Cash Management

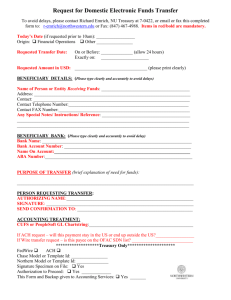

advertisement