Chapter 8 solutions

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

CHAPTER 8

INVENTORY

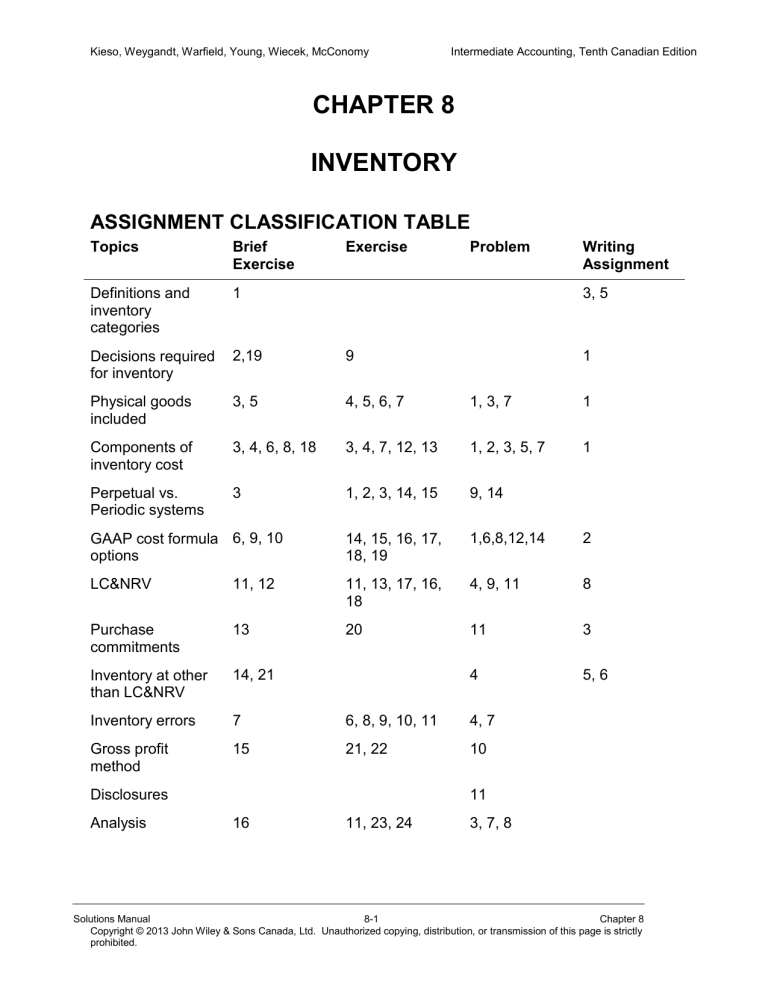

ASSIGNMENT CLASSIFICATION TABLE

Topics Brief

Exercise

Exercise Problem

Definitions and inventory categories

1

Decisions required for inventory

2,19

3, 5 Physical goods included

Components of inventory cost

Perpetual vs.

Periodic systems

3, 4, 6, 8, 18

3

9

4, 5, 6, 7

3, 4, 7, 12, 13

1, 2, 3, 14, 15

1, 3, 7

1, 2, 3, 5, 7

9, 14

GAAP cost formula options

6, 9, 10

LC&NRV 11, 12

13

14, 15, 16, 17,

18, 19

11, 13, 17, 16,

18

20

1,6,8,12,14

4, 9, 11

11 Purchase commitments

Inventory at other than LC&NRV

Inventory errors

14, 21

7

15

6, 8, 9, 10, 11

21, 22

4

4, 7

10 Gross profit method

Disclosures

Analysis 16 11, 23, 24

11

3, 7, 8

Writing

Assignment

3, 5

1

1

1

2

8

3

5, 6

Solutions Manual 8-1 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

ASSIGNMENT CLASSIFICATION TABLE (Continued)

Topics Brief

Exercise

Exercise Problem Writing

Assignment

4, 11, 13,14 4, 7, 11, 20, 26 2, 11 3, 5, 7 ASPE GAAP vs.

IFRS

Retail method

Primary GAAP sources

17

20

25

27

13 6

4

Solutions Manual 8-2 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE

Level of

Item Description

Time

Difficulty (minutes)

E8-1 Periodic versus perpetual entries.

E8-2 Determining merchandise amounts.

Moderate

Simple

15-25

10-20

E8-3 Purchases recorded net, periodic system. Moderate 15-20

E8-3 Inventoriable costs. Simple 10-15

E8-4

E8-5

E8-6

E8-7

Inventoriable costs.

Inventoriable costs - perpetual

Inventoriable costs-error adjustment

Inventoriable costs

Simple 10-15

Moderate 15-20

Moderate 15-20

Moderate 15-20

Simple 10-15

Moderate 15-20

E8-8 Inventory errors.

E8-9 Inventory errors.

E8-10 Inventory errors

E8-11 Lower of cost and NRV—error effect and analysis.

E8-12 Relative sales value method.

E8-13 Cost allocation and LC&NRV.

E8-14 Calculate FIFO, moving average cost — perpetual and periodic.

Complex 30-35

Simple

Simple

Moderate

Moderate

15-20

15-20

20-25

15-20

E8-15 SI, FIFO and weighted average.

E8-16 Calculate FIFO, weighted average cost — periodic

Moderate

Moderate

15-20

20-25

E8-17 Calculate FIFO, moving average cost — perpetual.

Complex 40-55

E8-18 Lower of cost and NRV

—journal entries.

Simple 10-15

E8-19 Lower of cost and NRV —valuation account. Moderate 20-25

E8-20 Purchase commitments. Simple 15-20

Solutions Manual 8-3 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE (Continued)

Item Description

Level of

Difficulty

Time

(minutes)

E8-21 Gross profit method. Simple 10-15

E8-22 Gross profit method. Moderate 15-20

E8-23

E8-24

*E8-25

E8-26

Inventory trend analysis and ratios.

Trend analysis and ratios.

Retail inventory method.

Biological inventory assets

Moderate 20-25

Complex 20-25

Simple

Simple

20-25

20-25

10-15 E8-27 Primary sources of GAAP

P8-1 Various inventory issues.

Simple

P8-2 Vendor rebates.

P8-3 Inventory adjustments.

P8-4 Income statement restatement and analysis for LC&NRV.

Moderate

Moderate

Moderate

Moderate

P8-5 Purchases recorded gross and net.

P8-6 FIFO Weighted average

– periodic.

P8-7 Inventory and other errors

– effect on ratios.

Simple

Moderate

Complex

P8-8 Calculate FIFO and weighted average cost income and ratios.

P8-9 Entries for lower of cost and NRV —direct and allowance.

Moderate

Moderate

Moderate

Complex

P8-10 Gross profit method.

P8-11 Statement and note disclosure, LC&NRV, and purchase commitment.

P8-12 Lower of cost and NR.

*P8-13 Retail inventory method.

P8-14 Calculate FIFO, moving average cost — perpetual.

Moderate

Moderate

Moderate

25-30

25-30

30-40

30-40

20-25

20-25

30-40

30-40

20-25

30-35

40-50

30-35

20-30

20-30

Solutions Manual 8-4 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 8-1

Raw Materials

Inventory

Work in Process

Inventory

Finished

Goods

Inventory

Other

(d)Standby equipment

(fixed asset)

(a)Engine

(b)Nuts and

Bolts (or materials and supplies inventory)

(e)Direct Labour:

Wages paid to assembly line employees

(h)Toyota

Corolla ready to be shipped to the dealer

(f)Manufacturing

Overhead:

Factory Rent

(g)Manufacturing

Overhead:

Wages paid to supervisors

The response would remain unchanged under ASPE.

(i)Manufacturing plant (fixed asset)

(c) Spare parts

Solutions Manual 8-5 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-2

Users of the financial statements will be interested in knowing the total investment made in inventories, the various types of inventory, how the inventory costs are calculated, whether the inventories have been pledged as collateral on any loans, and whether the inventories have been written down due to a decline in value.

BRIEF EXERCISE 8-3

(a) Perpetual Inventory System

Accounts Payable ................................................... 20,000

600 Inventory .................................................................

Sales Revenue ........................................................ 30,000

Inventory .................................................................

(b) Periodic Inventory System

15,000

Accounts Payable ................................................... 20,000

600 Purchase Returns and Allowances .......................

Sales ........................................................................ 30,000

Solutions Manual 8-6 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-3 (Continued)

(c)

Balance of 94 units is calculated as follows:

Unit Total

Beg. Inventory

@$100

50 $ 5,000

Purchases 200 20,000

Less: Purchase Returns (6) (600)

Cost of Goods Sold (150) (15,000)

Ending balance 94 $ 9,400

Purchases ............................................................... 20,000

*$9,400

– 5,000

Solutions Manual 8-7 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-4

(a) Invoice paid in full on July 15

(1) July 11 Purchases ........................................................................

July 15 Accounts Payable ............................................................

($4,000 X .03)

(2) July 11 Purchases ........................................................................

($4,000 X .97)

July 15 Accounts Payable ............................................................

(b) Invoice paid on July 31

(1) July 11 Purchases ........................................................................

July 31 Accounts Payable ............................................................

(2) July 11 Purchases ........................................................................

($4,000 X .97)

July 31 Accounts Payable ............................................................

(Discount lost on purchase

of July 11, $4,000, terms

3/10, n/30)

Solutions Manual 8-8 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-4 (Continued)

(c)

If Serafina is a private company reporting under ASPE:

Under ASPE, the only requirement is that the amount of interest be disclosed if it is capitalized into the cost of inventory. Therefore,

Serafina can choose to add the interest costs to the product costs.

(d)

If Serafina is a public company:

Under IFRS, interest costs incurred for inventory are capitalized if the inventory takes a long time to produce or manufacture – such as wine production. Additionally, if the interest costs relate to inventory manufactured in large quantities on a repetitive basis, a choice is permitted for capitalization.

BRIEF EXERCISE 8-5

December 31 inventory per physical count

Less: inventory on consignment for Delhi

Add:

Goods-in-transit purchased FOB shipping point

Goods-in-transit sold FOB destination

December 31 inventory

$2,000

(500)

400

180

$2,080

Solutions Manual 8-9 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-6

(a) Vendor rebates are recorded as a reduction to the cost of inventory when the rebate is “realizable”. Under the conceptual framework, the definit ion of an ‘asset’ and the recognition criteria must be satisfied.

If the rebate is discretionary on the part of the supplier (Traders), the definition and recognition criteria are not fulfilled. The rebate will only be recorded when the cash is received or Traders acknowledges that payment will be made.

If Doors Unlimited can reasonably estimate the amount of the rebate and receipt of the rebate is probable, an accrual can be made in advance. The amount recognized is the proportional amount relative to the total transactions to date.

(b) The amount that should be accrued is the expected rebate amount per unit for the calendar year multiplied by the number of units purchased to date.

The annual amount of the rebate expected is:

3,000 units to date X 2 = 6,000 units

Excess of the total units over the base amount of 3,500 is 2,500 X

$0.25 = total rebate of $625.00

The amount of purchases to date is half of the total amount of expected annual purchases. Consequently, accrue a rebate receivable at June 30, 2014 of half of the total expected rebate or

$625 X .5 = $312.50

(c) Per unit price to be used for costing:

Invoice price paid 3,000 units at $2.50 = $7,500.00

Less rebate 312.50

Net cost

Divided by units purchased to date

Per unit cost

$7,187.50

3,000

$2.3958

Solutions Manual 8-10 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-7

Cost of goods sold as reported

Overstatement of 12/31/13inventory

Overstatement of 12/31/14 inventory

Corrected cost of goods sold

12/31/14 Retained Earnings as reported

Overstatement of 12/31/14inventory

Corrected 12/31/14 retained earnings

$2,400,000

(155,000)

45,000

$2,290,000

$4,200,000

(45,000)

$4,155,000

BRIEF EXERCISE 8-8

Group

Number of CDs

Sales

Price

Total

Sales

Price

Relative

Sales

Price

Total

Cost

Cost

Allocated

Cost per CD

1 100 $ 5 $ 500 5/100 $7,500 $ 375 $3.75

2 800 $10 8,000 80/100 $7,500 6,000 $7.50

3 100 $15 1,500 15/100 $7,500 1,125 $11.25

$10,000 $7,500

Solutions Manual 8-11 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-9

(a) Periodic Weighted Average

Weighted average cost per unit

$14,000

1,000

= $14.00

Ending inventory 400 X $14 =

Cost of goods available for sale

Deduct ending inventory

Cost of goods sold

Or, Cost of goods sold

$5,600

$14,000

5,600

$ 8,400

600 units sold X $14.00 $ 8,400

(b) Periodic FIFO

June 23

Ending inventory

400 X $15 = $6,000

$6,000 400 units

Cost of goods available for sale

Deduct ending inventory (400 X

$15)

Cost of goods sold

$14,000

6,000

$ 8,000*

Alternatively, cost of goods sold = (200 X $12) + (400 X

$14) = $8,000.

Solutions Manual 8-12 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-9 (Continued)

(c) Specific Identification

Cost of Goods Sold:

200 X $12 = $2,400

300 X $14 = 4,200

100 X $15 = 1,500

$ 8,100

Cost of goods available for sale

Deduct cost of goods sold

Ending inventory

Or, ending inventory: (100 X $14) + (300 X $15) =

$14,000

8,100

$ 5,900

$ 5,900

Solutions Manual 8-13 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-10

(a)

Perpetual moving average cost:

Purchased Sold

Date

No. of units

Unit cost Amount

No. of units

Unit cost Amoun t

No. of units

Balance

Unit cost

Amount

Nov 1 250 $12 $3,000

Nov 15

Nov 19

400 14 5,600

250

650

$12.00

13.23 (1)

600 $13.23

$7,938 50 13.23

$ 3,000

8,600

662

Nov 23 350 15 5,250 400 14.78 (2) 5,912

Cost of Goods sold: $7,938

Ending Inventory Nov 30: $5,912

(1) ($3,000 + $5,600) = $ 13.23

(250 units + 400 units)

(2) ($662 + $5,250) = $ 14.78

(50 units + 350 units)

(b) Perpetual First-in, first out.

Purchased Sold Balance

Date

No. of units

Unit cost

No. of units

Unit cost Amount

No. of units

Unit cost Amount

Nov 1 Beg. Bal. 250 $12 $ 3,000

Nov 15 400 14

Nov 19

250 12 }

Nov 23 350 15

8,600

250 12 3,000

400 14 }

350 14 4,900 50 14 700

50 14 }

350 15 } 5,950

$7,900

Cost of Goods sold: $7,900

Ending Inventory Nov 30: $5,950

Solutions Manual 8-14 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-11 a) Assuming public company reporting under IFRS:

Estimated Estimated

Item

Neutrinos

Cost

$1,820

Selling

Price

$2,100

Disposal

Costs NRV

LC and

NRV

$100 $2,000 $1,820

Ocillinos

Electrons

Protons

5,000

4,290

3,200

4,900

4,625

4,210

100

200

100

4,800

4,425

4,110

4,800

4,290

3,200

$14,310 $15,335 $14,110

(b) Assuming Antimatter is a private company reporting under ASPE:

There would be no difference in accounting.

Solutions Manual 8-15 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-12

(a) Dec 31, 2013

(1) Direct method

Inventory ......................................................................... 7,075

($68,700 less $61,625).

Note that the inventory would have been written down to $54,000 in 2012 and this amount would be booked to CGS in 2013 when the inventory was sold.

(2) Indirect method

Allowance to Reduce Inventory to NRV ........................

($68,700 less $61,625) $7,075 less allowance balance

5,475 from December 31, 2012 of $1,600 ($55,600 - $54,000).

Since the opening inventory has been sold, the original cost of $55,600 has been booked to CGS. Under this method, the original cost is preserved and the writedown is effected through an adjustments to the allowance account.

(b) Dec 31, 2014

(1) Direct method

No entry needed as cost is lower than NRV. The opening inventory of $61,625 (NRV) would have been booked to CGS when sold in 2014.

(2) Indirect method

Recovery of Loss on Inventory Due to Decline in NRV. ..............................................................................

Balance December 31, 2013 of $7,075 ($68,700 - $61,625)

7,075

Solutions Manual 8-16 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-12 (Continued)

Any ‘gain’ under the indirect method is the excess of the credit effect of closing the beginning allowance over the debit effect of setting up the current year-end allowance. Recovering the loss up to original cost is permitted, but it may not exceed the original cost. Remember that the cost of the opening inventory ($68,700) would have been booked to CGS in 2014 when the opening inventory is sold. The JE shown above adjusts the allowance account to zero and also offsets the h igher “cost based” CGS.

Solutions Manual 8-17 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-13

(a)

Liability for Onerous Contracts ............................. 35,000

This assumes that the company expects it will incur a loss equal to the excess price it will have to pay above the market rate.

(b)

The entry in part (a) in effect recognized the loss on the commitment

(lower of cost and NRV) at December 31. The entry in (b) recognizes the inventory at i ts revised “cost”. Any of this inventory that is sold

Cash ......................................................................... 2,000,000 in the period (and the cost of goods sold) will be based on this

“cost” and a gross profit or loss will result. Any of the inventory remaining at the next balance sheet date will be reviewed for the lower of cost and net realizable value at that date and it will be adjusted accordingly. Alternatively, the inventory could be written down as soon as the acquisition is made so that it reflects the lower value of $1,915,000 at the date of acquisition. The $50,000 could be booked as an additional loss on contract. Either way, the $50,000 loss/cost is reflected in the period if the inventory has been sold

(either as part of CGS or as a Loss on Purchase Contracts)..

(c)

Under IFRS, if the unavoidable costs to complete a contract are higher than the benefits expected from receiving the goods under the contract, a loss provision is recognized as an onerous contract.

Although ASPE does not have a similar requirement, practice in

Canada has been to record the loss and liability as well. In essence, the accounting is the same.

Solutions Manual 8-18 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-14

(a) Inventory is generally reported at lower of cost and net realizable value. This works well for most industries. However, there are a few industries where reporting inventories at net realizable value, even if it above cost, is more appropriate. In such cases, the following criteria are necessary:

The sale is assured or there is an active market for the product

The disposal costs are estimable

(b) Under ASPE , biological assets such as sheep and produce at the point of harvest (such as wool) are excluded from the measurement standards of Section 3031 to the extent they are measured at NRV in accordance with established practice in that industry. Otherwise, the general provisions of accounting for inventory are used, i.e. use a lower of cost and net realizable value approach. These assets still must follow the expense recognition and disclosure requirements under Section 3031.

The carpet would be accounted for at the lower of cost and net realizable value in accordance with Section 3031 (i.e. it is not excluded from any of the requirements).

(c) There is specific guidance under IFRS for biological assets such as the sheep and the agricultural produce such as the wool

(IAS 41). IAS 41 provides that such inventories are measured at fair value less costs to sell.

Solutions Manual 8-19 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-15

Beginning inventory

Purchases

Cost of goods available

Sales

Less gross profit (31% X $1,100,000)

Estimated cost of goods sold

Estimated ending inventory destroyed in explosion

$ 310,000

780,000

$1,100,000

1,090,000

341,000

759,000

$ 331,000

BRIEF EXERCISE 8-16

Inventory Turnover Ratio =

=

Cost of Goods Sold

Average Inventory

$35,350

($5,310+5,706)/2

Average days to sell inventory =

= 6.42 times per year

365

Inventory Turnover Ratio

= 365

6.42 times

= 56.85 days

Solutions Manual 8-20 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

*BRIEF EXERCISE 8-17

Cost Retail

Beginning inventory

Net purchases

Net mark-ups

Total merchandise available for sale

$ 22,000 $ 30,000

157,500 215,000

_______ 10,000

$179,500 255,000

Deduct:

Net markdowns

Sales

Ending inventory at retail

Cost-to-retail ratio: $179,500 $255,000 = 70.4%

Ending inventory at lower of average cost and market

(70.4% X $63,500) = $ 44,704

7,000

184,500

$ 63,500

BRIEF EXERCISE 8-18 a) Yes, as raw materials inventory b) Yes, in retail inventory c) Yes, in work in progress d) Yes, a form of raw materials inventory e) No, this would be included in capital assets as it is equipment, not intended for sale. f) Yes, as a contract in progress g) Yes, as miscellaneous supplies inventory

Solutions Manual 8-21 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-19

Benefits of a just in time system include reduced inventory holding costs, such as warehouse space and storage, insurance, obsolete inventory, theft, the investment cost, etc.

The risks of a tight inventory management system generally result from stockouts. If the goods are not available in the store, the company loses a potential sale and creates an unhappy customer.

BRIEF EXERCISE 8-20 a) Under IFRS?

Primary sources of GAAP include IAS 2 – Inventories, IAS 32 and IAS 39 - financial instruments, IAS 11 – construction contracts, IAS 41 - Agriculture b) Under ASPE?

Primary sources of GAAP include Section 3031 – Inventories,

Section 3856 - financial instruments, 3400 – construction contracts. There is no separate guidance under ASPE for inventory of agricultural goods.

Solutions Manual 8-22 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-21

June 30 th a) May 1 – 31

Biological Assets

Cash b) June 30, 2014

1,000

1,000

Biological Assets

Accounts Payable

150

150

Biological Assets

Accounts Payable

150

150

Cost of hatchlings $1,000

Costs of feed and labour

Total costs incurred to date

300

1,300

Fair Value

Current fair value

Less transportation costs

1,800

300

Fair value less costs to sell $1500

Year End Adjustment 1500 – 1300 = 200

Biological Assets 200

Unrealized Gain or Loss 200

Solutions Manual 8-23 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 8-21 (Continued) c) Under ASPE , there is no specific guidance for accounting for

Biological assets. Section 3031 notes that these assets are excluded from the measurement requirements of Section 3031 if measured at NRV in accordance with well-established industry practice. Otherwise Section 3031 is applied and the chicks would be measured at $1,300. There would be no JE to adjust the assets up to the $1,500 fair value less costs to sell.

BRIEF EXERCISE 8-22

(a) Inventory 100

Interest Payable 100

Since the interest is capitalized, it is recorded as part of the cost of the inventory of wine.

(b) Under ASPE, companies can choose to either capitalize or expense the interest.

If a company chooses to expense the interest:

Dr Interest Expense 100

Cr Interest payable 100

If a company chooses to capitalize the interest, the entry will be the same as shown in part (a)

Solutions Manual 8-24 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 8-1 (15-25 minutes)

(a) July 4 Accounts Receivable .......................................................

Sales Revenue (120 X 2,250

$18.75) ..............................................................................

(b) Sales Revenue($1,440 + $2,250 +

$2,000)

Cost of goods sold

Gross profit

$5,690

4,825

$ 865

(c) For a periodic system, the journal entry would be

Purchases ($2,475 + 2,720) ...........................

Inventory (100 X $15) .....................................

5,195

1,500

Solutions Manual 8-25 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-1 (Continued)

(c) (Continued)

Therefore, the loss would be buried in Cost of Goods Sold assuming there are no accounting records available against which to compare the physical count. Alternately, if the company maintains a modified perpetual system, with accounting records tracking inventory in units, the company would then be able to identify the shortage and report it separately in the Other

Expenses and Losses section of the income statement. The loss of 8 units (110 - 102) or $136 (8 X $17) would then be recorded as inventory shrinkage to Inventory Over and Short and the Inventory account (ending) would be credited. If the shortage were caused by incorrect record keeping, the Inventory

Over and Short would be included in Cost of Goods Sold.

Solutions Manual 8-26 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-1 (Continued)

(d)

July 4 Accounts Receivable .......................................................

Cost of Goods Sold .........................................................

July 11 Inventory ..........................................................................

Accounts Payable (150 X 2,475

$16.50) ..............................................................................

July 13 Accounts Receivable .......................................................

Inventory ([(20 X $15) +

Cost of Goods Sold .........................................................

July 20 Inventory ..........................................................................

July 27 Accounts Receivable .......................................................

Inventory [(50 X $16.50) +

Cost of Goods Sold .........................................................

(e) Sales Revenue

Cost of goods sold

($1,200 + $1,950 +$1,675)

Gross profit

$5,690

4,825

$ 865

Solutions Manual 8-27 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-1 (Continued)

(f) Since the loss can be identified, the company would be able to identify the shortage and report it separately in the Other

Expenses and Losses section of the income statement.

The loss of 8 units would be recorded as inventory shrinkage to

Inventory Over and Short and the Inventory account (ending) would be credited. If incorrect record keeping caused the shortage, the Inventory Over and Short would be included in

Cost of Goods Sold.

Solutions Manual 8-28 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-2 (10-20 minutes)

2013 2014 2015

Sales

Sales returns

Net sales

Beginning inventory

Ending inventory

Purchases

Purchase returns and allowances

Transportation-in

Cost of good sold

Gross profit on sales

$290,000 $360,000 $410,000

6,000 13,000 10,000

284,000 347,000 400,000

20,000 32,000 37,000**

32,000* 37,000 34,000

247,000 260,000 298,000

5,000

8,000

8,000 10,000

9,000 12,000

238,000 256,000 303,000

46,000 91,000 97,000

*This was given as the beginning inventory for 2014.

**This can be calculated as the ending inventory for 2014.

Solutions Manual 8-29 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-3 (15-20 minutes)

(a) March 10 Purchases ........................................................................

($25,000 X .97)

($26,575 X .99)

Accounts Payable

(b) March 31 Purchase Discounts Lost ................................................

Accounts Payable

(Discount lost on purchase

of March 11, $26,575, terms

1/15, n/30)

Solutions Manual 8-30 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-3 (Continued)

(c) March 10 Purchases ........................................................................

(d) No entry is required at March 31 as the account balances are properly stated. It is not yet known if the discount on the March

24 purchase will be earned.

(e) From the perspective of the general manager, the net method provides additional information that is valuable in managing the business. Under the net method, the amount of purchase discounts lost is highlighted and quantified. Under the gross method, only discounts that are taken are recorded. The general manager would therefore have no means of determining the instances where the discounts were lost. Purchase discounts lost should be scrutinized carefully to determine the reason why this occurred. Plans can then be put into place to take advantage of any discounts in the future. These plans would include securing operating lines of credit that can be used in the short term to earn purchase discounts when offered by suppliers, or streamlining the accounting process so that payments can be processed quickly in order to take advantage of the discounts.

Solutions Manual 8-31 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-4 (10-15 minutes)

(a)

Inventory per physical count....................................................... $441,000

Goods in transit to customer, f.o.b. destination ........................ + 33,000

Goods in transit from vendor, f.o.b. shipping point ................. + 51,000

Inventory to be reported on balance sheet................................ $525,000

Item 1 - The consigned goods of $61,000 are not owned by Solaro and were properly excluded.

Item 3 - The goods in transit to a customer of $46,000, shipped f.o.b. shipping point, are properly excluded from the inventory because the title to the goods passed when they left the seller and therefore a sale and related cost of goods sold should be recorded in 2014.

Item 4 - The goods in transit from a vendor of $73,000, shipped f.o.b. destination, are properly excluded from the inventory because the title to the goods does not pass to Solaro until the buyer (Solaro) receives them.

Item 6 - Storage costs to store excess inventory cannot be inventoried; i.e., these charges must be expensed as a period cost.

Storage costs can only be added to the cost of inventory if they are necessary in the production process – i.e. wine making process).

Item 7 - Interest costs that are incurred from delayed purchase plans for inventories that are ready for sale or use are not product costs.

Solutions Manual 8-32 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-4 (Continued)

(b) Private company:

Under ASPE, the only requirement is that the amount of interest be disclosed if it is capitalized as part of the cost of inventory.

Therefore, Solaro can choose to add the interest costs to the product costs. But, following basic principles, ordinary financing costs would not qualify as an inventoriable product cost. Therefore, it would have to be in similar circumstances to those found under IFRS standards.

(c) A public company:

Under IFRS, interest costs incurred for inventory are capitalized if the inventory takes a long time to produce or manufacture – such as wine production. Additionally, if the interest costs relate to inventory manufactured in large quantities on a repetitive basis, a choice is permitted for capitalization.

Solutions Manual 8-33 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-5 (10-15 minutes)

(a)

1. Raw Materials ..................................................................

2. No adjustment necessary.

3. Raw Materials ..................................................................

4. Accounts Payable ............................................................

5. Raw Materials ..................................................................

Item 6 represents a special sales agreement between the supplier and

Motuto Machine. In this arrangement, the supplier has simply ‘parked’ its inventory with Motuto’s for a short purpose and has agreed to buy it back in January (presumably after the supplier’s year end). The risks and rewards of ownership have not passed to Motuto, this inventory should remain the supplier’s books at December 31, 2014.

See further discussion below under (b) regarding the ethics.

Item 7 represents consignment inventory. Motuto does not record this as inventory on its books at December 31, 2014. The inventory belongs to Able and should be recorded on its books at December

2014.

Item 1 should be reversed, since the journal entry was also made on

Jan 2. Item 4 also has to be reversed. The invoice was entered in

December in error, so the entry above reverses it. The original entry therefore has to be re-established in January – a reversal of the entry above.

Solutions Manual 8-34 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-5 (Continued)

(b) With respect to item 4, it is possible that Motuto’s supplier has made a clerical error in this case by issuing an invoice dated

December 30, 2014 prior to the shipment of the goods on

January 2, 2015. Motuto should point out this error, particularly if discount terms apply to the purchase. One must also consider the possibility that Motuto’s supplier is trying to manipulate its financial results for its fiscal year ended December 31, 2014.

They may be attempting to include a sale in their fiscal year while at the same time including the merchandise inventory on their balance sheet. This would indicate that the supplier is not acting legally and ethically and Motuto should reconsider whether or not they wish to do business with this supplier in the future.

With respect to item 5, Motuto should contact its supplier about the earlier-than-contracted delivery of materials. On this occasion, Motuto has accepted delivery so it appears that they are Motuto’s goods at December 31. However, the supplier should be informed that this practice is not acceptable in the future. Here the ethical issue may be with the supplier: did they arrange for an early delivery in order to increase their current year sales, for example, or was it in error?

With respect to item 6, Motuto should ensure that there is a valid business reason for holding these items (i.e. that the supplier warehouse was indeed full). They should also question why a sale and repurchase agreement has been issued If they are indeed just helping out with storing the goods there is no need to formally record a sale and repurchase.

Solutions Manual 8-35 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-6 (15-20 minutes)

(a) Inventory December 31, 2014 (unadjusted)

Transaction 2

Transaction 3

Transaction 4

Transaction 5

Transaction 6

Transaction 7

Transaction 8

Transaction 9

Inventory December 31, 2014 (adjusted)

$234,890

10,420

-0-

-0-

8,540

(10,438)

(11,520)

1,500

12,500

$245,892

Transaction 9 represents a special sales agreement. If Jaeco cannot make a reasonable prediction for the amount of potential returns from

Simply, then the sale is not valid and the goods cannot be considered sold, irrespective of the shipping terms. The inventory will remain on

Jaeco’s books at December 31, 2014.

Solutions Manual 8-36 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-6 (Continued)

(b) Transaction 3

Sales Revenue ...............................................

Accounts Receivable ...........................

(To reverse sale entry in 2014)

Transaction 4

12,800

12,800

Purchases ...................................................... 15,630

Accounts Payable ................................. 15,630

(To record purchase of merchandise in 2014)

Transaction 8

Sales Returns ................................................. 2,600 recognized on a cash basis (as discussed in chapter 6)

Accounts Receivable ...........................

(To record sales return)

Transaction 9

Note the sale would be reversed and

2,600

Solutions Manual 8-37 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-7 (15-20 minutes)

(a) Items 1, 3, 5, 8

1

, 10, 13, 15, 16, 18, 19, 20, 22, 23, and 26 would be reported as inventory in the financial statements.

Explanations

23. Normal waste or spoilage of raw materials during production would be included in the material cost of the product; i.e., inventoriable cost.

26. These costs can be capitalized since storage is a necessary part of the production process.

27. Under ASPE, decommissioning or restoration costs are added to the cost of the related natural resource asset

(discussed further in Chap 10 and 13).

These costs may be capitalized if a company elects to do so:

11. Interest costs incurred for inventories may be capitalized.

The following items would not be reported as inventory:

2. Cost of goods sold in the income statement

4. Not reported in the financial statements as not yet received

6. Cost of goods sold in the income statement

7. Cost of goods sold in the income statement

9. Selling expense for freight out

12. Advertising expense in the income statement

14. Office supplies in the current asset section of the balance sheet

17. Not reported in the financial statements as not owned

1

Freight charges costs are not always allocated between inventory and cost of goods sold. They are sometimes expensed completely in the year incurred out of expediency.

Solutions Manual 8-38 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-7 (Continued)

21. Temporary investments in the current asset section of the balance sheet

24. Abnormal levels of waste of raw materials cannot be included in the carrying amount of inventory; i.e., these must be expensed as incurred as a period cost.

25. Storage costs to store excess inventory cannot be inventoried; i.e., these charges must be expensed as a period cost.

(b) Under IFRS, the treatment for borrowing costs differs from

ASPE. Interest expenses are considered product costs if the inventory takes a long time to produce or manufacture.

Capitalization is not required for interest expenses relating to inventories manufactured in large quantities or produced on a repetitive basis; a company can choose to capitalize as an accounting policy choice.

Additionally, under IFRS, decommissioning costs incurred as part of the production process are treated as product costs and inventoriable.

Solutions Manual 8-39 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-8 (15-25 minutes)

Current Year Subsequent Year

1. Working capital Overstated by

$1,020

Current ratio Overstated

Retained earnings Overstated by

Net income

$1,020

Overstated by

2. Working capital

Current ratio

Retained earnings

Net income

Overstated

No effect

No effect

3. Working capital Overstated by $850

Current ratio Overstated

Retained earnings Overstated by $850

Net income

$1,020

No effect

No effect

No effect

No effect

Understated by

$1,020

No effect

No effect

No effect

No effect

No effect

No effect

No effect

Overstated by $850 Understated by $850

Solutions Manual 8-40 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-9 (10-15 minutes)

(a) 1. Net income for 2013 is overstated by $51,000 because beginning inventory is understated.

2. Net income for 2013 is overstated by $2,400 because purchases are omitted.

3. Net income is overstated by $1,000 because ending inventory is overstated.

(b) 1. No effect.

2. Accounts payable understated, retained earnings overstated,

$2,400.

3. Inventory is overstated by $1,000 and retained earnings are overstated, $1,000.

Solutions Manual 8-41 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-10 (20-25 minutes)

(a)

Year

Net

Income

Per

Books

Add

Overstatement

Jan. 1

2008 $ 50,000

2009 52,000 $5,000

2010 54,000 9,000

2011 56,000

2012 58,000

2013 60,000

$330,000

Errors in Inventories

Deduct

Under-

Deduct

Over -

Jan. 1 Dec. 31

$5,000

9,000

$11,000

2,000 10,000

(b)

2008

Original

Net Income

$ 50,000

Balance

Retained Corrected

2009

2010

2011

2012

2013

52,000

54,000

56,000

58,000

60,000

$ 330,000

Add

Understatement

Dec. 31

Corrected

Net

Income

$ 45,000

48,000

$11,000 74,000

45,000

2,000 60,000

48,000

$320,000

Revised

Retained

Earnings Net Income Earnings

$ 50,000

$ 45,000 $ 45,000

102,000

48,000 93,000

156,000

74,000 167,000

212,000

45,000 212,000

270,000

60,000 272,000

$ 330,000

48,000 $ 320,000

$ 320,000

Solutions Manual 8-42 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-10 (Continued)

(c) Manipulation of ending inventory is definitely indicated given the positive trend in net income created by the inventory errors.

Management can apply judgment in the valuation of ending inventory in different ways in order to smooth income over the reporting periods as appears to be the case for Lyondell

Industries Limited. In financially successful years, reserves

(sometimes referred to as “cookie jar reserves”) are used. These reserves are created by management by recording accruals for loss of utility or impairment of inventory in order to buffer for downturns in performance expected in the future. In less successful years, these reserves or accruals are reversed and result in recoveries, which in turn increase income. When results that follow a cycle are expected, management is often tempted to apply these techniques to create income smoothing and avoid having to explain to users the large variances in performance from year to year or cycle to cycle.

Solutions Manual 8-43 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-11 (15-20 minutes)

1. Reporting under ASPE:

(a)

Net realizable value

Cost

Lower of cost and NRV

$50 – $19 = $31

$45

$31

$35 figure used – $31 correct value per unit = $4 per unit.

$4 X 1,000 units = $4,000.

If ending inventory for 2014 is overstated, net income for 2014 will be overstated.

(b) Net income for 2015 is understated by $4,000 because the beginning inventory was overstated by $4,000 causing a corresponding overstatement in cost of goods sold.

(c) The current ratio at December 31, 2014 would be overstated since the inventory would be overstated. The inventory turnover for the year ending December 31, 2014 would be understated because the numerator, Cost of goods sold is understated and the denominator in the ratio calculation would be overstated

(divided by 2). The debt to total asset ratio at December 31, 2014 would be understated since the denominator, total assets in the ratio would be overstated.

The current ratio at December 31, 2015 would not be affected by an error in inventory at the end of fiscal 2014. The effect on the inventory turnover for the year ending December 31, 2015 cannot be determined. The numerator would be overstated by

$4,000 and the denominator in the ratio calculation would be overstated by $2,000. But, depending on the original numbers, the ratio could get smaller, larger, or stay the same. Because most inventory turns over more than twice a year (i.e.

4,000/2,000), it is likely that the error would make the turnover lower than it actually was.

The debt to total asset ratio at

December 31, 2015 would not be affected by an error in inventory at the end of fiscal 2014.

Solutions Manual 8-44 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-11 (Continued)

(d) If the error is discovered before closing entries are made and the release of the financial statements, then it must be corrected by management and a corresponding reduction of inventory recorded.

If we assume that the financial statements have already been released the opportunity to correct the error is denied.

Management must then follow the correction of error treatment and adjust the opening balance of retained earnings for the effect of the error, net of applicable taxes. The correction of the error would be shown in the following year ’s financial statements.

(e) Reporting under IFRS:

Response would remain unchanged.

Solutions Manual 8-45 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-12 (15-20 minutes)

Selling Total

No. price sales Relative sales Total of lots per lot value value

Cost

Allo-

Cost

Per

Cost * cated Lot

$20,157 $2,240 Gr.1 9 $3,500 $ 31,500 $31,500/$139,800 $89,460

Gr.2 15 4,500 67,500 $67,500/$139,800 89,460

Gr.3 17 2,400 40,800 $40,800/$139,800 89,460

$139,800

* $55,000 + $34,460 = $ 89,460

Group 1

Group 2

Group 3

$89,460

Units

Lot

selling Total Cost Cost of sold price sales per lot lots sold

(9-5) = 4 $ 3,500 $ 14,000 $ 2,240 $ 8,960

(15-7) = 8 4,500 36,000 2,880 23,040

(17-2) = 15 2,400 36,000 1,536 23,040

Inventory at end of year:

Group 1

Group 2

Group 3

$ 86,000 $55,040

Costs allocated

$20,157

43,194

26,109

$89,460

Cost of lots sold

15 @ 1,536

$ 55,040

Cost of ending inventory

$11,197

20,154

3,069

$34,420

Solutions Manual 8-46 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-12 (Continued)

Proof :

Unsold lots

Cost Total

per lot inventory

Group 1

Group 2

Group 3

5

7

2

$ 2,240

2,880

1,536

$ 34,432 *

*$34,432 - $34,420 = $12 rounding difference because unit cost is rounded to nearest dollar.

Net income for the year:

Sales

Cost of sales

$ 86,000

55,040

Gross profit

Operating expenses

Net income

30,960

18,200

$ 12,760

Solutions Manual 8-47 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-13 (20-25 minutes)

(a) Unit

No. of Selling

Total

Sales

% of Total

Total Allocated

Per

Unit

Chairs Price Value Value Cost * Cost

Lounge chairs 400 $ 95 $38,000 37.3% $22,324.05 $55.81

Armchairs 300 85 25,500 25.0% 14,962.50 49.88

Straight chairs 700 55 38,500 37.7% 22,563.45 32.23

$102,000 $59,850.00

* Percentage of total value applied to lump sum of $59,850 paid

Beginning Balance (cost above) $59,850.00

No. of

Per

Unit

Sales Chairs Cost

Lounge chairs 350 $55.81

Armchairs 210 49.88

Straight chairs 120 32.23

Cost of

Goods

Sold

$19,533.50

10,474.80

3,867.60

33,875.90 (33,875.90)

Cost of chairs remaining at end of 2014

OR: Cost of chairs remaining:

Lounge chairs: (400 – 350) X $55.81 =

Armchairs: (300 – 210) X $49.88 =

Straight chairs: (700 – 120) X $32.23 =

Cost of ending inventory

*$1.00 difference due to rounding

$25,974.10

$ 2,790.50

4,489.20

18,693.40

$25,973.10*

Solutions Manual 8-48 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-13 (Continued)

OR: Cost ratio: $59,850

$102,000

Beginning Balance (cost above)

Less: Cost of Goods Sold:

= 58.7%.

Sales

Lounge chairs

Armchairs

No. of Selling

Chairs Price Sales

350 $95 $33,250

210 85 17,850

Straight chairs 120 55 6,600

$ 59,850.00

57,700 X 58.7% (33,870.00)

Ending Inventory

(b)

$ 25,980.00

Discounted Net

No. of Selling Selling NRV Realizable

Chairs Price Cost Per Unit Value

Lounge chairs 50 $ 71.25 * $ 2.00 $ 69.25 $ 3,462.50

Armchairs 90 59.50 ** 2.00 57.50 5,175.00

Straight chairs 580 33.00 *** 2.00 31.00 17,980.00

Net realizable value of chairs in inventory

* $95 x 75% = $71.25

** $85 X 70% = $59.50

*** $55 X 60% = $33.00

$26,617.50

Solutions Manual 8-49 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-13 (Continued)

(c)

No. of

Per

Unit

Net

Realizable

Lower of Cost

Chairs Cost Cost Value and NRV

Lounge chairs 50 $55.81 $2,790.50 $ 3,462.50 $2,790.50

Armchairs 90 49.88 4,489.20 5,175.00 4,489.20

Straight chairs 580 32.23 18,693.40 17,980.00 17,980.00

Inventory value at December 31, 2014 at LC and NRV $25,259.70

Solutions Manual 8-50 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-14 (15-20 minutes)

(a) Beginning inventory

Purchases (2,000 + 3,000)

Goods available for sale

Sold (2,500 + 2,000)

Goods on hand

1,000

5,000

6,000

4,500

1,500

Periodic FIFO – (Same amount for Perpetual FIFO)

1,000 X $12 = $12,000

2,000 X $18 =

1,500 X $23 =

4,500

36,000

34,500

$82,500

(b) Periodic weighted average

1,000 X $12 = $ 12,000

2,000 X $18 = 36,000

3,000 X $23 =

6,000

69,000 4,500

$117,000 6,000 = $19.50 X $19.50

$87,750

(c) Perpetual moving average

Date Purchased Sold Balance

1/1

2/4 2,000 X $18 = $36,000

1,000 X $12 = $12,000

3,000 X $16 a

= $48,000

2/20

4/2 3,000 X $23 = $69,000

2,500 X $16 = 40,000 500 X $16 = $8,000

3,500 X $22 b

= $77,000

11/4 a

2,000 X $22 = 44,000 1,500 X $22 = $33,000

COGS =

1,000 X $12 = $12,000 b

84,000

500 X $16 = $ 8,000

2,000 X $18 = 36,000 3,000 X $23 = 69,000

3,000 $48,000 3,500 $77,000

($48,000 3,000 = $16) ($77,000 3,500 = $22)

Solutions Manual 8-51 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-15 (15-20 minutes)

(1) Ending inventory —Specific Identification

Date No. Units Unit Cost Total Cost

December 2

July 20

100

30

130

$30

25

$3,000

750

$3,750

(2) Ending inventory

Date

—FIFO

No. Units Unit Cost Total Cost

December 2

September 4

100

30

130

$30

28

(3) Ending inventory —Weighted Average Cost

Date Explanation

No.

Units

$3,000

840

$3,840

Unit

Cost

Total

Cost

January 1

March 15

Beg. inventory 100 $20 $ 2,000

Purchase 300 24 7,200

July 20 Purchase

September 4 Purchase

300 25 7,500

200 28 5,600

December 2 Purchase 100 30 3,000

1,000 $25,300

$25,300 1,000 = $25.30

Ending Inventory —Weighted Average Cost

No. Units Unit Cost Total Cost

130 $25.30 $3,289

Solutions Manual 8-52 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-16 (20-25 minutes)

(a) Calculations

1. 2,100 units available for sale – 1,400 units sold = 700 units in the ending inventory.

500 @ $4.58 = $2,290

200 @ 4.60 = 920

700 $3,210 Ending inventory at FIFO cost.

2. $9,240 cost of goods available for sale 2,100 units available for sale = $4.40 weighted-average unit cost.

700 units X $4.40 = $3,080 Ending inventory at weighted-average cost.

(b) Analysis of methods

FIFO will yield the highest ending inventory and therefore the highest current ratio. FIFO uses the most recent costs to price the ending inventory units. The company has experienced rising purchase prices.

FIFO gives the higher inventory values, a lower cost of goods sold (beginning inventory + purchases – ending inventory) and a higher gross profit.

Solutions Manual 8-53 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-17 (40-55 minutes)

(a) FIFO – same as periodic in Exercise 8-16 of $3,210

Moving average cost

Purchased Sold Balance

Date

No. of units

Unit cost

No. of units

Unit cost

No. of units

Unit cost Amount

May 1 Beg. Bal.

6 800 $4.20

100 $4.100 $ 410.00

900 4.189 3,770.00

7

10

12 400 4.50

300

300

$4.189

4.189

600 4.189

300 4.189

700 4.367

2,513.40

1,256.70

3,056.70

15 200

18 300 4.60

4.367 500 4.367 2,183.50

800 4.454 3,563.50

22 400 4.454

400 4.454 1,781.60

25 500 4.58 900 4.524 4,071.60

30 200 4.524 700 4.524 3,166.80

(b)

In the case of the FIFO cost flow formula, it would not matter if the inventory system used were the perpetual (Exercise 8-17) or the periodic (Exercise 8-16) systems, as the results would be the same.

This is because the FIFO method assumes that older goods are sold first. This flow of costs is not changed whether a periodic or perpetual system is used.

Results between periodic and perpetual systems would be different in the case where the weighted average and moving average cost flow assumptions are implemented. Under the perpetual inventory system, the average cost is recalculated each time there is a purchase. This is not the case for the periodic system where the average cost is determined at the end of the accounting period. Depending on the frequency of purchases and the range of price changes during the accounting period, the differences could be substantial.

Solutions Manual 8-54 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-18 (10-15 minutes)

(a)

(b)

12/31/14 Inventory ..........................................................................

Loss on Inventory Due to Decline

Allowance to Reduce

Recovery of Loss Due to

12/31/15 Cost of Goods Sold .........................................................

12/31/15 Inventory ..........................................................................

Allowance to Reduce Inventory

Solutions Manual 8-55 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-18 (Continued)

*Cost of inventory at 12/31/14

Lower of cost and NRV at 12/31/14

Allowance amount needed to reduce inventory

to NRV (a)

Cost of inventory at 12/31/15

Lower of cost and NRV at 12/31/15

Allowance amount needed to reduce inventory

to NRV (b)

$321,000

(283,250)

$ 37,750

$385,000

$ 33,750

Recovery of previously recognized loss = (a) – (b)

= $37,750 – $33,750

= $4,000.

(c) Both methods of recording lower of cost and NRV adjustments have the same effect on net income.

(351,250)

Solutions Manual 8-56 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-19 (20-25 minutes)

(a)

February March April

*

Sales $29,000 $35,000 $40,000

Cost of goods sold

Inventory, beginning

Purchases

Cost of goods available 45,000 49,100 55,500

Inventory, ending

25,000 25,100 29,000

20,000 24,000 26,500

25,100 29,000 23,000

Cost of goods sold 19,900 20,100 32,500

Gross profit 9,100 14,900 7,500

Gain (loss) due to market

fluctuations of inventory* (7,000) 1,100 700

$ 2,100 $16,000 $8,200

Jan. 31 Feb. 28 Mar. 31 Apr. 30

Inventory at cost

Inventory at the lower of cost

or NRV

Allowance amount needed to

reduce inventory to NRV

Gain (loss) due to fluctuations

in NRV of inventory**

$25,000 $25,100 $29,000 $23,000

24,500 17,600 22,600 17,300

$ 500 $ 7,500 $ 6,400 $ 5,700

$ (7,000) $ 1,100 $ 700

**$500 – $7,500 = $(7,000)

$7,500 – $6,400 = $1,100

$6,400 – $5,700 = $700

Solutions Manual 8-57 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-19 (Continued)

(b)

Allowance to Reduce Inventory

Allowance to Reduce Inventory

Recovery of Loss Due to Decline

Recovery of Loss Due to Decline

Solutions Manual 8-58 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-20 (15-20 minutes)

(a) Under IFRS, if the unavoidable costs to complete a contract are higher than the benefits expected from receiving the goods under the contract, a loss provision is recognized as an onerous contract. Although ASPE does not have a similar requirement, practice in Canada has been to record the loss and liability as well.

(b) If the commitment is material in amount, there should be a note to the financial statements stating the nature and extent of the commitment. The note may also disclose the market price of the materials. The excess of market price over contracted price will not be realized as the ultimate purchase cost will be at a maximum of the contract price of $3.25.

(c) The drop in the market price of the commitment should be charged to operations in the current year assuming the company will experience an equivalent loss on the receipt of the goods at the contracted price. If so, the following entry would be made:

Liability for Onerous Contract................................. 29,575

The entry is made because a loss in utility has occurred during the period in which the market decline took place. The account credited in the above entry should be included among the current liabilities on the balance sheet, with appropriate note disclosure indicating the nature and extent of the commitment.

This liability indicates the minimum obligation on the commitment contract at the present time.

Solutions Manual 8-59 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-20 (Continued)

(d) Assuming the $29,575 market decline entry was made on

December 31, 2014, as indicated in (c), the entry when the materials are received in January 2015 would be:

The inventory is effectively recorded at its current cost of

$2.60/litre.

(e) Recall from Chapter 1 that financial statements should provide information about the firm’s economic resources and claims on those resources. Purchase commitments clearly will result in claims against the resources of the company.

Disclosure of purchase commitments gives users of the financial statements additional information about the expected future cash flows of the firm. It may, for example, allow users to conclude that the firm has reduced its risks by securing a supply of inventory at a preferential price. It might also indicate that the firm has undertaken contracts that will be costly to the firm in the future reducing future earnings.

The ethics of not disclosing this information will be determined based on the reason for non-disclosure. For example, if a company chooses not to disclose this information on the grounds that competitors might use the information to negotiate a lower purchase price of the same raw materials from the same supplier, the company might argue that the disclosure would be disadvantageous to the company and its shareholders.

Solutions Manual 8-60 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-20 (Continued)

On the other hand, if the company does not disclose the information because management wishes to hide the fact that they entered into an unprofitable contract, this would clearly be unethical.

Solutions Manual 8-61 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-21 (10-15 minutes)

(a)

Inventory, May 1 (at cost)

Purchases (gross) (at cost)

Purchase discounts

Freight-in

Goods available (at cost)

Sales (at selling price)

$360,000

700,000

(12,000)

50,000

$1,200,000

1,098,000

Sales returns (at selling price)

Net sales (at selling price)

(70,000)

1,130,000

Less gross profit (25% of $1,130,000) 282,500

Estimated cost of goods sold 847,500

Estimated inventory, May 31 (at cost) $ 250,500

(b) Gross profit as a percent of sales must be calculated:

25%

= 20% of sales.

100% + 25%

Goods available (at cost) from (a) 1,098,000

Net sales (at selling price) from (a)

Less gross profit (20% of

$1,130,000)

Estimated cost of goods sold

1,130,000

226,000

Estimated inventory, May 31 (at cost)

904,000

$194,000

Solutions Manual 8-62 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-22 (15-20 minutes)

(a)

Sales

Gross profit based on pricing 35% of sales

Cost of Goods sold - calculated

$ 2,750,000

(962,500)

1,787,500

2,200,000 Total goods available for sale

Expected ending inventory $ 412,500

(b) The difference between the inventory estimate per the gross profit method and the amount per physical count may be due to several types of errors or omissions in the gross profit calculation:

1. Theft losses (shoplifting or pilferage).

2. Spoilage or breakage above normal.

3. Accounting errors in recording purchases or sales.

4. Error in the beginning inventory.

5. Errors in taking the physical count.

6. Errors in applying planned mark-up percentage.

The first two reasons are not applicable in this instance since the physical amount is higher than the amount estimated with the gross profit method.

Solutions Manual 8-63 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-23 (20-25 minutes)

(a) (1) Inventory Turnover Ratio = Cost of Goods Sold

Average Inventory

Fiscal 2014 = 863,239 (see part b)

(291,497 + 319,445)/2

= 2.83 times per year

Fiscal 2013 = 852,608 (see part b)

($319,445 + 302,207)/2

=

(2) Average days to sell inventory =

2.74 times per year

365

Inventory Turnover Ratio

Fiscal 2014

Fiscal 2013

=

=

=

365

2.83 times

129 days

365

=

2.74 times

133 days

Solutions Manual 8-64 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-23 (Continued)

(b)

Sales

Gross Margin

Cost of sales

Percentage Gross

Profit

Percentage Mark-up on Cost

C

B

C/A

F2014

863,239

35.90%

F2013

852,608

35.94%

Increase

A $1,346,758 $1,331,009

483,519 478,401

%

1.2%

C/B 56.01% 56.11%

End of year inventory $291,497 $319,445 $(27,948) (8.75)%

(c) The level of inventory fell 8.75% while sales grew slightly by

1.2%. This is consistent with the improved inventory turnover and days to sell inventory in part (a). Controlling the level of inventory helps a company manage costs.

Solutions Manual 8-65 Chapter 8

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 8-24

Missing values:

Sales

Cost of goods sold

Gross Margin

Ending inventory

Gross profit %

Inventory turnover

Days sales in inventory

Formula:

Days to sell inventory

Year 10

$401,244

306,158

95,086

34,511

23.7%