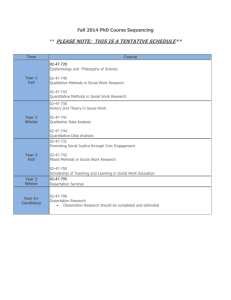

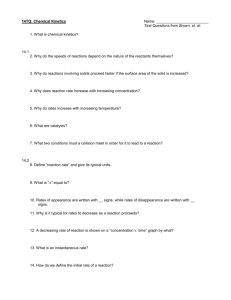

drnevich dissertation

advertisement