steel, fish and eventually pollution. In this case, there is no externality as the costs of pollution to the fishing activity has been LQWHUQDOLVHG. • The merged firm’s profit-maximisation problem is: 21 max S V + V S V , I ,[ − F (V, [ ) − F I I V I 0 , 5, I [ which yields the following optimality conditions: S V = ∂F ’ V V [ ∂F ’ 2 , 7, ∂V S = I I 2 I ’ , [’ ∂I 7, 0 = ∂ 2 , 7 + ∂ 2 F V ’ V [ ’ F ∂[ I firm will take into account the effect of pollution in the cost function of fish production, i.e. it takes the social cost of producing steel into account in its optimisation problem. • What does this imply to the quantity of pollution produced? Before the merge, firm S was producing is 0& 6 2 V * , [ * = 0 . After the merge the firm 7 producing − 0& 6 2 , 7= V ’ [ ’ pollution 0& ) 2 I ’ , [’ . Since 7 according 0& ) 2 I ’ to, , [’ > 0 , 7 then the firm will be producing pollution in the region where 0& 6 2 , 7 < 0 . This means that the optimum V ’ [ ’ amount of pollution will be lower after the merge, i.e. when the VRFLDO FRVW ’ ∂[ • The crucial term is last one as it shows that the merged according to, I is taken into account, pollution is reduced relative to the situation where the firm only considers its SULYDWHFRVWV. 22 , [’ 7 • Since Pareto efficiency requires the firm to minimise the social costs where the VXP of the MCs is equal to zero, it turns out that the competitive market is not efficient when externalities are present. • Notice that the same would be true if the externality was positive rather than negative. In that case the optimal amount of the externality good that would produced in a private logic would be too small, since the firm would not take into account the benefit other firms would be reaping. Price -MCS 62&,$/&267$1'35,9$7(&267 Socially optimal amount MCF Privately optimal amount [ ’ [ * Pollution 23 ,QWHUSUHWLQJWKH&RQGLWLRQV There are several interpretations for the conditions of Pareto efficiency presented above. Each provides a scheme to correct the efficiency loss due to the presence of externalities. • The first is that the firm faces the wrong price for pollution. For the polluting firm, pollution cost nothing, meaning that the firm is not assuming the social cost it is generating. Thus, the situation can be corrected by ensuring that the firm covers that social cost by paying a tax on pollution. • If the firm has to pay W euros for each quantity of pollution1, its optimising problem becomes: max S V − F ( V, [ ) - W[ , and the optimality condition are: V [ , S V = V V ∂F V 2 V * , [* ∂V 7 and W = ∂F V 2 V * , [* 7 ∂[ • The authorities problem is then to find the value of W that induces the firm to produce the optimum social amount of pollution. • Another possible interpretation is that there is a market missing – the market for pollution. In this market some 1 This kind of tax that corrects an inefficient situation is known as a Pigouvian tax after the economist named Arthur Pigou. 24 agents would be willing to pay to have the quantity of pollution produced reduced. Thus, pollution would have a negative price. • To illustrate suppose that firm F has the right to a clean water but has also the right to allow production of pollution for a certain price. Let that price be T . Then the profit-maximisation problems of both firms would be: max S V − F ( V, [ ) - T[ and max S V V [ , V I ,[ I I + T[ − F I 0,5 I [ • The optimality conditions are then: S V S I = ∂F = 2 V V * , [* ∂V ∂F I 2 I * 7 and , [* ∂I T 7 and = T ∂F V 2 V * , [* 7 ∂[ = ∂F I 2 I * , [* 7 ∂[ • Together, these conditions imply that: T =− ∂F V 2 V * , [* ∂[ 7=∂ 2 F I I * ∂[ , [* 7, which can be interpreted as saying that the MC to the steel firm of reducing pollution is equal to the marginal benefit to the fishery firm of that pollution reduction. • Again, this situation would produce a Pareto efficient outcome. 25