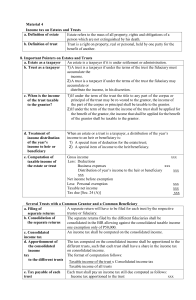

Fiduciary / 1041

advertisement

Fiduciary / 1041 Features, Forms and Schedules Features Customizable fiduciary and beneficiary transmittal letters Easy allocation of amounts to beneficiaries 16 pre-defined IRC elections Support for up to 1,000 beneficiaries Depreciation reports by activity Five-Year Tax History. Import assets from ProSeries/Fixed Asset Manager (sold separately) Import trial balance information from popular accounting packages How-to guide in Help offers advice on preparing a return using the program Integrated state business software is also available. In-Depth Calculations • • • • • • • Tentative trust accounting income calculated automatically. Easy allocation of deductions to taxable and tax-exempt income Handles tier-1 and tier-2 distribution, and automatically computes beneficiary allocation percentages Passive activities Supports grantor trusts with unlimited grantor letters NOL and AMT NOL worksheets track net operating losses Foreign Tax Credit and AMT Foreign Tax Credits Forms Form 1041, U.S. Income Tax Return for Estates and Trusts Form 1041-A, U.S. Information Return Trust Accumulation of Charitable Amounts Form 1041-ES, Estimated Income Tax for Estates and Trusts Form 1041-T, Allocation of ES Tax Payments to Beneficiaries Form 56, Notice Concerning Fiduciary Relationship Form 1116, Foreign Tax Credit Form 1116-AMT Form 2210, Underpayment of Estimated Tax Form 2848, Power of Attorney Form 3115, Change in Accounting Method Form 3800, General Business Credit Form 4136, Credit for Federal Tax Paid on Fuels Form 4255, Recapture of Investment Credit Form 4562, Depreciation and Amortization Form 4684, Casualties and Thefts Form 4797, Sales of Business Property Form 4835, Farm Rental Income and Expenses Form 4952, Investment Interest Expense Deduction Form 6252, Installment Sale Income Form 7004, Application for Automatic Extension of Time to File Form 8271, Investor Reporting of Tax Shelter Registration Number Form 8582, Passive Activity Loss Limitations Form 8594, Asset Acquisition Statement Form 8801, Credit for Prior Year Minimum Tax Form 8821, Tax Information Authorization Form 8822, Change of Address Form 8824, Like-Kind Exchanges Form 8855, Qualified Revocable Trust as Part of an Estate Form 8868, Application Extension Exempt Organization Return Form 8903, Domestic Production Activities Deduction Form 8913, Credit for Federal Telephone Excise Tax Paid Form SS-4, Application for Employer ID Number Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts Form W-7P Schedules Schedule C (1040), Profit or Loss from Business Schedule D, Capital Gains and Losses Schedule E (1040), Supplemental Income and Loss Schedule F (1040), Profit or Loss from Farming Schedule J, Accumulation Distribution for a Complex Trust Schedule J Additional Part IV Statement Schedule K-1, Beneficiary's Share of Income, Deductions, Credits, etc. Each program also contains many supporting worksheets, reconciliation summaries, and analytical comparisons. Forms and schedules are subject to change.