Dec 15, 2014

December 15, 2014

Colorado's Strong Economic Run Expected to Power on in 2015

With 2014 marking Colorado's highest employment growth this century, the state's economy will continue to expand in 2015, adding a variety of jobs in almost every business sector, according to economist Richard Wobbekind of the University of Colorado's Leeds

School of Business. "Not only is the state's economy solidly in positive territory, but it is ranking in the top five nationally for population growth, employment growth, wage and salary growth and personal income growth," Wobbekind said at the 50th annual Colorado

Business Economic Outlook. "This is a very strong run," Wobbekind told more than 600 people at a downtown Denver hotel. However, Wobbekind brought gasps from those in attendance when he reported that oil prices had dipped to $63 a barrel just moments before. Benchmark crude oil finished down $2.79 at $63.05 per barrel Monday on the New

York Mercantile Exchange. Wobbekind, who directs the business research division at Leeds, said that while Colorado is firmly positioned as a top-10 energy producing state, lower prices for an extended period could drag the economy down. "The oil price decline is both a positive and a negative for the economy," Wobbekind said. "Lower prices act as an economic stimulus for consumers. But the lower prices also stress the economic viability of drilling and extraction projects." He said that crude oil production began to boom in 2011 and oil production is projected to increase to 81 million barrels in Colorado in 2015. But he warned that if prices drop — and stay there — production could slip below forecast. "It would certainly slow activity," Wobbekind said. He said the impact of soft prices would likely first be felt in the Bakken Formation in Montana and North Dakota, and Manitoba and

Saskatchewan, and then ripple through the Niobrara Formation in Colorado, Kansas,

Nebraska and Wyoming. Areas that need to be watched closely in 2015 — because they may have a negative pull on Colorado's economy — include how well the U.S. Federal

Reserve pulls off reduction of its bond buying; what happens to the median family income; political gridlock in Washington; the cost of housing; the price of oil; and the availability of labor. Complaints about labor shortages will become more common next year, he said.

Many sectors are already "talking about the lack of available labor, even leisure and hospitality." Denver Metro Chamber of Commerce CEO Kelly Brough, who narrated the economic outlook with Wobbekind, said the shortage of qualified — and available — workers and competition from other industries and regions is expected to drive up labor costs by 7 percent or more next year. "We're seeing (construction) workers go to higher paying jobs in other states, like Texas and North Dakota and to other industries, like oil and gas," she said. "While an aging workforce may be able to extend a career at a desk job, the physical demands of this industry make it harder to extend into old age." The labor shortage,

Wobbekind said, will make it critical for "people (who are not working) to come off the sidelines." Still, Wobbekind said, Colorado's economic prospects are bright compared to most other states. He expects 61,300 jobs to be added in 2015 in Colorado, slightly less than the 72,900 jobs added in 2014. In-migration continues to boost the population, and unemployment is falling. "With a skilled workforce, a high-tech, diversified economy, relatively low cost of doing business, global economic access and exceptional quality of life,

Colorado is poised for both short- and long-term economic growth," Wobbekind said.

(Denver Post)

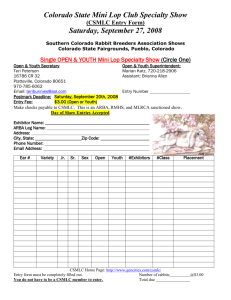

Ninth and Colorado Development Gets Nod from Denver City Council

The Ninth and Colorado redevelopment project jumped over another hurdle Monday night when tax-increment financing for the project was approved unanimously by the Denver City

Council. The $419 million redevelopment project will receive $47.9 million in tax-increment financing following the council's approval. The project, led by Denver developer Continuum

Partners, will bring new life to the site at Ninth Avenue and Colorado Boulevard, formerly home to the University of Colorado Health Sciences Center. The project received preliminary approval from a council committee last month. Renewing the site will require demolishing nearly all of the existing buildings on the site except for a parking structure, a historic nurses dormitory and a five-story bridge. The bridge will be redeveloped into a hotel, the dormitory into apartments and the parking structure will be re-used for parking.

The site will also house office space and retail. If all goes according to plan, Continuum should be able to close on the purchase of the land in January and begin remediation and demolition almost immediately, Continuum Director of Development Frank Cannon told the

Denver Business Journal in November. (Denver Business Journal)

▪▪▪

Pot's Presence in Properties

Since the legalization of recreational marijuana became effective on Jan. 1, the presence of pot has made itself known in nearly every industry. Of course, we can assume sales of

Cheetos and Taco Bell are up in Colorado, and we know that pot tourism has been beneficial for the state. But what about real estate? Much like the snack-food industry, real estate, too, has seen an increase in demand because of the growing prevalence of marijuana. The most visible pot real estate is the retail space in strip malls around the metro area that has gone to house dispensaries, with new operations going up throughout the year as various cities approved the sale of recreational pot. But the sector of commercial real estate that has felt the biggest impact is industrial properties. The pot industry is partially to blame for the Denver metro area's record-low industrial vacancy rate, real estate experts say. Other causes include food distribution companies and a lack of large-enough parcels of land to build new industrial. But as far as Class B industrial space around 50,000 square feet are concerned, marijuana companies are the go-to tenants. But there are some Class A spaces inhabited by marijuana companies. Take, for example, a building acquired in June by

Florida-based MJ Holdings Inc. The company, which is publicly traded over the counter, bought a Class A, 22,000-square-foot building at 5353 Joliet St. in Denver for $2.2 million, which it promptly leased to two marijuana-related tenants. That first building garnered so much interest that MJ Holdings (OTC: MJNE) quickly set about finding another building to buy. In September, the company purchased a second building at 503 Havana St, according to documents filed with the Securities and Exchange Commission. The building is located in

Aurora, where the first recreational pot shops opened in October. Even before closing on the property, MJ Holdings had pre-negotiated a 10-year lease for the space, the SEC filing says. "There is a critical need in the burgeoning cannabis industry to have both mature financial support and access to high-quality real estate," said Adam Laufer, co-CEO at MJ

Holdings. "At MJ Holdings, we're dedicated to both elements of the business. The Havana

Street property is an ideal location for a dispensary because of its visibility in the city of

Aurora." A Denver-based real estate company has also gotten into the marijuana game,

forming an over-the-counter-traded company in March. HMTF Cannabis Holdings Inc. is a division of Home Treasure Finders Inc. (OTCBB: HMTF) and purchased a 5,600-square-foot property at 4420 Garfield St. in Denver. The property is located in Denver's "Grow Zone," and has been fully leased to two grow operations, said Corey Wiegand, CEO of HMTF

Cannabis Holdings. The company is working to secure financing to expand in the market and has a goal of acquiring 125,000 square feet of space in the Denver market before eyeing expansion into other markets such as Washington. (Denver Business Journal)

▪▪▪

Colorado, Denver Need More Diverse Housing, says Study

Colorado and metro Denver need a larger selection of diverse housing options if residents want to avoid quickly and continuously rising housing prices in the coming years, according to a study released Monday. The study, titled "Driving a Vibrant Economy: Housing's Role in Colorado's Economic Success," was commissioned by several housing and community development organizations and seeks to address the need for more housing in diverse price ranges as it relates to the overall economic success of Colorado. Eight different types of housing were considered, from rent-subsidized housing to luxury housing only afforded by the wealthy, with both for-rent and for-sale properties taken into account. Other versions of the report have been done in previous years, with the most recent findings announced in

2012, said Elliot Eisenberg, a Washington, D.C.-based economist and one of the study's authors. Jennifer Newcomer, director of research at the Piton Foundation, and Phyllis

Resnick, lead economist at the Colorado Futures Center at CSU, were also involved in the research. "The study was designed to ring the bell, to tell the story of housing," Eisenberg said. "You can't just build affordable housing, you need all kinds of housing. There are lots of segments, none of them is more important than another, but when everyone has success, it's good for the market. You don't look at one at the expense of another." It's no secret to Denver residents, but the city's popularity is exploding, with new residents moving here in droves. But, Eisenberg said, the amount of home building occurring here is not enough to provide places for these new residents to live. Because of the fast growth of the city, housing prices are also rising quickly — too quickly for low- and middle-income earners, he said. Colorado's population increased by 1 million people between 2000 and

2013 and is 60 percent larger than it was 24 years ago, averaging out to a compound growth rate of about 2 percent per year, according to the study. Denver was ranked as the fourth-fastest growing city among the 50 most-populated cities in the nation between July

1, 2012 and July 1, 2013, by the U.S. Census Bureau. Housing prices in Colorado are 7 percent higher than they were during their peak before the Great Recession, the study says, but net worth fell during the recession from $135,400 on average nationwide in 2007 to

$81,200 in 2011. The pure act of homebuilding is good for the economy, 2013 home building accounting for $5.15 billion in economic impact, which equates to about 1.7 percent of the entire gross state product of Colorado, the study said. That number is a conservative one, because it takes into account only about 75 percent of the total housing stock in

Colorado, Eisenberg said. In reality, he said, the gross state product generated by home building is probably higher. Other industries that drive that level of gross state product are typically government and health care, Eisenberg said. New home building and rehabilitation analyzed in the report also created 81,375 full-time equivalent jobs, more than 2.9 percent of the Colorado labor force, the report states. Those jobs might be in construction, finance,

interior designers, mortgage lenders, realtors and many more. So how can institutions help boost the level of home construction in Colorado? Hint: It's not all about government subsidies for inclusionary housing. While government-assisted rentals and purchase programs for low-income individuals and families certainly play a part in maintaining diversity of housing options, getting more subsidized housing on the market does not solve every problem, Eisenberg said. Adding market-rate options near commercial cores is one end goal, and that goal can be met by increasing communication between involved entities.

For example, economic development professionals and groups can communicate with developers and builders about how many jobs are being added and how and where the employees taking those jobs should be housed. The government can also help by expediting development processes and allowing developers to make better use of vacant or underused structures, Eisenberg said. Governments can incentivize the reuse of these properties by including property tax abatements for early investors and occupants, density bonuses and expedited reviews, the study says. If adequate amounts of capital can be secured, developers and governments should not be afraid to tear down existing buildings and put up new ones with better uses or higher densities, Eisenberg said. Government bodies can also help boost development by helping developers gather up parcels of land suitable for development by using land banks, Eiseneberg said. Land banks are public entities with the authority needed to facilitate the resale of distressed properties. In addition, developers should be allowed to take some risks with their projects, Eisenberg said. "No one knows what's going to sell. The government needs to allow them to take some risks," he said. In Denver, the property type that comes to mind when one thinks of risk is condominiums, the construction of which has been mostly constricted by the statelevel construction defects law, which makes it easier for homeowners and condo associations to sue developers on behalf of homeowners. In Denver, only about 5 percent of current construction is in condos, including luxury condo developments, while nationwide that number is closer to 13 percent, Eisenberg said. Even construction of luxury products can help keep prices down, Eisenberg said, though that notion is somewhat counterintuitive.

Building a bigger supply of luxury units keeps prices on those products down, which in turn helps keep market-rate and low-income prices down in a trickle-down effect, Eisenberg said.

Luxury properties seem to be going up at a faster rate than others, something Eisenberg said is a national phenomenon. There isn't actually a higher number of luxury properties going up, he said, but because there's less construction overall, and because the luxury market has maintained its pace better than more affordable units, the percentage of luxury building is higher than it was before the recession. This gives the illusion that there is more luxury construction than there used to be, he said. Most developers in Colorado cite a lack of available land and difficulty finding workers as two of their biggest stumbling blocks to building more homes. These issues are common nationwide, Eisenberg said, with regulatory burdens probably rounding out the top three hurdles developers have to jump to build homes. The lack of available land has especially pinched the affordable and marketrate sectors of the industry, Eisenberg said, because as land prices go up, the ultimate price of the homes built on that land goes up as well. Developed land has become more scarce since the end of the recession, when there were many cheap parcels available to be purchased, often out of foreclosure. Most of those cheap parcels are gone, resulting in higher land prices up and down the Front Range. The trend has been underway for as long as two years in some parts of the state. Labor shortages have also been a problem, especially for subcontractors, for two to three years. Many of the workers who were employed by construction companies before the recession moved away or found other work when the recession brought construction to a halt. In Colorado, where the oil and gas boom

helped bring the economy out of the recession, many workers found a place in the oil fields and simply aren't coming back to the construction business now that the industry has found its footing again. "The labor problems are serious," Eisenberg said. "People changed careers and aren't coming back. If it had been the housing sector that pulled us out of the recession like it usually is, people would be coming back. But we have to wait for a whole new crop of kids to get through school and start working in the construction industry."

(Denver Business Journal)

▪▪▪

CURRENT 1 YEAR PRIOR

FED TARGET RATE

3 MONTH LIBOR

.25 .25 .25

.24 .23 .24

PRIME RATE

10 YEAR TREASURY

30 YEAR TREASURY

3.25 3.25 3.25

2.10 2.37 2.87

2.75 3.10 3.88