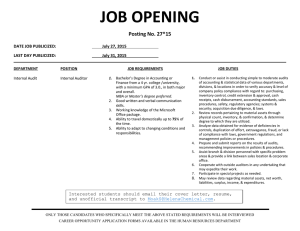

manager internal tax

advertisement

As a leader in thermal technology, we design, develop, and manufacture heating, cooling, and ventilating devices for diverse global markets. With our employees, we pioneer and shape markets for comfort devices while seeking new ways to drive value for our customers. We employ approximately 8,000 people at eleven locations in North America, Europe and Asia. In the field of Finance in Northville, MI. We are looking for you to strengthen our team as soon as possible as Manager of Internal Tax. MANAGER INTERNAL TAX The Internal Tax Manager is responsible for managing the tax function of a multinational publicly traded company. This includes all aspects of the Company’s tax provision, compliance, planning and audits. The successful candidate will work within an interdisciplinary team, including external tax advisors, to minimize cash taxes, proactively minimize the global effective tax rate, and document/ensure arm’s length pricing on intercompany transactions. ESSENTIAL DUTIES AND RESPONSIBILITIES include the following. Responsible for leveraging external tax advisors to complete Non-US tax returns, provisions, and special projects as needed. Create value added operational audits Coordinate with external auditors over their quarterly and annual audits of the Company’s accounting for income taxes. Work with the finance and accounting teams and external auditors to achieve efficient and effective audit results. Build strong working relationships with key stakeholders across the organization including the CFO, VP’s, and the Audit Committee to build his/her own reputation and for longer term internal progression opportunities. Responsible for the preparation and maintenance of analyses and supporting schedules used to prepare quarterly tax journal entries and related Balance Sheet reconciliations, to ensure that tax expense, deferred tax assets, deferred tax liabilities, and regulatory disclosures comply with U.S. GAAP requirements. Manage SOX processes and documentation related to international tax matters Responsible for coordinating with taxing jurisdictions their audits of all tax returns, etc. Responsible for reviewing intercompany activity for proper charges and drafting/reviewing annual transfer pricing studies. Partner with Internal Audit to develop controls and procedures to ensure the accuracy of tax returns and GAAP accounting for income taxes, and manage ongoing compliance to such controls. Assist SeniorYOUR Leadership with tax planning opportunities, mergers and acquisitions, etc as PROFILE required. May be required to perform other related duties as assigned. EDUCATION and EXPERIENCE: 10 (+) years of relevant tax experience, with at least five (+) years of Big-4 experience or similar industry experience and three (+) years of experience managing a tax function preferred Bachelor’s degree in Accounting required; master’s degree in business taxation a plus, active CPA license or JD preferred Strong knowledge of the new COSO framework, Standards of the PCAOB, other risk and controls standards and business process best practices Your resume can be sent by e-mail to: careers.usa@gentherm.com GENTHERM | 21680 Haggerty Rd. Suite 101 | Northville, Michigan | Tel.: 248.504.0500 | Fax: 248.348.9735 www.gentherm.com