Capital budgeting practice problems - it

advertisement

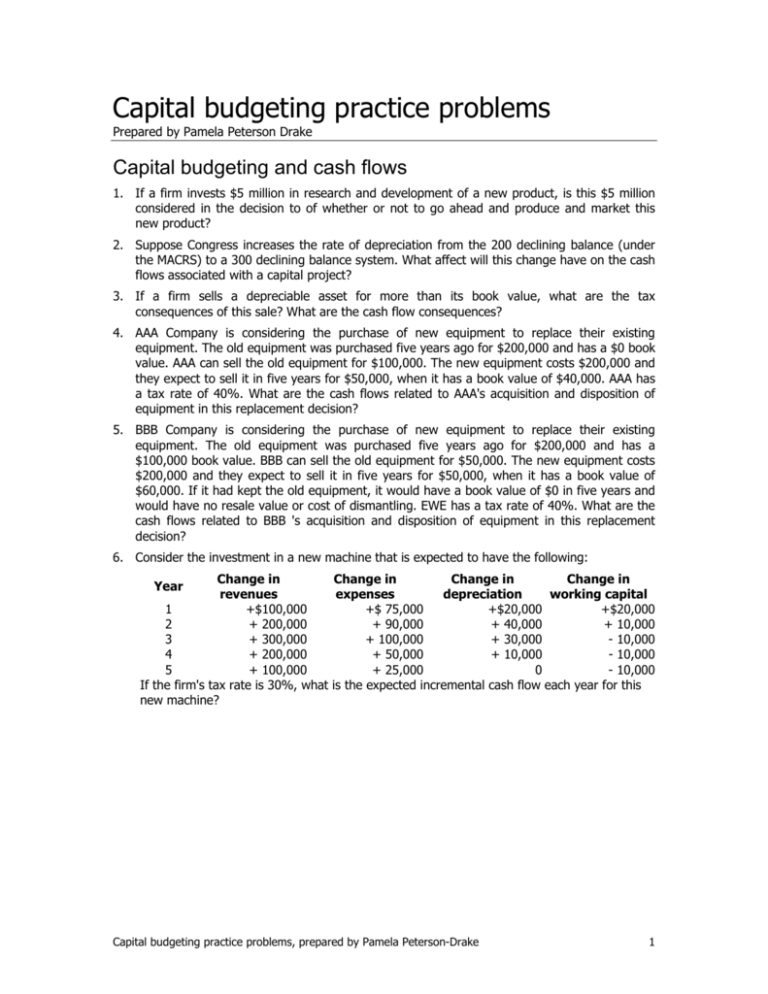

Capital budgeting practice problems Prepared by Pamela Peterson Drake Capital budgeting and cash flows 1. If a firm invests $5 million in research and development of a new product, is this $5 million considered in the decision to of whether or not to go ahead and produce and market this new product? 2. Suppose Congress increases the rate of depreciation from the 200 declining balance (under the MACRS) to a 300 declining balance system. What affect will this change have on the cash flows associated with a capital project? 3. If a firm sells a depreciable asset for more than its book value, what are the tax consequences of this sale? What are the cash flow consequences? 4. AAA Company is considering the purchase of new equipment to replace their existing equipment. The old equipment was purchased five years ago for $200,000 and has a $0 book value. AAA can sell the old equipment for $100,000. The new equipment costs $200,000 and they expect to sell it in five years for $50,000, when it has a book value of $40,000. AAA has a tax rate of 40%. What are the cash flows related to AAA's acquisition and disposition of equipment in this replacement decision? 5. BBB Company is considering the purchase of new equipment to replace their existing equipment. The old equipment was purchased five years ago for $200,000 and has a $100,000 book value. BBB can sell the old equipment for $50,000. The new equipment costs $200,000 and they expect to sell it in five years for $50,000, when it has a book value of $60,000. If it had kept the old equipment, it would have a book value of $0 in five years and would have no resale value or cost of dismantling. EWE has a tax rate of 40%. What are the cash flows related to BBB 's acquisition and disposition of equipment in this replacement decision? 6. Consider the investment in a new machine that is expected to have the following: Change in Change in Change in Change in revenues expenses depreciation working capital 1 +$100,000 +$ 75,000 +$20,000 +$20,000 2 + 200,000 + 90,000 + 40,000 + 10,000 3 + 300,000 + 100,000 + 30,000 - 10,000 4 + 200,000 + 50,000 + 10,000 - 10,000 5 + 100,000 + 25,000 0 - 10,000 If the firm's tax rate is 30%, what is the expected incremental cash flow each year for this new machine? Year Capital budgeting practice problems, prepared by Pamela Peterson-Drake 1 Capital budgeting techniques 1. The internal rate of return is often referred to as the yield on an investment. Explain the analogy between the internal rate of return on an investment and the yield to maturity on a bond. 2. The net present value method and the internal rate of return method may produce different decisions when selecting among mutually exclusive projects. What is the source of this conflict? 3. The net present value method and the internal rate of return method may produce different decisions when selecting projects under capital rationing. What is the source of this conflict? 4. The modified internal rate of return is designed to overcome a deficiency in the internal rate of return method. Specifically, what problem is the MIRR designed to overcome? 5. You are evaluating an investment project, Project CCC, with the following cash flows: Period 0 1 2 3 4 End of period cash flow -$100,000 35,027 35,027 35,027 35,027 Calculate the following: a. b. c. Internal Rate of Return Modified Internal Rate of Return, assuming reinvestment at 0% Modified Internal Rate of Return, assuming reinvestment at 10% 6. You are evaluating an investment project, Project DDD, with the following cash flows: Period 0 1 2 3 End of period cash flow -$100,000 43,798 43,798 43,798 Calculate the following: a. b. c. Internal rate of return Modified Internal Rate of Return, assuming reinvestment at 10% Modified Internal Rate of Return, assuming reinvestment at 14% 7. You are evaluating an investment project, Project EEE, with the following cash flows: Period 0 1 End of period cash flow -$200,000 65,000 Capital budgeting practice problems, prepared by Pamela Peterson-Drake 2 2 3 4 5 a. b. c. d. 65,000 65,000 65,000 65,000 Calculate the following: Internal Rate of Return Modified Internal Rate of Return, assuming reinvestment at 10% Modified Internal Rate of Return, assuming reinvestment at 15% 8. You are evaluating an investment project, Project FFF, with the following cash flows: Period 0 1 2 3 4 End of period cash flow -$100,000 0 0 0 174,901 Calculate the following: a. b. Internal Rate of Return Modified Internal Rate of Return, assuming reinvestment at 10% Capital budgeting practice problems, prepared by Pamela Peterson-Drake 3 Capital budgeting and risk 1. What distinguishes sensitivity analysis from simulation analysis? 2. Suppose you are responsible for determining the cost of capital of a project. How should your approach differ if the firm is a small, one-owner firm, as compared to a large publicly-held corporation? 3. Suppose the GGG Company evaluates most projects using the net present value method and a single discount rate that reflects its marginal cost of raising new capital. Can you see any problem with their method? 4. Suppose the HHH's management evaluates investment opportunities by grouping projects into three risk classes: low, average, and high risk. They assign a cost of capital to each group and use this cost of capital to discount a project's future cash flows: 5% for low risk, 10% for average risk, and 15% for high risk projects. Critique their method of adjusting for risk. 5. Product A has an expected first year cash flow of $10 million and a standard deviation of its probability distribution of its first year cash flows of $2 million. Product B has an expected first year cash flow of $15 million and a standard deviation of its probability distribution of first year cash flows of $3 million. Which product has the greater total risk? 6. Consider the probability distribution of cash flows for Product X: Probability Cash Flow 20% $1 million 40% $3 million 40% $5 million Calculate the following: a. b. c. 7. Expected cash flow. Standard deviation of the cash flows. Coefficient of variation of the cash flows. Calculate the asset beta for each firm, III, JJJ and KKK: Firm Marginal tax rate Debt Equity Equity beta Firm III 50% $300 $200 Firm JJJ 30% $300 $400 1.5 Firm KKK 40% $200 $200 1.0 Capital budgeting practice problems, prepared by Pamela Peterson-Drake 1.5 4