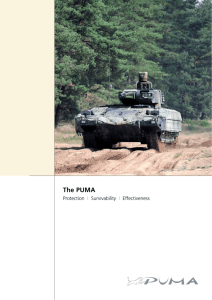

ManageMent RepoRt P : 106 | C : 1 PUMAVision To oUr

advertisement