Introduction to Macroeconomics

August 2013

Annaïg Morin

Copenhagen Business School

Department of Economics

Email: amo.eco@cbs.dk

Course Description

The aim of this course is to provide students with an introduction to macroeconomics. The

course focuses on the behavior of the economy in the short-run, specifically looking at the goods

market and the financial market. The course is designed to help students understand how these

two markets operate, how they interact with each other, and how they are impacted by

macroeconomic policies. The key mechanisms will first be explained in a context of closed

economy and the analysis will then be extended to include trade and financial openness.

Prerequisites and Technical Level

The technical level required by the course is modest. Only basic math will be used in this class.

No prerequisites are required.

Methodology

The course will mainly consist of general lectures which will present and explain

macroeconomic concepts and models. Each mechanism presented in class will be embodied in a

simple analytical framework to facilitate understanding the underlying logic. Moreover, graphs

will be extensively used to build intuition.

In addition to general lectures, short sessions devoted to solving exercises will be organized at

the end of each topic.

Course materials

– Blanchard, O. and Johnson, D., Macroeconomics (6th Edition), 2013, Pearson Prentice Hall.

– Slides are provided which can be downloaded from www.annaig.com (Teaching section).

Content

The course consists of 5 key lecture topics.

TOPIC 1: Introduction to Macroeconomics, Definitions and Measurement

Readings:

• Slides

• Blanchard Chapter 2

Outline:

Definition and Measurement of GDP, GDP vs. GNP, Nominal vs. Real GDP, HDI, Consumer

Price Index and GDP deflator, Business Cycles, Procyclical vs. Countercyclical Variables,

Unemployment, Inflation.

TOPIC 2: The Goods Market

Readings:

• Slides

• Blanchard Chapter 3

Outline:

Determinants of the Demand for Goods, Equilibrium on the Goods Market, Shifts in Demand,

Multiplier.

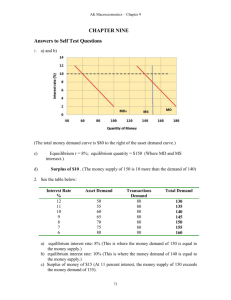

TOPIC 3: The Financial Market

Readings:

• Slides

• Blanchard Chapter 4

Outline:

Demand for Money, Supply of Money, Determination of the Interest Rate, Shifts in the Money

Demand, Monetary Policy (Open-Market Operations),

TOPIC 4: The IS-LM Model: the Goods and Financial Markets

Readings:

• Slides

• Blanchard Chapter 5

Outline:

IS Curve, Shifts of the IS Curve, LM Curve, Shifts of the LM Curve, The IS-LM Model, Fiscal

Policy, Monetary Policy, Policy Mix.

TOPIC 5: Trade and Financial Openness.

Readings:

• Slides

• Blanchard Chapters 18, 19 and 20

Outline:

Balance of Payment, Trade Balance, Nominal and Real Exchange Rate, Determinants of Imports,

Determinants of Exports, Domestic and Foreign Assets, Interest Rate and Exchange Rate,

Interest Parity Condition, Depreciation, Marshall-Lerner Condition, the J-Curve, the IS-LM

Model in Open Economy, Fiscal and Monetary Policies, Fixed vs. Flexible Exchange Rate.

Schedule

Date

Start

End

Room

19.08.2013

8h55

12h35

SP213

20.08.2013

8h55

12h35

SPs08 Nykredit Aud.

21.08.2013

8h55

12h35

SPs05 KPMG Aud.

22.08.2013

8h55

12h35

SP205 Nordea Aud.

23.08.2013

8h55

12h35

SP208

Detailed road map

TOPIC 1: Introduction to Macroeconomics, Definitions and Measurement

1. Aggregate output

1.1.

National accounts

1.2.

GDP vs. GNP

1.3.

Nominal vs. Real GDP

1.4.

PPP adjusted GDP

2. HDI

3. Unemployment rate

3.1.

Definition

3.2.

Who are the unemployed?

3.3.

Why to look at the UR?

4. Inflation rate

4.1.

How to define the price level?

4.1.1. GDP deflator

4.1.2. CPI

4.2.

Evolution of the inflation rate

5. Trend and Business cycle

5.1.

GDP

5.2.

Cyclical properties

5.2.1. Unemployment

5.2.2. Employment

5.2.3. Inflation

5.2.4. Imports

5.2.5. Pro/countercyclical

TOPIC 2: The Goods Market and the IS Curve

1. Demand for goods

1.1.

Components

1.1.1. Consumption

1.1.2. Investment

1.1.3. Government spending

2. Equilibrium in the goods market

3. Changes of the equilibrium

TOPIC 3: The Financial Market and the LM Curve

1. Demand for money

1.1.

What is money?

1.2.

Demand for money : Equation

1.3.

Increase in nominal income

2. Supply of money

2.1.

Supply of money - What do banks and the central bank do?

2.2.

Supply of money - Central bank money and money

3. Equilibrium: Interest rate

4. How to change the interest rate?

TOPIC 4: The IS-LM Model: the Goods and Financial Markets

1. The goods market

1.1.

What we remember from Topic 2

1.2.

Investment

1.3.

Determining output

1.4.

IS relation

1.5.

Shifts of the IS curve

2. The financial market

2.1.

The LM relation

2.2.

Shifts of the LM curve

3. The IS-LM model

3.1.

An equilibrium concept

3.2.

Fiscal policy

3.3.

Monetary policy

3.4.

Fiscal and monetary policies

3.5.

Policy mix

TOPIC 5: Trade and Financial Openness.

1. Two concepts to better understand openness

1.1.

The balance of payments

1.2.

Nominal and real exchange rates

2. The goods market in an open economy

2.1.

Determination of the equilibrium

2.1.1. The demand for domestic goods

2.1.2. The equilibrium

2.2.

Changes in demand

2.3.

Depreciation

3. IS-LM in an open economy

3.1.

The goods market

3.2.

The financial market

3.3.

The goods and financial markets together: the open IS-LM model

3.4.

Effects of policy