Existing Shopping Center13

advertisement

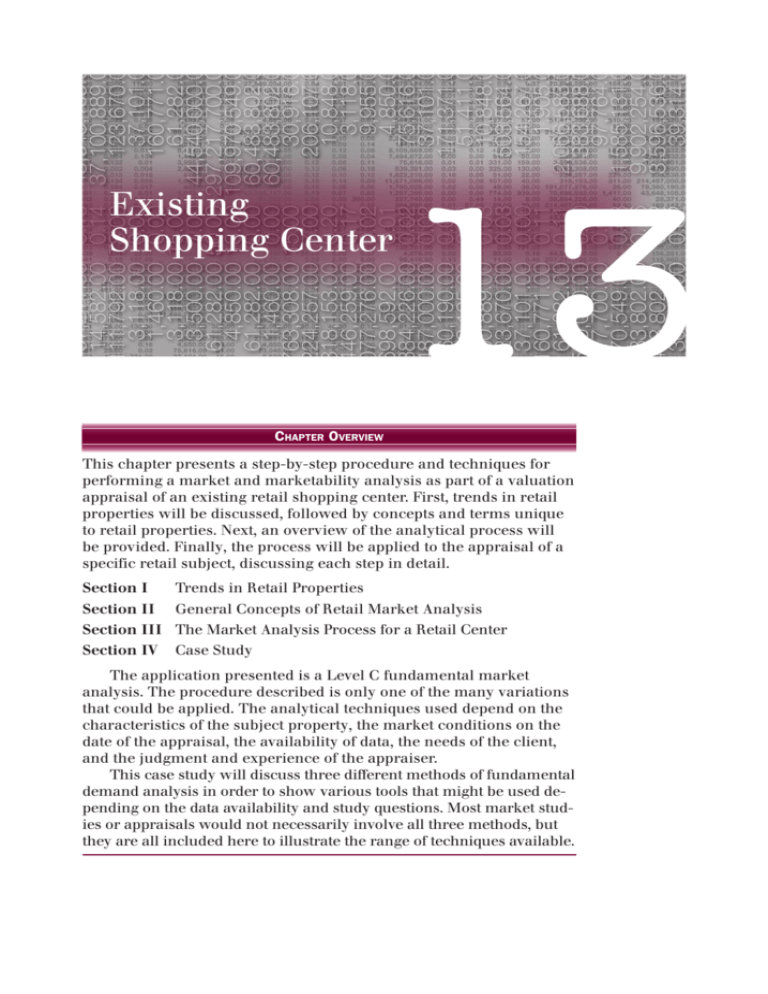

13 Existing Shopping Center Chapter Overview This chapter presents a step-by-step procedure and techniques for performing a market and marketability analysis as part of a valuation appraisal of an existing retail shopping center. First, trends in retail properties will be discussed, followed by concepts and terms unique to retail properties. Next, an overview of the analytical process will be provided. Finally, the process will be applied to the appraisal of a specific retail subject, discussing each step in detail. Section I Section II Section III Section IV Trends in Retail Properties General Concepts of Retail Market Analysis The Market Analysis Process for a Retail Center Case Study The application presented is a Level C fundamental market analysis. The procedure described is only one of the many variations that could be applied. The analytical techniques used depend on the characteristics of the subject property, the market conditions on the date of the appraisal, the availability of data, the needs of the client, and the judgment and experience of the appraiser. This case study will discuss three different methods of fundamental demand analysis in order to show various tools that might be used depending on the data availability and study questions. Most market studies or appraisals would not necessarily involve all three methods, but they are all included here to illustrate the range of techniques available. Section I. Trends in Retail Properties A shopping center is a tract of land, under individual or joint real estate ownership or control, improved with a coordinated group of retail buildings that contain a variety of stores and offer free parking.1 In recent years, individual supercenters by retailers such as Target and Wal-Mart have emerged that contain full-line grocery, department store, automotive, nursery, and convenience items, all under one roof, and that function as shopping centers on their own. Thus, in this book, the term shopping center refers to the traditional multitenant shopping center as well as to the stand-alone big-box stores and other one-store concepts that function similarly to or compete with traditional shopping centers. Regardless of whether an individual shopping center is a multitenant property or a stand-alone property, in practice shopping centers are planned and managed as a unit, and their location, size, and retail mix are determined by the trade area that they serve. Until the mid-twentieth century, retail activity in the United States was concentrated in the downtown areas of cities and towns. After World War II, the production and use of the automobile increased significantly and, along with government programs like the interstate highway system and new government housing programs, contributed to the change in urban development patterns toward the suburbs. Consequently, retail activity has been dispersed throughout metropolitan regions and into specialized areas and outlying centers. The nature of retail activity continues to change. During the 1960s and 1970s, the retail trend favored enclosed malls. The 1980s brought a dispersion of neighborhood and community centers throughout the metropolitan areas. The 1990s introduced the power center, a retail concept that included a number of major stores and very little in-line space. The 1990s were also the advent of the entertainment center, which contains a mix of retail, restaurants, and entertainment uses. Entertainment ranged from restaurants to movie houses to massive game rooms, with the idea being that children would lure their parents to the center so that the retailers could entice them to part with their money. The outlet mall, a large concentration of major retail stores selling their seconds merchandise, also arose during this time. Typically, these stores are located some distance from the primary chain store. They are usually located outside of major metropolitan areas and serve a large trade area. Various other trends emerged around 2000. For example, the stand-alone community department store located full-line department stores in neighborhoods. These stores usually carried economically priced merchandise. Another significant trend that gained traction in the early years of the twenty-first century was the lifestyle center, which aimed to attract higher-income shoppers through con- 1. The Dictionary of Real Estate Appraisal, 5th ed. (Chicago: Appraisal Institute, 2010). 234 Market Analysis for Real Estate venience and tenant mix. The likely tenant types at lifestyle centers are more upscale specialty stores such as home furnishings, women’s fashion, bookstores, restaurants, and some major department store anchors. The lifestyle center is designed as an open-air mall where shoppers can drive up to the stores. These centers typically vary in size from 300,000 to 500,000 square feet. The upscale architectural design is intended to create a nostalgic experience, the goal being to create a downtown shopping experience reminiscent of the 1940s and 1950s. In the United States, this open-air center has proven to be successful in the cold climates of the north states as well as the hot humid climates of the southern states. This type of center also proved to be economical, as typical sales for the first half of 2005 were about $298 per square foot, compared to about $245 for traditional regional malls. Higher sales per visit, along with lower operating costs, have made lifestyle centers very attractive. The supercenter discount store trend came into its own from the 1990s to 2012. These stores compete for community shopping as well as with regional shopping centers. These stores, which typically have about 180,000 square feet of space, offer similar merchandise as large community shopping centers and some low-end malls. Power centers and big-box stores accounted for about 4.3% of all shopping center space in 1983 and grew to 11.1% in 2012, showing the increased popularity of this retail format. Another trend during the 2005-2012 time frame was a surge of smaller discount “dollar stores” that were dispersed throughout moderate-income neighborhoods and small towns. In 2011, the combined store count of the four national dollar store (or extreme value) chains—Dollar General, Dollar Tree, Family Dollar and 99 Cents Only—surpassed that of the three biggest national drugstore chains—Walgreens, CVS, and Rite Aid.2 The dollar stores took on the larger supercenters, directly catering to some of their customer types, offering some similar merchandise, and offering more convenience by providing faster in-and-out shopping. The latest retail trend to watch is online sales. Some market observers think online retail might outstrip the demand for bricksand-mortar stores. However, at least at this time, online sales have not fulfilled this prediction, but they are becoming more significant, particularly for what are known as shoppers’ goods, one of the types of goods discussed later in this chapter.3 One of the more current trends in retailing is a combination store. This is a small store with a display of all the retailer’s merchandise, such as clothes and shoes, but only for direct observation of quality and style and for fitting purposes. Any purchase is still delivered to the customer’s house, whether the transaction occurs in the store or online. From 2000 to 2. 3. “Dollar Days: How Dollar Stores are Growing in a Weak Economy,” white paper published by Colliers International (2011). Traditionally, the shoppers’ goods category was known as shopping goods, but a shift in usage has occurred in recent literature. Existing Shopping Center 235 2014, there was also a push toward online sales of convenience goods like groceries, but this has not become widespread in 2014. Exhibit 13.1 shows the overall market trend in online sales. As of 2014, experts say that most chains should have at least 10% of their sales come from online sources. For example, Staples displayed one of the highest rates of online sales, 42%, in 2013. At that time, the rates at typical department stores, like Macy’s, were at 11%, with stores like Wal-Mart coming in on the lower end at 2%.4 At each step in the appraisal process, an appraiser must remember that retail centers have changed in the past and will continue to do so in the future. Their dynamics may depend on changes in linkages to demand and product distribution, in demographics, or in retail marketing techniques. Consequently, the changing nature of retail centers forces analysts to reconsider their criteria for each assignment. The challenge is to assess how the shopping center being valued compares with competitive properties, both existing and anticipated. Although current competition may be investigated directly, future competition requires more study because of the ever-changing nature of shopping centers. All of the retail dynamics of demand, competition, and subject capture have a direct connection to the valuation of the subject shopping center Exhibit 13.1 Online Sales in the United States because the real estate Year Share of Total US Retail Sales Share of GAFO* Sales that houses retail 20000.9% 2.3% activity is more valuable 20052.1% 8.1% the more retail goods 20104.0% 14.0% that are sold, and the higher the price point 20124.9% 17.7% of the goods sold, at that Source: US Census Bureau and International Council of Shopping Centers shopping center. * GAFO stands for general merchandise, apparel, furniture, and other (electronics, etc.). Section II. General Concepts of Retail Market Analysis The first concept to understand about retail market analysis is that demand comes from the customers in the trade area, not from the shopping center, which means that a new or renovated shopping center cannot create new demand. A shopping center can only harvest customers in four ways: 1. Attracting them from other competing businesses in the trade area because of better linkages to customers, i.e., ease of access 2. Providing products that other shopping centers do not provide 3. Filling a vacuum created by obsolete buildings or by the competition’s marketing weaknesses 4. Realizing sales growth from new sources of demand entering the trade area such as population growth 4. Internet Retailer as reported in Dallas Morning News (March 24, 2014). 236 Market Analysis for Real Estate The second major concept for appraisers to keep in mind is that retail has traditionally followed, rather than led, community growth. A shopping center is like a magnet—the more customers it can attract, the better it will be. Thus, it needs households and linkages to those households (or other demand sources such as daytime employment in the trade area). The next concept to understand is that the ability of a shopping center to capture a share of market demand depends on the size of its trade area and how the shopping center compares to its competition in terms of the merchandise it offers, the physical and functional appeal of the retail outlet, and the shopping center’s linkages to customers. Thus, a market analyst must also consider the existing competition as well as planned and potential competition. The retail cluster is another important concept. Clustering may result when stores that sell similar but not identical goods (e.g., auto dealerships, furniture stores, and appliance stores along arterial streets) locate near each other to offer customers a wider selection. Although the stores sell similar goods, consumers can differentiate the products of the different stores, and the storeowners believe that the benefits of increased consumer traffic outweigh the negative effects of proximity to competitors. This concept is also called the principle of cumulative attraction, which recognizes that a location in a retail cluster with similar but not identical retailers attracts more customer traffic than a single retailer would.5 Shopping centers represent another type of retail cluster. A shopping center usually contains stores that do not directly compete with one another, although some stores may sell products that are close substitutes. Finally, the drawing power of dominant shopping centers is subject to the principle of interception, or the principle of intervening opportunities, which recognizes that most shoppers will not bypass a dominant center to get to a subordinate center. These and other concepts show how shopping centers differ from other types of real estate. Moreover, the principles and concepts underlying the operation of shopping centers are not static. Additional specialty stores and a broader product mix in community centers, for example, may counteract the effects of the principle of interception. The appraiser’s dilemma is apparent. In appraising a shopping center, an appraiser must consider whether or not the subject real estate is still competitive today and is likely to be in the future. If the subject property is on the verge of becoming outdated, comparable sales that are two or three years old may be of little use. The subject property’s historic income may be misleading because future income may be declining. Major renovation or alternative uses may have to be considered. Thus, understanding the retail business and the real estate product (the shopping center) that houses it is the key to estimating the subject property’s value. 5. One of the first scholars to describe this concept and use this word was Richard L. Nelson in The Selection of Retail Locations (New York: F. W. Dodge, 1958). Existing Shopping Center 237 Types of Shopping Centers Shopping centers are usually classified according to two criteria: • • size in square feet of gross leasable area (GLA) and their tenantry. In this discussion, tenantry is synonymous with “products sold or services rendered.” A subcategory of tenantry is the anchor or principal tenant and the tenant mix. Secondary criteria are drive time and customer base. The principal determinants of the type of shopping center are the tenants, the products sold, and whether the products are convenience goods, shoppers’ goods, or specialty goods. Determining the type of center is critical to a market study. The type of center establishes the customer category and the distance that customers will travel to it. The customer type and location determine, in large part, the trade area. The trade area sets the limits of the demand calculations. Consequently, the leading edge of the market study is the type of shopping center, as the center type dictates in large part the extent of the trade area. The two major classifications of shopping centers are • • convenience goods centers shoppers’ goods centers Shoppers’ goods centers are general merchandise stores that sell apparel and accessories, furniture, and home furnishings. They include discount stores and other specialty stores. The industry code for these types of stores is GAFO, which stands for general merchandise, apparel, furnishings, and other. GAFO stores sell merchandise normally sold in department stores. Convenience goods stores include supermarkets and other food stores, drugstores, home improvement stores, and Exhibit 13.2 Retail Terminology convenience goods Commodities purchased frequently and without extensive comparison of style, price, or quality. That is, goods from drug, grocery, liquor, and hardware stores, services from beauty, barber, and bake shops, and services from laundry and dry cleaning establishments. Because the consumer purchases these “low-order” goods often, the quality of products and their prices are well-known. shoppers’ goods Goods from variety, department, and general merechandise stores, e.g., clothing, furniture, and appliances. specialty goods Items that shoppers will take more care and spend greater effort to purchase. GAFO stores include the following: • General merchandise stores (NAICS 452) • Clothing and accessories stores (NAICS 448) • Furniture and home furnishings stores (NAICS 442) • Electronics and appliance stores (NAICS 443) • Sporting goods, hobby, book, and music stores (NAICS 451) • Office supplies, stationery, and gift stores (NAICS 453) 238 Market Analysis for Real Estate hardware stores. The marketing concept for supercenters (i.e., WalMart, Target, and similar stores) includes both shoppers’ goods and convenience goods stores. Centers that specialize in selling primarily shoppers’ goods find that their customers come from greater distances than those for retail facilities that primarily sell convenience goods. Traditional types of shopping centers include • • • convenience centers neighborhood, community, regional, and super-regional shopping centers specialty or theme centers Variations and new types of centers are continually evolving. Some examples are off-price outlets and discount centers, festival shopping centers, lifestyle centers, supercenters, hypermarts, supermalls, power centers, and thoroughfare- or highway-related commercial developments.6 (See Exhibit 13.3.) Trade Area Concept Defined A trade area (also called a market study area in some contexts) is defined as the geographic area from which a retail facility consistently draws most of its customers.7 The definition’s focus is on the origination of most of the subject property’s customers and sales. However, for the residual demand study of the market, the competition must also be considered. In some instances, retail properties have two market areas: 1. The origination point of most of the customers 2. The location of most of the competition Thus, the trade area, in practice, is usually combined, forming the overall market study area as defined by ULI: The geographic region from which the majority of demand and the majority of competition are located.8 The extent of this area is the result of many factors, among them accessibility, the extent of physical barriers, the location of competing facilities, and drive time. The usual focus of the market study is known as the primary trade area, which is a subset of the trade area, defined as “the geographic area around a retail facility from which approximately 60% to 80% of the facility’s customers are drawn.”9 The next layer of the trade area is called the secondary trade area, where about 15% to 20% of the sales are generated. The last layer is the tertiary trade area, where an additional 5% to 10% of sales are 6. 7. 8. 9. For a more complete description of retail types, see James D. Vernor, Michael F. Amundson, Jeffery A Johnson, and Joseph S. Rabianski, Shopping Center Appraisal and Analysis, 2nd ed. (Chicago: Appraisal Institute, 2009), 3-14. The Dictionary of Real Estate Appraisal, 5th ed. (Chicago: Appraisal Institute, 2010). Adrienne Schmitz and Deborah L. Brett, Real Estate Market Analysis: A Case Study Approach (Washington D.C.: Urban Land Institute, 2001). The Dictionary of Real Estate Appraisal, 5th ed. (Chicago: Appraisal Institute, 2010). Existing Shopping Center 239 240 Market Analysis for Real Estate Stores that sell convenience goods and stores that provide personal services, e.g., dry cleaning, shoe repair. A supermarket is often the principal tenant. Stores that sell convenience goods, personal • 100,000 to 300,000 square feet of services, and shoppers’ goods, e.g., apparel, gross leasable area appliances. A junior department store or off-price/ • 10 to 30 acres (includes minimalls) discount store is often the principal tenant. Other tenants include variety or super drugstores and home improvement centers. Neighborhood shopping center Community shopping center 300,000 to 1,000,000 square feet of gross leasable area 30 to 100 acres Contains one or more department stores of at least 100,000 square feet • • • 20- to 40-minute driving time 5- to 10-mile range 150,000 to 400,000 potential customers • 5- to 20-minute driving time • 3- to 6-mile range • 40,000 to 150,000 potential customers • Less than 5-minute driving time • 1- to 1½-mile range • 5,000 to 40,000 potential customers • Less than 5-minute driving time Trade Area Name brand outlet stores or wholesale grocery and hardware stores. Convenience stores, fast-food restaurants, car dealerships, and service stations. Motels, restaurants, truck stops, service stations; may • Varies • Passing motorists in need of highwaystand as a single establishment within a cluster of related services other highway-related service facilities. Off-price outlet and discount center Strip commercial (a contiguous row or strip along a main thoroughfare) Highway commercial • Varies according to trade area • 60,000 to 400,000 square feet A minimum of three, but usually five or more, anchor • Typically open-air centers of more • A minimum of 15 miles—typically a tenants that are dominant in their categories. than 250,000 square feet 20-minute range and a population • Almost all space designed for large tenants of 400,000 to 500,000 Power center • Neighborhood or community • Similar to super-regional center • Similar to regional shopping centers Stores that sell upscale home furnishings or women’s • 300,000 to 500,000 square feet fashion, department stores, and restaurants. • Similar to that of a regional shopping center Lifestyle centers • Same range as a neighborhood or community shopping center Boutiques and stores that sell design items, craft wares, and gourmet foods. A high-profile specialty shop is often the principal tenant. Festival malls and fashion centers are types of theme centers. Specialty, or theme, center Super-regional shopping center Stores that sell general merchandise, apparel, • Over 800,000 square feet of gross • In excess of 30-minute driving time furniture, home furnishings, and services as well leasable area • Typically 10- to 35-mile range as recreational facilities. • Contains at least three major • Over 500,000 potential customers department stores of at least 100,000 square feet each Regional shopping center Stores that sell general merchandise, shoppers’ • goods, and convenience goods. One or more department stores are the principal tenants. • • • 30,000 to 150,000 square feet of gross leasable area • 4 to 10 acres • Less than 30,000 square feet Stores that sell convenience goods, e.g., groceries, pharmaceutical; not anchored by a supermarket. Size Tenantry Convenience center Principal Types of Shopping Centers Type Exhibit 13.3 generated. For a typical shopping center, this accounts for about 95% of sales. The sales from other various sources usually are not well defined. The customer base for each layer of a trade area can reside in the area or can be derived from nonresident groups in the area such as daytime employees, tourists, and other groups who live outside the area but who regularly frequent the subject trade area. Different types of shopping centers have distinctly different tenant compositions and trade areas (see Exhibit 13.4), and some important industry terms pertaining to shopping centers are defined in Exhibit 13.5. The general guidelines for delineating the trade areas shown in Exhibit 13.4 must be modified to fit the characteristics of the specific shopping center, primarily as they relate to the type of products sold, the linkages to its customers, and adjustments for competition. Detailed discussion on procedures for defining the trade area is presented in the case study section of this chapter covering Step 2: Delineate the Market. Exhibit 13.4 Trade Area Breakdown by Total Sales and Driving Time Neighborhood shopping centers Community shopping centers Regional shopping centers Super-regional shopping centers Primary Trade Area* Under 5 minutes 5 to 20 minutes 20 to 40 minutes More than 40 minutes Secondary Trade Area† 5 to 15 minutes 20 to 35 minutes 40 to 60 minutes Tertiary Trade Area‡ * The geographic area immediately adjacent to the facility from which approximately 60% to 80% of its customers are derived † The geographic area adjacent to the primary trade area from which an additional 20% to 40% of the facility’s sales/customers are derived ‡ The farthest outlying segment of the trade area from which the remaining percentage of the facility’s sales/customers are derived Exhibit 13.5 Building Terms gross leasable area (GLA) The total floor area rented to tenants, including basements and mezzanines. Gross leasable area is measured from the outside wall surface to the center of interior partitions. gross building area (GBA) Gross leasable area plus all common areas. gross sales area (GSA) Gross leasable area minus storage and work areas. sales per square foot The annual store sales divided by the floor area that generates the sales. The number is used in the market analysis calculation to convert economic data to real estate. It is important to identify the type of floor area measurement used in the economic data. Most survey data uses sales per gross leaseable area to the tenant (GLA). common area The total area within a property that is not intended for sale or rent but is available for common use by all owners, tenants, or their customers, e.g., mallways, parking, and restrooms; not included in gross leasable area. parking area The area of a facility designated for parking employees’ and customers’ cars, including parking surface, aisles, stalls, and islands. parking ratio The ratio of parking area to GBA or GLA. This figure is used only as a rough estimation of the parking area needed. parking index The number of car parking spaces per 1,000 square feet of GLA. Existing Shopping Center 241 Section III. The Market Analysis Process for a Retail Center Exhibit 13.6 is an overview of a Level C market and marketability analysis of a shopping center. The six-step process includes • • • • • • analysis of the subject property analysis of the subject’s trade area an estimate of existing and potential demand an inventory of competitive supply analysis of market equilibrium the estimated subject capture The six-step market and marketability analysis provides essential data used in the highest and best use analysis and, in turn, the application of the three approaches to value. Each of the six steps is divided further into substeps. For example, the ten substeps of Step 3.3, identified as Steps 3.3(1) through 3.3(10), describe the segmentation process used to estimate demand in the retail center’s primary and secondary trade areas. The case study application follows the sequence of steps shown in Exhibit 13.6. The forecast capture rate for the subject property is then employed as a basis for the highest and best use conclusion. In particular, a forecast of timing is needed to test financial feasibility. Forecast capture is also essential data in the three valuation approaches, such as the revenue forecast for the income capitalization approach. Section IV. Case Study The case study that follows is an application of the six-step process to a valuation appraisal of a specific retail property. The case study is based on an actual market value appraisal. General procedures for each step are introduced and then applied to the case study, and the application of the market analysis procedures is shown as it appeared as part of the market value appraisal. Some parts have been abbreviated for purposes of illustration and some descriptive text has been added about the procedure for explanatory purposes. The purpose of the original appraisal was to lend support to the highest and best use conclusion and to furnish information for the valuation approaches applied to the market value opinion. The question of use is not a major element of this study because the subject retail center is relatively new and currently occupied. The value of the land as though vacant is far less than the value of the property as improved. Alternative uses that would require remodeling are not feasible. Thus, the analysis of highest and best use as if vacant would be a minimal, Level A study because it is not critical to the overall property value conclusion. Thus, for brevity, the Level A analysis of highest and best use “as if vacant” is not shown here. In this case study, the portion of the original appraisal that has the most significant effect on value is the ability of the subject prop 242 Market Analysis for Real Estate