Part 2 - Assumption University

advertisement

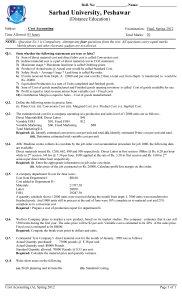

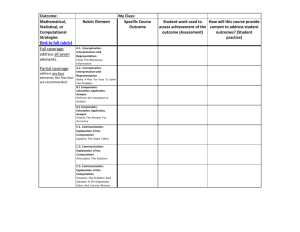

BA 6601 MANAGERIAL ACCOUNTING Assumption University Graduate School of Business Guideline for Written Comprehensive Examination 3/2010 Professional MBA Evening Managerial Accounting (MA) Dr. Surasakdi Prugsamatz Part 2 COMPREHENSIVE EXAMINATION GUIDELINE –by Dr. Surasakdi Prugsamatz Topics to be Examination: prepared for Comprehensive 1. COST CONCEPTS AND CLASSIFICATIONS: PRODUCT COSTS AND PERIOD COSTS NONINVENTORABLE UNEXPIRED COSTS TYPES OF MANUFACTURING COSTS ESTIMATED FACTORY OVERHEAD RATE COMPUTATION PRIME COSTS AND CONVERSION COSTS TYPES OF COST BEHAVIOR MANUFACTURING COST FLOW - APPLICATION SCHEDULE OF COST OF GOODS MANUFACTURED INCOME STATEMENT FORMATS 2. COST VOLUME PROFIT ANALYSIS: CONTRIBUTION MARGIN CONCEPT AND FORMULA COMPUTATION OF BEP AND TRAGET PROFIT MARGIN OF SAFETY OPERATING LEVERAGE SALES MIX 3. ACTIVITY BASE COSTING SYSTEM (ABC & ABM) AND TRADITIONAL COSTING SYSTEM (TCS): STANDARD FOH RATE COMPUTATION BASED ON TCS STANDARD FOH RATE COMPUTATION BASED ON ABC COST DISTORTION - OVER AND UNDER COSTING TYPES OF ABC ACTIVITIES. 4. MASTER BUDGET: CASH BUDGET; INCOME STATEMENT BUDGET; AND BALANCE SHEET BUDGET OF NON-MANUFACTURING AND MANUFACTURING FIRMS. 1 BA 6601 MANAGERIAL ACCOUNTING 5. FLEXIBLE BUDGET AND COST VARIANCE ANALYSIS: MASTER AND FLEXIBLE BUDEGT PERFORMANCE REPORT COMPUTATION OF COST VARIANCES AND REASONS FOR VARIANCES 6. DECISION MAKING: RELEVANT AND IRRELEVANT CONCEPTS DIFFERENT TERMINOLOGY USED IN DECISION MAKING TYPES OF DECISION MAKING 1. COST CONCEPTS AND CLASSIFICATIONS: PRODUCT COSTS AND PERIOD COSTS 1. Characteristics of Product costs related to the merchandise and manufacturing firms. 2. Characteristics of Period costs related to the merchandise and manufacturing firms. 3. Understanding of Product and Period costs concepts related to merchandise and manufacturing firms. NONINVENTORABLE UNEXPIRED COSTS 1. Characteristics of noninventorable unexpired costs 2. Differentiated between product costs and noninventorable unexpired costs. TYPES OF MANUFACTURING COSTS 1. Concepts required identifying manufacturing costs into direct costs. 2. Concepts required identifying manufacturing costs into indirect costs. ESTIMATED FACTORY OVERHEAD RATE COMPUTATION 1. Concept of TCS. 2. Formula, based on TCS, used in computing FOH rate 3. Computation of FOH adjustment during the period. PRIME COSTS AND CONVERSION COSTS 1. How to compute the prime costs and conversion costs. 2. Application of prime costs and conversion costs in the problem. TYPES OF COST BEHAVIOR 1. Characteristics of various types of cost behavior such as variable costs; fixed costs; mixed costs; step-fixed costs. 2. High-low method used in identifying variable and fixed costs. 3. Application of cost behavior in the problem. MANUFACTURING COST FLOW – APPLICATION 2 BA 6601 MANAGERIAL ACCOUNTING 1. Permanent accounts namely Raw Materials Inventory account; Work-in-process inventory account; and Finished Goods inventory account. 2. Temporary accounts namely Factory Payroll; Factory Overhead; Cost of goods sold. 3. Types of inventory methods – FIFO; LIFO; and weighted average. SCHEDULE OF COST OF GOODS MANUFACTURED 1. Formulae required determining the CGM. 2. Average cost per unit. INCOME STATEMENT FORMATS 1. Functional/ Traditional Income Statement Format. 2. Contribution Margin Income Statement Format. 2. COST VOLUME PROFIT ANALYSIS: CONTRIBUTION MARGIN CONCEPT AND FORMULAE 1. Meaning of contribution margin. 2. Common Contribution margin formulae. COMPUTATION OF BEP AND TRAGET PROFIT 1. Assumptions of CVP. 2. Methods used in BEP and Target Profit – Simple equation method or contribution margin method. MARGIN OF SAFETY – AMOUNT AND PERCENTAGE 1. Meaning and computation of Margin of safety expressed in units and percentage. 2. Interpretation of Margin of Safety. OPERATING LEVERAGE 1. Meaning of Operating Leverage. 2. Computation of Operating Leverage. 3. Application and Interpretation of Operating Leverage in business. SALES MIX 1. Meaning of Sales Mix. 2. Calculation of Weighted Average Contribution Margin per unit and Overall contribution margin percentage. 3 BA 6601 MANAGERIAL ACCOUNTING 3. Computation of Sales Mix expressed in units and in amount and allocation of the results to individual product. 3. ACTIVITY BASE COSTING SYSTEM (ABC & ABM) AND TRADITIONAL COSTING SYSTEM (TCS): STANDARD FOH RATE COMPUTATION BASED ON TCS 1. As stated in Topic 1. STANDARD FOH RATE COMPUTATION BASED ON ABC 1. Concepts of Activity Base Costing. 2. Difference between ABC and TCS. 3. Computation of POOL rate per selected cost driver. 4. Computation of POOL COST for the product line. 5. Computation of Cost per unit of a product line. 6. Concept of Activity base management. 7. Advantages and weaknesses of ABM. TYPES OF ABC ACTIVITIES 1. Five level of ABC activities meaning and objectives. 2. Characteristics and procedures of ABC. COST DISTORTION 1. Application of over or under cost distortion in decision making. 2. The interpretation of over or under cost distortion in problem. 4. MASTER BUDGET: Preparing Cash budget; Income Statement budget; and Balance sheet budget for non-manufacturing and manufacturing firms. It is necessary to know how to prepare them with the given full or missing information. 5. FLEXIBLE BUDGET AND COST VARIANCE ANALYSIS: MASTER AND FLEXIBLE BUDEGT PERFORMANCE REPORT 1. Performance report format and its particulars for both. 2. Characteristics of Flexible budget performance report. COMPUTATION OF COST VARIANCES AND REASONS FOR VARIANCES 1. Formulae and calculation of DMPV and DMQV. 4 BA 6601 MANAGERIAL ACCOUNTING 2. Formulae and calculation DLRV and DLUV. 3. Formulae and calculation of Variable FOH SV and Variable FOH EV. 4. Formulae and calculation of Fixed FOH SV and Fixed FOH VV. 5. Reasons for all the variances calculated above. 6. DECISION MAKING: RELEVANT AND IRRELEVANT CONCEPTS 1. Characteristics of RELEVANT COST DATA. 2. Characteristics of IRRELEVANT COST DATA. 3. Basic classification of manufacturing and operating costs as relevant and irrelevant costs. DIFFERENT TERMINOLOGY USED IN DECISION MAKING 1. Avoidable and unavoidable costs. 2. Opportunity costs. 3. Sunk costs; allocation costs, common costs, joint costs; committed costs. 4. Internal costs; External costs. 5. Incremental costs; marginal costs. 6. Separable costs; cost of indifferent point. TYPES OF DECISION MAKING 1. Make or Buy decision including existence of additional alternatives due to decision buy. 2. Special order decision including the price decision. 3. Joints Products decision including the allocation of joint costs by relative sales value at split –off point. 4. Drop decision including the affect of drop decision on other products. 5. Profit maximization through utilization of limited capacity decision. ****************** 5 BA 6601 MANAGERIAL ACCOUNTING 6