Fact Sheet:SPDR S&P Emerging Latin America ETF, Dec2015

advertisement

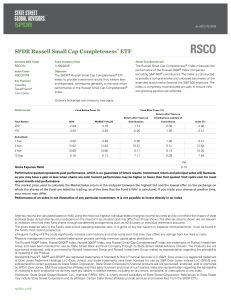

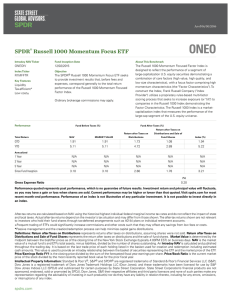

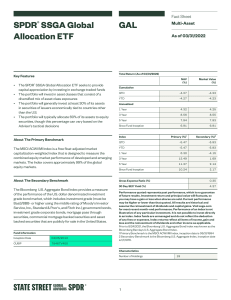

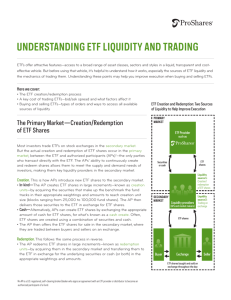

As of 12/31/2015 GML SPDR® S&P® Emerging Latin America ETF Intraday NAV Ticker Fund Inception Date About This Benchmark GMLIV 03/20/2007 Index Ticker Objective SLAUN The SPDR® S&P® Emerging Latin America ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P® Latin America BMI Index. The S&P® Latin America BMI Index is a market capitalization weighted index that defines and measures the investable universe of publicly traded companies domiciled in emerging Latin American markets. The Latin America Index is "float adjusted", meaning that only those shares publicly available to investors are included in the Latin America Index calculation. Key Features Tax-efficient* Low cost± Low turnover Liquidity Ordinary brokerage commissions may apply. Performance Fund Before Taxes (%) Fund After Taxes (%) Return after Taxes on Return after Taxes on Distributions and Sale of Total Return NAV MARKET VALUE Distributions Fund Shares Index (%) QTD -3.06 -3.74 -3.60 -1.73 -2.31 YTD -31.78 -31.82 -32.52 -17.92 -30.87 1 Year -31.78 -31.82 -32.52 -17.92 -30.87 3 Year -19.91 -20.21 -20.57 -14.31 -19.36 5 Year -15.00 -15.16 -15.49 -10.25 -14.12 -3.25 -3.31 -3.75 -2.15 -2.32 Annualized Since Fund Inception (%) Gross Expense Ratio 0.49 Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit spdrs.com for most recent month-end performance. The market price used to calculate the Market Value return is the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund's NAV is calculated. If you trade your shares at another time, your return may differ. Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index. After-tax returns are calculated based on NAV using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. The gross expense ratio is the fund’s total annual operating expense ratio. It is gross of any fee waivers or expense reimbursements. It can be found in the fund’s most recent prospectus. ±Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs. *Passive management and the creation/redemption process can help minimize capital gains distributions. S&P - In net total return indices, the dividends are reinvested after the deduction of withholding tax. Tax rates are applied at the country level or at the index level. Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index. Distributor: State Street Global Markets, LLC, member FINRA, SIPC, a wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs. spdrs.com SPDR® S&P® Emerging Latin America ETF As of 12/31/2015 Characteristics State Street Global Advisors Key Facts 3.15% Index Dividend Yield 13.45 Price/Earnings Ratio FY1 SPDR Bloomberg GML Ticker Symbol Number of Holdings 246 CUSIP Price/Book Ratio 1.31 Primary Benchmark $13,079.42 Weighted Average Market Cap $M 78463X707 S&P Latin America BMI Index SSGA Funds Management, Inc. Investment Manager State Street Global Markets, LLC Distributor Top Holdings Fund Weight (%) Top Sectors (%) America Movil SAB de CV Class L 4.54 Financials Itau Unibanco Holding S.A. Sponsored ADR Pfd 4.39 Consumer Staples 21.16 Fomento Economico Mexicano SAB de CV Units Cons. Of 1 ShsB And 4 ShsD 4.11 Materials 12.41 Ambev SA Sponsored ADR 3.92 Grupo Financiero Banorte SAB de CV Class O 2.98 Wal-Mart de Mexico SAB de CV 2.92 Banco Bradesco S.A. Sponsored ADR Pfd 2.82 Grupo Televisa S.A.B 2.31 S.A.C.I. Falabella 1.61 Alfa S.A.B. de C.V. Class A 1.61 Top Country Weights Weight (%) 27.12 Consumer Discretionary 9.22 Industrials 8.89 Utilities 6.43 Telecommunication Services 5.94 Energy 5.93 Information Technology 1.79 Health Care 0.73 Weight (%) Brazil 42.41 Colombia 5.42 Mexico 36.78 Peru 3.64 Chile 11.46 Unassigned 0.24 Weight (%) Luxembourg 0.05 Before investing, consider the funds' investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 or visit www.spdrs.com. Read it carefully. Foreign investments involve greater risks than US investments, including political and economic risks and the risk of currency fluctuations, all of which may be magnified in emerging markets. Equity securities may fluctuate in value in response to the activities of individual companies and general market and economic conditions. Non-diversified funds that focus on a relatively small number of securities tend to be more volatile than diversified funds and the market as a whole. Passively managed funds hold a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics. This may cause the fund to experience tracking errors relative to performance of the index. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress. ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns. Definitions: Pre-liquidation represents returns after taxes on distributions, assuming shares were not sold. Post-liquidation represents the return after taxes on distributions and the sale of fund shares. Market Value is determined by the midpoint between the bid/offer prices as of the closing time of the New York Stock Exchange (typically 4:00PM EST) on business days. NAV is the market value of a mutual fund's and ETFs total assets, minus liabilities, divided by the number of shares outstanding. An Intraday NAV is calculated and published throughout the trading day. It is based on the last trade price of each holding listed in the basket used for creation and redemption including estimated cash amounts. This value is used to provide an intraday relationship between the basket of securities representing the ETF and the market price of the ETF. FY 1 P/E Ratio is the closing price divided by the sum of the forecasted fiscal year earnings per share. Price/Book Ratio is the current market price of the stock divided by the most recently reported book value for the prior fiscal year. Not FDIC Insured * No Bank Guarantee * May Lose Value Date of First Use: January 2016 Expiration Date: 04/20/2016 ETF-GML 20160111/20:11