Dr. Pepper Snapple Group, Inc. - University of Oregon Investment

advertisement

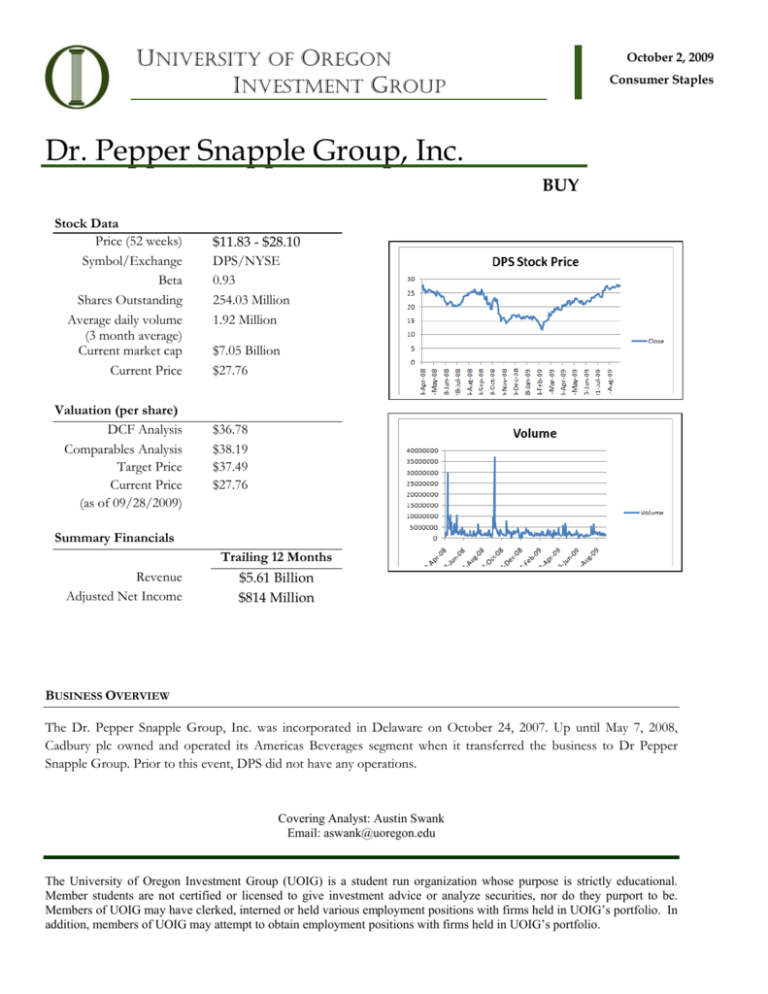

UNIVERSITY OF OREGON INVESTMENT GROUP October 2, 2009 Consumer Staples Dr. Pepper Snapple Group, Inc. BUY Stock Data Price (52 weeks) Symbol/Exchange Beta Shares Outstanding Average daily volume (3 month average) Current market cap Current Price Valuation (per share) DCF Analysis Comparables Analysis Target Price Current Price (as of 09/28/2009) $11.83 - $28.10 DPS/NYSE 0.93 254.03 Million 1.92 Million $7.05 Billion $27.76 $36.78 $38.19 $37.49 $27.76 Summary Financials Trailing 12 Months Revenue Adjusted Net Income $5.61 Billion $814 Million BUSINESS OVERVIEW The Dr. Pepper Snapple Group, Inc. was incorporated in Delaware on October 24, 2007. Up until May 7, 2008, Cadbury plc owned and operated its Americas Beverages segment when it transferred the business to Dr Pepper Snapple Group. Prior to this event, DPS did not have any operations. Covering Analyst: Austin Swank Email: aswank@uoregon.edu The University of Oregon Investment Group (UOIG) is a student run organization whose purpose is strictly educational. Member students are not certified or licensed to give investment advice or analyze securities, nor do they purport to be. Members of UOIG may have clerked, interned or held various employment positions with firms held in UOIG’s portfolio. In addition, members of UOIG may attempt to obtain employment positions with firms held in UOIG’s portfolio. Dr. Pepper Snapple Group university of oregon investment group http://uoinvestmentgroup.org DPS is a leading integrated brand owner, bottler and distributor of non-alcoholic beverages in the United States, Mexico, and Canada. The Company’s key brands include: Dr Pepper, Snapple, 7 UP, Motts, Sunkist, Hawaiian Punch, A&W, Canada Dry, Schweppes, Squirt, Clamato, Penafiel, and Mr & Mrs. T. The Company’s overall operations can be classified into three revenue generating segments: Beverage Concentrates, Packaged Beverages and Latin American Beverages. These last two categories were added when finished goods and bottling were removed as of January 1, 2009. Beverage Concentrates – 19% This segment contains sales of the Company’s branded concentrates and syrup to third party bottlers primarily in the United States and Canada. It exists primarily as a brand ownership business. Most of the brands such as Dr Pepper, 7UP, Sunkist, and Squirt are carbonated soft drink (CSD) brands. The vast majority of these brand concentrates are manufactured at the Company plant in St. Louis, Missouri which are then shipped to both company internal and third party bottlers who then combine them with carbonation, water, sweeteners and other ingredients, package in PET, glass bottles and aluminum cans, and sell as a finished beverages to retailers. Packaged Beverages – 75% This segment reflects sales in the United States and Canada from the manufacture and distribution of finished beverages and other products, including sales of the Company’s own brands and third party brands through both DSD and warehouse direct delivery systems. Latin American Beverages – 6% This segment is a combination of both manufacturing and distribution of both concentrates and finished beverages in the Mexican and Caribbean markets. Growth Strategy & Opportunities I believe DPS will exhibit growth faster than projected industry figures. They currently have a strong product that has seen increasing amounts of market share, especially when compared against the big two brands of Coca Cola and Pepsi. DPS outlines six key elements of the firm’s business strategy: • Build and enhance leading brands: The Company uses a well-defined strategy to allocate marketing and sales resources to engage in a continual process of market and consumer analysis to determine brands that have the greatest potential for profitable sales growth. • Focus on opportunities in high growth and high margin categories: The Firm is focused on driving growth in emerging categories including ready to drink teas, energy drinks, and other beverages. • Increase presence in high margin channels and packages: The Company is working to drive growth in high margin channels such as convenience stores, vending machines and small independent retail outlets through increased selling activity and significant investments in coolers and other cold drink equipment. 2 Dr. Pepper Snapple Group university of oregon investment group http://uoinvestmentgroup.org • Leverage the integrated business model: Management believes the integrated brand ownership, bottling and distribution business model provides opportunities for net sales and profit growth through the alignment of these businesses. • Strengthen the route-to-market: The Company is rolling out handheld technology and upgrading the IT infrastructure to improve route productivity and data integrity and standards. • Improve operating efficiency: DPS has undergone restructurings to reduce SG&A expenses as well as to improve manufacturing, warehousing, and distribution operations. RECENT NEWS September 9, 2009 – DPS affirms previous 2009 forecasts of earnings per shares to be in the range of $2.03 to $2.11. Excluding special items the Company sees $1.88 to $1.96. August 13, 2009 – Dr Pepper reports second quarter earnings. At this point, the company raised its guidance for 2009 EPS giving a sign of improving conditions over the first half. April 27, 2009 – Dr Pepper Snapple releases that it has reached an agreement with McDonald’s USA to expand the availability of Dr Pepper and Diet Dr Pepper into all 14,000 U.S. restaurants. Previously, these products were only available in 8,500 (Dr Pepper) and 3,500 (Diet Dr Pepper) restaurants. This deal also opens up major new markets including Chicago, Los Angeles, Northern California and the Northeast. INDUSTRY As an integrated company in the Soft Drink industry, the Company participates in multiple layers of the value chain. To get a full understanding of the operating conditions, I looked at the Syrup & Flavoring Production and Soft Drink Production industries. Syrup & Flavoring Production This industry’s players are manufacturers of syrup drink concentrates and related products for soda fountain use or the manufacture of soft drinks. Annual revenue for the industry in 2008 was approximately $8.5 billion with fairly high concentration as The Coca-Cola Company and PepsiCo comprise over 75% of revenue. In spite of this heavy concentration, smaller firms have been able to thrive through catering to regional tastes and influences. Another aspect of the high concentration at the top with smaller players opens the door for further consolidation. Products produced by this industry are liquid beverage bases, fountain soft drink beverage bases and other flavoring agents. Liquid beverage bases comprise the largest portion of revenue. These are produced and then sold to downstream soft drink manufacturers. As it is the primary input for soft drinks and usually have a proprietary aspect to them, downstream companies are forced to purchase the product. Fountain soft drink beverage bases are primarily used by restaurants, convenience stores, and other food service industries. Finally, other flavoring agents include concentrated fruit juices or other concentrates, fruit processed for use in a soda fountain, and other flavoring syrups. Another product in this industry that is beginning to gain popularity has been the pre made powders to be mixed with water on an individual batch basis. 3 Dr. Pepper Snapple Group university of oregon investment group http://uoinvestmentgroup.org Demand is based primarily on the end consumer demand for soft drinks cordials. Recently, the growth in consumption of bottled water and other non-carbonated beverages has dampened growth for soft drinks and thus syrup. As the industry’s products are relatively price inelastic, producers have been able to increase prices every year for well over the past decade. Some concerns affecting the industry have been on the nutritional front. More people are concerned about the calorific content of beverages and how they affect their overall health. Within the concern, the growing societal concern over obesity, especially in children, has spurred some political pressure to pass laws surrounding the marketing and availability in schools and other areas where children frequent. Competition is driven through four primary factors: advertising and promotion, product differentiation, contracting agreements, and product range. As the dominant players with national brands have been able to achieve high gross margins, they have been able to invest heavily in advertising campaigns. Beverage base manufacturers will engage in significant advertising to generate downstream end consumer demand. As syrups are usually a proprietary patented formula with trademarked brands, manufacturers promote product differentiation and work to fend off attacks of replication. Bottlers have the ability to switch their bottling agreements to different brands. Since bottlers are the primary way for syrups to become finished goods, syrup manufacturers offer incentives to retain key bottlers. Finally, if a company has a wide range of products, it can cater to the changing demand dynamics of the end consumer to maintain and grow revenues. Due to the nature of the product, this industry’s performance is closely tied to that of the Soft Drink Production industry. Soft Drink Production Firms in this industry acquire ingredients to produce soft drink beverages. Ingredients include liquid beverage bases, syrup, sweeteners, caffeine, acidulants, preservatives, potassium and sodium. These ingredients are then combined with water and bottled in glass or plastic or otherwise canned in aluminum for sale to grocery product wholesalers, retailers, and export markets. Demand is driven by the same factors as the syrup and flavoring production industry. Competition is primarily passed on the ability to gain licensing from the syrup and flavoring production companies. As the formulas are proprietary intellectual property, a bottler needs to gain permission from the brand producer to produce and distribute the finished good. Both The Coca Cola Company and PepsiCo grant bottlers exclusive rights to manufacture their respective beverage brands within a specific geographic area. Hence, a company with the right to bottle a national brand in an area has an inherent advantage. S.W.O.T. ANALYSIS Strengths • • Strong position in each product niche: Overall DPS is the #1 company in the flavored CSD market. Dr. Pepper is the #2 flavored CSD and Snapple is the leading ready-to-drink tea. The current trend of flavored CSD’s gaining market share on cola’s will benefit the company top line. Integrated business model: The Company’s combination of brand ownership, bottling and distribution gives it inherently more control over the value chain and thus a competitive advantage. 4 Dr. Pepper Snapple Group university of oregon investment group http://uoinvestmentgroup.org • • Customer relationships: DPS has established long standing relationships with many of the Company’s top customers including bottlers and distributors to national retailers, large foodservice and convenience store customers. Experienced management: Many board members and executive management have experience in the food and beverage industry. Their collective experience totals over 200 years. Weaknesses • Smaller compared to larger peers: The firm relies on some third-party bottlers including Coke and Pepsi affiliated bottlers for packaging and distribution. This could cause costs to rise in the future. • Lack of exposure to some fast growing segments: DPS has very little or no foothold in some fast growing segments including energy drinks, sports drinks, and enhanced waters. Opportunities • • Expansion into international markets: Currently, DPS effectively draws no significant portion of revenue from outside North America. Comparing the Company to Coca-Cola which operates in over 200 countries and derives approximately 76% of revenues outside of North America, DPS could see a large increase in revenues if it decided to expand internationally. New product launches and line extensions: DPS sees the best opportunity for growth through line extensions, especially with opportunities in high growth and high margin categories, including ready to drink teas, energy drinks, and other functional beverages. Threats • Loss of Coca-Cola or PepsiCo affiliated bottlers: If these companies acquire their affiliated bottlers and make them wholly owned subsidiaries, DPS could see increased costs. Currently 73% of Dr. Pepper volumes are distributed through the Coca-Cola and PepsiCo affiliated bottler systems. Furthermore, Coca-Cola and Pepsi affiliated systems each constituted approximately 15% of net sales of the Beverage Concentrates segment. Besides increased costs, this could lead to less favorable placement within retailers which may be the bigger problem. CATALYSTS Upside • • • • • Shift of consumer tastes to DPS products Decrease in aluminum, corn, sugar, and other raw materials costs Successful international expansion, especially into high growth markets Addition of new food service partners Increased successful advertising: With most companies trying to cut costs, advertising has gone to the wayside for most firms, lowering advertising costs for firms who have the capability to make ad purchases. DPS has launched a new campaign that should increase awareness of their products and market share. 5 Dr. Pepper Snapple Group university of oregon investment group http://uoinvestmentgroup.org Downside • Increased health consciousness: This could hurt sales in their main Dr. Pepper product but could be partially offset with increased purchases of Snapple and other perceived healthier alternatives. • Loss of a Coca-Cola or PepsiCo affiliated bottler COMPARABLES ANALYSIS As the products produced by DPS have many substitute products, finding good comparable companies was relatively easy. As DPS is an integrated brand and bottler, I chose companies from both industries as well as another integrated company. As these companies are pure play competitors within their respective markets, I elected to provide detailed reasoning for only one of the companies within each respective industry. The Coca Cola Company (KO) – 20% “The Coca-Cola Company manufactures, markets, and distributes soft drink concentrates and syrups. The Company also distributes and markets juice and juicedrink products. Coca-Cola distributes its products to retailers and wholesalers in the United States and internationally.” – Bloomberg This is a good comparable as its products compete directly with DPS. It operates as a syrup and flavoring producer and thus has strong market power. It can dictate where and who has the ability to produce the finished product. DPS also has this power with the syrups and other flavors it produces. PepsiCo Inc (PEP) – 20% “PepsiCo, Inc. operates worldwide beverage, snack and food businesses. The Company manufacture or uses contract manufacturers, market and sell a variety of grain-based snacks, carbonated and non-carbonated beverages and foods in countries throughout the world.” – Bloomberg The reasoning behind this company is the same as The Coca Cola Company. I weighted PEP slightly less than KO as PepsiCo has other operating segments such as Frito Lay which does not directly compete with DPS offered products. Coca-Cola Enterprises Inc (CCE) “Coca-Cola Enterprises Inc. markets, sells, manufactures, and distributes nonalcoholic beverages. The Company provides refreshments, including sparkling waters, juices, isotonics, teas, and sodas. Coca-Cola Enterprises operates internationally.” – Bloomberg This company represents the other half of the value chain for KO. This is The Coca Cola Company’s primary bottler which is has a minority stake. CCE bottles products for both KO as well as producing bids for other products within their distribution range. DPS also has its products bottled by CCE. Pepsi Bottling Group Inc. (PBG) “The Pepsi Bottling Group, Inc. manufactures, sells, and distributes a wide range of carbonated and non-carbonated beverages. The Company distributes its products in the United States, Canada, Spain, Greece, and Russia. Pepsi Bottling also sells other branded products besides its own brands.” – Bloomberg This is the same as CCE. However, PEP has submitted a bid for both PBG and PAS to acquire the remaining uncontrolled interests in these companies. I feel that by PEP 6 Dr. Pepper Snapple Group university of oregon investment group http://uoinvestmentgroup.org choosing to integrate its operations shows the superior business strategy that DPS has exhibited throughout its history. PepsiAmericas Inc (PAS) “PepsiAmericas, Inc. manufactures, packages, sells, and distributes soft drink products and bottled water in the United States and the Caribbean. The Company's products include Pepsi, Lipton Brisk, Mountain Dew, FruitWorks , AquaFina, 7-up, Welch's, Slice, Mug Root Beer, Frappuccino , Sunkist, Dr. Pepper and Hawaiian Punch.” – Bloomberg The reasoning is the same as PBG. Hansen Natural Group (HANS) “Hansen Natural Corporation markets and distributes fruit juices, fruit juice Smoothies, juice cocktails, iced teas, lemonades, energy drinks, and still water. The Company distributes its beverages under the Hansen's Natural brand name in the United States and overseas.” – Bloomberg Hansen was chosen as it operates in similar segments as DPS’ other products including Snapple. It also uses an integrated business model with brand development and distribution. I selected the following metrics: • EV/Revenue - This was used to measure size of the company in relation to its ability to generate revenue. • EV/EBITDA – This is a good measure of the profitability of a company against its peers since it eliminates the impact of financing and accounting differences. • EV/Operating Cash Flows – This is a measure of how much cash a firm generates compared to the total value of the firm. DISCOUNTED CASH FLOW ANALYSIS Revenue Overall, I see the long-term outlook for DPS to be positive and outperform the industry. However, for the remainder of 2009, I foresee a decline in revenues from the second half of 2008. Consolidated company growth should return in 2010 and beyond. Beverage Concentrates I forecast growth for the second half of 2009 to slow compared to the first half of the year. Revenue is still increasing however as downstream firms continue to purchase syrup to meet institutional needs such as the expansion of Dr Pepper and Diet Dr Pepper into all McDonald restaurants. However, beginning in 2010, I feel growth will slow due to the lack of new deal. Up through 2013, I project growth to increase as DPS continues to gain market share in the carbonated soft drink market as well as leverage its non-carbonated offerings. After this point, growth will taper off through the terminal year. 7 Dr. Pepper Snapple Group university of oregon investment group http://uoinvestmentgroup.org Packaged Beverages and Latin American Beverages I projected a slower decline in revenue decreases in the second half. This is due to a return of some demand in retailer demand and thus end consumer demand. Growth will increase through 2012 and then begin to slow through the terminal year. Cost of Sales I project cost of sales to decrease slightly through 2011. Depressed demand for inputs has allowed DPS to experience lower Cost of Sales recently. I believe this will continue but begin to shrink. As these commodities begin to exhibit more demand, Cost of Sales will increase, reducing gross margins. In 2014 through the terminal year, I project a constant cost of sales as a percentage of revenue as I feel the Company will be able to pass on increases due to commodity inflation on to its customers. Selling, General, and Administrative I project SG&A at the same rate for the second half of the year as the first. In 2010 and forward, SG&A fall slightly back to historical norms but still at a higher level due to increased promotional spending to generate market share gains in the short term and then maintain the market share into the future. Depreciation and Amortization I projected this as a constant two percent throughout the life of the model. This is in line with recent historical figures and felt this was an appropriate amount. Other Operating Expense/Income and Other Income/Expense I decided to project this as zero percent through the terminal year. In previous years, this line generated income on average. I also felt that in the long run, gains and losses would most likely offset each other. Provision for Income Taxes I projected this as a constant 37.5% of revenues through the terminal year. This is in the historical range. Equity in Earnings of Unconsolidated Subsidiaries This is a noncash line item in the income statement; therefore, I declined to project this item. Net Working Capital I removed both cash and current portion of long term debt from the net working capital calculation. Instead, these were allocated appropriately in the implied value calculation. I then projected each portion of current assets or liabilities as either a percentage of revenue or a percentage of an expense depending on the underlying cause of the balance sheet item. Capital Expenditures I projected Capital Expenditures to remain relatively high in the second half of 2009 and then begin becoming a smaller percent of revenues up to the terminal year. 8 Dr. Pepper Snapple Group university of oregon investment group http://uoinvestmentgroup.org Beta As Dr Pepper Snapple has only been trading since April of 2008, a five year regression was not possible. Instead, I used the Hamada formula to calculate at beta for DPS. The companies and weightings I used for this calculation were the same as my comparables analysis. Cost of Debt This was calculated as a weighted average of the three tranches of the most recent debt issuance which took place in 2008. This consisted of $250 million at 6.12% due 2013, $1.2 billion at 6.82% due 2018, and $250 million at 7.45% due 2038. The average came to 6.81% which is also consistent with the 10 year offering of 6.82%. RECOMMENDATION Dr. Pepper Snapple’s spin off from Cadbury Schweppes last year has and will allow management to focus on its core competencies and work to leverage the strength of its brands. As consumers shift their preferences and thus spending away from cola’s to other alternatives, DPS is poised to take advantage of this shift. To a certain extent, DPS seems to still be experiencing the after effects of being spunoff from Cadbury, with people still not fully understanding DPS’s business model. The market is treating DPS as a bottler when comparing firms on an earnings estimate multiple. I feel that as the Company uses an integrated model, it should trade at a minimum somewhere in between bottlers and a brand owner. Combining these factors, I arrived at a discounted cash flows implied price of $36.78 and comparables analysis of $38.19. Using equal weightings, I derived an implied price of $37.49 which represents a 35.0% undervaluation. With this, I recommend a BUY for the Tall Firs and Svigals’ portfolios. 9 Dr. Pepper Snapple Group university of oregon investment group http://uoinvestmentgroup.org APPENDIX 1 – COMPARABLES ANALYSIS APPENDIX 2 – REVENUE PROJECTIONS 10 Dr. Pepper Snapple Group university of oregon investment group http://uoinvestmentgroup.org APPENDIX 3 – DISCOUNTED CASH FLOWS 11 Dr. Pepper Snapple Group university of oregon investment group http://uoinvestmentgroup.org APPENDIX 4 – NET WORKING CAPITAL 12 Dr. Pepper Snapple Group university of oregon investment group http://uoinvestmentgroup.org APPENDIX 5 – DISCOUNTED CASH FLOWS ANALYSIS ASSUMPTIONS APPENDIX 6 – HAMADA BETA & SENSITIVITY ANALYSIS 13 Dr. Pepper Snapple Group university of oregon investment group http://uoinvestmentgroup.org APPENDIX 7 – SOURCES • • • • • • • • • DPS 10-k and 10-q Standard and Poor’s Bloomberg Professional Bloomberg.com Google Finance Yahoo! Finance Morningstar Merrill Lynch IBIS World 14