EMA NOTE : Issue 13

advertisement

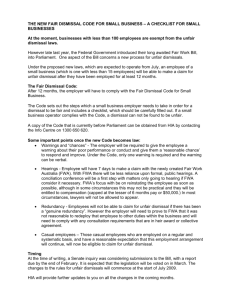

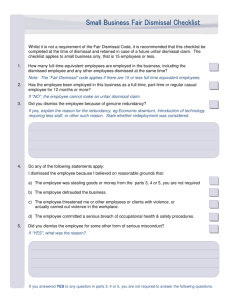

Issue 3 2011 Definition of ‘small business’ for unfair dismissal has now changed The definition of a small business employer for the purpose of unfair dismissal has changed effective 1 January 2011. This EMA Note outlines the changes to the method of calculation and provides a summary of the key aspects of the Small Business Fair Dismissal Code. A small business employer has been defined since 1 July 2009 as someone who employs fewer than 15 employees. This was previously determined by taking the total number of hours worked by all employees in a business and dividing it by 38 to find the number of full-time equivalent employees. However, from 1 January 2011, the method of calculation is now based on an actual headcount of the number of employees within the business, irrespective of how many hours they work. This headcount includes casuals employed on a regular and systematic basis and employees of associated entities as well as the employee being dismissed. The changes may affect the manner in which a fair dismissal may be carried out for affected employers. The definition of a small business for the purposes of unfair dismissal is therefore now consistent with other elements of the Fair Work Act 2009 (“Act”), such as redundancy. The Small Business Fair Dismissal Code The Small Business Fair Dismissal Code (“Code”) provides special arrangements to small businesses as defined, which simplify the dismissal process. Such arrangements include: • a minimum employment period of 12 months instead of 6 months (i.e. employees cannot lodge an unfair dismissal claim within the 12 month period), and • a checklist contained within the Code to assist employers in ensuring dismissals are not unfair. The reasons for the special unfair dismissal arrangements for small business are due to the following general characteristics of small businesses: 1. they do not typically have a human resource department to advise them on procedure; 2. they cannot afford ‘lost time’, and 3. they usually cannot find alternative positions for employees when positions become redundant (refer below). It is important to note that where employees are dismissed due to a business downturn or their position is no longer required (i.e. redundancy), such employees cannot bring a claim for unfair dismissal if the redundancy is genuine. On the contrary, refilling the position with a new employee may not be a genuine redundancy and may be subject to dispute. The requirements for determining whether a dismissal was a genuine redundancy are contained within section 389 of the Act, summarised as follows: 1. the role is no longer required to be performed by anyone due to changes in operational requirements, and 2. the employer has complied with any obligations contained within industrial instruments such as a modern award or enterprise agreement in respect to consultation. EMA-Note Issue 3 2011 Page 2 Further, in the case of genuine redundancy, the employer must consider any opportunity for redeployment of the employee(s) within the business enterprise, or any associated entity of the employer. The Code contains a checklist which can assist in determining whether a redundancy is a genuine redundancy in order to mitigate any risk to employers. Tips for Employers In summary, small business employers as defined should note the following: • The method of calculation of whether an employer is a small business employer is now based on an actual headcount of the number of employees in the business, irrespective of how many hours they work and is inclusive of: - • casuals who are employed on a regular and systematic basis; employees of associated entities, and the employee being dismissed. If an employee within a small business is being terminated due to redundancy, the redundancy must be a genuine redundancy as defined in the Act. It is recommended that employers who intend to dismiss an employee contact their local Consultant to ensure compliance with the legislation. Require further information/assistance? Contact your local Consultant at either our Adelaide or Melbourne Offices. Article prepared by Helen Peace IR Consultant, Adelaide Office