STOCKHOLM UNIVERSITY

advertisement

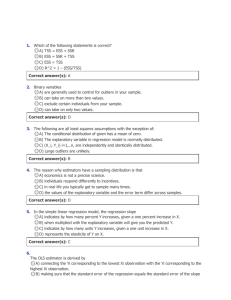

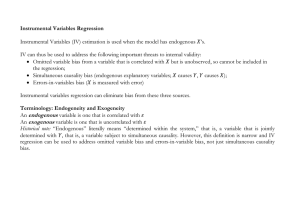

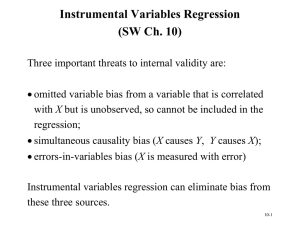

STOCKHOLM UNIVERSITY Department of Economics Course name: Empirical Methods 2 Course code: EC2402 Examiner: Per Pettersson-Lidbom Number of credits: 7.5 credits Date of exam: Friday, January 15, 2010 Examination time: 3 hours Write your name, Swedish personal number and the number of the question on every cover sheet. Do not write answers for more than one question in the same cover sheet. Explain notions/concepts and symbols. Only legible exams will be marked. No aids are allowed with the exception of calculators provided by exam administrators. ----------------------------------------------------------------------------------------------------------------The exam consists of two parts. Part 1 consists of 20 multiple choice questions worth 40 points in total (2 points each). All students must answer this part of the exam. Part 2 consists of two discussion questions worth 60 points in total (30 points each). If you have received credit you do not need to answer discussion question 1. The exam is worth 100 points in total. For the grade E 40 points are required, for D 50 points, C 60 points, B 75 points and A 90 points. ----------------------------------------------------------------------------------------------------------------If you think that a question is vaguely formulated: specify the conditions used for solving it. ----------------------------------------------------------------------------------------------------------------Results will be posted on the notice board, House A, floor 3, January 25 th, 2010 at the latest ----------------------------------------------------------------------------------------------------------------- Good luck! Part 1: Multiple Choice Questions (40 points) Circle the right answer. Only one answer per question. No credit will be given for multiple answers or additional explanations. Two points per question for correct answers. 1). The guidelines for whether or not to include an additional variable include all of the following, with the exception of a. providing “full disclosure” representative tabulations of the results. b. testing whether additional questionable variables have nonzero coefficients. c. determining whether it can be measured in the population of interest. d. being specific about the coefficient or coefficients of interest. 2) A possible solution to errors-in-variables bias is to a. use log-log specifications. b. choose different functional forms. c. use the square root of that variable since the error becomes smaller. d. mitigate the problem through instrumental variables regression. 3) You try to explain the number of IBM shares traded in the stock market per day in 2005. As an independent variable you choose the closing price of the share. This is an example of a. simultaneous causality. b. invalid inference due to a small sample size. c. sample selection bias since you should analyze more than one stock. d. a situation where homoskedasticity-only standard errors should be used since you only analyze one company. 4) In the case of errors-in-variables bias, the precise size and direction of the bias depend on a. the sample size in general. b. the correlation between the measured variable and the measurement error. c. the size of the regression R 2 . d. whether the good in question is price elastic. 5) When the fifth assumption in the Fixed Effects regression (cov (uit , uis | X it , X is ) for t s ) is violated, then 0 a. using heteroskedastic-robust standard errors is not sufficient for correct statistical inference when using OLS. b. the OLS estimator does not exist. c. you can use the simple homoskedasticity-only standard errors calculated in your regression package. d. you cannot use fixed time effects in your estimation. 6) The main advantage of using panel data over cross sectional data is that it a. gives you more observations. b. allows you to analyze behavior across time but not across entities. c. allows you to control for some types of omitted variables without actually observing them. d. allows you to look up critical values in the standard normal distribution. 7) One of the following is a regression example for which Entity and Time Fixed Effects could be used: a study of the effect of a. minimum wages on teenage employment using annual data from the 48 contiguous states in 2006 . b. various performance statistics on the (log of) salaries of baseball pitchers in the American League and the National League in 2005 and 2006. c. inflation and inflationary expectations on unemployment rates in the United States, using quarterly data from 1960-2006. d. drinking alcohol on the GPA of 150 students at your university, controlling for incoming SAT scores. 8) Consider a panel regression of unemployment rates for the G7 countries (United States, Canada, France, Germany, Italy, United Kingdom, Japan) on a set of explanatory variables for the time period 1980-2000 (annual data). If you included entity and time fixed effects, you would need to specify the following number of binary variables: a. 21. b. 6. c. 28. d. 26. 9) A pattern in the coefficients of the time fixed effects binary variables may reveal the following in a study of the determinants of state unemployment rates using panel data: a. macroeconomic effects, which affect all states equally in a given year. b. attitude differences towards unemployment between states. c. there is no economic information that can be retrieved from these coefficients. d. regional effects, which affect all states equally, as long as they are a member of that region. 10) If the instruments are not exogenous, a. you cannot perform the first stage of TSLS. b. then, in order to conduct proper inference, it is essential that you use heteroskedasticity-robust standard errors. c. your model becomes overidentified. d. then TSLS is inconsistent. 11) In the case of exact identification a. you can use the J-statistic in a test of overidentifying restrictions. b. you cannot use TSLS for estimation purposes. c. you must rely on your personal knowledge of the empirical problem at hand to assess whether the instruments are exogenous. d. OLS and TSLS yield the same estimate. 12) To calculate the J-statistic you regress the a. squared values of the TSLS residuals on all exogenous variables and the instruments. The statistic is then the number of observations times the regression R 2 . b. TSLS residuals on all exogenous variables and the instruments. You then multiply the homoskedasticity-only F-statistic from that regression by the number of instruments. c. OLS residuals from the reduced form on the instruments. The F-statistic from this regression is the J-statistic. d. TSLS residuals on all exogenous variables and the instruments. You then multiply the heteroskedasticity-robust F-statistic from that regression by the number of instruments. 13) When using panel data and in the presence of endogenous regressors a. the TSLS does not exist. b. you do not have to worry about the validity of instruments, since there are so many fixed effects. c. the OLS estimator is consistent. d. application of the TSLS estimator is straightforward if you use two time periods and difference the data. 14) In practice, the most difficult aspect of IV estimation is a. b. c. d. 15) finding instruments that are both relevant and exogenous. that you have to use two stages in the estimation process. calculating the J-statistic. finding instruments that are exogenous. Relevant instruments are easy to find. Consider a model with one endogenous regressor and two instruments. Then the Jstatistic will be large a. if the number of observations are very large. b. if the coefficients are very different when estimating the coefficients using one instrument at a time. c. if the TSLS estimates are very different from the OLS estimates. d. when you use homoskedasticity-only standard errors. 16) If the causal effect is different for different people, then the population regression equation for a binary treatment variable Xi, can be written as a. Yi b. Yi c. Yi d. Yi 17) 0 1 Xi ui . 0 1i Xi ui . 0i 0 1i Gi 1 Xi ui . 2 Dt ui . In the case of heterogeneous causal effects, the following is not true: a. in the circumstances in which OLS would normally be consistent (when E (ui | X i ) 0 ), the OLS estimator continues to be consistent. b. OLS estimation using heteroskedasticity-robust standard errors is identical to TSLS. c. the OLS estimator is properly interpreted as a consistent estimator of the average causal effect in the population being studied. d. the TSLS estimator in general is not a consistent estimator of the average causal effect if an individual’s decision to receive treatment depends on the effectiveness of the treatment for that individual. 18) One of the major lessons learned in the chapter on experiments and quasi-experiments a. is that there are almost no true experiments in economics and that quasiexperiments are a poor substitute. b. you should always use TSLS when estimating causal effects in quasi experiments. c. populations are always homogeneous. d. is that the insights of experimental methods can be applied to quasiexperiments, in which special circumstances make it seem “as if” randomization has occurred. 19) Quasi-experiments a. provide a bridge between the econometric analysis of observational data sets and the statistical ideal of a true randomized controlled experiment. b. are not the same as experiments, and lessons learned from the use of the latter can therefore not be applied to them. c. most often use difference-in-difference estimators, which are quite different from OLS and instrumental variables methods studied in earlier chapters of the book. d. use the same methods as studied in earlier chapters of the book, and hence the interpretation of these methods is the same. 20) The major distinction between the experiments and quasi-experiments is the a. frequent use of binary variables. b. type of data analyzed and the special opportunities and challenges posed when analyzing experiments and quasi-experiments. c. superiority of TSLS over OLS. d. use of heteroskedasticity-robust standard errors. Part 2: Discussion Questions (60 points) On separate sheets of paper, answer the following two discussion questions. Write your name, personal number (personnummer) and the question number on each sheet. Answer each question clearly and concisely. Only legible answers will be considered, others will be disregarded. If you think that a question is vaguely formulated, specify the conditions used for solving it. Each question is worth 30 points. Discussion question 1: NOTE: Those with a credit receive 30 points for this question and do not have to answer discussion question 1. Earnings functions provide a measure, among other things, of the returns to education. It has been argued these regressions contain a serious omitted variable bias due to differences in abilities. Furthermore, ability is hard to measure and bound to be highly correlated with years of schooling. Hence the standard estimate of about a 10 percent return to every year of schooling is upward biased. Suggest some ways to address this problem. One famous study looked at earnings of identical twins. Explain how this can be viewed as a quasi-experiment, and mention some of the threats to internal and external validity that such a study might encounter. Discussion question 2: You want to study whether or not the use of trained midwifes (utbildade barnmorskor), as compared to traditional birth attendants, has an effect on maternal and child mortality. Explain in detail how you would ideally set up such a randomized experiment and what threats to internal and external validity there might be. Note. Discuss these issues in relation to the specific question.