Franchises and

Buyouts

Part 2 Starting From Scratch or

Joining an Existing Business

PowerPoint Presentation by Charlie Cook

The University of West Alabama

Copyright © 2006 Thomson Business & Professional Publishing.

All rights reserved.

Franchising from the

Franchisor’s Perspective

• Benefits

– Reduction of capital

requirements

– Increase in management

motivation

– Speed of expansion

• Drawbacks

–Reduction in control

–Sharing of profits

–Increase in operational

support costs

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–2

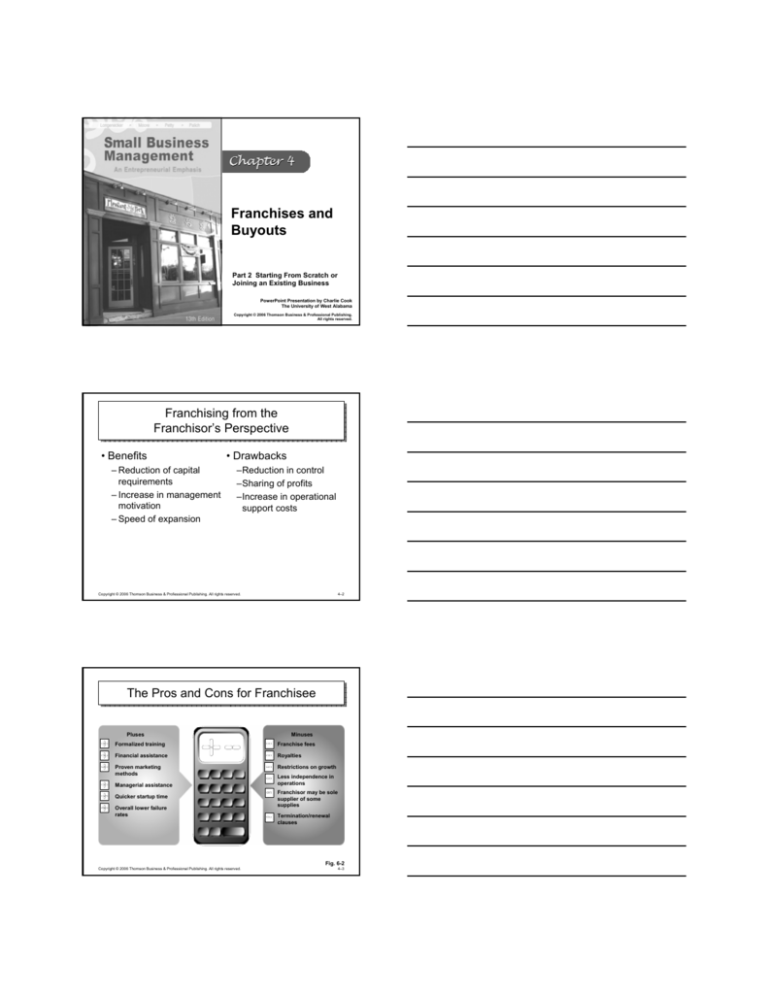

The Pros and Cons for Franchisee

Pluses

Minuses

Formalized training

Franchise fees

Financial assistance

Royalties

Proven marketing

methods

Restrictions on growth

Managerial assistance

Quicker startup time

Overall lower failure

rates

Less independence in

operations

Franchisor may be sole

supplier of some

supplies

Termination/renewal

clauses

Fig. 6-2

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–3

Franchising Agreements

• Franchise contract

–The legal agreement between franchisor and

franchisee

• Franchise

–The privileges conveyed in the franchise contract

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–4

Franchising Arrangements

• Product and Trade Name Franchise

–Grants the right to use a widely recognized product or

name

• Business Format Franchise

–Provides an entire marketing system and ongoing

guidance from the franchisor

• Master Licensee

–An independent firm or individual acting as a sales

agent with the responsibility for finding new franchises

within a specified territory

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–5

Franchising Arrangements (cont’d.)

• Multiple-Unit Ownership

–The holding by a single franchisee of more than one

franchise from the same company

• Area Developers

–Individuals or firms that obtain the legal right to open

several franchised outlets in a given area

• Piggyback Franchising

–The operation of a retail franchise within the physical

facilities of a host store

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–6

Legal Considerations in Franchising

• The Franchising Contract

–Signed with legal counsel present

–Contains a termination and transfer provision

–Contains a statement of rights to renew contract

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–7

Pros and Cons of Buying an

Existing Business

• Pros

• Cons

– High chance of success

– Existing problems

– Less planning

– Poor quality of current

employees

– Existing customers/

suppliers

– Poor business image

– Necessary equipment

– Modernization required

– Bargain price

– Experienced employees

– Purchase price based on

inaccurate data

– Existing business records

– Poor business location

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–8

Investigating and Evaluating

Available Businesses

• Due Diligence

–The exercise of prudence, such as would be expected

of a reasonable person, in the careful evaluation of a

business opportunity

• Relying on Professionals

–Accountants

–Attorneys

–Other experienced business owners

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–9

Finding Out Why the Business Is For Sale

• Owner’s reasons for selling the business

–Old age or illness

–Desire to relocate to a different section of the country

–Decision to accept a position with another company

–Unprofitability of the business

–Loss of an exclusive sales franchise

–Maturing of the industry and lack of growth potential

• Beware of sellers who may have “cooked the

books” to make the business more attractive.

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–10

Valuing the Business

• Asset-Based Valuation

– Estimates the value of the firm’s assets;

– Does not reflect the value of the firm as a going concern.

• Market-Comparable Valuation

– Considers the sale prices of comparable firms;

– Difficulty is in finding comparable firms.

• Cash-Flow-based Valuation

– Compares the expected and required rates of return on the

amount of capital to be invested in the business.

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–11

Nonquantitative Factors in

Valuing a Business

• Competition

• Market

• Future Community

Development

• Legal Commitments

• Union Contracts

• Buildings

• Product Prices

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–12

Negotiating and Closing the Deal

• Terms of Purchase

–Assets purchase or total entity

–Indemnification clause

–Payment in full or partial payments over time

• Closing the sale

–Best handled by a third party

• Bill of sale

• Tax certifications

• Payment-to-seller agreements

and guarantees

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–13

Characteristics of Successful High-Growth

Startups

• Begin as a team effort

• Are in service and manufacturing industries

• Have competent founders who:

–have related experience.

–have started other businesses.

–share in ownership of business.

• Are somewhat better financed

• Do not limit themselves to local markets

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–14

Key Terms

franchising

multiple-unit ownership

franchisee

area developers

franchisor

piggyback franchising

franchise contract

disclosure document

franchise

Uniform Franchise Offering

Circular (UFOC)

product and trade name

franchising

business format franchising

matchmakers

due diligence

master licensee

Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

4–15

![[10]. Accessing Resources for Growth from External Sources](http://s2.studylib.net/store/data/005546472_1-5ce4dc20e590c3a704ef63f6f22a5a81-300x300.png)