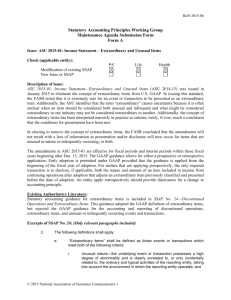

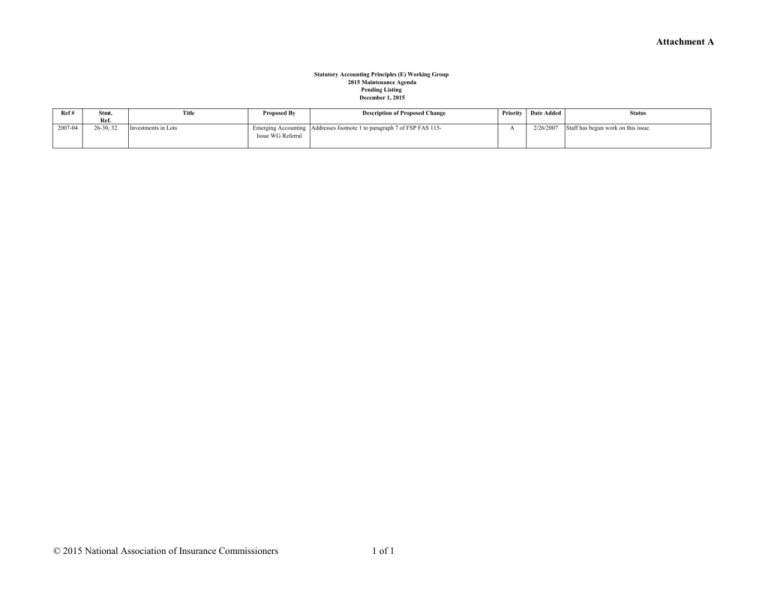

Maintenance Agenda - National Association of Insurance

advertisement