Key Principles of Microfinance

Key Principles of Microfinance

CGAP

Building Financial Systems for the Poor www.cgap.org

PRESENTATION INSTRUCTIONS

This CGAP presentation may be used or changed without permission. Attribution to CGAP is appreciated.

Slides are accompanied by notes.

To view notes, select from the PowerPoint menu: View/

Notes Page. Scroll to advance to next page.

To print notes, select File/ Print/ Print what: Notes Pages.

To print handouts of just slides (no notes), select File/

Print/ Print what: Handouts. Then enter the number of slides to print per page.

For optimal printing on a black-and-white printer, select from the menu: File/ Print/ Pure Black and White.

January 6, 2006

Overview

CGAP is a global resource center for microfinance standards, operational tools, training, and advisory services. Its 31 members - including bilateral, multilateral, and private donors - are committed to building more inclusive financial systems for the poor.

These principles were developed and endorsed by CGAP and its 31 member donors, and further endorsed by the

Group of Eight leaders at the G8

Summit on 10 June 2004.

Poor people need a variety of financial services

Meeting the Needs of Poor People

Savings Loans

Money

Transfers

Convenient,

Flexible, and

Affordable

Insurance

Microfinance is a powerful tool to fight poverty

The Promise of Microfinance

Microfinance

• Credit

• Savings

• Insurance

• Transfers

Increases

• Income

• Assets

• Security

• Confidence in future

Better

• Health

• Education

• Nutrition

• Community participation

• Banking for the majority

Microfinance means building financial systems that serve the poor

Building Inclusive Financial Systems

In most developing countries, poor people are the majority of the population but usually lack access to financial services.

Microfinance will reach the maximum number of poor clients when it is integrated into the financial sector.

Clients

Microfinance can pay for itself, and must do so to reach very large numbers of poor people

Achieving Long Term Scale and Impact

Cost recovery is the only way a financially sustainable institution can continue and expand services over the long term.

Ach ievin g bility sust aina mea ns

Lowering transaction costs

Offering services that are more useful to clients

Finding new ways to reach more of the unbanked poor.

Microfinance is about building permanent local financial institutions

Unleashing Domestic Capital Markets

Deposits

• Individual

• Institutional

Debt

• Commercial loans

• Concessional loans

• Bonds

Equity

• Private placements

• Stocks

Domestic

Funding

Sources

+

Strong Local

Institutions

=

Less reliance on donors and governments

Microcredit is not always the answer.

Microcredit is not the best tool for everyone or every situation.

Using Other Tools When Necessary

Destitute people with no income or means of repayment need other kinds of support before they can make good use of loans.

Where possible, such services should be coupled with building savings.

Interest rate ceilings hurt poor people by making it harder for them to get credit

Interest Rate Caps Hurt The Poor

AVOID INTEREST

RATE CAPS

When governments regulate interest rates, they usually set them at levels so low that microcredit cannot cover its costs

Microlenders need to cover their relatively higher costs.

If microlenders cannot cover their costs, they may only operate for a limited time, reach a limited number of clients, and will tend to be driven by donor or government goals, not client needs.

Poor people can afford higher rates because they compare interest rates favorably to

¾ their business/household costs

¾ their income streams

¾ and informal financial alternatives

The role of government is to enable financial services, not to provide them directly

Setting Sound Policy and Legal

Frameworks

Rather than act as direct providers of credit services, governments need to:

¾

Set policies that stimulate financial services for poor people at the same time as protecting deposits

¾

Maintain macroeconomic stability

¾

Clamp down on corruption

¾

Improve the environment for micro-businesses, including access to markets and infrastructure

¾

Avoid interest rate caps

¾

Refrain from distorting markets with subsidized, high-default loan programs that cannot be sustained

Donor funds should complement private capital, not compete with it

Making Way for Private Capital

Donor grants, loans, and equity for microfinance should be temporary and used to:

9

Build the capacity of microfinance providers

9

Develop supporting infrastructure at the micro and meso levels

9

Support experimentation

Donors should:

9

Integrate microfinance with the rest of the financial system

9

Use experts when designing and implementing projects

9

Set clear performance targets tied to future funding

9

Set a realistic exit strategy from the beginning

The key bottleneck is the shortage of strong institutions and managers

Building Capacity at All Levels

Central banks, relevant ministries and parliamentarians

Training firms, audit firms, credit bureaus, IT companies

Managers and information systems of microfinance providers

Clients

Microfinance works best when it measures and discloses - its performance.

Supporting Transparency and

Standard Reporting

Donors, investors, banking supervisors, and customers need accurate, standardized performance information to judge their cost, risk, and return:

¾

Financial information (e.g., interest rates, loan repayment, and cost recovery)

¾

Social information (e.g., number of clients reached and their poverty level)

Building financial systems for the poor

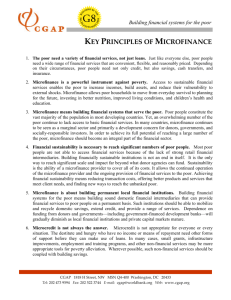

KEY PRINCIPLES OF MICROFINANCE

1. Poor people need a variety of financial services, not just loans.

2. Microfinance is a powerful tool to fight poverty.

3. Microfinance means building financial systems that serve the poor.

4. Microfinance must pay for itself to reach large numbers of poor people.

5. Microfinance is about building permanent local financial institutions.

6. Microcredit is not the best tool for everyone or every situation.

7. Interest rate ceilings making it harder for poor people to get credit.

8. The role of government is to enable financial services, not to provide them.

9. Donor funds should complement private capital, not compete with it.

10. The key bottleneck is the shortage of strong institutions and managers.

11. Microfinance works best when it measures and discloses its performance.