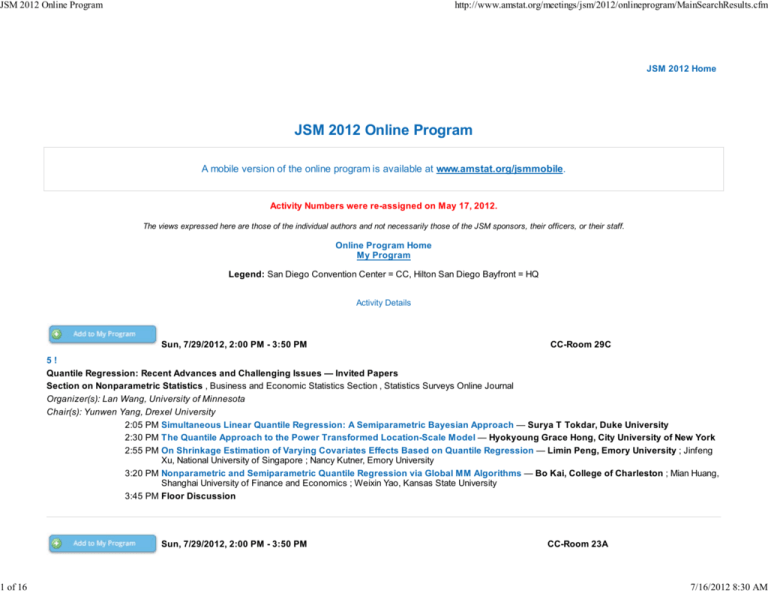

JSM 2012 Online Program - American Statistical Association

advertisement

JSM 2012 Online Program 1 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm JSM 2012 Home JSM 2012 Online Program A mobile version of the online program is available at www.amstat.org/jsmmobile. Activity Numbers were re-assigned on May 17, 2012. The views expressed here are those of the individual authors and not necessarily those of the JSM sponsors, their officers, or their staff. Online Program Home My Program Legend: San Diego Convention Center = CC, Hilton San Diego Bayfront = HQ Activity Details Sun, 7/29/2012, 2:00 PM - 3:50 PM CC-Room 29C 5! Quantile Regression: Recent Advances and Challenging Issues — Invited Papers Section on Nonparametric Statistics , Business and Economic Statistics Section , Statistics Surveys Online Journal Organizer(s): Lan Wang, University of Minnesota Chair(s): Yunwen Yang, Drexel University 2:05 PM Simultaneous Linear Quantile Regression: A Semiparametric Bayesian Approach — Surya T Tokdar, Duke University 2:30 PM The Quantile Approach to the Power Transformed Location-Scale Model — Hyokyoung Grace Hong, City University of New York 2:55 PM On Shrinkage Estimation of Varying Covariates Effects Based on Quantile Regression — Limin Peng, Emory University ; Jinfeng Xu, National University of Singapore ; Nancy Kutner, Emory University 3:20 PM Nonparametric and Semiparametric Quantile Regression via Global MM Algorithms — Bo Kai, College of Charleston ; Mian Huang, Shanghai University of Finance and Economics ; Weixin Yao, Kansas State University 3:45 PM Floor Discussion Sun, 7/29/2012, 2:00 PM - 3:50 PM CC-Room 23A 7/16/2012 8:30 AM JSM 2012 Online Program 2 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm 19 * ! Uncertainty and Real-Time Business Cycle Analysis — Topic Contributed Papers Business and Economic Statistics Section Organizer(s): Gian Luigi Mazzi, Eurostat Chair(s): Riccardo Gatto, Eurostat-C4 2:05 PM Statistical Design of Leading Indicators: A Systematic Approach with Applications to OECD-CLIs — Marc Wildi 2:25 PM Comprehensive Benchmark Revisions for the Conference Board Leading Economic Index for the United States — Ataman Ozyildirim, The Conference Board ; Gad Levanon, The Conference Board ; Brian Schaitkin, The Conference Board ; Justyna Zabinska La-Monica, The Conference Board ; Jean-Claude Manini, The Conference Board 2:45 PM Nowcasting Business Cycle Turning Points in an Uncertain Environment — Francesco Ravazzolo, Norges Bank ; Knut Are Aastveit, Norges Bank ; Herman van Dijk, Tinbergen Institute/Erasmus University Rotterdam 3:05 PM Direct Versus Indirect Approach to Estimates Euroarea Business Cycle Fluctuations — Gian Luigi Mazzi, Eurostat ; Monica Billio, University of Venice ; Laurent Ferrara, Bank of France ; Filippo Moauro, Eurostat 3:25 PM Discussant: Aleksandar Tomic, Hendyplan 3:45 PM Floor Discussion Sun, 7/29/2012, 2:00 PM - 3:50 PM CC-Room 23B 38 Multivariate Time Series, Dimension Reduction, and Miscellaneous Topics — Contributed Papers Business and Economic Statistics Section , Section on Statistical Learning and Data Mining Chair(s): James McDonald, Brigham Young University 2:05 PM Coherence Estimation and Dimension Reduction in Multivariate Nonstationary Time Series — Timothy Park, Lancaster University ; Idris Eckley, Lancaster University ; Hernando Ombao, University of California at Irvine 2:20 PM Dimension Reduction on Multivariate Time Series Data — Prabir Burman, University of California at Davis ; Wolfgang Polonik, University of California at Davis ; Yinhong Weng 2:35 PM Design of a Coincident Index Using Dynamic Common Factors — Wilmer Martinez, Central Bank ; Fabio H. Nieto, Universidad Nacional de Colombia ; Pilar Poncela, Universidad Autónoma de Madrid 2:50 PM Factor Model for Forecasting with Multi-Collinearity and Nonlinear Dependence — Joseph Egbulefu, Rice University 3:05 PM Bayesian Multivariate Inference for a Non-Standard Fuzzy Regression Discontinuity Design — Fan Li, Duke University ; Fabrizia Mealli, University of Florence ; Alessandra Mattei, University of Florence ; Fei Liu, IBM T. J. Watson Research Center 3:20 PM A New Method for Interval Forecasting of Autoregressive Time Series with a Root Near 1 — Staffan Fredricsson 3:35 PM Floor Discussion Sun, 7/29/2012, 4:00 PM - 5:50 PM CC-Room 23A 61 * ! Innovative Statistical Applications to Business — Topic Contributed Papers 7/16/2012 8:30 AM JSM 2012 Online Program 3 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm Business and Economic Statistics Section , International Indian Statistical Association Organizer(s): Burcu Aydin, Hewlett-Packard Labs Chair(s): Yili Hong, Virginia Tech 4:05 PM Kernel Dimension Reduction in Data-Rich Marketing Research — Yuexiao Dong, Temple University 4:20 PM Statistical Analysis for IBM Smarter Planet Initiative — Yasuo Amemiya, IBM T. J. Watson Research Center 4:35 PM Innovative Statistical Applications to Business — Han Ye, The University of North Carolina at Chapel Hill 4:50 PM Applications Using Mobile Call Detail Records for Clustering and Urban Planning — Chris Volinsky, AT&T Shannon Laboratory 5:05 PM Topic Discovery for Online Video Ads — Sangho Yoon, Google 5:20 PM Discussant: J. Steve Marron, The University of North Carolina at Chapel Hill 5:35 PM Floor Discussion Sun, 7/29/2012, 4:00 PM - 5:50 PM CC-Room 31C 78 * ! Applications in Business and Economics — Contributed Papers Business and Economic Statistics Section Chair(s): Fan Li, Duke University 4:05 PM Bright Lights, Risky Business: A Longitudinal Study of Broadway Show Success — Lan Nygren, Rider University ; Kjell Nygren, ImpactRx, Inc. ; Jeffrey Simonoff, New York University 4:20 PM Who Are the Good and Bad Borrowers of the Home Affordable Loan Modification Program? — Xun Wang, George Mason University ; James Gentle, George Mason University 4:35 PM Academic Salary Compression: Winners and Losers — James McDonald, Brigham Young University ; Jeff Sorensen, University of California at Berkeley 4:50 PM Mass Transit Demand in El Paso — Thomas Fullerton, The University of Texas at El Paso ; Adam G. Walke, The University of Texas at El Paso 5:05 PM Price Movements: Online Versus Onsite — John Marcis, Coastal Carolina University ; Bomi Kang, Coastal Carolina University 5:20 PM Measuring the Economic Sentiments Using Ordinary Response Options — Inho Park, Pukyong National University 5:35 PM Early-Life Circumstances and Late-Life Incomes — Omar Paccagnella, University of Padua ; Christelle Garrouste, European Commission - Joint Research Centre Mon, 7/30/2012, 7:00 AM - 8:30 AM HQ-Sapphire 412 208528 Business and Economic Statistics Section Executive Committee Meeting — Other Cmte/Business Business and Economic Statistics Section Chair(s): Mark Little, SAS Institute 7/16/2012 8:30 AM JSM 2012 Online Program 4 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm Mon, 7/30/2012, 8:30 AM - 10:20 AM CC-Room 29D 109 * ! Emerging Challenges in Energy Time Series — Topic Contributed Papers Business and Economic Statistics Section Organizer(s): Idris Eckley, Lancaster University Chair(s): Idris Eckley, Lancaster University 8:35 AM Functional Instrumental Regression for Energy Price Forecasting — Sebastien Van Bellegem, Universite Catholique de Louvain 8:55 AM Change Point Detection for Marine Energy Series — Rebecca Killick, Lancaster University 9:15 AM Space-Time Wind Speed Forecasting for Improved Power System Dispatch — Marc Genton, Texas A&M University ; Xinxin Zhu, Texas A&M University ; Yingzhong Gu, Texas A&M University ; Le Xie, Texas A&M University 9:35 AM Nonstationary Approaches for Energy Time Series — Marina Iuliana Knight, University of Bristol 9:55 AM Locating and Quantifying Gas Emission Rates Using Remotely Obtained Concentration Data — Philip Jonathan, Shell Projects & Technology ; Bill Hirst, Shell Projects & Technology ; David Randell, Shell Projects & Technology ; Fernando Gonzalez del Cueto, Shell Projects & Technology ; Oliver Kosut, MIT Laboratory for Information and Decision Systems 10:15 AM Floor Discussion Mon, 7/30/2012, 8:30 AM - 10:20 AM CC-Room 29C 133 * ! Volatility and ARCH/GARCH — Contributed Papers Business and Economic Statistics Section Chair(s): Ginger Koev, Hewlett-Packard 8:35 AM The Estimation of Leverage Effect with High-Frequency Data — Dan Wang, The University of Chicago 8:50 AM Weekly Crude Oil Spot Price Forecasting Using Oil Inventories and Stock Market Indexes — Myung Suk Kim, Sogang University 9:05 AM Exploratory Data Analysis of Stock Returns — Kimihiro Noguchi, University of California at Davis ; Alexander Aue, University of California at Davis ; Prabir Burman, University of California at Davis 9:20 AM Is the TAR Model Useful for Analyzing Financial Time Series? — Fabio H. Nieto, Universidad Nacional de Colombia ; Edna Carolina Moreno, Universidad Santo Tomás 9:35 AM GARCH Models Estimation with Missing Observations Using State Space Representation — Natalia Bahamonde, Pontificia Universidad Católica de Valparaiso ; Sebastián Ossandón, Pontificia Universidad Católica de Valparaíso 9:50 AM Constrained Regression for Interval-Valued Data: The Daily Low/High Interval of SP500 Returns — Wei Lin, University of California at Riverside ; Gloria González-Rivera, University of California at Riverside 10:05 AM Regularized Realized Covariance Estimator Under Market Microstructure Noise — Changgee Chang, The University of Chicago Mon, 7/30/2012, 10:30 AM - 12:20 PM CC-Room 29C 160 * ! 7/16/2012 8:30 AM JSM 2012 Online Program 5 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm Recent Advances in Multivariate and Multiple Time Series — Topic Contributed Papers Business and Economic Statistics Section Organizer(s): Scott Holan, University of Missouri Chair(s): Katherine Bennett Ensor, Rice University 10:35 AM Multivariate Time Series for Mixed Data Types — Ginger Koev, Hewlett-Packard ; Katherine Bennett Ensor, Rice University 10:55 AM Forecasting State Unemployment Rates: A Robust Clustering Approach — Ruey-Shiong Tsay, The University of Chicago 11:15 AM Fast Methods for High-Dimensional Financial Time Series Modeling — Nalini Ravishanker, University of Connecticut ; Jeffrey S. Pai, University of Manitoba 11:35 AM Flexible Spectral Models for Multivariate Time Series — Scott Holan, University of Missouri ; Tucker McElroy, U.S. Census Bureau 11:55 AM A Nonparametric Approach for Multiple Change-Point Analysis of Multivariate Data — David Scott Matteson, Cornell University ; Nicholas A James, Cornell University 12:15 PM Floor Discussion Mon, 7/30/2012, 2:00 PM - 3:50 PM HQ-Sapphire EF 212 ! Spatial Socio-Demographics — Invited Papers Business and Economic Statistics Section , International Indian Statistical Association , Statistics Surveys Online Journal Organizer(s): Noel Cressie, The Ohio State University Chair(s): Scott Holan, University of Missouri 2:05 PM Spatial Econometrics in an Age of CyberGIScience — Luc Anselin, Arizona State University ; Sergio Rey, Arizona State University 2:30 PM Quantifying Spatial Spillovers Using Simulated Maximum Likelihood Spatial Probit Model Estimates — James Paul LeSage, Texas State University ; Ronald Kelley Pace, Louisiana State University ; Shuang Zhu, Louisiana State University 2:55 PM Change of Support in Dynamical Spatio-Temporal Models — Christopher Wikle, University of Missouri 3:20 PM Discussant: Noel Cressie, The Ohio State University 3:40 PM Floor Discussion Mon, 7/30/2012, 2:00 PM - 3:50 PM CC-Room 26B 247 * ! Forecasting — Contributed Papers Business and Economic Statistics Section Chair(s): Bonnie Ray, IBM T. J. Watson Research Center 2:05 PM Forecast Optimality Tests in the Presence of Instabilities — Barbara Rossi, Duke University ; Tatevik Sekhposyan, Bank of Canada 2:20 PM Measuring the Effect of Financial Stress — Michael Owyang, Federal Reserve Bank of St. Louis ; Ana Beatriz Galvao, Queen Mary College, University of London 2:35 PM Challenges with Forecasting Ratios in Hierarchies — Bruce Elsheimer, SAS Institute ; Michael J Leonard, SAS Institute ; Michele Trovero, SAS Institute ; Peter Dillman, SAS Institute 7/16/2012 8:30 AM JSM 2012 Online Program 6 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm 2:50 PM What Unemployment Data Can Tell Us About House Prices: Stabilizing Strong but Unstable Connection — Vladimir Ladyzhets, Lincoln Financial Group 3:05 PM Aggregating and Evaluating Analyst Forecasts Using Percentage and Relative Error — Victor Jose, Georgetown University 3:20 PM Applications of HMMs to Financial Data: A Data-Motivated Approach — Tessa Childers-Day, University of California at Berkeley ; Lisa Goldberg, MSCI 3:35 PM Tests of Specification and Distributional Change for Predictive Densities — Tatevik Sekhposyan, Bank of Canada ; Barbara Rossi, Duke University Mon, 7/30/2012, 5:30 PM - 7:00 PM HQ-Indigo 202 208712 Business & Economic Statistics Section Business Meeting — Other Cmte/Business Business and Economic Statistics Section Chair(s): Mark Little, SAS Institute Tue, 7/31/2012, 8:30 AM - 10:20 AM CC-Room 30D 269 * ! High-Dimensional Time Series Models — Invited Papers JBES-Journal of Business & Economic Statistics , Business and Economic Statistics Section , International Indian Statistical Association Organizer(s): Oscar Jorda, University of California at Davis/Federal Reserve Bank of San Francisco Chair(s): Oscar Jorda, University of California at Davis/Federal Reserve Bank of San Francisco 8:35 AM Modeling Dependence in High Dimensions with Factor Copulas — Andrew Patton, Duke University ; Dong Hwan Oh, Duke University 9:00 AM Robust and Sparse Factor Modeling — Christophe Croux, K. U. Leuven ; Peter Exterkate, CREATES - Aarhus University 9:25 AM The Three-Pass Regression Filter: A New Approach to Forecasting Using Many Predictors — Seth Pruitt, Federal Reserve Board ; Bryan Kelly, Chicago Booth 9:50 AM Estimation of Treatment Effects with High-Dimensional Controls — Alexandre Belloni, Duke University ; Victor Chernozhukov, Massachusetts Institute of Technology ; Christian Hansen, The University of Chicago 10:15 AM Floor Discussion Tue, 7/31/2012, 8:30 AM - 10:20 AM CC- Room 33B 273 Resampling and Related Methods in Time Series and Econometrics — Invited Papers Business and Economic Statistics Section , SSC , Section on Statistical Computing , International Indian Statistical Association , Section on Government Statistics Organizer(s): Xiaofeng Shao, University of Illinois at Urbana-Champaign 7/16/2012 8:30 AM JSM 2012 Online Program 7 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm Chair(s): Yinxiao Huang, University of Illinois at Urbana-Champaign 8:35 AM Subsampling Inference for the Autocovariances of Heavy-Tailed Long-Memory Time Series — Tucker McElroy, U.S. Census Bureau 9:05 AM Bootstrapping Factor-Augmented Regression Models — Silvia Goncalves, Universite de Montreal ; Perron Benoit, Universite de Montreal 9:35 AM A New Version of Blockwise Empirical Likelihood for Time Series — Soumen Lahiri, Texas A&M University ; Dan Nordman, Iowa State University 10:05 AM Floor Discussion Tue, 7/31/2012, 10:30 AM - 12:20 PM CC-Room 32A 312 * ! New Bayesian Methods with Application to Econometrics — Invited Papers Council of Chapters , Business and Economic Statistics Section , International Indian Statistical Association Organizer(s): Hao Wang, University of South Carolina Chair(s): Hao Wang, University of South Carolina 10:35 AM Identification, Learning, and Less Informative Priors in Endogenous Variable Models — Justin L Tobias, Purdue University ; Josh Chan, Australian National University 11:00 AM Bayesian Regression with Nonparametric Heteroskedasticity — Andriy Norets, Princeton University 11:25 AM On Some Properties of Markov Chain Monte Carlo Simulation Methods Based on the Particle Filter — Robert Jacob Kohn, University of New South Wales ; Michael Pitt, University of Warwick ; Paolo Giordani, Sveriges Riksbank 11:50 AM Reparameterizations for Bayesian Econometrics — P. Richard Hahn, The University of Chicago Booth School of Business 12:15 PM Floor Discussion Tue, 7/31/2012, 10:30 AM - 12:20 PM CC-Room 33A 327 ! New Developments in Methods for Locally Stationary Processes — Topic Contributed Papers Business and Economic Statistics Section Organizer(s): Matthew Nunes, Lancaster University Chair(s): Hernando Ombao, University of California at Irvine 10:35 AM Inference for Local Autocorrelation Process in Locally Stationary Models — Zhibiao Zhao, Penn State University 10:55 AM Adaptive Sampling of Discrete Time Locally Stationary Processes — Matthew Nunes, Lancaster University ; Idris Eckley, Lancaster University 11:15 AM Alias Detection and Spectral Estimation Within Locally Stationary Random Fields — Idris Eckley, Lancaster University ; Aimée Gott, Lancaster University 11:35 AM Tree-Structured Wavelet Thresholding for Estimation of Evolutionary Spectra — Rainer Von Sachs 7/16/2012 8:30 AM JSM 2012 Online Program 8 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm 11:55 AM Semiparametric Dynamic Factor Models for Nonstationary Time Series — Michael Eichler, Maastricht University ; Giovanni Motta, Maastricht University 12:15 PM Floor Discussion Tue, 7/31/2012, 10:30 AM - 12:20 PM CC- Room 33B 344 ! Nonparametrics, Mixtures, and Functional Data — Contributed Papers Business and Economic Statistics Section Chair(s): William Leeds, University of Missouri 10:35 AM Finite Mixtures of Archimedean Copulas — Renate Meyer, University of Auckland ; Goeran Kauermann, Ludwig-Maxilians-Universität München 10:50 AM Time-Varying Beta and the Value Premium: Evidence from the Varying-Coefficient Single-Index Model — Chaojiang Wu, University of Cincinnati ; Hui Guo, University of Cincinnati ; Yan Yu, University of Cincinnati 11:05 AM Adaptive Nonparametric Regression for Marketplace Response Detection — Junqing Wu, Microsoft Corporation ; Yuedong Wang, University of California at Santa Barbara ; Wendy Meiring, University of California at Santa Barbara 11:20 AM Nonparametric Estimation of Risk Neutral Distribution Implied by Options — Kam Hamidieh, California State University Fullerton 11:35 AM Functional Coefficient Autoregressive Models for Nonlinear Time Series — Alireza Tahai, Mississippi State University 11:50 AM Modeling and Forecasting the Daily Load Curves for Electricity — Jonathan Hosking, IBM Research ; Soumyadip Ghosh, IBM Research ; Ramesh Natarajan, IBM Research 12:05 PM Functional Prediction of Intraday Cumulative Returns — Xi Zhang, Utah State University ; Piotr Stefan Kokoszka, Colorado State University Tue, 7/31/2012, 12:30 PM - 1:50 PM CC-Room 33C 357 Economic Outlook Speaker Luncheon (fee event) — Roundtables Speaker with Lunch Business and Economic Statistics Section Organizer(s): Alan Montgomery, Carnegie Mellon University TL11: Forecasting When You Suspect 'This Time Is Different': A Typical Day in the Life of a Macroeconomic Forecaster — Edward Leamer, University of California at Los Angeles Tue, 7/31/2012, 2:00 PM - 3:50 PM CC-Room 29B 385 * Dynamic Factor and Volatility Modeling of Multivariate Economic and Financial Time Series — Topic Contributed Papers 7/16/2012 8:30 AM JSM 2012 Online Program 9 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm Business and Economic Statistics Section Organizer(s): Peter Zadrozny, Bureau of Labor Statistics Chair(s): Peter Zadrozny, Bureau of Labor Statistics 2:05 PM One-Sided Representations of Generalized Dynamic Factor Models — Marco Lippi, Universita' di Roma "La Sapienza" ; Mario Forni, Università degli Studi di Modena e Reggio Emilia ; Marc Hallin, ECARES ; Paolo Zaffaroni, Imperial College London 2:25 PM Reduced-Rank Time-Series Models — Victor Solo, University of New South Wales 2:45 PM Generalized Linear Dynamic Factor Models: The Single and the Mixed Frequency Case — Manfred Deistler, Vienna University of Technology ; Brian D.O. Anderson, Australian National University ; Elisabeth Felsenstein, Vienna University of Technology ; Alexander Filler, Uniqa ; Bernd Funovits, University of Vienna ; Mohsen Zamani, Australian National University 3:05 PM Cholesky Factorization Method for VARMA Modeling of Residual Volatilities of Single- and Mixed-Frequency Data — Peter Zadrozny, Bureau of Labor Statistics ; Klaus Wohlrabe, Ifo Institut ; Stefan Mittnik, Ludwig-Maxilians-Universität München 3:25 PM Multivariate Stochastic Volatility Models Based on Non-Gaussian Ornstein-Uhlenbeck Processes: A Quasi-Likelihood Approach — Arvid Raknerud ; Øivind Skare, University of Oslo 3:45 PM Floor Discussion Tue, 7/31/2012, 2:00 PM - 3:50 PM CC-Room 30E 395 ! Labor Estimates by Firm Size — Topic Contributed Papers Section on Government Statistics , Section on Survey Research Methods , Business and Economic Statistics Section Organizer(s): Nathan Clausen, Bureau of Labor Statistics Chair(s): Ed Robison, Bureau of Labor Statistics 2:05 PM Estimates by Firm Size Using the CES Survey — Nathan Clausen, Bureau of Labor Statistics ; Chris Manning, Bureau of Labor Statistics 2:25 PM Analytical Highlights of CES Firm Size Employment Data — John Mullins, Bureau of Labor Statistics 2:45 PM Development of JOLTS Firm Size Estimation Procedures — Darrell Greene, Bureau of Labor Statistics ; Shail Butani, Bureau of Labor Statistics ; Mark Crankshaw, Bureau of Labor Statistics ; Vinod Kapani, Bureau of Labor Statistics 3:05 PM Analysis of JOLTS Research Estimates by Size of Firm — Katherine Klemmer, Bureau of Labor Statistics 3:25 PM Choosing Size Classes for Industry Employment Estimates by Firm-Size Class — Jeffrey Groen, Bureau of Labor Statistics ; Lowell Mason, Bureau of Labor Statistics 3:45 PM Floor Discussion Tue, 7/31/2012, 2:00 PM - 3:50 PM CC-Room 29C 406 ! Seasonal Time Series, Goodness-of-Fit, and Unit Root — Contributed Papers Business and Economic Statistics Section Chair(s): Barbara J. Robles, Board of Governors of the Federal Reserve System 7/16/2012 8:30 AM JSM 2012 Online Program 10 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm 2:05 PM Detecting Hidden 'Peaks' in ARMA Spectral Estimators — Wayne Woodward, Southern Methodist University ; Henry L Gray, Southern Methodist University ; Alan C Elliott, The University of Texas Southwestern Medical Center at Dallas 2:20 PM Weighted Portmanteau Statistics — Colin Gallagher, Clemson University ; Thomas Fisher, University of Missouri-Kansas City 2:35 PM Time Series Goodness-of-Fit Testing Using a Weighted Portmanteau Statistic — Thomas Fisher, University of Missouri-Kansas City ; Colin Gallagher, Clemson University 2:50 PM New Results on Linear Filters Minimizing Phase-Shift for Seasonal Adjustment — Fabien Guggemos, Insee ; Dominique Ladiray, INSEE ; Michel Grun-Rehomme 3:05 PM The Quality of Seasonal Adjustment: An Empirical Comparison of Various Methods of Seasonal Adjustment — Raj Jain, Bureau of Labor Statistics 3:20 PM A Note on Mean Squared Prediction Error Under the Unit Root Model with Deterministic Trend — Shu-Hui Yu 3:35 PM Prediction Intervals for ARIMA Processes: A Sieve Bootstrap Approach — Maduka Rupasinghe, Ashland University ; V A Samaranayake, Missouri University of Science and Technology Tue, 7/31/2012, 2:00 PM - 3:50 PM CC-Sails Pavilion 416 Contributed Oral Poster Presentations: Business and Economic Statistics Section — Contributed Poster Presentations Business and Economic Statistics Section Chair(s): Marie Kraska, Auburn University 01: Variance - Mean Relationships to Analyze Large Survey Data with Application to Health Expenditure Data — Wenli Luo, AstraZeneca ; Howard Stratton, University of Albany 02: A Study of the Quality of Family Life for Business Executives — Jonathan Trower, Baylor University ; Kris Moore, Baylor University ; Charles Goldwaite, Baylor University 03: Investment Strategy in a Business Cycle — Les Yen, PAE Inc. ; Joshua Burke, ICE Communications, DHS 04: A Subjective Production Function for Soybeans, Corn, and Sunflower in the Pampean Region (Argentina) — Luis Frank, University of Buenos Aires ; Marcial Demarchi, University of Buenos Aires 05: Inference for Duration Models Using Estimating Functions — Julieta Frank, University of Manitoba ; Melody Ghahramani, University of Winnipeg ; Aerambamoorthy Thavaneswaran, University of Manitoba 06: Investigations Using the Weibull Analysis for Predictability of Failure in the Service Industry — Michael Anderson 07: Bayesian Modeling of Regime-Switching Models: An Application in Multistream Asset Pricing — David Engler, Brigham Young University ; Brian Hartman, University of Connecticut Wed, 8/1/2012, 8:30 AM - 10:20 AM CC-Room 29A 450 * Topics in Seasonal Adjustment — Topic Contributed Papers Business and Economic Statistics Section , Section on Survey Research Methods , Section on Government Statistics Organizer(s): Tucker McElroy, U.S. Census Bureau Chair(s): Robert Lund, Clemson University 7/16/2012 8:30 AM JSM 2012 Online Program 11 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm 8:35 AM Coupling X-12-Arima-Seats with a Multidimensional Direct Filter Approach for Signal Extraction in Nonstationary Seasonal Time Series — Chris Blakely, U.S. Department of Commerce 8:55 AM Evaluating AICC Tests in X-13Arima-Seats — Brian Monsell, U.S. Census Bureau 9:15 AM Differences in Performance Between Concurrent and Projected Seasonal Factors for Weekly UI Data — Thomas Evans, Bureau of Labor Statistics 9:35 AM Complementary Properties of an F-Test and an Empirical Spectral Test for Identifying Seasonality in Unadjusted or Seasonally Adjusted Series — David Findley, U.S. Census Bureau 9:55 AM Moving from X-12-Arima to X-13Arima-Seats: The UK Experience — Gary Brown, Office for National Statistics ; Daniel Ayoubkhani, Office for National Statistics 10:15 AM Floor Discussion Wed, 8/1/2012, 8:30 AM - 10:20 AM CC-Room 28E 472 Panel Data, Skewness, and Testing — Contributed Papers Business and Economic Statistics Section Chair(s): Georgette Nicolaides, Syracuse University 8:35 AM Moment-Based Tests for Random Effects in Panel Data Models — Guodong Li, The University of Hong Kong 8:50 AM Nonparametric Panel Data Model Estimation: Efficiency Comparison of Kernel and Spline Estimators — Yue Liu, University of California at Riverside 9:05 AM Efficient Moment Selection from High-Dimensional Moment Conditions — Hyunkeun Cho, University of Illinois at UrbanaChampaign ; Annie Qu, University of Illinois at Urbana-Champaign 9:20 AM An Innovative Estimation Approach — Yang Yu, Bowling Green State University ; John Chen, Bowling Green State University 9:35 AM Student's T Confidence Intervals Adjusted for Skewed and Autocorrelated Populations — Kyungduk Ko, Boise State University 9:50 AM A Parametric Measure of Dispersion Derived from the Generalized Mean — Victor Guerrero, ITAM ; Claudia R Solis Lemus, University of Wisconsin-Madison 10:05 AM Directed $T$ Tests of Inequality Constraints Under Alternatives in Linear and Nonlinear Models — Zeng-Hua Lu, University of South Australia Wed, 8/1/2012, 10:30 AM - 12:20 PM CC-Room 29B 480 ! Modeling and Seasonality in Economic Time Series — Invited Papers Business and Economic Statistics Section , International Indian Statistical Association , Section on Government Statistics Organizer(s): Tucker McElroy, U.S. Census Bureau Chair(s): Tucker McElroy, U.S. Census Bureau 10:35 AM Models for High Lead Time Prediction — Granville Tunnicliffe-Wilson, Lancaster University ; John Haywood, Victoria University of Wellington 7/16/2012 8:30 AM JSM 2012 Online Program 12 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm 11:00 AM Seasonal Heteroskedasticity and Signal Extraction in Time Series — Thomas Morgan Trimbur, Federal Reserve Board ; William Bell, U.S. Census Bureau 11:25 AM Normally Distributed Seasonal Unit Root Tests — David Alan Dickey, North Carolina State University 11:50 AM Seasonal Autocovariance Structures: PARMA or SARMA? — Robert Lund, Clemson University 12:15 PM Floor Discussion Wed, 8/1/2012, 10:30 AM - 12:20 PM CC-Room 29A 514 Heavy Tails and Long Memory — Contributed Papers Business and Economic Statistics Section Chair(s): Myung Suk Kim, Sogang University 10:35 AM Robust Fitting of Heavy-Tailed Autoregressive Models Using Gini Autocovariance Functions — Marcel Carcea ; Robert Serfling, The University of Texas at Dallas 10:50 AM Are the Tails Different from the Body? An International Approach to Stock Returns' Tail Dependence — Jose Faias, Catolica Lisbon SBE 11:05 AM Goodness-of-Fit Testing for Non-Causal Autoregressive Time Series with Stable Noise — Yunwei Cui, University of HoustonDowntown ; Thomas Fisher, University of Missouri-Kansas City ; Rongning Wu, Baruch College 11:20 AM A Goodness-of-Fit Test for Identifying the Maximum Domain of Attraction — Tatsuyoshi Okimoto, Hitotsubashi University ; Hiroaki Kaido, Boston University 11:35 AM A New Portmanteau Test for Short Memory in Long Memory Processes — Timothy Hughes, PacificSource ; Jaechoul Lee, Boise State University 11:50 AM Risk and Return: Long-Run Relationships, Fractional Cointegration, and Return Predictability — Natalia Sizova, Rice University 12:05 PM Floor Discussion Wed, 8/1/2012, 2:00 PM - 3:50 PM HQ-Sapphire IJ 543 * Repression of Statistics and Statisticians by the Argentine Government: Recent Developments, the Human Rights Context, and International Responses — Invited Papers Committee on Scientific Freedom and Human Rights , SSC , Section on Survey Research Methods , Business and Economic Statistics Section , International Indian Statistical Association , Section on Government Statistics , Statistics Without Borders Organizer(s): Joseph B. Kadane, Carnegie Mellon University Chair(s): Joseph B. Kadane, Carnegie Mellon University 2:05 PM Human Rights and Statistics: A Reciprocal Relationship — Jessica Mary Wyndham, AAAS Scientific Responsibility, Human Rights and Law Program 2:30 PM Argentina: An Update on Credibility in CPI and Other Official Statistics and Perils Endured by Some Statisticians — Edmundo Berumen, Berumen y Asociados, SA de CV ; Victor A Beker, Economia de la Universidad de Belgrano 7/16/2012 8:30 AM JSM 2012 Online Program 13 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm 2:55 PM International Responses to Governmental Targeting of Statisticians and Research Organizations in Argentina — William Seltzer, Fordham University 3:20 PM Discussant: Joseph B. Kadane, Carnegie Mellon University 3:40 PM Floor Discussion Wed, 8/1/2012, 2:00 PM - 3:50 PM HQ-Sapphire H 549 * ! Benchmarking and Seasonal Adjustment — Invited Papers Section on Government Statistics , Section on Survey Research Methods , Business and Economic Statistics Section Organizer(s): Tucker McElroy, U.S. Census Bureau Chair(s): Michael Sverchkov, Bureau of Labor Statistics (SCI) 2:05 PM Reducing Revisions in Real Time Trend-Cycle Estimation — Estelle Bee Dagum, University of Bologna ; Silvia Bianconcini, University of Bologna 2:35 PM Frequency Domain Analysis of Seasonal Adjustment Filters Applied to Periodic Labor Force Survey Series — Richard B. Tiller, Bureau of Labor Statistics 3:05 PM Theoretical and Real Trading-Day Frequencies — Dominique Ladiray, INSEE 3:35 PM Floor Discussion Wed, 8/1/2012, 2:00 PM - 3:50 PM CC-Room 31A 563 * ! Modeling and Analyzing Data Revisions — Topic Contributed Papers Business and Economic Statistics Section , Section for Statistical Programmers and Analysts , Section on Government Statistics Organizer(s): Riccardo Gatto, Eurostat Chair(s): Riccardo Gatto, Eurostat 2:05 PM The Importance of Metadata for Analyzing Data Revisions — Andreas Lorenz, Deutsche Bundesbank 2:25 PM Data Revisions and ISO Vintages — Jorge Dias, European Central Bank ; Magdalena Lalik, European Central Bank 2:45 PM Modeling Multivariate Data Revisions — Jan-Egbert Sturm, KOF Swiss Economic Institute, ETH Zurich 3:05 PM Modeling Multivariate Revisions in a Cointegrated Vector Autoregressive Model — Riccardo Gatto, Eurostat ; Gian Luigi Mazzi, Eurostat ; Alain Hecq, Maastricht University 3:25 PM An Area-Wide Real-Time Database for the Euro Area — Domenico Giannone, Universite' Libre de Bruxelles 3:45 PM Floor Discussion Wed, 8/1/2012, 2:00 PM - 3:50 PM CC-Room 30E 7/16/2012 8:30 AM JSM 2012 Online Program 14 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm 574 ! Optimal Portfolios, Clustering, and Change Points — Contributed Papers Business and Economic Statistics Section Chair(s): Jason Duan, The University of Texas at Austin 2:05 PM Optimal Orthogonal Portfolios with Conditioning Information — Andrew Siegel, University of Washington ; Wayne E. Ferson, University of Southern California 2:20 PM Inference on Optimal Portfolio Weights Using Generalized Pivotal Quantity — Yuanyuan Zhu, The University of Hong Kong ; Philip L.H. Yu, The University of Hong Kong ; Thomas Mathew, University of Maryland Baltimore County 2:35 PM Utilizing ARC Length to Cluster Stocks According to Risk — Ferebee Tunno, Arkansas State University ; Tharanga Wickramarachchi, Clemson University 2:50 PM A Bayesian Model on Market Microstructure and Asymmetric Information Trading — Feng Liu, University of North Carolina at Chapel Hill 3:05 PM Day of the Week Effect on Turkish Foreign Exchange Market Volatility During the Global Financial Crisis — Ece Oral, Central Bank of the Republic of Turkey 3:20 PM Lasso for Change-Point Detection in Time Series — Chun-Yip Yau, Chinese University of Hong Kong ; Ngai Hang Chan, Chinese University of Hong Kong ; Rongmao Zhang, Zhejiang University 3:35 PM Arc Length as a Measure of Risk — Tharanga Wickramarachchi, Clemson University ; Colin Gallagher, Clemson University ; Robert Lund, Clemson University Thu, 8/2/2012, 8:30 AM - 10:20 AM CC-Room 31C 591 ! Analysis of Complex Time Series: Correlation, Nonlinearity, Nonstationarity, and Functional Structure — Invited Papers Business and Economic Statistics Section , Section on Survey Research Methods , International Indian Statistical Association Organizer(s): Lily Wang, The University of Georgia Chair(s): Lily Wang, The University of Georgia 8:35 AM Functional Dynamic Factor Models with Application to Yield Curve Forecasting — Haipeng Shen, The University of North Carolina at Chapel Hill ; Spencer Hays, Pacific Northwest Research Laboratory ; Jianhua Huang, Texas A&M University 9:05 AM Robust Association Studies Using Density Power Divergences with Application to Consumer Expenditure Survey and Survey of Consumer Finance — T N Sriram, University of Georgia ; Ross Iaci, The College of William and Mary 9:35 AM Efficient Inference for Autoregression in the Presence of Trend — Lijian Yang, Soochow University/Michigan State University ; Debin Qiu, Soochow University ; Qin Shao, University of Toledo 10:05 AM Floor Discussion Thu, 8/2/2012, 8:30 AM - 10:20 AM CC-Room 32A 617 * ! Demand and Non-Gaussian Data — Contributed Papers 7/16/2012 8:30 AM JSM 2012 Online Program 15 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm Business and Economic Statistics Section Chair(s): Baoline Chen, Bureau of Economic Analysis 8:35 AM Assessing the Difference Between Demand Sharing and Shock Sharing in Supply Chains — Vladimir Kovtun, Stern School of Business ; Avi Giloni, Yeshiva University ; Clifford Hurvich, Stern School of Business 8:50 AM Analysis of Multinomial Discrete Choice Probit Model with Structured Correlation Matrix — Bhaskara Ravi, Old Dominion University ; N. Rao Chaganty, Old Dominion University 9:05 AM Censored Regression with Heteroskedasticity — Hieu Nguyen, Brigham Young University ; James McDonald, Brigham Young University 9:20 AM Learning from Only Positive and Unlabeled Data Using Generalized Stochastic Frontier Model — Liuxia Wang, Sentrana Inc. 9:35 AM Multifractal Processes for Count Data, with an Application in Car Insurance — Jean-Philippe Boucher, Université du Québec à Montréal 9:50 AM Estimation and Evaluating of Aggregate Discounted Claims — Min Deng, University of Maryville of St. Louis 10:05 AM Floor Discussion Thu, 8/2/2012, 10:30 AM - 12:20 PM CC-Room 29C 645 * ! Recent Developments in Benchmarking and Reconciliation of Large Systems of Time Series Data: Theory and Practice — Topic Contributed Papers Business and Economic Statistics Section , International Indian Statistical Association , Statistics Surveys Online Journal , Section on Government Statistics Organizer(s): Baoline Chen, Bureau of Economic Analysis Chair(s): Tommaso Di Fonzo, ISTAT/University of Padua 10:35 AM Diagnostics for Benchmarking Economic Time Series at the U.S. Census Bureau — Irene Brown, U.S. Census Bureau 10:55 AM Restoring Accounting Constraints in Time Series of U.S. Industry Accounts — Baoline Chen, Bureau of Economic Analysis 11:15 AM Benchmarking and Reconciliation of Time Series According to a Growth Rates Preservation Principle — Marco Marini, International Monetary Fund ; Tommaso Di Fonzo, ISTAT/University of Padua 11:35 AM A New Method of Simultaneously Balancing Economic Accounting Systems at Current and Constant Prices — Vittorio Nicolardi 11:55 AM A Review of Benchmarking Methods — Neil Parkin, Office for National Statistics ; Gary Brown, Office for National Statistics 12:15 PM Floor Discussion Thu, 8/2/2012, 10:30 AM - 12:20 PM CC-Room 29D 662 ! Option Pricing, Nonparametrics, and Testing — Contributed Papers Business and Economic Statistics Section Chair(s): Song Lin, The Nielsen Company 10:35 AM Option Pricing and Distribution Characteristics — David Mauler, Brigham Young University ; James McDonald, Brigham Young University 7/16/2012 8:30 AM JSM 2012 Online Program 16 of 16 http://www.amstat.org/meetings/jsm/2012/onlineprogram/MainSearchResults.cfm 10:50 AM European Option Pricing Under Jump Diffusion with Proportional Transaction Costs — Yang Yu, SUNY at Stony Brook ; Haipeng Xing, SUNY at Stony Brook ; Tiong Wee Lim, National University of Singapore 11:05 AM C(a)-Type LM Tests in Time Series GEL Model Under Strong and Weak Identification — Kalidas Jana, The University of Texas at Brownsville 11:20 AM Smoothed Jackknife Empirical Likelihood Inferences for Lorenz Curves — Shan Luo, Georgia State University ; Gengsheng Qin, Georgia State University ; Xin Huang, Fred Hutchinson Cancer Research Center 11:35 AM A New Test For Randomness with Application to Stock Market Index Data — Boris Iglewicz, Temple University ; Alicia Graziosi Strandberg, Temple University 11:50 AM Examining Inequality in Subpopulations Using the Gini Index — Chaitra Nagaraja, Fordham University 12:05 PM Semiparametric Conditional Moment Models with Possibly Nonsmooth Residuals and Nonclassical Measurement Errors — Suyong Song, University of Wisconsin-Milwaukee 2012 JSM Online Program Home For information, contact jsm@amstat.org or phone (888) 231-3473. If you have questions about the Continuing Education program, please contact the Education Department. ASA Meetings Department • 732 North Washington Street, Alexandria, VA 22314 • (703) 684-1221 • meetings@amstat.org 7/16/2012 8:30 AM