Anatomy of Government Failure - Department of Political Science

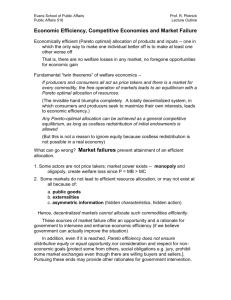

advertisement