Organizational Capabilities, Strategic Orientation, Strategy

Organizational Capabilities, Strategic Orientation, Strategy Formulation Quality,

Strategy Implementation and Organizational Performance in Brazilian Textile

Industries

Autoria: Fátima Evaneide Barbosa de Almeida, João Veríssimo Lisboa, Mário Gomes Augusto,

Paulo César de Sousa Batista

Abstract

This research analyses how the interaction between strategy capabilities, strategy types, strategy formulation quality and strategy implementation capability affects organizational performance in the Brazilian textiles companies. A conceptual framework was proposed and tested, with data from 211 firms. It was found a support for links between organizational capabilities and strategies types. It was found an inter-relationship between generic strategies, revealing the use of combined strategies by Brazilian textiles companies. It was also found a relationship between strategy implementation capability and strategy formulation quality. It was identified that management capability and market performance have a statistically significant relationship with financial performance.

1

1. Introduction

Competitive advantage is an important issue that had deserved special attention in the literature. Given the importance of competition, scholars have focused on the identification of the most successful competitive strategies that firms pursue, in order to produce supernormal profits (ORMANIDHI & STRINGA, 2008; BOWMAN & TOMS, 2010).

According to Bowman & Toms (2010), this area of research was influenced by the structure conduct performance paradigm of industrial organization economics, which explained how competitive advantage derives from privileged market positions. Among the authors that advocate this, Porter (1980) has contributed with a competitive strategy typology that is the most used in practice, although it was published thirty years ago (LEITNER &

GULDENBERG, 2010).

In the early 90s, it was developed another explanation of the source of competitive advantage, the Resources Based View (RBV). This theory locates the sources of advantage inside the firm, which is viewed as a bundle of resources (BOWMAN & TOMS, 2010).

Johannessen & Olsen (2010) refer to three theories to explain sustainable competitive advantages: the Industrial Organization (IO) theory, the Resource Based View (RBV), and

Dynamic Capabilities. The IO approach has been criticized due to its inattention to dynamic environments, when compared to the others two theoretical explanations.

Recently, some authors have argued that the IO and RBV approaches can be complementarily to each other (ORTEGA, 2009; LEITNER & GULDENBERG, 2010). They defend that distinct competencies and resources are important for realizing sustainable competitive advantage when firm adopts a differentiation strategy (LEITNER &

GULDENBERG, 2010).

The relationship between strategy and performance has been widely discussed over the past three decades (PARNELL, 2011; HAHN & POWERS, 2010; RAY, BARNEY &

MUHANNA, 2004; SPANOS, ZARALIS & LIOUKAS, 2004; VENKATRAMAN &

RAMANUJAM, 1986). Hahn & Powers (2010) argue that, despite of the great importance given to an adequate strategy implementation for performance, the relationship between strategy formulation quality and its implementation did not received the deserved attention.

Motivated by these previous aspects, this study aims to investigate how the interaction between strategy capabilities (marketing, technology and management), strategy types (focus, differentiation and cost leadership strategies), strategy formulation quality and strategy implementation capability, affects organizational performance in the Brazilian textiles companies. In additions, the authors of this study expect to contribute for the understanding of the main factors that drive the financial performance of the Brazilian textiles firms.

To obtain these goals, the article is structured as follows: Theoretical Background,

Methodology, Results and Conclusions, limitations, and future research.

2. Theoretical background

2.1 Strategic orientation

During the past 30 years, the most used framework related to strategic orientation of organizations is Porter’s generic strategies. A large amount of research in this theme was developed along these years (DESS & DAVIS, 1984; KIM & LIM, 1988; ROBINSON &

PEARCE, 1988; CAMPBELL-HUNT, 2000; MILLER & DESS, 1993; BOWMAN &

AMBROSINI, 1997; KIM, NAM & STIMPERT, 2004; SPANOS, ZARALIS & LIUKAS,

2004; ACQUAAH & YASAI-ARDEKANI, 2008), among others.

These studies revealed different results. Some support Porter´s affirmation that a business must make a choice between cost leadership and differentiation strategies or it will

2

become “stuck in the middle” or without a coherent strategy. Others studies disagree with

Porter´s findings and give support to the use of combined strategy.

For instance, Acquaah & Yasai-Ardekani (2008) found support for the viability and profitability of implementing coherent generic competitive strategies and the combination of singular strategies. Firms that combine strategies tend to experience substantial incremental performance benefits over those that implement only the cost-leadership strategy. However, the authors found that the incremental performance difference between firms implementing a combined strategy do not differ from those that adopt only the differentiation strategy. Firms implementing one of the generic strategies (combination, cost-leadership, or differentiation) perform better than firms “stuck in the middle”.

More recent studies seem to ensure the superiority of differentiation strategies and the combined strategy. According to Leitner & Guldenberg (2010), some studies indicate that

SMEs primarily follow a focus strategy, supplemented by differentiation, which appears to be the most popular competitive strategy of SMEs in market niches. These authors considered two differentiation alternatives central to SMEs: (i) product innovation and (ii) product quality. As they reinforced, product innovation is regarded as a particularly important strategy for survival in dynamic environments.

Others studies using Porter´s typology were applied to the manufacturing firms in

Portugal (GREEN, LISBOA & YASIN, 1993; JÁCOME, LISBOA & YASIN, 2002;

MARQUES ET AL.

, 2000; SILVA, 1996). These studies were based on Dess & Davis (1984) study that developed a set of competitive methods, which represent the underlying components of the Porter typology. The main purpose of these studies were to investigate the strategic orientation and performance in Portuguese firms, namely in the ceramic industry

(Jácome, Lisboa & Yasin, 2002), in the crystal glass industry (Marques et al ., 2000) and in the mould industry (Silva, 1996), in the context of Porter´s typology. These three studies besides to indicate the utility and the applicability of Porter´s typology in defining the behavior of

Portuguese industrial firms also suggest that Porter´s generic strategies are dependent on the industry and have more a contingent character than generic.

2.2 Strategic capabilities

Spanos & Lioukas (2001) indicate differences between Porter´s competitive strategy framework and the resources based theory. A firm is viewed by Porter as a bundle of activities and by the resource-based scholars as a bundle of unique resources. Porter´s competitive strategy framework gives priority to the analysis of the environment–performance relationship and no emphasis on the impact of idiosyncratic firm attributes on performance. For the RBV´s defenders, two main assumptions are implicitly on Porter´s theory: (i) firms are identical in terms of strategically relevant resources; (ii) any attempt to develop resource heterogeneity has no long term viability, due to the high mobility of strategic resources among firms.

The definition of strategic capabilities was proposed by Day (1994:38) as: “complex bundles of skills and accumulated knowledge that enable firms to coordinate activities and make use of their assets to create economic value and sustain competitive advantage”. Spanos

& Lioukas (2001) listed types of strategic capabilities that can be identified and are common to businesses: technological, product development, production process, manufacturing, and logistics capabilities; production efficiency; market sensing, channel and customer linking, and technology-monitoring capabilities; marketing capabilities, such as skills in segmentation, targeting, pricing, and advertising. All these capabilities allow a firm to keep costs down and/or differentiate its offerings, improve consistency in delivery, and ultimately increase

3

competitiveness. In addition, these capabilities also allow a business to respond swiftly to changing customer needs and to exploit its technological strengths most effectively.

Several authors conducted empirical studies evaluating the internal resources impact in performance. These authors considered Industrial Organizational and Resource based View theories as complementary approaches. Spanos & Lioukas (2001) consider that the RBV theory provides the “Strength-Weaknesses” part of the overall SWOT framework, by emphasizing firm-specific efforts in developing and combining resources to achieve competitive advantage. Also, industry analysis supplies the “Opportunities-Threats” part within the context of SWOT analysis.

Regarding the RBV approach, Ray, Barney & Muhanna (2004) advocate that firms must translate efficiently and effectively their resources and capabilities into business process, otherwise they cannot expect to realize the competitive advantage potential of their resources.

The authors stress that the potential to generate competitive advantage from resources can be realized only if used in business process, defined by the actions that firms engage in to accomplish some business purpose or objective. They state that is through business process that firm´s resources and capabilities get exposed to the market, and consequently have their value recognized.

2.3 Strategy formulation quality and strategy implementation capability

Despite of the strategy´s effect on performance, it is broadly discussed the role of strategy formulation quality and its implementation in increasing business performance.

Several authors reported the importance and controversies in this field (e.g., HREBINIAK,

2006A, 2006B; MESKENDAHL, 2010; MANKINS & STEELE, 2005; SPECULAND, 2006;

HEIDE, GROUHANG & JOHANNESSEN, 2002; JOHNSON, 2004; CATER & PUCKO,

2010). Mankins & Steele (2005) pointed out that businesses realize only 63% of their strategies’ potential value, whereas Johnson (2004) indicated that 66% of business strategy was never implemented. These figures can explain why companies that develop complex and extensive strategic plans do not reach competitive advantages.

Crittenden & Crittenden (2008) advocate that the problem lies on a existence of a gap in the formulation-to-implementation process. The employees’ lack of knowledge of the company´s strategy contributes to strategy implementation failure, probably resulting in a poor financial performance. Another problem is that a poor strategy implementation can impoverish the next plan cycle, which can conduct to wrong strategy implementation. After this, it is hard to say if a weak performance is due to good implementation of a bad strategy or to poor implementation of a good strategy.

According to Hahn & Powers (2010), earlier studies about the quality of the strategic plan formulation and firm’s performance show that high quality strategic plans have a positive and significantly association with firm’s performance.

3. Model development and research hypothesis

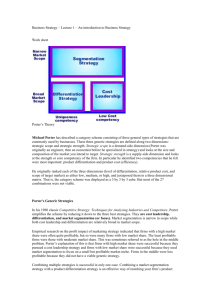

Taking the previous analysis in consideration, this study intends to investigate how the interaction between organizational capabilities (strategic, marketing, technology, and management), strategy types, strategy formulation quality and strategy implementation capability affects organizational performance in the Brazilian textiles companies. The conceptual model in Figure 1 attempts to establish a broader perspective on the causal relationships to be tested.

The model considers a set of underlying assumptions, which represent the core of the theory. It is expected that management capability have a positive direct and indirect effect on

4

financial performance and that differentiation strategy have a positive impact on market performance. It is considered that companies that adopt the focus strategy tend to have a high marketing capability. Companies that adopt the strategy of cost leadership have high management capability and those who adopt the strategy of differentiation present high technological capability. The model also tests the impact of strategy implementation capabilities on strategy formulation quality, as well as the effect of strategy formulation quality on market performance and consequently the impact of market performance on the financial performance.

Studies of the influence of marketing capabilities were developed by De Sarbo et al .

(2005), Parnell (2011), Spanos & Lioukas (2001), Spanos, Zaralis & Lioukas (2004), and

Ortega (2009). Spanos & Lioukas (2001) advocate that the ability to develop a successful strategy is related to the development of capabilities or internal resources and the ability to modify its strategy posture. So, the following hypothesis was defined:

Hypothesis 1: There is a positive and significant association between organizational capabilities and strategic orientation.

Moreover, Parnell (2011) claims that certain strategic capabilities can be more important to support a type of strategy orientation. For example, a focus strategy can require specific attributes related with marketing capabilities to concentrate efforts on a particular market niche. Parnell (2011) suggests that firms pursuing high differentiation strategy have more probability to possess technological expertise than firms utilizing other strategic orientations. Otherwise, the Cost Leadership Strategy is more likely to be linked to management capabilities required to assurance cost controls and production efficiencies.

Consequently, firms that pursue high management capabilities will probably obtain a positive financial performance. Based on these assertions, the following hypotheses were formulated:

Hypothesis 1a: There is a positive and significant association between marketing capabilities and focus strategy;

Hypothesis 1b: There is a positive and significant association between technology capabilities and differentiation strategy;

Hypothesis 1c: There is a positive and significant association between management capabilities and cost leadership strategy;

Hypothesis 1d: There is a positive and significant association between management capabilities and financial performance.

According to Parnell (2011) numerous studies have linked the generic strategies of focus, cost leadership and differentiation to firm’s performance. Spanos & Lioukas (2001), although finding positive evidence in the relationship between generic strategies and market performance, did not find any significant evidence linking generic strategies and financial performance. Others studies have tested the superiority of the differentiation strategy compared with cost leadership strategy and focus strategy and also the impact of combined strategies on firm’s performance (LEITNER & GULDENBERG, 2010, ACQUAAH &

YASAI-ARDEKANI, 2008). Due to these considerations, the following hypotheses were formulated:

Hypothesis 2: The use of combined strategies has a positive and significant impact on market performance;

Hypothesis 3: There is a positive and significant association between differentiation strategy and market performance.

5

Organizational capabilities

Strategic orientation

Outcomes

Strategy implementation capabilities

Marketing capabilities

Technological capabilities

Focus strategy

Differentiati on strategy

Strategy formulation quality

Market performance

Management capabilities

Cost leadership

Financial performance

Figure 1: Conceptual framework

Crittenden & Crittenden (2008) advocate that a poor strategy implementation weakens the future rounds of the strategy formulation quality. Hahn & Powers (2010) found that firms that formulate a high quality strategic plan, successfully implemented, can realize superior performance when compared to firms that do not do so. Based on these premises, the following hypotheses were proposed:

Hypothesis 4: There is a positive and significant association between strategic implementation capabilities and strategy formulation quality;

Hypothesis 5: There is a positive and significant association between strategy formulation quality and market performance.

In Spanos & Lioukas (2001), support was found to the positive and significant relationship between marketing performance and financial performance, despite of others researchers argue that market performance and profitability association is causally spurious.

These authors consider market performance as an antecedent of financial performance.

Therefore, the following hypothesis was formulated:

6

Hypothesis 6: There is a positive and significant association between market performance and financial performance.

4. Methodology

4.1. Research instrument

Data used in this study were collected through a national survey. The instrument utilized was based on an extensive literature review. Respondents were asked to provide information about their position in the firm’s hierarchy, the degree of respondent’s autonomy, the time of companies’ operation, the annual revenue, the number of employees, the source of capital and the phase of the textile chain in which the company has activity.

Babbie (2003) notes that survey constitutes an empirical method of verification, involving data collection and quantification. After this, they become permanent source of information. The use of survey, therefore, is seen as a valid instrument for social science research, being particularly effective when combined with other methods.

The research instrument was developed in five sections in a multi-item Likert-type scale ranging from 1 to 7. The first one relates to the characterization of the Brazilian textile industry and the others to the definition of scales to be used to build the constructs to be investigated. The scales built were based on the literature review. The measurement of organizational capabilities was based on Parnell’ study (2011) that adopted DeSarbo et al .

(2005) strategic capability scales. According to this author, marketing capabilities, such as skills in segmentation, pricing and advertising, allow companies to take advantage of their technological capabilities and market knowledge in the effective implementation of marketing programs. Management capabilities include the skills and technological capabilities, marketing and human resource management, financial management, efficiency in forecasting earnings and revenues, among others. Technology capabilities refer to skills necessary to convert inputs in outputs (Spanos & Lioukas, 2001) or the ability to perform any relevant technical function or volume activity within the firm, including the ability to develop new products and processes and to operate facilities effectively (ORTEGA, 2009).

Regarding to focus, cost leadership and differentiation strategies the scales’ construction was based in studies developed by Zahra & Covin (1993), Jácome, Lisboa &

Yasin (2002) & Parnell (2011). These authors took Dess & Davis (1984) seminal work on generic strategies as a cornerstone of their research. A total of 16 competitive methods were chosen to be used on the investigation of the Brazilian textiles companies. Differentiation aims to create a product that consumers perceive as unique, and hence allows the firm to command a premium price that exceeds the accumulation of extra costs (PORTER, 1985,

1989). The cost leadership strategy emphasizes the efficiency of operations and the economies of scale, which implies seeking tight cost, overhead control and minimization of costs in

R&D, services and advertising. However, firms that focus in Cost Leadership Strategy do not ignore areas such as product and service quality, despite of having significantly lower cost structures (AMOAKO-GYAMPAH & ACQUAAH, 2008). By adopting focus strategy, the company chooses a competitive environment or a narrow segment within an industry and tailors its strategy to serve them. It can choose between two variants: cost focus and differentiation focus (PORTER, 1980, 2008).

The development of the scale of strategy implementation capabilities was based in principles of good implementation suggested by Kaplan & Norton (2001) and Hrebiniak

(2006a). Strategy implementation capabilities can be related to the ability to effectively implement a business strategy, which can only be possible if a firm pursue some principles that facilitate the implementation process.

7

For the development of the scale of strategy formulation quality, this study adopted the definition which relates this construct to a sophisticated process that involves the strategic management process steps: mission statement, analysis of internal and external organization, strategy formulation, implementation, monitoring and follow-up (BAKER & LEIDECKER,

2001, HAHN & POWERS, 2010).

The measure of Organizational Performance was based in Spanos & Lioukas (2001) study. The performance is considered a two dimensional construct, namely financial performance and market performance (VENKATRAMAN & RAMANUJAM, 1986).

Therefore, market performance reflects the external firm accomplishments, and profitability the internal financial performance (SPANOS & LIOUKAS, 2001).

4.2. Sample

According to CNI/ABIT (2012) and IEMI (Studies and Industrial Marketing Institute), in 2010, there were 30,924 businesses units in the Brazilian textile chain, 4,748 of these belong to product textiles manufacturing and 26,176 to clothing sector. The total number of employees, in 2010, was over 350,000 in product textiles manufacturing, and over 1,300,000 in the clothing sector, producing, approximately 4,579,500 tons of clothing.

The research universe is composed of more than 30,000 companies that operate directly on the national textile chain, and generate annual revenue of 60 billion U.S. dollars.

This study includes a random sample of 211 companies spread across seven Brazilian states and involved in the various stages of the textile industry (spinning, weaving, knitting and clothing).

5. Results

To estimate and evaluate the proposed model (see Figure 1), an application of structural equation modelling (SEM) is used. The structural equation modelling approach is comprised of two models: a measurement model and a structural model. According to

Jöreskog & Sörbom (1993) and Anderson & Gerbing (1988), these two models can be estimated simultaneously or using a two-step approach.

The results reported in this section are obtained using a two-step approach, as recommended by Anderson & Gerbing (1988). The maximum likelihood estimation method and the AMOS 19 software were used for this purpose.

5.1. Measurement model

Before the analysis of the causal relations outlined in the proposed model (see Figure

1), it was conducted a preliminary data analysis to detect ill-fitting items grounded on item-tototal correlations and exploratory factor analysis. This analysis looks into items that were poorly correlated with the remaining items in each scale, and that had cross-loadings. After this analysis, some items were deleted. After a preliminary data analysis, the remaining items were submitted to a confirmatory analysis to assess the psychometric properties of the scales of the 10 latent variables (constructs) included in the proposed model. The final model shows an adequate fit: Chi-square ( χ 2 ) = 1004.08, df = 729, p < .01, Incremental Fix Index (IFI) =

.95, Goodness of Fit Index (GFI) = .82, Tucker-Lewis Index (TLI) = .94, Comparative Fit

Index (CFI) = .95, and Root Mean Square Error of Approximation (RMSEA) = .04. Although the chi-square of the model is statistically significant, the remaining global-fit indices indicated a good fit based on acceptable levels cited in the literature (e.g., BROWNE &

CUDECK, 1993; HULLAND, CHOW & LAN, 1996; SCHUMACKER & LOMAX, 1996;

JACCARD & WAN, 1996; MILES & SHEVLIN, 1998; HU & BENTLER, 1999; STEIGER,

8

2007; HOOPER ET AL ., 2008). The standardised factor loadings are larger (all loading exceeding .5, but 2 in 41) and highly significant ( p < .01), with all t statistics above 4. Thus, these results support the convergent validity of the measures. The magnitude of residuals and modification index is low, providing additional evidence of the uni-dimensionality of the scales.

Subsequently, the scales were examined for internal consistency. Table 1 presents univariate statistics, correlation coefficients, Cronbach’s alphas, composite reliabilities, and average variances extracted. The Cronbach alphas were all, but one, above the 0.70 threshold.

The composite reliability (CR) of each scale exceeds the 0.8 threshold, except ‘focus strategy’, with a reliability of 0.64 (FORNELL & LARCKER, 1981; HATCHER, 1994). This suggests that the scales are internally consistent. The variance extracted estimates (AVE) ranged from 0.38 for ‘focus strategy’’ to 0.89 for ‘financial performance’. In one case, they did not equal or exceed the 0.50 threshold as suggested by Fornell & Larcker (1981).

However, some authors (e.g., Hatcher, 1994) considered these values quite conservatives, arguing that lower thresholds are acceptable as minimum. On the basis of these results, it can be concluded that the constructs are unidimensional and meet acceptable levels of reliability and convergent validity.

5.2. Structural model

After to establish the validity of the scales, we proceeded with the estimation of the structural model to test the causal relationships proposed in the conceptual model. Table 2 reports the results of the estimation of the structural model, which include the overall-fit of the model and the structural standardized paths. Based on these results, it can be concluded that the overall model shows a good fit. The Chi-square is statistically significant ( χ 2 =

1071.20, df = 758, p < 0.01), and the remaining global fit indexes indicate an adequate fit

(TLI = 0.94, IFI = 0.94, GFI = 0.81, CFI= 0.94, RMSEA = 0.04). Overall, the results provided support for the proposed research model. The majority of the causal relationships received statistical support (9 out of 10). In addition, the modification indices reveal that no other paths are significant, showing also the robustness of the proposed model.

Table 1:

Standard deviation, correlation matrix, reliability, and variance extracted estimates

Mkt cap (X1)

Mgm cap (X2)

Tech cap (X3)

Str implem cap (X4)

Foc str (X5)

Cost lead str (X6)

Differentiation str (X7)

SD

.971

X1 X2 X3 X4 X5 X6 X7 X8 X9 X10 CR AVE

.84

.86

.60

1.073

.62

.81

.82

.54

1.014

.65

.54

.82

.83

.63

.86

.51

1.014

.50

.68

.46

.86

.819

.686

.852

.30

.25

.18

.34

.64

.20

.31

.10

.35

.80

.79

.30

.32

.15

.33

.70

.79

.85

.64

.82

.83

.38

.50

.50

Str form quality (X8)

Market perf (X9)

1.570

.52

.54

.43

.54

.24

.16

.25

.92

1.534

.34

.18

.10

.26

.08

.22

.22

.33

.92

.91

.64

.92

.85

Financial perf (X10) 1.464

.34

.29

.16

.27

.10

.12

.19

.35

.78

.96

.96

.89

Notes : Diagonal entries (highlighted in bold) are Cronbach’s alpha coefficients, all others are correlation coefficients. CR =

Composite Reliability; AVE = Average Variance Extracted.

9

Table 2:

Results of the structural model

Mkt cap Foc str

Tec cap Dif str

Mgm cap Cost lea str

Mgm cap Fin perf

Foc str Cost lead str

Cost lead str Dif str

Dif str Mkt perf

Str imp cap Str form qual

Stand. coeff.

.25

.06

.15

.15

.77

.79

.15

.57

S.E.

.061

.025

.037

.069

.137

.096

.259

.096

C.R.

p Hypotheses

2.605

** H1a: S

1.078

H1b: NS

2.169

* H1c: S

2.935

** H1d: S

5.195

** H2: S

6.221

** H2: S

1.973

* H3: S

7.243

** H4: S

Str form qual Mkt perf .31

.077

4.039

** H5: S

Mkt perf Fin perf .75

.057

12.658 ** H6: S

Model fit: Chi-square ( χ 2 ) = 1071.20, df = 758, Incremental Fix Index (IFI) = .94, Goodness of Fit Index (GFI) =

.81, Tucker-Lewis Index (TLI) = .94, Comparative Fit Index (CFI) = .94, and Root Mean Square Error of

Approximation (RMSEA) = 0.04.

Notes: Stand. coeff. = Standardized coefficients; S. E. = Standard error, C.R. = Critical ratio, * p ≤ .05, ** p ≤

.01; S: Supported, and NS: Not significant.

5.3. Discussion of the results

After the results reported in the previous section, the next phase of the research is to test the hypotheses stated in Section 3. The hypothesis 1a was supported. There is a positive and significant relationship between marketing capabilities and focus strategy. This relationship finds support in the work of Parnell (2011). Remembering that Porter’s focus strategy concentrate efforts on a particular market niche and the marketing capabilities can serve as a necessary precursor of the focus strategy implementation. The hypothesis 1b was not supported, once the relationship between technological capabilities and differentiation strategy is not significant. Although others researchers find evidences to this relationship, the data did not present the same results, probably due the sector characteristics. Otherwise, the hypothesis 1c was supported; management capabilities have a positive and significant relationship with the cost leadership strategy. This result is supported in the literature, considering that cost leadership strategy emphasizes production efficiencies, and the development of management capabilities as necessary to achieve efficiency and effectiveness.

The hypothesis 1d was supported; there is a positive and significant relationship between management capabilities and financial performance. According to DeSarbo et al . (2005), the ability to integrate logistics systems and control costs can conduct to a successful financial result.

It was found a positive and significant relationship between focus strategy and cost leadership strategy. The same occur with the relationship between cost leadership strategy and differentiation strategy. This can indicate the use of combined strategies by Brazilian textiles companies. Therefore, the hypothesis 2 was supported. Empirical studies also support this statement (MILLER & DESS, 1993, BOWMAN & AMBROSI, 1997; KIM, NAM &

10

STIMPERT, 2004; ACQUAAH & YASAI-ARDEKANI, 2008; LEITNER &

GULDENBERG, 2010; AMONG OTHERS).

The hypothesis 3 was also supported, indicating the existence of a positive and significant relationship between differentiation strategy and marketing performance. This statement finds a large support in empirical studies (Leitner & Guldenberg, 2010), ensuring the superiority of differentiation strategies or the use of combined strategies.

The relationship between strategy implementation capabilities and strategy formulation quality, defined in the hypothesis 4, resulted positive and significantly, corroborating with the results of authors such as Crittenden & Crittenden (2008), that advocate the influence of mode strategy implementation in strategy formulation quality. The hypothesis 5 was also supported; there is a positive and significant relationship between the strategy formulation quality and marketing performance. This finding agrees with the study of

Hahn & Powers (2010) that provided support to the role of strategy formulation quality in the performance of the banking industry.

The relationship between market performance and financial performance, hypothesis

6, was supported too and it is in accordance with the study of Spanos & Lioukas (2001).

These authors argue that market performance is a predecessor of profitability, despite of others researchers interpret the association between market performance and profitability as an evidence of firm’s internal capabilities impact on the firm success. These findings reinforce the idea that internal capabilities and strategy typologies are complementary and related to business performance and competitive advantage. It should be noted that certain types of internal capacities have a particular relationship with a particular type of strategy.

Marketing capabilities are related to the focus strategy and management skills to the cost leadership strategy. Nevertheless, and although it was found evidences in the literature of the relationship between the technological capabilities and the differentiation strategy the data of this study. This finding may indicate a peculiarity of the Brazilian textile industry regarding the use of technology to differentiate itself in the market. Another result indicates that the industry has a tendency to use combined strategies, leading to a positive performance in the market.

The research revealed that the differentiation strategy results in an increased market performance, but does not act directly on financial performance. However, capacity management has a positive effect on the financial performance.

6. Conclusions, limitations, and future research

This study sought to evaluate the effectiveness of business strategies adopted by the

Brazilian textile companies. Effectiveness was assessed by means of a model based on the relationships between internal capabilities, types of competitive strategies or methods, the ability to execute strategies, strategy formulation quality and their impact on the market and financial performance. Regarding to internal capabilities, the study found that the management capability produces a positive and significant impact on the financial performance of companies. Moreover, certain types of internal capabilities are more related to the adoption of certain typology of strategies. Marketing capabilities have an impact on focus strategy and the management capabilities have an impact on cost leadership strategy.

However, it was expected that the technological capabilities were related to the differentiation strategy, but this hypothesis was not supported by the data.

The use of combined strategies by Brazilian textile companies is also a result of the study. However, the strategy that has a positive impact on Market Performance is the differentiation strategy, while the cost leadership and focus strategies have their indirect

11

effects on performance through differentiation strategy. It seems that companies adopt initially a focus strategy, then a cost leadership strategy and after that, differentiate.

The ability to implement strategies strongly influences the quality of formulating strategies, proving that it is important for businesses to adopt principles and patterns of behavior that may favor the implementation of developed or emerging strategies and ensure the quality of the next planning cycle. It was also found that the strategy formulation quality has a positive impact on market performance.

It was also found that the market performance has a strong impact on financial performance, which corroborates previous research results, such as Spanos & Lioukas (2001) study, among others.

This study has some limitations that can be explored in future works. The difficulty to obtain answers from executive managers restricted the sample size. Our suggestion for future studies is to obtain data from others Brazilians’ states and from others industries, beyond textiles manufacturing. Comparisons between countries could be interesting. The data collection occurred in a given moment, or in cross-section, which could be another limitation.

It could be better to have a longitudinal collection enabling more detailed findings.

Future works could also investigate further the relationship between technological capabilities and the differentiation strategy, to see if this association is contingent do the sector of firm’s activity.

References

Acquaah, M. & Yasai-Ardekani, M. (2008). Does the implementation of a combination competitive strategy yield incremental performance benefits? A new perspective from a transition economy in Sub-Saharan Africa. Journal of Business Research , 61(4), 346-354.

Amoako-Gyampah, K. & Acquaah, M. (2008). Manufacturing strategy, competitive strategy and firm performance: An empirical study in a developing economy environment.

International. Journal of Production Economics, 111(2), 575-592.

Anderson, J.C. & Gerbing, D.W. (1988). Structural equation modelling in practice: a review and recommended two-step approach. Psychological Bulletin, 103(3), 411-413.

Babbie, E. (2003). Metodologia de Pesquisa de Survey. Tradução de Guilherme Cezarino.

Belo Horizonte: UFMG.

Baker, G.A. & Leidecker, J.K. (2001). Does it pay to plan? Strategic planning and financial performance. Agribusiness, 17(3), 355–364.

Bowman, C. & Ambrosini, V. (1997). Perceptions of strategic priorities, consensus and firm performance. Journal of management Studies, 34(2), 241-258.

Bowman, C. & Toms, S. (2010). Accounting for competitive advantage: The resource based view of the firm and the labour theory of value. Critical Perspectives on Accounting, 21(3),

183–194.

Browne, M.W. & Cudeck, R. (1993). Alternative ways of assessing model fit: Testing structural equation models. In: K. A. Bollene and J. S. Long, ed. 1993. Testing Structural

Equation Models. Sage Publications, Newbury Park. Chapter 2.

Campbell-Hunt, C. (2000). What we have learned about generic competitive strategy? A meta-analysis.

Strategic Management Journal

, 21(4), 127–154.

Cater, T. & Pucko, D. (2010). Factors of effective strategy implementation: Empirical evidence from Slovenian business practice. Journal for East European Management Studies.

Chemnitz, 15(3), 207-236.

Crittenden V.L. & Crittenden, W.F. (2008). Building a capable organization: The eight levers of strategy implementation. Business Horizons, 51(4), 301-309.

12

Day, G.S. (1994). The capabilities of market-driven organizations. Journal of Marketing,

58(4), 37-52.

DeSarbo, W.S., Anthony Di Benedetto, C. & Sinha, I. (2005). Revisiting the Miles and Snow strategic framework: Uncovering interrelationships between strategic types, capabilities, environmental uncertainty, and firm performance. Strategic Management Journal, 26(1), 47-

74.

Dess, G.G. & Davis, P.S. (1984). Porter’s (1980): Generic strategies as determinants of strategic group membership and organizational performance. Academy of Management

Journal, 27(3), 467-488.

Fornell, C. & Larcker, D.F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50.

Green, R.F., Lisboa, J. & Yasin, M.M. (1993). Porter´s (1980) generic strategies in Portugal.

European Business Review, 93(2), 3-10.

Hahn, W. & Powers. T.L. (2010). Strategic plan quality, implementation capability, and firm performance. Academy of Strategic Management Journal, 9(1), 63-81.

Hatcher, L. (1994). A set-by-step approach to using the SAS system for factor analysis and structural equation modelling. SAS Institute, Cary: NC.

Heide, M. Gronhaug, K. & Johannessen, S. (2002). Exploring barriers to the successful implementation of a formulated strategy. Scandinavian Journal of Management, 18(2), 217-

231.

Hooper, D., Coughlan, J. & Mullen, M.R. (2008). Structural equation modelling: Guidelines for determining model fit. The Electronic Journal of Business Research Methods, 6(1), 53-60.

Hrebiniak, L.G. (2006a). Fazendo a estratégia funcionar: o caminho para uma execução bemsucedida. Porto Alegre: Bookman, Brazil.

Hrebiniak, L.G. (2006b). Obstacles to effective strategy implementation. Organizational

Dynamics, 35(1), 12-31.

Hu, L.T. & Bentler, P.M. (1999). Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modelling, 6(1),

1-55.

Hulland, J., Chow, Y.H. & Lam, S. (1996). Use of causal models in marketing research: A review. International Journal of Research in Marketing, 13(2), 181-197.

Jaccard, J. & Wan, C.K. (1996). Lisrel approaches to interaction effects in multiple regression. Thousand Oaks, CA: Sage Publications.

Jácome, R., Lisboa, J. & Yasin, M. (2002). Time-based differentiation – an old strategic hat or an effective strategic choice: An empirical investigation. European Business Review, 14(3),

184-193.

Johannessen, J.A. & Olsen, B. (2010). The future of value creation and innovations: Aspects of a theory of value creation and innovation in a global knowledge economy. International

Journal of Information Management, 30(6), 502-511.

Johnson, L.K. (2004). Execute your strategy — without killing it. Harvard Management

Update, 9(12), 3-6.

Jöreskog, K. & Sörbom, D. (1993). LISREL 8: User’s reference guide, Scientific Software

International, Chicago.

Kaplan, R.S. and Norton, D.P. (2001). Organização orientada para a estratégia: como as empresas que adotam o balanced scorecard prosperam no novo ambiente de negócios. Rio de

Janeiro: Campus, Brazil.

13

Kim, E., Nam, D. & Stimpert, J.L. (2004). Testing the applicability of Porter's generic strategies in the digital age: A study of Korean cyber malls. Journal of Business Strategies,

21(1), 19-45.

Kim, L. & Lim, Y. (1988). Environment, generic strategies, and performance in a rapidly developing country: A taxonomic approach. Academy of Management Journal, 31(4), 802-

827.

Leitner, K.H & Guldenberg, S. (2010). Generic strategies and firm performance in SMEs: A longitudinal study of Austrian SMEs. Small Business Economics, 35(3), 169-189.

Mankins, M.C. & Steele, R. (2005). Turning great strategy into great performance. Harvard

Business Review, 83(7), 64-72.

Marques, A., Lisboa, J., Zimmerer, T.W. & Yasin, M.M (2000). The effectiveness of strategies employed by dominant firms in the Portuguese crystal glass industry: An empirical investigation. European Business Review, 12(1), 34-40

Meskendahl, S. (2010). The influence of business strategy on project portfolio management and its success - A conceptual framework. International Journal of Project Management,

28(2), 807-817.

Miles, J. & Shevlin, M. (1998). Effects of sample size, model specification and factor loadings on the GFI in confirmatory factor analysis. Personality and Individual Differences,

25(1), 85-90.

Miller, A. & Dess, G.G. (1993). Assessing Porter's (1980) model in terms of its generalizability, accuracy and simplicity. The Journal of Management Studies, 34(4), 553-

585.

Ormanidhi, O. & Stringa, O. (2008). Porter’s model of generic competitive strategies.

Business Economics, 43(3), 55-64.

Ortega, M.J.R. (2009). Competitive strategies and firm performance: Technological capabilities' moderating roles. Journal of Business Research, 63(12), 1273-1281

Parnell, J.A. (2011). Strategic capabilities, competitive strategy, and performance among retailers in Argentina, Peru and the United States. Management Decision, 49(1), 130-155.

Porter, M. (1980). Competitive strategy: techniques for analyzing industries and competitors.

New York: Free Press.

Porter, M. (1985). Competitive advantage: creating and sustaining superior performance. New

York: Free Press.

Porter, M. (1989). Vantagem competitiva. Rio de Janeiro, Campus, Brazil.

Porter, M. (2008). The Five Competitive Forces That Shape Strategy. Harvard Business

Review, January 2008.

Ray, G., Barney, J.B. & Muhanna, W.A. (2004). Capabilities, business processes and competitive advantage: Choosing the dependent variable in empirical tests of the resourcebased view. Strategic Management Journal, 25(1), 23-37.

Robinson, R.B. Jr. & Pearce, J.A. (1988). Planned patterns of strategic behavior and their relationship to business-unit performance. Strategic Management Journal, 9(1), 43-60.

Schumacker, R.E. & Lomax, R.G. (1996). A beginner's guide to structural equation modelling. Lawrence Erlbaum Associates, Mahwah, New Jersey.

Silva, G. (1996). Estratégias genéricas de Porter: O caso da indústria portuguesa de moldes.

Master Dissertation, University of Coimbra, School of Economics, Portugal.

Spanos, Y.E. & Lioukas S. (2001). An examination into the causal logic of rent generation: contrasting Porter's competitive strategy framework and the resource based perspective.

Strategic Management Journal, 22(10), 907-934.

14

Spanos, Y.E., Zaralis, G. & Lioukas, S. (2004). Strategy and industry effects on profitability: evidence from Greece. Strategic Management Journal, 25(2), 139-165.

Speculand, R. (2006). The great big strategy challenge. Strategic Direction, 22(3), 3-5.

Steiger, J.H. (2007). Understanding the limitations of global fit assessment in structural equation modeling. Personality and Individual Differences, 42(5), 893-898.

Venkatraman, N. & Ramanujam, V. (1986). Measurement of business performance in strategy research: A comparison of approaches Massachusetts Institute of Technology. Academy of

Management Review, 11(4), 801-814.

Zahra, S.A & Covin, J.G. (1993). Business strategy, technology policy and firm performance.

Strategic Management Journal, 14(6), 451-478.

15

![[5] James William Porter The third member of the Kentucky trio was](http://s3.studylib.net/store/data/007720435_2-b7ae8b469a9e5e8e28988eb9f13b60e3-300x300.png)