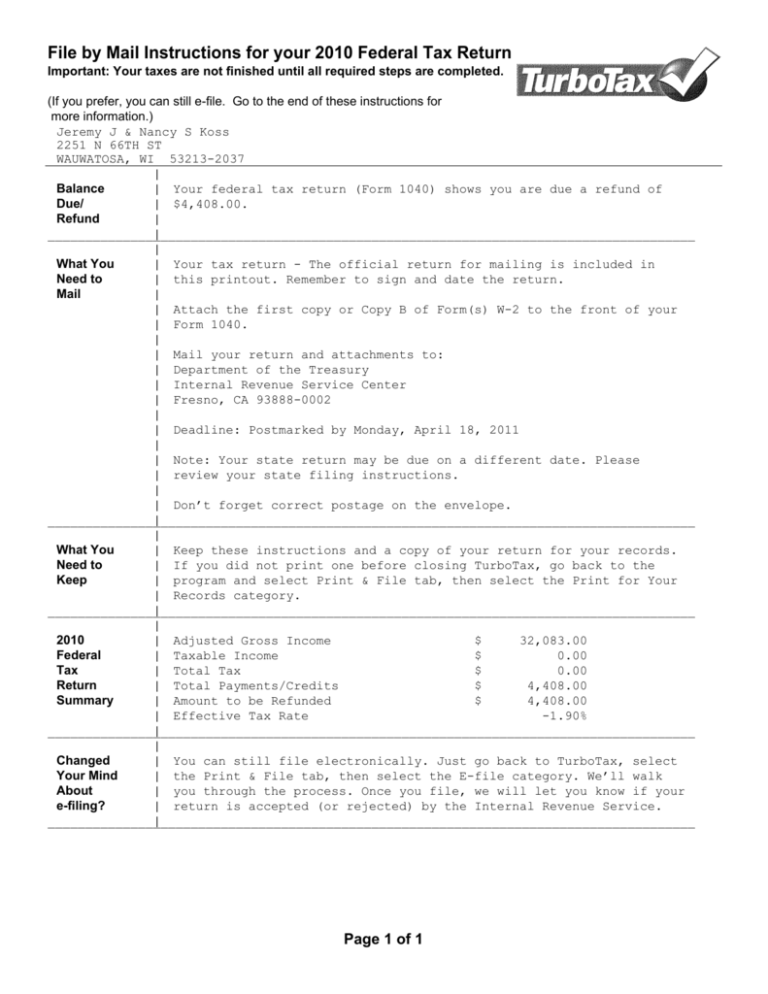

File by Mail Instructions for your 2010 Federal Tax Return

advertisement