Solution- CHE374F – Engineering Economic Analysis Quiz #1

advertisement

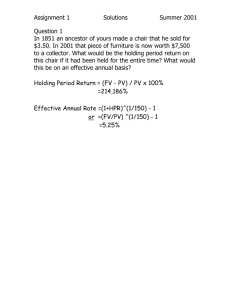

Solution- CHE374F – Engineering Economic Analysis Quiz #1, September 29, 2010 Question # 1 (5 marks) Given Calculate Answer 6 % interest per year (effective) Quarterly interest rate based on quarterly compounding (1+6%) = (1+r)^4 1.47% 10% interest per year based on daily compounding Interest per year (effective) (1+10%/252)^252=1+r 10.51% 4% interest per year, with quarterly compounding Continuously compounding interest rate per quarter (1+4%/4)^4 = exp(4*r) 1% 2% interest per month compounded monthly Continuously compounding interest rate per day (1+2%)^12 = exp(r*252) .09% 6% interest per quarter with monthly compounding Interest per five years based on semi-annual compounding (1+6%/3)^12 = (1+r/10)^2 126.16% Assume 252 trading days per year, where applicable. Page 1 of 3 Question # 2. (3 marks) Determine the effective annual rate for an investment that earns 3% per quarter based on quarterly compounding for the first 5 months, then earns 10% per year based on semiannual compounding for another 6 months. First approach: 11.29% Second approach: 11.29% Page 2 of 3 Bonus Question (2 marks) Discuss the principal-agent problem that is often present in public firms? Give a strategy that may correct this issue. The principal-agent problem arises in organizations between the interests of shareholders who lend liquidity to CEOs and management that run the company. Shareholders desire conservative, steady growth, but management may seek out risky, short-term investments. Mechanism to correct this issue align the interests of management with shareholders. Examples include stock options or deferred compensation. Page 3 of 3