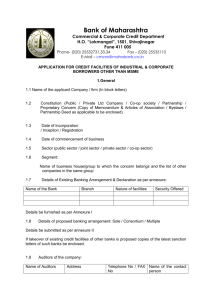

Here - The Thal Industries Corporation Limited

advertisement