Becker CPA Review - Becker Professional Education

advertisement

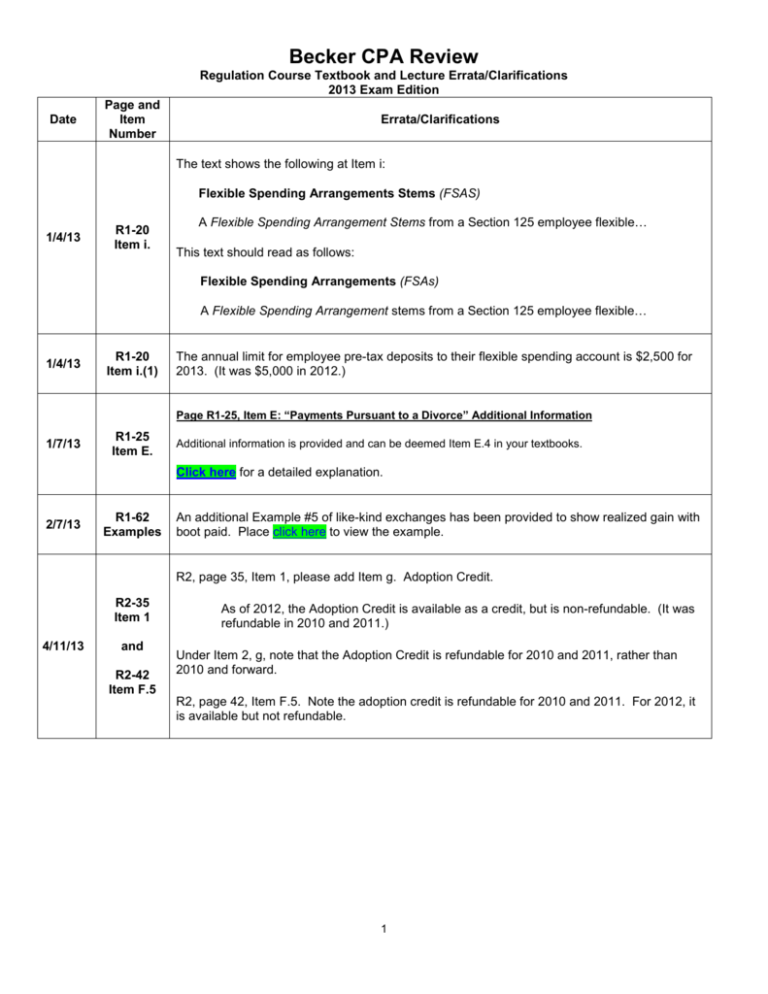

Becker CPA Review Regulation Course Textbook and Lecture Errata/Clarifications 2013 Exam Edition Date Page and Item Number Errata/Clarifications The text shows the following at Item i: Flexible Spending Arrangements Stems (FSAS) 1/4/13 R1-20 Item i. A Flexible Spending Arrangement Stems from a Section 125 employee flexible… This text should read as follows: Flexible Spending Arrangements (FSAs) A Flexible Spending Arrangement stems from a Section 125 employee flexible… 1/4/13 R1-20 Item i.(1) The annual limit for employee pre-tax deposits to their flexible spending account is $2,500 for 2013. (It was $5,000 in 2012.) Page R1-25, Item E: “Payments Pursuant to a Divorce” Additional Information 1/7/13 R1-25 Item E. Additional information is provided and can be deemed Item E.4 in your textbooks. Click here for a detailed explanation. 2/7/13 R1-62 Examples An additional Example #5 of like-kind exchanges has been provided to show realized gain with boot paid. Place click here to view the example. R2, page 35, Item 1, please add Item g. Adoption Credit. R2-35 Item 1 4/11/13 and R2-42 Item F.5 As of 2012, the Adoption Credit is available as a credit, but is non-refundable. (It was refundable in 2010 and 2011.) Under Item 2, g, note that the Adoption Credit is refundable for 2010 and 2011, rather than 2010 and forward. R2, page 42, Item F.5. Note the adoption credit is refundable for 2010 and 2011. For 2012, it is available but not refundable. 1 Becker CPA Review Regulation Course Textbook and Lecture Errata/Clarifications 2013 Exam Edition (b) R3-6 Item .1.b. (2)(b) Of course, there are exceptions to the rule, and these exceptions (notice and consent requirements) will keep the excess benefits from being included in income, if the taxpayer qualifies. The exceptions will apply if certain notice and consent requirements are met, and only if the insured is a United States citizen or resident. Further, the insured must have been: (1) an employee of the policyholder during the 12-month period before the insured’s death, or (2) a director or other highly compensated employee at the time the contract was issued. Proceeds paid to a member of the insured’s family, a designated beneficiary, a trust for the beneficiary, or an estate of the insured are also not included if the notice and consent requirements are met. and 1/7/13 1/30/13 R3-22 Life Insurance Proceeds (Under Items Not Includible in "Taxable Income") R3-31 Item VI.A.1. In addition to annual reporting and record retention requirements, the notice and consent requirements that must be satisfied in order to make the benefits non-taxable include: (1) written notification to the employee that the company plans to insure the life of the employee, (2) disclosure to the employee of the maximum face amount of insurance, (3) written consent of the employee being insured that this policy may be continued even if the employee terminates employment, and (4) written notification to the employee of the policyholder that will be the beneficiary of the proceeds payable upon the death of the employee. The paragraph heading is Long-term Capital Gain Treatment. Note: The lower capital gains rates indicated here do not apply to C corporations. All capital gains of a C corporation are taxed at ordinary income rates. 2 Becker CPA Review Regulation Course Textbook and Lecture Errata/Clarifications 2013 Exam Edition As indicated in item VI.C.2, the rule for Section 1250 recapture requires only the difference between the accelerated depreciation taken on the real estate (typically those assets placed into service before 1987) and what straight-line depreciation would have been if it had been taken on the asset instead. This rule has the effect of the overall gain being taxed at 25%, as indicated in item VI.C.3. [Phase-out provisions may apply in some cases, all of which are beyond the scope of the CPA exam.] A few students have inquired of the special rules regarding Section 1250 additional recapture for corporations. While this topic has historically not been tested on the CPA exam, we are providing the information in this update to address the issue. 1/7/13 R3-32 Item 3. Per Internal Revenue Code section 291, for corporations, “in the case of section 1250 property which is disposed of during the taxable year, 20 percent of the excess (if any) of (a) the amount which would be treated as ordinary income if such property was section 1245 property, over (b) the amount treated as ordinary income under section 1250 (determined without regard to this paragraph), shall be treated as gain which is ordinary income under section 1250 and shall be recognized notwithstanding any other provision of this title.” Effectively, the calculation above means that the TOTAL amount of the taxable recapture as ordinary income for a corporation subject to the provisions of Section 1250 is equal to the amount of the ordinary income under the general Section 1250 rules (see above) plus 20% of the straight-line depreciation that was not recaptured under the general rules. As always, the total depreciation recaptured is limited to the recognized gain. Under heading "Included Costs": The three lines under this heading should be replaced with the following, providing a separate description for organizational expenditures and start-up costs. 2/7/13 R4-14 Item 6.b. b. Allowable organizational expenditures and include fees paid for legal services in drafting the partnership agreement, fees paid for accounting services, and fees paid for partnership filings. Start-up costs include the following costs incurred prior to the opening of the business: training costs, advertising costs, and testing costs. IRS Tax Return Preparer Program 1/30/13 R4-45 Item 10.d. In 2011, the IRS began requiring all tax return preparers who prepare and file tax returns for a fee to pass an exam, pay an annual fee, and complete 15 hours of continuing education each year. Attorneys, CPA’s and Enrolled Agents were exempt from the new regulation. In January of 2013, a federal court overturned this ruling, and the IRS is appealing. For the time being, the tax return preparer program is no longer required. If the situation changes, we will post additional information. 3 Becker CPA Review Regulation Course Textbook and Lecture Errata/Clarifications 2013 Exam Edition R4, page 60, Item 3. Required Disclosure of Tax Preparer 4/11/13 R4-60 Item 3 Change this section to read: The tax preparer should inform the taxpayer of the penalty risks with respect to the tax effects (tax return position) of a transaction. The courts will not uphold (sustain) the imposition of the penalty if the transaction, at a minimum, meets the more-likelythan-not standard. Note: The tax portion of the Regulation exam focuses primarily on principles and concepts, and not on year-specific amounts, thresholds and phase-outs. New tax law is not testable until six months after the date passed by Congress. Therefore, the American Taxpayer Relief Act passed on January 1, 2013 is not testable on the CPA Exam until July 1, 2013. 4