The Perfect Fit - Lauren D'Alessandro

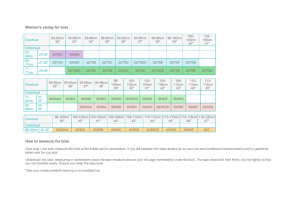

advertisement

The Perfect Fit Business Plan Lauren Rose D'Alessandro Table of Contents Section Executive Summary Start-up Summary Products and Services Competitive Comparison Growth Plan Industry Analysis Page Number 3 3 4 5 6 6 Market Research Main Competitors 9 12 SWOT Analysis Pricing Strategy Sales Forecast Management Team 14 15 15 16 Financial Plan 17 Appendix Works Cited 22 27 Page 2 Executive Summary The Perfect Fit is a specialty retail store that will provide a wide selection of bras in sizes 28D-36K. It will carry a large selection of popular lingerie brands as well as the store’s own line of everyday bras. The Perfect Fit will also retail a variety of sleepwear, sportswear, and other accessories. Currently, this venture is in the start-up phase: it will be a limited liability company located in Cherry Hill, New Jersey. Lauren D’Alessandro is the owner and will also be the store manager. She has two years of retail experience and is completing her bachelor’s degree in entrepreneurship from Rowan University in May of 2010. Eight out of ten women are wearing the wrong bra size, (Jo Roberts, “Learning Curves”). Not only does an improperly fitted bra appear less flattering, but it can also cause back problems and shoulder dents. For women who are smaller framed but have to wear extended cup sizes, finding lingerie in their size can be a daunting task. The Perfect Fit’s goal is to provide them with the widest selection of comfortable lingerie, as well as highly trained associates who can provide them with excellent customer service. In the first year, the store will open and its product line will be introduced. This line will consist of four bra styles, including a t-shirt bra (available in fullcoverage or demi), a multi-way bra, and a cleavage bra. By the third year of operation, The Perfect Fit will begin retailing its products online, and by the fourth year the product line will expand to include more bra styles and other clothing products. The owner is looking for an angel investor to raise $500,000 of capital to cover the first two years of operating expenses. She is willing to negotiate paying the investor a percentage of the business’s income for the first ten years of operations. Start-Up Summary The following table summarizes the start-up costs associated with the first year of operations. (Table 1) Start-up Expenses Marketing and Advertising Store Fixtures Equipment Security Deposit Legal Product Design Total Start-up $23,889 $13,400 $3,914 $5,000 $2,000 $10,000 $58,203 Page 3 The following table illustrates all assets to will be purchased as part of the start-up. (Table 2) Store Fixtures Mannequins Shelving Clothing racks Total Fixtures $ 400 $ 8,000 $ 5,000 $13,400 Equipment Dell POS System Printer Safe Total Equipment $ 3,314 $ 100 $ 500 $ 3,914 Furniture Desk Filing Cabinet Desk Chair Folding Chairs (6) Card table Mini fridge Total Furniture $ $ $ $ $ $ $ 100 50 50 240 50 100 590 Locations and Facilities The first location for The Perfect Fit will be either in or near the Cherry Hill Mall. The majority of women in the market research survey conducted purchase lingerie in stores that are located in shopping malls, so The Perfect Fit will provide convenience by being in a prime shopping location. The owner is currently searching for available store space in these areas. The operating hours are projected to be: Monday – Saturday 10am – 9:30pm Sunday 10am – 6:30pm Products and Services 1. Lingerie: The Perfect Fit will be carrying a wide variety of bras in sizes 28D-36K by popular brands that will include Wacoal, Felina, Chantelle, Fantasie, Lunaire, Freya, Panache, and Wonderbra. In addition to these brands, the store will carry its own line of bras. The line will initially focus on comfortable everyday bras. In the market research that that was conducted for this business plan, it was found that comfort and fit were the qualities women found most important, followed by good quality and seamless fit under clothing. Because of this data, these characteristics will be the initial focus of the line. There will be four basic designs that will be manufactured by a textile company at a cost of $30 per unit. The Perfect Fit will hire a designer to create the original Page 4 patterns for these products. Basic diagrams and explanation of the product design can be found in the appendix (page 22). 2. Loungewear and activewear: The Perfect Fit will carry a selection of robes, pajama sets, slippers, sweat suits, sports bras, and workout clothes. 3. Other accessories: The store will also carry important basics, including band extenders, clear straps, pasties, laundry bags, detergent, stockings, and shapewear. Competitive Comparison 1. Large chains of stores with well-known names are our biggest form of competition. The most obvious examples are Victoria’s Secret, Aerie, and Cacique, which all specialize in lingerie. Department stores are also competitors. Nordstrom, Sears, JCPenney, Macy’s, Lord & Taylor, and Boscovs are all found in the area that the first store will be located. The main thing that will set The Perfect Fit apart from these other stores is the variety of sizes and styles that will be carried. 2. Specialty stores are a second form of competition. Chrysi’s Bra Boutique is the only lingerie boutique located in Cherry Hill. There are no other major specialty stores that retail bras in the area around Cherry Hill. 3. Discount retailers such as Wal-Mart and Target are a third form of competition, as they carry selections of bras, underwear, and sleepwear at low prices. Technology The Perfect Fit will use a point of sale system that will track inventory and transactions with customers. An accounting software system will be used to keep up with the day-to-day transactions of the business, as well as perform payroll functions. A customer relationship management database will list customers by name and keep data on their bra and clothing sizes, favorite items, and contact information. This database can be used to assist customers (for example, if a man wants to purchase items for his wife who has shopped at the store before, it will take away some of the guesswork) as well as to send them promotional materials such as catalogs and coupons. Page 5 Future Products and Services The following timeline illustrates the growth plans for the first six years of operation. These plans include the expansion of the store’s product line and the use of a website for retail. (Table 3) Six Year Growth Plan Year One Year Two Year Three Year Four Year Five Year Six Open first store Perfect bras already produced Expand and begin producing sleepwear, lingerie, and sportswear Begin plans to open new locations Retail sports attire, lingerie, and sleepwear Conduct market research to determine best way to expand store’s own line Focus on branding Focus on CRM Continue to grow customer base Begin online retailing Work to increase revenue from online retail Produce four bra styles GROWTH Develop store website Carry fewer outside brands Target Market Segmentation The Perfect Fit will be located in Cherry Hill, New Jersey. Our target market includes women in Camden County as well as Burlington and Gloucester counties who fall between the ages of 20-49. As shown by the table below, the total target market is composed of approximately 267,126 women. (Table 4) County Total Females % 20-49 Target Market Burlington 225,284 41.50% 93,493 Camden 266,249 41.40% 110,227 Gloucester 146,097 43.40% 63,406 Total Target Market 267,126 Market Needs “The complex physical nature of the bra and the unique physiological makeup of each bra wearer suggests that consumer behavior for bras will be different from that for other apparel,” (Hart and Dewsnap, “An Exploratory Study of the Consumer Decision Making Process”). Not only are all women different, but a woman’s breast shape and size can change many times throughout her life due to pregnancies, weight gain, hormonal changes, etc. Many Page 6 women have little knowledge of how a bra should fit them and perform for them. As a result, 80% of women are wearing the incorrect bra size, (Jo Roberts, “Learning Curves”). Also, women view bras as a high-risk purchase, due to the fact that even if the bra does appear to fit in the store, its qualities can change after a washing or two. Another problem is that there is a huge disparity in sizes among different brands of lingerie, and sometimes even within a brand. Women shopping for lingerie express the desire to be brand loyal; this desire is complicated by the fact that bra styles frequently get discontinued, so the process of finding a style they like begins all over again. All of these factors make it very difficult for women to select well-fitted, good quality lingerie. Koff and Benavage (1998) found that, “Lower self-esteem was associated with lower breast size satisfaction…while high public self-consciousness, social anxiety, and appearance preoccupation were associated with a mismatch between the ideal and perceived size,” (Hart and Dewsnap). The way a woman’s bra performs can drastically affect her self-esteem and confidence. Unfortunately, many women find bra shopping to be “a nightmare, frustrating, boring, a necessary evil, and traumatic,” (Hart and Dewsnap). Most women do not find it to be an enjoyable experience, and the reasons include “lack of attractive bras in larger sizes, lack of choice in general, the difficulties encountered in finding bras that offer fit, comfort, and the right body shape through clothes,” (Hart and Dewsnap). Not every experience has been a bad one; under some circumstances, women have had good bra shopping experiences. It was found that factors leading to a good experience included when a women was able to find a bra and return later to make a repeat purchase, when they had money to spend, if the women was a standard size (which meant she was offered a wider range of choices), and if the woman was shopping for a bra for a specific occasion (Hart and Dewsnap). Market Trends Price, value, and quality are important features that women are looking for right now in apparel. Even though women are still shopping, getting a good deal is important to them. Currently, the price threshold for a single bra has gone from $48 or $50 to just $40, which puts pressure on lingerie stores to provide stylish lingerie at lower prices. “Consumers loyal to an upscale brand are still buying bras in the $60 to $69 range, but are purchasing one style as opposed to two or three,” (Monget and Iannaccone, “Chantelle Charts Fast-Track Retail Plan”). Page 7 Online lingerie stores such as FigLeaves.com, BareNecessities.com, Jockey International, HerRoom.com, Frederick’s of Hollywood, and the Victoria’s Secret online store are doing well. Sites use tools such as “The Bounce Test” (Monget and Iannaccone), used by Frette Inc., which includes videos of a model testing out the sports bras so that women can have an idea of how the bra will perform for them. They also rely on customer feedback to help them improve their services. Rising gas prices may be one factor contributing to the growth of these businesses. Another reason why boutiques and websites are doing well is because “consumers are rejecting promotional and generic-looking merchandise at major stores that often do not provide the personalized service or specialty and fashion products… of a boutique or website,” (Georgia Lee, “Specialty Stores Get Personal”). Despite the success of online vendors, most women still generally prefer shopping in stores to the Internet. Women often go shopping because they find it therapeutic. “Women like the scene, the service, being told something looks good on them, that is why they do not shop a lot on designer websites. A woman gets no joy out of clicking on a mouse and buying a dress,” (“It’s a Love Thing 2006”). Market Growth The women’s intimate apparel market in the United States took in an estimated $9.8 billion in 2007 (ReportLinker.com, “U.S. Market for Women’s Intimate Apparel”), and it continues to grow at a slow but steady pace. According to Maidenform’s CEO Maurice Reznick, the intimate apparel industry is doing very well (Cnbc.com, “Intimate Apparel Sales Heating Up”). Despite the economic downturn, women (and men) are still buying lingerie. Specialty lingerie stores are getting great business, especially those which offer a wide selection of sizes and styles, as well as bra fittings and personalized assistance. It provides a great opportunity for a business to work on relationship marketing and to have loyal customers and repeat sales. Victoria’s Secret, perhaps the most popular example of branding in the lingerie business, has been doing well and expanding the styles it offers to customers. Bravissimo, a specialist underwear chain in the UK that specializes in D-K cup sizes, has enjoyed great success since its start in 1995. The market for D cup sizes and above has recently had sharp increases (Jane Bainbridge, “Form and Function Fuel Sales”). This can be explained by increases in obesity, plastic surgery, and better fittings being offered by stores. This trend has also contributed to the success of boutiques, because these types of stores offer more customized service and carry more sizes than stores like Victoria’s Secret, Target, and Wal-Mart. Page 8 Market Research A team of three Rowan students (Andrew Amand, Kevin Lynn and Lauren D’Alessandro) conducted marketing research to gather more information. The purpose of the research was to determine if there is a market for a retail store specializing in extended size lingerie, and to analyze the various characteristics of the segments of this market to determine consumer preferences, buying habits, and the shortcomings of the current market. In order to collect this information, a 16-question marketing research questionnaire was used. (Appendix, page 23) Because this is a product specifically for women, only women were included in the population sample. A total of 51 questionnaires were administered. Due to the time constraints of this project, a convenience sample was taken, which was composed primarily of Rowan University students and coworkers, as well as some family members. Because a convenience sample was used, the results are generally limited to the younger segment of the target market. In future research, one of the objectives would be to survey more women in their 30s and 40s to determine if their preferences are the same, or if there are significant differences. Another limitation was that some women gave more than one answer to certain questions, or checked more than one response in the multiple choice, which could have skewed the results for a few of the questions. There were also a few questions that were misunderstood, and had to be thrown out. Of those surveyed, 27.6% of women indicated that they wear a bra size fitting within the range of sizes that The Perfect Fit will carry. This is good news, because it means that a significant portion of consumers will be able to purchase the specialty products being offered. Overall, 70.6% of respondents normally purchase lingerie in stores that are usually found in a mall (Victoria’s Secret, department stores, and Aerie). These findings support the decision to locate the first store in or near a shopping mall. The mean age of participants was 22.53, and the median was 22.5, and the mode was 21. 70.7% were in their twenties, 25.5% were teenagers, and 4% were above the age of 30. 92.2% were single, 3.9% were married, 2% were divorced, and 2% were widowed. 39.2% had completed “some college” and 35.3% had received their Associate’s Degree. Those with a Bachelor’s degree made up 7.8% of respondents, while 15.7% had completed high school or received a GED, and 2% were still in high school. Lastly, 15.7% of respondents were employed full-time; 68.6% were employed part-time, and 15.7% were not employed. Page 9 When asked what the name brand of their favorite bra was, 31.4% did not reply or stated that they were not sure; 31.4% answered Victoria’s Secret but did not specify which bra. 7.8% said Victoria’s Secret Very Sexy Push-Up; 5.9% wear the Victoria’s Secret Biofit. The remaining 23.8% listed ten other brands as their favorite. Because such a large portion of women did not answer the question, it can be concluded that a decent portion of the market are either not brand loyal, or desire to be, but have not found a bra that they can be loyal to. This means that there is opportunity for new retailers to seize the loyalty of a portion of the market. The second part of the question asked what they liked about their favorite bra. 35.3% of participants did not respond; 27.5% said comfort, 5.9% said style, 3.9% said that it enhanced their size, 2% said quality, 2% said good lift, 21.6% said fit, and 2% said that they could buy the same bra every time they shopped. The two ranking questions asked in the survey were designed to show what potential customers value both the product and the experience in the store. The first question asked respondents to rank six bra characteristics in order of importance, with 1 being the least important and 6 being the most important. These qualities included 1) Good fit, 2) Stylish, 3) Comfortable, 4) Doesn’t show under clothes, 5) Good quality, and 6) Low price. The chart below shows the six characteristics and their average rank. (Table 5) Preferred Lingerie Characteristics and their Average Rank High Priority Moderate Priority Lowest Priority Comfort (4.43) Fit (4.37) Good quality (3.49) Seamless (3.12) Low Price (2.84) Stylish (2.75) The top two, middle two, and lowest two characteristics were very close in their average rank. The feel, or comfort of the bra, and the fit, which refers to the way that it shapes and supports the breasts were the most valued qualities. Next came the quality of the bra, which refers to the actual construction and how sturdy the bra is, and how seamless the bra is (if it shows under clothing). Of the least importance were price and how stylish the bra is. This chart shows that the women in our survey value function over price and appearance. While most noted that stylish bras are a plus, they would rather choose a bra that is well made, comfortable, and creates the desired shape under clothing. Page 10 The second ranking question asked the respondents what variables make bra shopping a good experience, and asked them to rank them from 1 to 5, with 1 being the least important. There was a less distinct variation between the average rankings for these variables. (Table 6) Preferred Shopping Experience Qualities and Their Average Rank Women have very concrete ideas about what they want in Highest ranked a bra, but they seem to be less aware of what they want or need Wide selection (3.71) when it comes to a good shopping experience. It is interesting to Affordable prices (3.65) note that most women valued comfort and fit as being most Organization of Merchandise (3.53) Comfortable fitting rooms (2.10) important, but then “bra fittings offered” received the lowest Bra fittings offered (2.02) ranking in the next question. Wearing the right size bra will greatly Lowest Ranked improve both the comfort and fit, and many women are not knowledgeable enough to assess the fit on their own, which is why receiving a professional fitting can be so helpful. The majority of respondents (56.9%) have never received a bra fitting. The fact is women who receive fittings are more likely to find the correct fit and also to find a style that they prefer. The availability of assistance (from bra fittings to advice on which styles to try), the organization of the store, and the selection of merchandise have a huge impact on whether or not a women is able to find products that meet her needs. This information shows that many women do not see the correlation between the shopping experience and their satisfaction with the product itself. There is a decent-sized market for extended size lingerie (approximately 27.6% of women). Approximately 7.8% might become a part of the market if they were educated about proper bra sizing. The majority of participants would be willing to spend more money on higher quality bras, so it will be more important for this new venture to focus on providing quality rather than cutting prices. Women generally dislike bra shopping due to the small selection, lack of available sizes, and having to spend a lot of money on uncomfortable or cheaply made bras. Most women have a pretty good idea about what they are looking for in a bra, but they are less sure about what they want in a shopping experience. They also fail to see how important the experience can be in helping them to find the right bra for them. It will be important to educate customers about the importance of a Page 11 properly fitting bra, and how receiving a good fitting and personalized service from a professional can have a big impact on their satisfaction with the product they purchase. Main Competitors Victoria’s Secret is one of the largest lingerie companies around, and they rely heavily on branding to sell their product. They sell bras and lingerie, sleepwear, clothing, beauty products, shoes, and more in over 1,000 store locations, as well as in their mail order catalog and at VictoriasSecret.com. They offer bra fittings in their store. Victoria’s Secret is a threat because of its huge presence and large number of locations. It is a wellestablished company and has a significant portion of the market share. They carry up to size DD, and recently have included 32D and 32DD in their size range. Many women would be likely to turn to Victoria’s Secret for their lingerie because of the popularity and the brand name. Victoria’s Secret’s product is known to wear out quickly, which many survey participants pointed out. This presents The Perfect Fit with the opportunity to develop bras of higher quality. The store will also provide a different size range; Victoria’s Secret only offers lingerie up to a DD, and they don’t offer a wide variety of choices in sizes past a C cup. They also don’t carry any band sizes lower than 32. Cacique is a brand of intimates created by Lane Bryant, one of the most recognized plus-sized retailers. It provides lingerie in sizes 36-48 B-H, and also offers bra fittings. Cacique offers a great variety of styles and sizes. They are a threat because their size range does overlap with The Perfect Fit at some points, so some women that fall in the overlap may choose Cacique over The Perfect Fit because it is established and part of a well-respected brand. Generally, Cacique focuses on a different size range: they offer sizes that fit plus-sized women, while The Perfect Fit will cater to petite women who have larger chests. Nordstrom is one of few department stores that offer extended sizes beyond DD. On their website, they offer sizes ranging from 30AA-52HH. Their intimates department in their store has bra fit specialists to help customers find the right size. Page 12 Although Nordstrom does carry extended sizes, they don’t have a wide selection. The selection they do carry doesn’t provide optimal support. The styles are mostly lingerie bras that aren’t built for everyday use. Intimacy is a specialty store that has locations in many major cities (including New York, Washingon DC, and Chicago); customers make appointments for a bra fitting and a specialist helps them find their size and brings them a variety of bras that they might prefer. Intimacy has a wide variety of bras, and they give customers personalized attention. They have been in business since 1992, and they are experts at bra fittings. Customers are not allowed to shop through the bras on their own. They are not getting the experience of being able to shop through and select product themselves. Also, price points are extremely high; customers pay a premium price for the wider range of sizes, but the selection is the same that would be offered in most stores that carry extended sizes. Because the stores are only located in major cities, a visit to Intimacy would be a day trip for someone living in the South Jersey area. Chrysi’s Bra Boutique is a specialty shop located on Route 70 in Cherry Hill. They are a small store and they have a selection of bras in larger sizes. Chrysi’s does have some extended sizes available, and they offer in-store fittings. They don’t have a wide selection of styles or colors. They don’t provide a fun shopping experience, and are located in a small block of stores that is much less convenient than a mall location. Other competitors include department store lingerie departments, such as Sears, JCPenney, and more; specialty boutiques; and stores like Walmart and Target. The main advantage that The Perfect Fit has over these stores is a wider selection of sizes and styles. Websites such as FigLeaves.com, BareNecessities.com, and HerRoom.com all sell lingerie in a wide range of sizes. These websites also do not have a great selection, and there is the risk of having to buy things without having tried them on. Page 13 SWOT Analysis Strengths By focusing on a specific market niche, The Perfect Fit can provide more variety Providing higher quality products, which are in demand according to market research Owner’s knowledge of the intimate apparel market Proven business model Weaknesses Higher costs for quality products Lack of in-house design expertise Owner’s lack of management experience Opportunities Growing demand for D+ cup sizes Expanding to new locations Online retail Expanding the product line Threats Entering a highly competitive market and competing against well-established brands When the economy is in recession, it causes the price threshold for items such as bras to drop Value Proposition Customer service is one of the most important things that The Perfect Fit will offer customers. Every employee will be trained to assist customers in bra fittings and to help them find the best items that match their body type and their taste. Competitive Edge The Perfect Fit is filling a need that is often unmet in the intimate apparel market. While other stores are starting to pick up on the trend to include larger cup sizes in their size offerings, the store will compete by offering a wider variety. Because The Perfect Fit specializes in larger cup sizes only, there will be more in- store space to Page 14 stock a wider variety of lingerie in these sizes than can be found in other stores. The Perfect Fit will also compete by producing its own line of bras and filling the need for comfortable, everyday bras in large sizes. Promotional Strategy To promote the Grand Opening of the store, The Perfect Fit will print small brochures that include savings coupons and send them to women on a mailing list. These brochures will also be distributed at locations such as women’s health clubs, clothing stores, and college campuses. Once the store has an established mailing list, savings coupons and notifications of sales will be periodically distributed to keep customers coming back. There are also plans in motion to host a fashion show event to promote the new line of bras. Companies selling products and services for women (such as salons, make-up companies, etc.) will be asked to come to the event to provide women with free samples of their services. Not only will this promote The Perfect Fit, but other companies with complimentary services will get the opportunity to promote themselves as well. Pricing Strategy All merchandise bought from wholesalers and manufactured will be marked up 100%. Sales Forecast Sales for the first year were based on the sale of 7,963 units of a product that sells for $60/unit. Sales should increase by 20% in the second year and by 30% in each of the following three years. The seasonalized sales per month can be found in the appendix (page 26). (Table 7) Sales Forecast Table Year 1 Unit Sales Year 2 7,963 60 Year 3 9,556 60 12,422 $ 477,780 $ 573,336 $ 745,337 $ 968,938 $ 1,259,619 Direct Unit Cost $ $ $ $ $ Direct Cost of Sales $ 238,890 30 $ 372,669 $ 60 20,994 Total Sales $ 286,668 60 16,149 $ 30 $ Year 5 Unit Price 30 $ Year 4 30 $ 484,469 $ 60 30 $ 629,810 Page 15 Management Team The owner, Lauren D’Alessandro, will be managing the business until it becomes more well-established. Lauren D’Alessandro has an associate’s degree in business and is completing the last semester of her bachelor’s degree at Rowan University. She has also worked as a sales associate at Victoria’s Secret for two years. Bonnie McCloy will be filling the second management position. She has experience in inventory management and sales and has the ability to use Quick Books. She is currently completing her bachelor’s degree in finance at Rowan University. Any gaps in expertise will be filled by the recruitment of a three-member board of advisors, which will include a retail advisor, a financial advisor, and a marketing advisor. The owner is currently seeking qualified persons to fill these positions. Personnel Plan The Perfect Fit will employ two managers (including the owner) and about eight sales associates. The sales associates will be trained to assist customers by giving bra fittings, run the register, clean the store, and perform stockroom duties. For the safety of employees and to avoid theft, there must be at least one manager and one employee in the store at all times. (Table 8) Personnel Table Year 1 Year 2 Year 3 Year 4 Year 5 Co-Manager $ 30,000 $ 33,000 $ 36,300 $ 39,930 $ 43,923 Sales Associate(s) $ 49,692 $ 59,627 $ 77,515 $ 100,770 $ 131,000 My Salary $ 40,000 $ 46,000 $ 52,900 $ 60,835 $ 69,960 Total People Total Payroll 9 $ 119,692 11 $ 138,627 13 $ 166,715 15 $ 201,535 17 $ 244,883 Financial Plan According to the following break-even analysis, the monthly break-even point is 690 units, or $41,388 in sales. Page 16 (Table 9) Break-Even Analysis Table Monthly Units Break-Even 690 Monthly Revenue Break-Even $ 41,388 Assumptions: Average Per-Unit Revenue $ 60 Average Per-Unit Variable Cost $ 30 Estimated Monthly Fixed Cost $ 20,694 The table below illustrates the projected net income (loss) for the first five years of operations. Sales projections are based on a 20% increase in sales for the second year and a 30% annual increase in years 3-5. (Table 10) Pro Forma Profit and Loss Year 1 477,780 Year 2 573,336 Year 3 745,337 Year 4 968,938 Year 5 1,259,619 Cost of Sales 238,890 286,668 372,668 484,469 629,810 Gross Margin Gross Margin % 238,890 50% 286,668 50% 372,668 50% 484,469 50% 629,810 50% Payroll Advertising Rent Utilities Insurance Supplies Accounting Pest Control Misc. Expense 124,176 23,889 60,000 7,200 10,000 840 3,200 900 9,556 147,979 22,933 63,000 7,560 10,000 882 3,360 900 11,467 183,244 22,360 66,150 7,938 10,000 926 3,696 900 14,907 228,380 19,379 69,458 8,335 10,000 972 4,066 900 19,379 286,286 12,596 72,930 8,752 10,000 1,021 4,472 900 25,192 Total Operating Expenses Start-up Costs 239,761 58,203 268,081 - 310,121 - 360,868 - 422,150 - Total Expenses 297,964 268,081 310,121 360,868 422,150 Gross Income Tax (30%) Net Income (59,074) 123,601 37,080 86,521 207,660 62,298 145,362 Sales Operating Expenses (59,074) 18,587 5,576 13,011 62,547 18,764 43,783 Page 17 The following table represents The Perfect Fit’s balance sheet for the first five years of operations. (Table 11) Pro Forma Balance Sheet Assets Year 1 Year 2 Year 3 Year 4 Year 5 Current Assets Cash Inventory Total Current Assets $(10,987) $ 9,500 $ (1,487) $ 32,171 $ 11,400 $ 43,571 $118,589 $ 14,820 $133,409 $263,804 $ 19,266 $283,070 $487,380 $ 25,046 $512,426 Long-term Assets $ 17,904 $ 17,904 $ 17,904 $ 17,904 $ 17,904 Total Assets $ 16,417 $ 61,475 $151,313 $300,974 $530,330 Liabilities and Capital Year 1 Year 2 Year 3 Year 4 Year 5 Current Liabilities Accounts Payable Current Borrowing Total Current Liabilities $ 25,853 $ $ 25,853 $ 31,912 $ $ 31,912 $ 39,740 $ $ 39,740 $ 49,755 $ $ 49,755 $ 62,687 $ $ 62,687 Long-term liabilities Total Liabilities $ $ 25,853 $ $ 31,912 $ $ 39,740 $ $ 49,755 $ $ 62,687 Paid-in Capital Retained Earnings Earnings Total Capital Total Liabilities and Capital $ $ $ (9,436) $ (9,436) $ 16,417 $ $ (9,436) $ 39,000 $ 29,564 $ 61,475 $ $ 29,564 $ 82,009 $111,573 $151,313 $ $111,573 $139,646 $251,219 $300,974 $ $251,219 $216,424 $467,643 $530,329 Net Worth $ (9,436) $ 29,564 $111,573 $251,219 $467,643 Page 18 The table below is the statement of cash flows for the first five years, followed by a graphical representation of the first year of cash flows. (Table 12) Cash Flow Table Cash Received Year 1 Year 2 Year 3 Year 4 Year 5 Cash from Operations Cash Sales $477,780 $573,336 $745,337 $968,938 $1,259,629 Total Cash Received $477,780 $573,336 $745,337 $968,938 $1,259,629 Expenditures Year 1 Year 2 Year 3 Year 4 Year 5 Expenditures from Operations Cash Spending Bill Payments Subtotal spent on Operations $124,176 $346,686 $470,862 $147,979 $382,199 $530,178 $183,244 $475,675 $658,919 $228,380 $595,342 $823,722 $ 286,286 $ 749,758 $1,036,044 Additional Cash Spent Purchase Long-Term Assets Subtotal Cash Spent $ 17,904 $488,766 $ $530,178 $ $658,919 $ $823,722 $ $1,036,044 Net Cash Flow Cash Balance $ (10,987) $ (10,987) $ 43,158 $ 32,171 $ 86,418 $118,589 $145,215 $263,804 $ 223,575 $ 487,380 Page 19 The following table is a comparison of The Perfect Fit’s financial projections to the industry. Woman’s clothing retail industry was used in this table. (Table 13) Ratio Analysis Year 1 0.00 Year 2 20.00 Year 3 30.00 Year 4 30.00 Year 5 30.00 Industry Profile 7.94 Percent of Total Assets Inventory Other Current Assets Total Current Assets Long-term Assets Total Assets 57.87 0.00 (9.06) 109.06 100.00 18.54 0.00 70.88 29.12 100.00 9.79 0.00 88.17 11.83 100.00 6.40 0.00 94.05 5.95 100.00 4.72 0.00 96.62 3.38 100.00 36.71 27.00 91.68 8.32 100.00 Current Liabilities Long-term Liabilities Total Liabilities Net Worth 157.48 0.00 157.48 (57.48) 51.91 0.00 51.91 48.09 26.26 0.00 26.26 73.74 16.53 0.00 16.53 83.47 11.82 0.00 11.82 88.18 41.18 14.98 56.16 43.84 Percent of Sales Sales Gross Margin Selling, Gen. and Admin. Expenses Advertising Expenses Profit Before Interest and Taxes 100.00 50.00 51.98 0.53 (1.98) 100.00 50.00 43.20 0.44 6.80 100.00 50.00 39.00 0.39 11.00 100.00 50.00 35.59 0.34 14.41 100.00 50.00 32.82 0.30 17.18 100.00 21.23 11.14 0.65 2.01 Main Ratios Current Quick Total Debt to Total Assets Pre-tax Return on Net Worth Pre-tax Return on Assets (0.06) (0.42) 157.48 100.00 (57.48) 1.37 1.01 51.91 131.92 63.44 3.36 2.98 26.26 73.50 54.20 5.69 5.30 16.53 55.59 46.40 8.17 7.77 11.82 46.28 40.81 2.06 0.95 62.21 15.31 5.79 Additional Ratios Net Profit Margin Return on Equity (1.98) 0.00 6.80 131.92 11.00 73.50 14.41 55.59 17.18 46.28 n.a. n.a. Activity Ratios Inventory Turnover Accounts Payable Turnover Payment Days Total Asset Turnover 24.00 14.41 27.00 29.10 27.43 12.17 27.00 9.33 28.43 12.17 27.00 4.93 28.43 12.17 27.00 3.22 28.43 12.17 27.00 2.38 n.a. n.a. n.a. n.a. 0.00 1.00 1.08 1.00 0.36 1.00 0.20 1.00 0.13 1.00 n.a. n.a. Sales Growth Debt Ratios Debt to Net Worth Current Liab. To Liab. Page 20 Liquidity Ratios Net Working Capital Interest Coverage Additional Ratios Assets to Sales Current Debt/Total Assets Acid Test Sales/Net Worth Dividend Payout ($27,340) 0.00 $11,660 0.00 $93,669 0.00 $233,315 0.00 $449,739 0.00 n.a. n.a. 0.03 157% (0.42) 0.00 0.00 0.11 52% 1.01 19.39 0.00 0.2 26% 2.98 6.68 0.00 0.31 17% 5.30 3.86 0.00 0.42 12% 7.77 2.69 0.00 n.a. n.a. n.a. n.a. n.a. Page 21 Appendix A.1 Manufacturing Design Page 22 A.2 Marketing Research Survey I. Marketing Research Survey This survey is being conducted by Rowan students for a market research project. Our purpose is to determine if there is a market for a retail store specializing in extended-size lingerie, and to analyze the various characteristics of this market to determine consumer preferences, buying habits, and the shortcomings of the current market. All information submitted will be used for research purposes only and will be kept confidential. 1) Where do you usually purchase bras/lingerie? (Please list) _____________________________________________________________________________________ 2) How much do you typically spend on a single lingerie item? None <$25 $25-$40 $40-$50 $50-$60 $60-$70 $70-$80 >$80 3) How much would you be willing to spend on a single lingerie item if it was of higher quality than your current lingerie? None <$25 $25-$40 $40-$50 $50-$60 $60-$70 $70-$80 >$80 4) Rank the following bra characteristics in order of importance (1 being least important): ____ Good fit ____ Stylish ____ Comfortable ____ Doesn’t show under clothes ____ Good quality ____ Low price Page 23 5) How often do you enjoy bra shopping? Always Often Sometimes Never 6) What makes bra shopping a good experience? (Rank with 1 being least important) ____ Bra fittings offered ____ Wide selection of merchandise ____ Organization of merchandise ____ Comfortable fitting rooms (lighting, etc) ____ Affordable prices 7) What is the size of your most comfortable bra? _______________ 8) When wearing your most comfortable bra, does the band on your back look closer to the first or second image?(Circle one) 9) Have you ever been professionally fitted for a bra? Yes No If so, where?____________________________________________ 10) Name brand of your favorite bra _______________________ -and what makes it so great? 11) What don’t you like about the bras you currently own? ______________________________________________________________________________ 12) In general, what frustrates you about the bras currently available in stores? (Check all that apply, or leave blank if none apply) Don’t carry enough sizes Selection is too small Uncomfortable Too expensive Not stylish enough Other (please specify): Page 24 13) Age:_____ years 14) What is your marital status? Single Married Separated Divorced Widowed 15) What is your highest level of education that you have completed? Less than high school High School/GED Some college 2-year college degree (associate’s) 4-year college degree (BA, BS) Master’s Degree Doctoral Degree Professional Degree (MD, JD) 16) Are you currently employed? Yes (Full time) Yes (Part time) No Thank you for your participation! Page 25 A.3 Monthly Seasonalized Sales Forecast Year 1 Year 2 Year 3 Year 4 Year 5 43,680 52,416 68,141 88,583 115,158 45,500 54,600 70,980 92,274 119,956 46,000 55,200 71,760 93,288 121,274 44,000 52,800 68,640 89,232 116,002 33,600 40,320 52,416 68,141 88,583 35,000 42,000 54,600 70,980 92,274 47,000 56,400 73,320 95,316 123,911 37,000 44,400 57,720 75,036 97,547 40,000 48,000 62,400 81,120 105,456 34,000 40,800 53,040 68,952 89,638 34,000 40,800 53,040 68,952 89,638 38,000 45,600 59,280 77,064 100,183 $ 477,780 $ 573,336 $ 745,337 $ 968,938 $ 1,259,619 June July Aug Sept Oct Nov Dec Jan Feb Mar April May Total 140,000 120,000 100,000 Sales ($) Year 1 80,000 Year 2 Year 3 Year 4 60,000 Year 5 40,000 20,000 June July Aug Sept Oct Nov Dec Jan Feb Mar April May Page 26 Works Cited Allen, Jeremy, Anne Riley-Katz, and Lisa Rinna. (2008): "Boutiques Sprout Despite Hard Times." WWD: Women's Wear Daily 196.71 16-1NULL. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=34833324&site=ehost-live. Anderson, Tami, and Elizabeth Howland. (2009): "Finding Your Feminine Voice." SGB 42.3 54-5. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=37293407&site=ehost-live. Bainbridge, Jane. (2008): "Form and Function Fuel Sales." Marketing (00253650) 28-9. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=33373959&site=ehost-live. Edgar, Michelle. (2007): "Victoria's Secret Growth Plans." WWD: Women's Wear Daily 194.68 12-. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=27299505&site=ehost-live. “Fact Finder.” US Census Bureau. (2010). http://factfinder.census.gov/. "Getting Intimate." (2005): WWD: Women's Wear Daily 189.30 2-. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=16210049&site=ehost-live. Hart, Cathy, and Belinda Dewsnap. (2001): "An Exploratory Study of the Consumer Decision Process for Intimate Apparel." Journal of Fashion Marketing & Management 5.2 108-19. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=9775785&site=ehost-live. Helena M De, Klerk, and Stephna Lubbe. (2008): "Female Consumers' Evaluation of Apparel Quality: Exploring the Importance of Aesthetics." Journal of Fashion Marketing & Management 12.1 36-50. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=32791343&site=ehost-live. Kleinman, Rebecca. (2007): "Sex & Hits South Beach." WWD: Women's Wear Daily 194.111 11-. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=28010681&site=ehost-live. Page 27 Lee, Georgia. (2007): "Specialty Stores Get Personal." WWD: Women's Wear Daily 193.97 14-. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=25076915&site=ehost-live. Lewis, Len. (2008): "Lingerie's Slip is Showing." Stores Magazine 90.8 32-4. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=34068160&site=ehost-live. Monget, Karyn, and Thomas Iannaccone. (2008): "Chantelle Charts Fast-Track Retail Plan." WWD: Women's Wear Daily 195.90 11-. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=32121674&site=ehostlive. Monget, Karyn. (2009): "Boutiques Bloom Amid the Gloom." WWD: Women's Wear Daily 197.61 9-1NULL. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=37369008&site=ehost-live. "Lingerie's Outlook: The Price must be Right." (2009): WWD: Women's Wear Daily 198.3 9-1NULL. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=43272547&site=ehost-live. "Online Lingerie Sales Take Off." (2008): WWD: Women's Wear Daily 195.73 10-. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=31722910&site=ehost-live. "Will Lingerie Sell in A Down Market?" (2009): WWD: Women's Wear Daily 197.6 10-1NULL. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=36275621&site=ehost-live. "New Mass Lingerie Line Easy on the Eyes and Pockets." (2006): Retailing Today 45.16 13-. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=22423021&site=ehost-live. ReportLinker. (2008): “U.S. Market for Women’s Intimate Apparel (Lingerie).” http://www.reportlinker.com. Roberts, Jo. "Learning Curves." (2007): In-Store 18-. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=24524509&site=ehost-live. Page 28 Schulaka, Carly. (2009): "MARKETING TO CONSUMERS: Effectively Reaching High Net Worth Women." Journal of Financial Planning 22.9 6-7. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=44142259&site=ehost-live. Silverstein, Michael J., and Kate Sayre. (2009): "The Female Economy." Harvard business review 87.9 46-53. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=43831019&site=ehost-live. Skenazy, Lenore. (2008): Victoria's Secret has Forgotten the Refined Art of the Tease. Vol. 79. Crain Communications Inc. (MI), http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=31393854&site=ehost-live. "Staying-in Boost for Lingerie Shops." (2009): Estates Gazette.912 22-. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=37601047&site=ehost-live. "Women's Buying Habits in 2008." (2009): SGB 42.3 22-. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=37293398&site=ehost-live. It's a Love Thing. (2006). WWD: Women's Wear Daily, 191(84), 2-2. Retrieved from http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=20627209&site=ehost-live. Page 29