Questions Related to the Link & Learn Taxes

advertisement

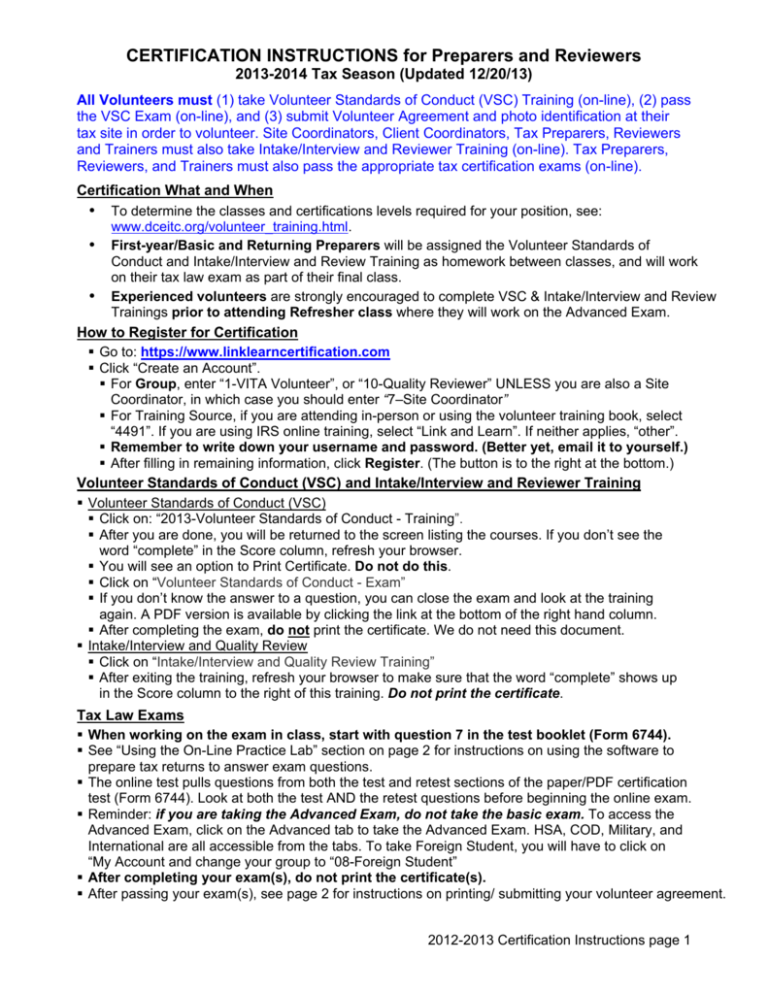

CERTIFICATION INSTRUCTIONS for Preparers and Reviewers 2013-2014 Tax Season (Updated 12/20/13) All Volunteers must (1) take Volunteer Standards of Conduct (VSC) Training (on-line), (2) pass the VSC Exam (on-line), and (3) submit Volunteer Agreement and photo identification at their tax site in order to volunteer. Site Coordinators, Client Coordinators, Tax Preparers, Reviewers and Trainers must also take Intake/Interview and Reviewer Training (on-line). Tax Preparers, Reviewers, and Trainers must also pass the appropriate tax certification exams (on-line). Certification What and When To determine the classes and certifications levels required for your position, see: www.dceitc.org/volunteer_training.html. First-year/Basic and Returning Preparers will be assigned the Volunteer Standards of Conduct and Intake/Interview and Review Training as homework between classes, and will work on their tax law exam as part of their final class. Experienced volunteers are strongly encouraged to complete VSC & Intake/Interview and Review Trainings prior to attending Refresher class where they will work on the Advanced Exam. How to Register for Certification Go to: https://www.linklearncertification.com Click “Create an Account”. For Group, enter “1-VITA Volunteer”, or “10-Quality Reviewer” UNLESS you are also a Site Coordinator, in which case you should enter “7–Site Coordinator” For Training Source, if you are attending in-person or using the volunteer training book, select “4491”. If you are using IRS online training, select “Link and Learn”. If neither applies, “other”. Remember to write down your username and password. (Better yet, email it to yourself.) After filling in remaining information, click Register. (The button is to the right at the bottom.) Volunteer Standards of Conduct (VSC) and Intake/Interview and Reviewer Training Volunteer Standards of Conduct (VSC) Click on: “2013-Volunteer Standards of Conduct - Training”. After you are done, you will be returned to the screen listing the courses. If you don’t see the word “complete” in the Score column, refresh your browser. You will see an option to Print Certificate. Do not do this. Click on “Volunteer Standards of Conduct - Exam” If you don’t know the answer to a question, you can close the exam and look at the training again. A PDF version is available by clicking the link at the bottom of the right hand column. After completing the exam, do not print the certificate. We do not need this document. Intake/Interview and Quality Review Click on “Intake/Interview and Quality Review Training” After exiting the training, refresh your browser to make sure that the word “complete” shows up in the Score column to the right of this training. Do not print the certificate. Tax Law Exams When working on the exam in class, start with question 7 in the test booklet (Form 6744). See “Using the On-Line Practice Lab” section on page 2 for instructions on using the software to prepare tax returns to answer exam questions. The online test pulls questions from both the test and retest sections of the paper/PDF certification test (Form 6744). Look at both the test AND the retest questions before beginning the online exam. Reminder: if you are taking the Advanced Exam, do not take the basic exam. To access the Advanced Exam, click on the Advanced tab to take the Advanced Exam. HSA, COD, Military, and International are all accessible from the tabs. To take Foreign Student, you will have to click on “My Account and change your group to “08-Foreign Student” After completing your exam(s), do not print the certificate(s). After passing your exam(s), see page 2 for instructions on printing/ submitting your volunteer agreement. 2012-2013 Certification Instructions page 1 Training Materials: will be handed out at training and are on-line at www.irs.gov and http://bit.ly/1hSiCNN Volunteer Training Book (4491) Volunteer Test Book (6744) Pub. 4012 HSA and COD training/test Practice Workbook (4491W) (4942) Other resources: IRS Link & Learn Training: http://www.irs.gov/app/vita/ Pub. 17: http://www.irs.gov/pub/irs-pdf/p17.pdf Foreign Student Test (4704-FS) Using the On-Line Practice Lab (for practice and testing) Completion of the certification test requires preparing several tax returns. New volunteers are strongly encouraged to use Practice Lab to complete the tax returns and for practice preparing tax returns. Note to experienced volunteers: look at the test questions for each scenario as you may find that you can print and fill out a couple worksheets instead of preparing the complete return. WARNING: You must use Internet Explorer for the Practice Lab to function correctly. In Internet Explorer, go to: http://www.voltaxprep.com/ Log in using the password learntwo The first time you log in, you need to click “Create New User”. Write Down YOUR 6-digit User ID. It cannot be retrieved if it is lost or misplaced. (Email it to yourself for backup.) You can use your User ID and Zip Code from last year if you remember it. See Pub. 4012 for tips on using TaxWise Online. See page N-2 (page 182 in the PDF) for the shortcuts and how to get the red out. See page N-7 for navigating and linking (page 187 in the PDF) You can save your work by using the save button at the top of the screen. When you log back into the Practice Lab with your User ID use the link “All Returns.” While in a return, you may need to press “save” for automatic calculations to happen. Example: After entering wages into box 1 of the W-2, you need to click save (on the button bar at the top of the screen) for boxes 3, 4, 5, and 6 to calculate. You will use your User ID to complete the SSNs and EINs when creating returns. The first three numbers of the SSN and EINs are provided in the scenarios. Replace the X’s in the SSNs and EINs with the six digit User ID generated from the Practice Lab. Use the Run Diagnostics button to run Diagnostics in the Practice Lab. Printing & Submitting Volunteer Agreement After completing your tax law test(s): 1. On the right side of the screen, you will see a box that says, “You may sign your Volunteer Agreement electronically by checking this box.” Click the box 2. Under the box, you will see “Click here to open and complete your Volunteer Agreement”. 3. Click on the link. It will generate your volunteer agreement with your test results. 4. Click on the printer icon to print the form. [If you are unable to print, bring your username & password your first day. Your Site Coordinator will help you print your agreement.] 5. After printing the form: Under volunteer position(s) enter the primary position(s) you will fill at this site. Cross out and fill in the correct position. (Choose from: Interpreter, Client Coordinator, Greeter, SNAP, Tax Preparer, Site Coordinator, Reviewer, E-filer, or Client Story Collection.) Under “Number of years volunteered” make sure the correct number is entered (cross out and correct the number if necessary). Enter 1 if this is your first year. Under Volunteer Signature: if you name is not preprinted, sign the form 6. All volunteers: Take your photo ID and volunteer agreement to your tax site the first day. (If you volunteer at more than one site, you will need to take one to each site.) 7. Reviewers, Trainers, and Site Coordinators: also submit your agreement to CTA; Fax: 202-521-3988 (no cover letter necessary), or Email: taxtestresults@yahoo.com, or Mail: Community Tax Aid, 218 D Street SE, 1st Floor, Washington, DC 20003 2012-2013 Certification Instructions page 2