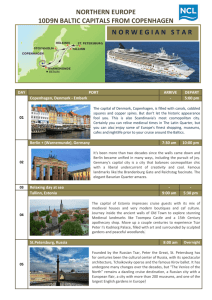

2013 Northern New Brunswick Cruise Strategy

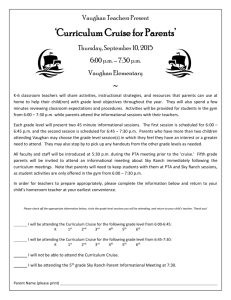

advertisement