Best Rating Updates

advertisement

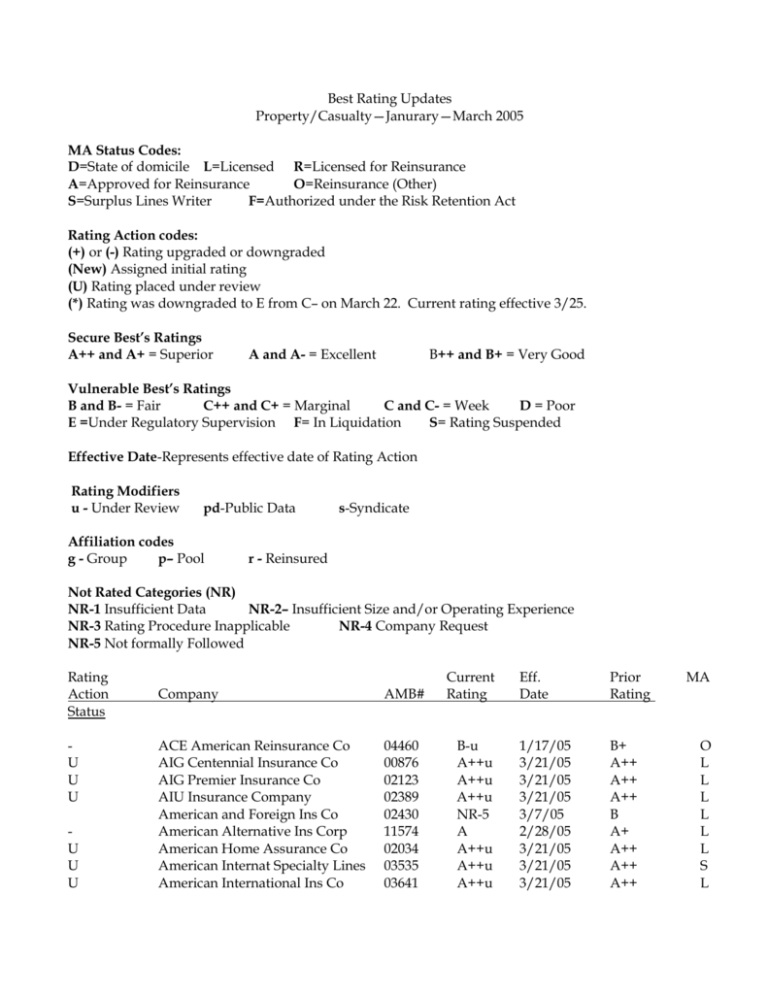

Best Rating Updates Property/Casualty—Janurary—March 2005 MA Status Codes: D=State of domicile L=Licensed R=Licensed for Reinsurance A=Approved for Reinsurance O=Reinsurance (Other) S=Surplus Lines Writer F=Authorized under the Risk Retention Act Rating Action codes: (+) or (-) Rating upgraded or downgraded (New) Assigned initial rating (U) Rating placed under review (*) Rating was downgraded to E from C– on March 22. Current rating effective 3/25. Secure Best’s Ratings A++ and A+ = Superior A and A- = Excellent B++ and B+ = Very Good Vulnerable Best’s Ratings B and B- = Fair C++ and C+ = Marginal C and C- = Week D = Poor E =Under Regulatory Supervision F= In Liquidation S= Rating Suspended Effective Date-Represents effective date of Rating Action Rating Modifiers u - Under Review pd-Public Data Affiliation codes g - Group p– Pool s-Syndicate r - Reinsured Not Rated Categories (NR) NR-1 Insufficient Data NR-2– Insufficient Size and/or Operating Experience NR-3 Rating Procedure Inapplicable NR-4 Company Request NR-5 Not formally Followed Rating Action Status U U U U U U Company AMB# Current Rating ACE American Reinsurance Co AIG Centennial Insurance Co AIG Premier Insurance Co AIU Insurance Company American and Foreign Ins Co American Alternative Ins Corp American Home Assurance Co American Internat Specialty Lines American International Ins Co 04460 00876 02123 02389 02430 11574 02034 03535 03641 B-u A++u A++u A++u NR-5 A A++u A++u A++u Eff. Date Prior Rating 1/17/05 3/21/05 3/21/05 3/21/05 3/7/05 2/28/05 3/21/05 3/21/05 3/21/05 B+ A++ A++ A++ B A+ A++ A++ A++ MA O L L L L L L S L U Rating Action Status American International Pacific 02359 Company AMB# U U U American Re-Insurance Co Automobile Ins Co of Hartford CT Birmingham Fire Ins Co of PA Century Indemnity Company Charter Oak Fire Ins Company Connecticut Indemnity Co Evergreen USA Risk Retention Gr Farmington Casualty Company Globe Indemnity Company Granite State Insurance Co Guaranty National Insurance Co Hartford Steam Boiler Inspec & Ins. Hartford Steam Boiler Inspe/Inc CT Illinois National Insurance Co Insurance Company of State of PA Landmark Insurance Co Lexington Insurance Co Medical Assurance Company Inc National Union Fire Ins Co Pitts.PA New Hampshire Insurance Co NIPPONKOA Ins Co of America Ohio Indemnity Company Old United Casualty Company Peak P&C Ins. Corp. Phoenix Assurance Co of NY Phoenix Insurance Company Potomac Insurance Co of Illinois Princeton Excess & Surplus Lines Royal Indemnity Company Royal Ins. Co of America Royal Surplus Lines Ins Co Safeguard Insurance Company Sea Ins Co of America SEACO Insurance Company Security Ins Co of Hartford Senior Citizens Mutual Ins Co Sompo Japan Ins. Co. of America Stonington Insurance Company Standard Fire Insurance Co Tennessee Insurance Company Travelers Casualty & Surety Co Travelers Casualty & Surety of Am 00149 04046 02349 04047 02516 02454 11155 01744 02432 02360 00443 00465 11074 02361 02035 03756 02350 03826 02351 02363 01909 04813 10362 11414 02400 02518 02760 12170 02438 02437 01745 02440 02094 02071 02457 10835 03060 00175 02002 03179 02001 03609 U U U U U U U U U U U U + U U U U U U A++u Current Rating A A+u A++u B-u A+u NR-5 B A+u NR-5 A++u C++ A++u A++u A++u A++u A++u A++u A-u A++u A++u NR-3 B++u A Bu NR-5 A+u NR-5 A C++ NR-5 C++ NR-5 C++ NR-5 C++ B-u A Au A+u NR-4 A+u A+u 3/21/05 Eff. Date A++ Prior Rating 2/28/05 2/7/05 3/21/05 1/17/05 2/7/05 3/7/05 1/17/05 2/7/05 3/7/05 3/21/05 3/7/05 3/21/05 3/21/05 3/21/05 3/21/05 3/21/058 3/21/05 3/14/05 3/21/05 3/21/05 1/24/05 2/21/05 1/31/05 3/7/05 3/7/05 2/7/05 1/3/05 2/28/05 3/7/05 3/7/05 3/7/05 3/7/05 3/7/05 2/21/05 3/7/05 3/21/05 1/3/05 2/28/05 2/7/05 2/7/05 2/7/05 2/7/05 A+ A+ A++ B+ A+ B B+ A+ B A++ B A++ A++ A++ A++ A++ A++ AA++ A++ AA AB B A+ A A+ B B B B B E B B+ A+ A A+ BA+ A+ L MA L L L L L L F L L L S L L L L L S L L L L L L L L L L S L L S L L D L F L L L F L L U U Rating Action Status U U U U U U U U U Travelers Casualty Co of CT Travelers Casualty Ins Co of Am 11024 04465 AMB# A+u A+u Current Rating 2/7/05 2/7/05 Eff. Date A+ A+ Prior Rating Company Travelers Commercial Cas. Co Travelers Commercial Ins Co Travelers Excess & Surplus Lines Travelers Indemnity Co of Am Travelers Indemnity Co. Travelers Indemnity Co of CT Travelers Personal Security Ins Travelers Property Casualty Co AM Yosemite Insurance Company 11767 11025 00241 04003 02520 02517 11026 04461 03222 A+u A+u A+u A+u A+u A+u A+u A+u Au 2/7/05 2/7/05 2/7/05 2/7/05 2/7/05 2/7/05 2/7/05 2/7/05 3/21/05 A+ A+ A+ A+ A+ A+ A+ A+ A L L MA L L S L L L L L L ACE American Reinsurance Company (A.M. Best #: 04460 NAIC #: 22705) Century Indemnity Company (A.M. Best #: 04047 NAIC #: 20710) RATING RATIONALE The following text is derived from the report of Brandywine Group. Under Review Rationale: The rating will remain under review pending regulatory approvals. Rating Rationale: The rating applies to the Brandywine Group and its three members, led by Century Indemnity Company and mainly reflects Brandywine's $25 million of capitalization - a minimal level required by the insurance regulators. The rating was lowered in Jan. 2005 subsequent to management's announcement of a $281 million after tax charge for prior year reserve deficiency including an addition of approximately $90 million to its bad debt reserve. A.M. Best believes the charge is less than conservative. The downgrade is based on A.M. Best's increase in its estimate of Brandywine's ultimate asbestos liabilities as well as the significantly reduced reinsurance protections remaining. In addition ACE announced its intention to sell its assumed reinsurance run-off businesses within the Brandywine Group which would reduce reserves by approximately $1 billion or 17% of Brandywine liabilities. The sale would cause a $50 million loss mainly due to discounting. The benefit of the sale would be to reduce liabilities ceded to National Indemnity Company (NICO) and ACE American Pool by around $200 million. The charge causes a negative capital position at Century Indemnity which ACE "cured" with a $100 million surplus note which allowed surplus to rise to $25MM - an amount that coincides with the minimum surplus requirement provided in the 1995 Restructuring Agreement. ACE's continued financial support of Brandywine is uncertain. The charge significantly depleted the $800MM excess loss reserve development protections from ACE American Pool. Adverse loss reserve development beyond the minimal remaining protections could exceed capitalization. The capitalization level decreased in 2002 to $25 million as a result of the group's $2.2 billion (gross)/$318 million (net- pre-tax) reserve strengthening. The rating also heavily considers the fact that during 2003 the attachment point under the NICO cover was reached on a paid basis and NICO began reimbursing losses, loss adjustment expenses and uncollectible reinsurance paid by Brandywine. Once the NICO cover is exhausted on a paid basis, the $800 million ACE American Pool reinsurance will begin to pay claims which is not expected for several years. As a result, A.M. Best believes that Brandywine will be able to meet its obligations for a considerable period of time. Therefore, the rating outlook is stable. The Brandywine Group was created in 1995 by the restructuring of CIGNA's domestic operations into separate ongoing (INA companies) and run-off (Brandywine Group) operations. As part of the restructuring, INA Financial Corporation established a dividend retention fund consisting of $50 million plus investment earnings to be contributed to Century Indemnity Company as necessary. In addition, affiliated INA companies provided aggregate excess of loss reinsurance coverage to Century Indemnity Company of $800 million. At the acquisition of CIGNA P&C business by ACE in 1999, National Indemnity Company, a subsidiary of Berkshire Hathaway, Inc. (NICO) provided $2.5 billion of reinsurance protection for adverse development on Brandywine loss and loss adjustment expense reserves and for uncollectible ceded reinsurance. Brandywine A&E reserves were strengthened at year-end 2002 by $2.2 billion gross, $318 million net of reinsurance. As a result of this adjustment, the culmination of an extensive internal and outside actuarial A&E ground-up exposure analysis, the dividend retention fund balance and the NICO reinsurance cover were fully utilized. Coverage under the aggregate excess of loss reinsurance agreement provided by INA affiliated companies was also partially utilized and $182 million of losses were ceded in 2002. At yearend 2003, an internal expanded group-up exposure study was conducted resulting in no additional reserve adjustments. At year-end 2003 $238 million of losses had been ceded under the aggregate excess of loss reinsurance contract. The additional coverage utilized in 2003 primarily reflects unwinding statutory loss reserve discount, other incurred expenses, investment income and net investment gains as they impact Brandywine's statutory surplus, which is the basis of attachment for the coverage. Uncertainties remain regarding long-term claims run-off, including potential federal asbestos claims settlement reform. While the group's direct funding, together with NICO and affiliated aggregate excess reinsurance coverage, have provided adequate support so far, the final outcome remains contingent upon economic conditions as well as claims settlement results and asset management practices. A.M. Best continues to monitor state regulatory issues, legal challenges and management's ability to manage runoff operations successfully. AIG Centennial Insurance Company (A.M. Best #: 00876 NAIC #: 34789) AIG Premier Insurance Company (A.M. Best #: 02123 NAIC #: 20796) The following text is derived from the report of AIG Personal Lines Pool. Under Review Rationale: A.M. Best placed the financial strength ratings of member companies of American International Group, Inc. (NYSE: AIG) under review with negative implications following their announcement that the Chairman and CEO, Maurice Greenberg, will retire as CEO, although he remains non-executive Chairman. Mr. Greenberg will be succeeded by Martin J. Sullivan, who had been AIG's vice chairman and co-chief operating officer. The company additionally announced that the CFO, Howard Smith, has taken leave and that the filing of AIG's 2004 10-K has been delayed. Howard Smith will be succeeded by Steven J. Bensinger. The retirement of Mr. Greenberg follows concern over an increasing number of regulatory inquiries as well as queries from the New York Attorney General and the SEC. The vast majority of AIG's major insurance subsidiaries have held financial strength ratings of A++, A.M. Best's highest rating, for many years. There remain a number of unresolved issues with the potential for continued uncertainty. The ratings have been placed under review due to the delay in the filing, the premature retirement of two top senior executives, and the numerous regulatory inquiries. A.M. Best believes that the operating fundamentals within AIG are sound, there is significant management benchstrength among the leaders of the business segments, and barring any additional negative reports, the ability to generate historical earnings should continue. The ratings will remain under review pending A.M. Best's review of the filed 10-K as well as any further company developments. Rating Rationale: The rating applies to American International Group Inc. 's (AIG) twelve member personal lines pool, led by American International Insurance Company (AIIC), and is based on the consolidation of these entities. On Aug. 29, 2003 five personal lines companies were acquired by AIG from GE Assurance Holdings, Inc. and on Dec. 31, 2004, four of these companies were added to the AIG Personal Lines Pool. The former GE companies are directly owned by Lexington Insurance Co., an excess and surplus lines company and member of AIG's Domestic Brokerage Group, which also provides an unconditional and irrevocable guarantee to the companies. The rating reflects the advantages of being affiliated with American International Group, Inc., one of the largest property/casualty insurance organizations in the U.S. The benefits of AIG ownership is supported by the pool's broad geographic diversification, low-cost distribution channels and strategic partnering. Since its formation in 1996, the pool has benefited from the ongoing support and commitment of its parent through substantial reinsurance linkage, sharing of intellectual resources, the formation of a dedicated personal lines business unit and increased brand-building initiatives. American Home Assurance Co., a member of the AIG commercial lines pool, provides an unconditional and irrevocable guarantee to AIIC. In addition, the pool's utilization of multiple distribution channels enhances its market penetration and limits its reliance on any one distribution source. Finally, upgraded technological capabilities and a rapidly growing direct marketing program continue to enhance its already low-cost expense structure. Offsetting these positive factors are the historical variability in premium, underwriting income and net income, which have all improved in 2003 and 2004. However, the average combined ratio over the past five years has remained acceptable at 100.9%. The inclusion of the GE companies acquired by AIG should prove beneficial going forward as their underwriting performance in 2004 has produced an underwriting profit. Capitalization is adequate for the rating level, although growth in premiums and liabilities have outpaced surplus appreciation in recent years. The pool has historically maintained elevated underwriting and investment leverage relative to its personal lines peers. However, this aggressive leverage is mitigated by the financial strength and flexibility of AIG, its strong balance sheet, outstanding profitability and excellent capital formation capability, and the explicit support provided to the personal lines pool. Other negative factors include very competitive market conditions and increasing, but still somewhat modest, brand-name recognition. These factors are tempered by AIG's expense advantage and its extensive advertising campaign, effectively enhancing AIG's ability to compete and increasing consumer awareness. Best's Rating: A++pu Implication: Negative AIU Insurance Company (A.M. Best #: 02389 NAIC #: 19399) American Home Assurance Company (A.M. Best #: 02034 NAIC #: 19380) American Internat Specialty Lines Ins Co (A.M. Best #: 03535 NAIC #: 26883) American International Insurance Company (A.M. Best #: 03641 NAIC #: 32220) American International Pacific Ins Co (A.M. Best #: 02359 NAIC #: 23795) Birmingham Fire Insurance Company of PA (A.M. Best #: 02349 NAIC #: 19402) Granite State Insurance Company (A.M. Best #: 02360 NAIC #: 23809) Illinois National Insurance Company (A.M. Best #: 02361 NAIC #: 23817) Insurance Company of State of PA (A.M. Best #: 02035 NAIC #: 19429) National Union Fire Ins Co Pittsburgh PA (A.M. Best #: 02351 NAIC #: 19445) New Hampshire Insurance Company (A.M. Best #: 02363 NAIC #: 23841) RATING RATIONALE The following text is derived from the report of American International Group. Under Review Rationale: A.M. Best placed the financial strength ratings of member companies of American International Group, Inc. (NYSE: AIG) under review with negative implications following their announcement that the Chairman and CEO, Maurice Greenberg, will retire as CEO, although he remains non-executive Chairman. Mr. Greenberg will be succeeded by Martin J. Sullivan, who had been AIG's vice chairman and co-chief operating officer. The company additionally announced that the CFO, Howard Smith, has taken leave and that the filing of AIG's 2004 10-K has been delayed. Howard Smith will be succeeded by Steven J. Bensinger. The retirement of Mr. Greenberg follows concern over an increasing number of regulatory inquiries as well as queries from the New York Attorney General and the SEC. The vast majority of AIG's major insurance subsidiaries have held financial strength ratings of A++, A.M. Best's highest rating, for many years. There remain a number of unresolved issues with the potential for continued uncertainty. The ratings have been placed under review due to the delay in the filing, the premature retirement of two top senior executives, and the numerous regulatory inquiries. A.M. Best believes that the operating fundamentals within AIG are sound, there is significant management benchstrength among the leaders of the business segments, and barring any additional negative reports, the ability to generate historical earnings should continue. The ratings will remain under review pending A.M. Best's review of the filed 10-K as well as any further company developments. Rating Rationale: The rating of the eleven members of the American International Group (AIG) Commercial Lines Pool, led by National Union Fire Insurance Company of Pittsburgh, Pa., and certain strategic affiliates is based on the consolidated operating performance of AIG's domestic property / casualty insurance group, which includes the operating results of the following companies: the AIG Commercial Pool; the AIG Personal Lines Pool; the Lexington Insurance Pool; the Hartford Steam Boiler Group; majority-owned Transatlantic Holdings, Inc.; and majority-owned 21st Century Industries. Each of the aforementioned Pools/Groups are separately rated. The rating reflects AIG's outstanding operating performance, specialty underwriting focus, and recognized global leadership position within its select and highly specialized market segments, particularly management liability (including directors and officers liability), commercial umbrella, environmental coverages and excess and surplus lines. The nation's largest underwriters of commercial and industrial coverages, AIG is widely recognized in the broker community for its unique and highly innovative product offerings, substantial risk management and service capabilities, as well as its ability to provide high coverage limits and broad global capacity. AIG also benefits from its profit center approach and strong broker relationships. Through its extensive overseas network and full array of commercial products, AIG can accommodate most of its clients' global insurance needs. Finally, the group maintains a high-quality investment portfolio and a conservative net limit risk profile that minimizes AIG's exposure to potentially large losses. Partially offsetting these strengths is the uncertainty associated with AIG's ongoing exposure to asbestos and environmental (A&E) liabilities. Despite these uncertainties, A.M. Best believes that AIG's exposure to A&E claims is very manageable given its relatively lower market share of exposed policies, greater utilization of reinsurance and extremely strong earnings generation. The group also maintains a sizeable amount of stacked capital with affiliated investments equal to approximately one-third of its capital base. Despite recording a material $2.8 billion loss reserve charge in 2002 and additional reserve increases of $1.4 billion in 2003, AIG remains one of a select number of large national property/casualty groups that consistently produces outstanding operating results, with a five-year average combined ratio of 99.7% and pretax operating return on surplus of 10.3% both of which significantly outperform the industry. A.M. Best believes that AIG is extremely well positioned to capitalize on the industry's flight-to-quality trends and market dislocations within many of its core specialty segments. In addition, AIG's core philosophy of refusing to underwrite unprofitable business should enable the company to continue to perform better than the industry should prices appreciably soften. A.M. Best believes AIG's long-term growth and profitability prospects continue to be favorable given its quality management teams, franchise value, product innovation, specialized underwriting expertise and use of high-quality reinsurance. Added financial flexibility and access to capital markets is afforded by its ultimate parent--American International Group, Inc., a globally diversified leader in the insurance and financial services industries. Best's Rating: A++pu Implication: Negative American Alternative Insurance Corp (A.M. Best #: 11574 NAIC #: 19720) American Re-Insurance Company (A.M. Best #: 00149 NAIC #: 10227) Princeton Excess & Surplus Lines Ins Co (A.M. Best #: 12170 NAIC #: 10786) RATING RATIONALE The following text is derived from the report of American Re Corporation Group. Rating Rationale: American Re Corporation Group (American Re) is comprised of American ReInsurance Company, American Alternative Insurance Corporation, and Princeton Excess & Surplus Lines Insurance Company, (all domiciled in Wilmington, DE). The rating reflects American Re's excellent risk-adjusted capitalization, its dominant business franchise and the explicit financial support provided by its ultimate parent, Munich Re (Germany). These strengths are derived from American Re's extensive risk management and innovative product offerings augmented by its access to alternative risk markets through its primary subsidiaries, all of which have fostered longstanding relationships with its targeted clients. Further, American Re serves as the reinsurance operating platform for Munich Re in the United States. American Re announced that it had taken additional reserve strengthening of $180 million in the fourth quarter related to asbestos exposure, culminating in $482.3 million pre-tax of prior-year adverse reserve development in 2004. Consequently, the quality of American Re's risk-adjusted capitalization and underwriting performance as well as earnings trend over the past five years have been negatively affected by significant and repeated adverse development charges covering the 1997-2001 accident years, asbestos charges and catastrophe-related exposure. Despite the historical explicit and implicit support provided by its parent, Munich Re (Germany), in the form of capital infusions, stop loss covers and retrocessional arrangements, American Re's risk-adjusted capitalization and earnings performance have eroded, weakening the company's stand alone financial strength. In December 2004, A.M. Best revised American Re's rating outlook on to negative from stable, citing the protracted period of weak underwriting performance on a calendar year basis and declining riskadjusted capitalization despite the previous explicit support from Munich Re. Since then, American Re's rating was lowered to A (Excellent). American Re's ratings and the stable outlook continue to reflect the benefit and anticipated future support from its parent, but the amount of rating enhancement has decreased due to the continued poor earnings performance of American Re. Best's Rating: A g Outlook: Stable Automobile Ins Co of Hartford, CT (A.M. Best #: 04046 NAIC #: 19062) Charter Oak Fire Insurance Company (A.M. Best #: 02516 NAIC #: 25615) Farmington Casualty Company (A.M. Best #: 01744 NAIC #: 41483) Phoenix Insurance Company (A.M. Best #: 02518 NAIC #: 25623) Standard Fire Insurance Company (A.M. Best #: 02002 NAIC #: 19070) Travelers Casualty and Surety Company (A.M. Best #: 02001 NAIC #: 19038) Travelers Casualty and Surety of America (A.M. Best #: 03609 NAIC #: 31194) Travelers Casualty Company of CT (A.M. Best #: 11024 NAIC #: 36170) Travelers Casualty Insurance Co of Amer (A.M. Best #: 04465 NAIC #: 19046) Travelers Commercial Casualty Company (A.M. Best #: 11767 NAIC #: 40282) Travelers Commercial Insurance Company (A.M. Best #: 11025 NAIC #: 36137) Travelers Excess and Surplus Lines Co (A.M. Best #: 00241 NAIC #: 29696) Travelers Indemnity Co of America (A.M. Best #: 04003 NAIC #: 25666) Travelers Indemnity Company (A.M. Best #: 02520 NAIC #: 25658) Travelers Indemnity Company of CT (A.M. Best #: 02517 NAIC #: 25682) Travelers Personal Security Insurance Co (A.M. Best #: 11026 NAIC #: 36145) Travelers Property Casualty Co of Amer (A.M. Best #: 04461 NAIC #: 25674) RATING RATIONALE The following text is derived from the report of Travelers Property Casualty Pool. Under Review Rationale: Travelers PC Pool's rating was placed under review with negative implications on January 31, 2005 following the fourth quarter earnings announcement by the parent, The St. Paul Travelers Companies, Inc. (St. Paul Travelers), that it increased prior year reserves by $868 million pretax, resulting in weaker than expected earnings for the year for St. Paul Travelers, as well as less than anticipated holding company liquidity. The reserve increase reported by St. Paul Travelers stems from the completion of an internal annual asbestos reserve review that resulted in a reserve charge of $922 million pretax, along with an $84 million charge for environmental reserves (collectively A&E). The St. Paul Companies' A&E reserve increase was $576 million pretax while Travelers PC Pool's was $430 million. The A&E charges were partly offset by $140 million of favorable prior year reserve development in personal lines. St. Paul Travelers also reported $180 million of favorable development in current year reserves resulting from favorable claim activity in commercial and personal lines of business, offset by $113 million of additional net reserves for catastrophe losses related to the third quarter hurricanes. As part of its strategic review of its businesses, management also disclosed that it is exploring strategic alternatives for divesting its 79% equity ownership of Nuveen Investments, Inc. (Nuveen), a publicly traded company that has a total market capitalization of approximately $3.5 billion. The potential divestiture of its investment in Nuveen would result in a significant increase in St. Paul Travelers' holding company liquidity, operating company capital and tangible net worth and a significant reduction goodwill and intangible assets. This transaction would provide the St. Paul Companies with a sizable capital cushion to diffuse the impact of further adverse loss reserve development on capitalization should it occur, reduce the potential need for further capital support from Travelers PC Pool, and enable dividends from the Travelers PC Pool to build holding company liquidity. Travelers PC Pool's rating was placed under review with negative implications, pending the close of this transaction. The $576 million pretax A&E reserve increase required by the St. Paul Companies in the fourth quarter 2004, combined with its $1.625 billion pretax second quarter charge, substantially exceeded A.M. Best's expectations as did the degree and need for Travelers PC Pool to financially support the St. Paul Companies since the consummation of the merger. A.M. Best believes that based on the reserve development that has occurred in recent periods, there is potential for further adverse reserve development. While currently rated separately, considerable enhancement is afforded to the St. Paul Companies' rating given Travelers PC Pool's continued financial support, its strategic role and its importance to the overall organization. Conversely, charges at the St. Paul Companies have weakened the rating of its affiliate, Travelers PC Pool, which has been called upon to fund the reserve charges at the St. Paul Companies. Consequently, Travelers PC Pool dividended approximately 75% of its net earnings in 2004 to recapitalize the St. Paul Companies and service the greater combined holding company's cash needs. Furthermore, St. Paul Travelers has been unable to reduce its outstanding borrowings and build holding company liquidity as it had prudently planned to do following the consummation of the merger. Although Travelers PC Pool's earnings prospects remain strong in 2005, substantial dividends are anticipated to be paid in order to enhance holding company liquidity. Travelers PC Pool's dividend capacity, while sizable, is not sufficient to meet these objectives and fund future recapitalization needs at the St. Paul Companies, should they emerge. This view will be substantially mitigated by the successful completion of the Nuveen divestiture. Overall risk-adjusted capitalization of Travelers PC Pool remains supportive of its current rating despite the financial support provided to the St. Paul Companies in 2004. However, the capital drag has placed downward pressure on Travelers PC Pool's rating. Rating Rationale: The rating applies to the 20 pool members, led by the Travelers Indemnity Company, and three reinsured affiliates. The rating also applies to Travelers Casualty and Surety Company of America, which A.M. Best considers to be core and integral member of the Travelers Property Casualty Group. The rating reflects Travelers' dominant market profile, superior earnings power and strong capitalization. The rating also acknowledges the group's strategic focus on profitability, emphasizing both underwriting and financial discipline. The success of this approach is exemplified by the group's exceptionally strong earnings performance in recent years, with returns on both revenue and equity surpassing industry norms by a wide margin. These ratios underscore Travelers' effective expense management, catastrophe mitigation strategies and adherence to strict underwriting and reserving discipline. These favorable considerations are tempered somewhat by Travelers' ongoing exposure to emerging asbestos and environmental (A&E) claims, as well as the substantial prior year loss reserve development that occurred over the past several years. While A.M. Best believes there is potential for continued reserve development at Travelers in the near term, the group's operating returns are expected to remain solid and its capitalization strong. The rating also takes into consideration the Travelers Property Casualty Corp.'s merger with The St. Paul Companies, which formed The St. Paul Travelers Companies, Inc., on April 1, 2004 and the benefits to be derived by this merger. The combined organization possesses significant market share, ranking second in the U.S. in commercial lines as well as in personal lines agency companies, with 7.6% and 6.8% market shares, respectively. The merger also results in greater geographic spread and diversification of business, with Travelers' presence being particularly strong in the Northeast and East Coast and St. Paul in the Midwest and South. Furthermore, the merger should afford significant expense savings potential through integration. Offsetting these positive factors are the potential for further drag on Travelers' capital resulting from adverse reserve development at St. Paul - as evidenced in 2004, as well as the challenges and risks of integrating the groups in terms of operations and systems. Notwithstanding, the management of both organizations has significant experience with regard to integrating groups having previously been involved in the successful merger of several other large insurance organizations. Moreover, concentrations of Travelers and St. Paul business within agencies may be a concern to those agencies preferring to produce business for a more diversified group of carriers. In light of the group's A&E reserve strengthening of $2.7 billion in 2002 and $636 million in 2004, A.M Best believes this bolstering of A&E reserves should lessen future earnings drag, as well as narrow the gap between Travelers' carried reserves and Best's view of Travelers' unfunded A&E reserves. While A.M. Best is reasonably comfortable with the adequacy of Travelers' A&E reserves, there is potential for further adverse development. Being among the largest commercial insurers, Travelers also has exposure to potential terrorist-related losses, although it has an extensive exposure management program in place to manage its spread of risk and reduce its exposure to a single event. Notwithstanding, as a recognized market leader, A.M. Best expects Travelers to benefit from the current favorable property/casualty market environment and achieve profitable growth. Best's Rating: A+ pu Implication: Negative Evergreen USA Risk Retention Group, Inc (A.M. Best #: 11155 NAIC #: 38466) RATING RATIONALE Rating Rationale: The rating action reflects Evergreen USA Risk Retention Group's marginal operating performance over the last three years, which in spite of showing signs of improvement for 2003, did not continue to improve based on preliminary results as of September 30, 2004. Capital has not grown from internal operations or investments. Additionally, the company has a high net retention per occurrence relative to its total writings and surplus. These negative rating factors are somewhat offset by the continuing capital availability from Evergreen Indemnity Limited (EIL), an affiliated Barbados captive insurance company, which has provided several capital contributions to Evergreen USA. Given the balance of these factors, A.M. Best has assigned a negative outlook to the rating. A.M. Best acknowledges the positive benefits to Evergreen USA resulting from its relationship with its affiliated company, EIL, which is rated Excellent by A.M. Best. These benefits include shared management, common ownership, and the role it has served as a resource for capital. Starting in 2002, and again in the first quarter of both 2003 and 2004, EIL increased its financial support of Evergreen USA via letters of credit. This additional capital was needed to offset significant operating losses in 2001, 2002, and 2003. The deteriorating operating performance and capitalization has primarily been the result of adverse loss experience. The recent partial recovery in operating performance has been the result of rate increases obtained during 2002 and 2003 that have inured to the bottom line somewhat during 2003. Loss reserve development on a calendar year basis has been adverse since 2001 reflecting the unfavorable claim experience over the period. As operations consist of relatively long tailed lines of business, A.M. Best will continue to monitor results for continuing adverse loss reserve development. Guaranty National Insurance Company (A.M. Best #: 00443 NAIC #: 11401) Royal Indemnity Company (A.M. Best #: 02438 NAIC #: 24678) Sea Insurance Company of America (A.M. Best #: 02094 NAIC #: 20354) Security Insurance Company of Hartford (A.M. Best #: 02457 NAIC #: 24902) RATING RATIONALE The following text is derived from the report of Royal & SunAlliance USA Insurance Pool. Rating Rationale: The rating applies to the members of the Royal & SunAlliance USA Insurance Pool, led by Royal Indemnity Company, and is based on the consolidated financial results of the pool and the pool's separately rated Royal Surplus Lines Insurance Company subsidiary (RSLIC). The rating reflects the pool's poor capitalization and poor operating performance driven primarily by unfavorable loss reserve development. The rating also reflects the ancillary nature of the U.S. operations to the ultimate parent, Royal & Sun Alliance Insurance Group plc (R&SA). The parent placed the U.S. operations into runoff in late 2003 with only a modest book of non standard auto business remaining as active. A.M. Best's outlook reflects the rapid decline in capitalization experienced in recent years as well as the elevated level of uncertainty regarding the ultimate outcome of a number of significant issues currently being litigated by the group. Loss reserves have proven deficient by sizable margins in recent years, with reserves for asbestos and environmental (A&E) exposures adjusted upwards by nearly $600 million since 2001. In the fourth quarter of 2004, the pool recorded an additional reserve charge of $240 million which further weakened an already vulnerable capitalization position. Additional reserve development is likely, in A.M. Best's opinion, given the significant and lengthy history of reserve deficiencies experienced by the U.S. entities. Another area of uncertainty is the potentially negative impact on the U.S. companies' surplus if current litigation over a student loan guarantee program, as well as certain other issues in litigation, are decided against Royal. Best's Rating: C++p Outlook: Negative Hartford Steam Boiler Inspec & Ins (A.M. Best #: 00465 NAIC #: 11452) Hartford Steam Boiler Inspec & Ins Co CT (A.M. Best #: 11074 NAIC #: 29890) RATING RATIONALE The following text is derived from the report of The Hartford Steam Boiler Group. Under Review Rationale: A.M. Best placed the financial strength ratings of member companies of American International Group, Inc. (NYSE: AIG) under review with negative implications following their announcement that the Chairman and CEO, Maurice Greenberg, will retire as CEO, although he remains non-executive Chairman. Mr. Greenberg will be succeeded by Martin J. Sullivan, who had been AIG's vice chairman and co-chief operating officer. The company additionally announced that the CFO, Howard Smith, has taken leave and that the filing of AIG's 2004 10-K has been delayed. Howard Smith will be succeeded by Steven J. Bensinger. The retirement of Mr. Greenberg follows concern over an increasing number of regulatory inquiries as well as queries from the New York Attorney General and the SEC. The vast majority of AIG's major insurance subsidiaries have held financial strength ratings of A++, A.M. Best's highest rating, for many years. There remain a number of unresolved issues with the potential for continued uncertainty. The ratings have been placed under review due to the delay in the filing, the premature retirement of two top senior executives, and the numerous regulatory inquiries. A.M. Best believes that the operating fundamentals within AIG are sound, there is significant management benchstrength among the leaders of the business segments, and barring any additional negative reports, the ability to generate historical earnings should continue. The ratings will remain under review pending A.M. Best's review of the filed 10-K as well as any further company developments. Rating Rationale: The rating applies to The Hartford Steam Boiler Inspection and Insurance Company (HSBIIC), its partially reinsured subsidiary, The Hartford Steam Boiler Inspection and Insurance Company of Connecticut, as well as two non-U.S. subsidiaries, The Boiler Inspection and Insurance Company of Canada and HSB Engineering Insurance Limited, UK (EIL). The rating is based on a host of positive factors including the group's outstanding franchise, level of capitalization, and favorable earnings and reserving history. Ownership of the group by AIG is also a consideration, however, on a stand-alone basis, the group meets the ratings criteria for A++. Specifically, the group's rating reflects very strong capitalization, historically outstanding underwriting results, and sustainable competitive advantages derived from the group's preeminent technical expertise and extensive loss control capabilities. The group's reserves have proved redundant in recent years given that the large-sized, power generation risks are being ceded 100% to AIG. In addition to being the leading provider of specialty engineering intensive property and boiler & machinery insurance in the U.S., the group has also developed a solid worldwide reputation for its outstanding loss control and risk management services. These factors are further enhanced by the group's firmly entrenched position in the United States, its gradual expansion outside of North America and its large base of client insurance companies which utilize its underwriting expertise, loss control and engineering services. The rating also acknowledges the group's favorable distribution strategy, strong brand name, high customer loyalty and persistency. The group also benefits from management's commitment to balance sheet integrity, strict underwriting discipline, and continued emphasis on risk management and loss prevention services. Compared to the industry, HSB's expense ratio remains high, however this expense burden stems from the group's heavy emphasis on loss prevention, failure analysis and other engineering services which serve to contain losses and maintain the group's exceptional loss ratio advantage. Through strategic partnerships and reinsurance arrangements, HSB maintains business relationships with approximately 200 multi-line insurers. Over the years, this strategy has been extremely successful in providing the group with new growth opportunities in the small to middle markets, two segments previously underserved by HSB. With the acquisition of the group by American International Group (AIG) in 2000, HSB is afforded additional financial flexibility and is viewed by A.M. Best to be a strategic affiliate within AIG's global network of companies. Operated and managed autonomously, HSB is a strategic part of AIG's overall corporate strategy and benefits from AIG's financial resources and global reach, particularly with regard to distribution channels. HSB also maintains its commanding position within the boiler & machinery market, fostering its own brand name and market reputation among the large national and regional broker communities. These positive factors are partially offset by competition in the boiler & machinery market and the level of equity investments in the group's portfolio. However, these concerns are mitigated by HSB's solid earnings performance and its prominent position within this highly specialized segment. Best's Rating: A++gu Implication: Negative Landmark Insurance Company (A.M. Best #: 03756 NAIC #: 35637) Lexington Insurance Company (A.M. Best #: 02350 NAIC #: 19437) RATING RATIONALE The following text is derived from the report of Lexington Insurance Pool. Under Review Rationale: A.M. Best placed the financial strength ratings of member companies of American International Group, Inc. (NYSE: AIG) under review with negative implications following their announcement that the Chairman and CEO, Maurice Greenberg, will retire as CEO, although he remains non-executive Chairman. Mr. Greenberg will be succeeded by Martin J. Sullivan, who had been AIG's vice chairman and co-chief operating officer. The company additionally announced that the CFO, Howard Smith, has taken leave and that the filing of AIG's 2004 10-K has been delayed. Howard Smith will be succeeded by Steven J. Bensinger. The retirement of Mr. Greenberg follows concern over an increasing number of regulatory inquiries as well as queries from the New York Attorney General and the SEC. The vast majority of AIG's major insurance subsidiaries have held financial strength ratings of A++, A.M. Best's highest rating, for many years. There remain a number of unresolved issues with the potential for continued uncertainty. The ratings have been placed under review due to the delay in the filing, the premature retirement of two top senior executives, and the numerous regulatory inquiries. A.M. Best believes that the operating fundamentals within AIG are sound, there is significant management benchstrength among the leaders of the business segments, and barring any additional negative reports, the ability to generate historical earnings should continue. The ratings will remain under review pending A.M. Best's review of the filed 10-K as well as any further company developments. Rating Rationale: The rating is based on the consolidated operating performance of American International Group's Lexington Insurance Pool and applies to the three pool members, led by Lexington Insurance Company (Lexington) and its two affiliates, Starr Excess Liability Insurance Company, Ltd. (Starr Excess) and Landmark Insurance Company. This rating reflects Lexington's superior operating performance, strong capitalization and distinguished leadership position as the largest and most recognized excess and surplus lines insurance company in the U.S. These positive factors are supported by Lexington's specialized underwriting expertise, its innovative coverage approach and the competitive advantages derived from its affiliation with American International Group, Inc. (AIG)--one of the nation's largest property/casualty insurance organizations. However, despite excellent earnings that have outperformed the industry, Lexington has taken material reserve increases in each of the last two years. Lexington and its pool members remain integral to AIG's overall corporate strategy and benefit from strong parental support and the utilization of AIG's extensive service, resources and global reach. As a stand-alone company, Lexington also maintains its commanding position within the E&S market, fostering its own brand name and market reputation among the large national and regional broker communities. The rating also recognizes Lexington's adherence to strict underwriting fundamentals, effective reinsurance utilization and its ability to respond to market opportunities. Lexington's successful underwriting strategies are demonstrated by its superior track record, as evidenced by its five-year average pre-tax operating return on revenue of 23.1% - a level significantly higher than its peers. Lexington maintains several competitive advantages, including a low-cost structure, multiple distribution channels and strong capitalization. These factors are partially offset by Lexington's high - although substantially collateralized - reinsurance leverage. Best's Rating: A++pu Implication: Negative Medical Assurance Company Inc (A.M. Best #: 03826 NAIC #: 33391) RATING RATIONALE The following text is derived from the report of ProAssurance Group. Under Review Rationale: A.M. Best Co. has placed the financial strength rating of A- (Excellent) of ProAssurance Group (ProAssurance) (Birmingham, AL) under review with negative implications following the February 28, 2005, announcement that it has entered into an agreement that provides for NCRIC Group (Washington, DC) to be merged into ProAssurance through an all stock transaction. A.M. Best believes that there is uncertainty related to the prospective operating performance and capitalization of the newly formed entity largely due to the adverse loss reserve development experienced by NCRIC Group. Although ProAssurance has reported strong operating results in the past two years and has demonstrated success in its past experiences of acquiring companies, the group's risk-adjusted capitalization is at the lower end of an acceptable level for its current rating. A.M. Best believes that any required capital infusions into NCRIC could have adverse effects on the consolidated group's capitalization. However A.M. Best recognizes ProAssurance's ability to acquire additional capital in the public markets and the potential for capital growth through earnings prior to closing. A.M. Best expects to meet with ProAssurance's management prior to the close of the transaction to fully review the newly integrated entity's operating plan and full loss reserve analysis of each statutory operating unit. The transaction is expected to close during the third quarter of 2005 and still requires regulatory and NCRIC shareholder approval. Rating Rationale: The rating reflects ProAssurance Group's adequate risk-adjusted capitalization, comparatively favorable operating performance, and strong regional market position as a leading writer of professional liability coverages in the U.S. Somewhat offsetting these strengths are the group's moderately elevated underwriting leverage position, the heightened market risks associated with adverse claims trends that have impacted the professional liability industry, and fluctuations in the group's operating results during the most recent five-year period. The rating further recognizes the financial flexibility available to the group that is derived from its publicly-traded parent company, ProAssurance Corporation. The holding company has raised $198 million in additional capital in the past 18 months through an equity offering in 2002, a debt offering in 2003 and through a series of collateralized debt obligations in 2004. Further, in 2004, ProAssurance Corp. filed a $250 million universal shelf offering. Proceeds from any potential capital raising could be used for general corporate purposes, including additional funding for the insurance operations. In addition, the 100% wholly-owned personal lines subsidiary, MEEMIC Insurance Company, has contributed significant earnings to the group's consolidated earnings, as MEEMIC's five-year average total return on equity exceeds 15%. The rating applies to The Medical Assurance Company, Inc. and ProNational Insurance Company as well as its reinsured subsidiary, Red Mountain Casualty Insurance Company, Inc. The rating is based on the consolidation of the companies to which the rating applies in addition to two separately rated affiliates, MEEMIC Insurance Company, a subsidiary of ProNational, and Medical Assurance of West Virginia, Inc., a subsidiary of Medical Assurance, Inc. Best's Rating: A- gu Implication: Negative Ohio Indemnity Company (A.M. Best #: 04813 NAIC #: 26565) RATING RATIONALE Under Review Rationale: This rating action follows an earlier announcement made by Bancinsurance Corporation ("Bancinsurance") [NASDAQ: BCISE] that Ernst and Young LLP ("E&Y") had withdrawn its audit reports for Bancinsurance and its two subsidiaries, including Ohio Indemnity Company. This rating action also contemplates the uncertainty with respect to potential losses as it relates to the bail bond business reinsured by Ohio Indemnity during the period 2001 though 2004. E&Y's withdrawal covers three years ending 2001 - 2003 and stems from material weaknesses of internal controls related to the bail bond business These internal control weaknesses allege that Ohio Indemnity was aware of significant claim development in its bail bond program and did not provide E&Y with this information on a timely basis prior to filing its 2003 Form 10-K. Therefore, E&Y contends that they can no longer rely on the representations of management at this time. As a consequence, Bancinsurance Corporation's securities will also be delisted from the Nasdaq Stock Market on February 22, 2005. Disclosures related to claim development from this bail bond program were made available in Bancinsurance's Form 10-Q for the periods ending June 30, 2004 and September 30, 2004. Management states that certain loss reserves from this program had not been established since those losses were in dispute and in arbitration. The Company's audit committee is reviewing the matter and is expected to recommend whatever action may be necessary to resolve these issues. Management's objective is to have these withdrawn audit reports re-issued or replaced as soon as possible. A.M. Best plans to monitor this situation closely. Rating Rationale: The rating of Ohio Indemnity Company reflects the company's sustained underwriting profitability, solid operating returns and excellent capitalization. Offsetting these positive factors is the company's significant growth since 2000 without a commensurate increase in surplus, resulting increase in underwriting leverage, declining pre-tax operating margins and narrow product mix. The rating also recognizes the benefits derived from Ohio Indemnity's conservative operating philosophy and specialty niche underwriting expertise in providing blanket vendor single interest and other types of collateral protection coverages to banks and other lending institutions. The company also offers a unique and profitable unemployment compensation program provided to not-for-profit organizations. This rating also recognizes the additional capital raised in 2002 and 2003 and the financial flexibility afforded by its parent, Bancinsurance Corporation, a publicly-traded company. Although Ohio Indemnity's capitalization is commensurate with its rating, the capital cushion the company has enjoyed in the past has been reduced due to significant premium growth over the past five years. Gross written premium has grown over 200% since 1999 while surplus has increased only 50% in that time. Concurrently, underwriting leverage increased significantly. Most of this premium growth is derived from the introduction of creditor placed insurance in 2002, introduction of guaranteed auto protection insurance in 2000 and new blanket vendor single interest business penetration among larger banks. Although the company's pre-tax returns have been declining, A.M. Best acknowledges the impetus behind it as Ohio Indemnity pursues larger clients. While larger banks and financial institutions generally produce lower profit margins than community banks, the overall profitability on these accounts is maintained via low-cost direct marketing and its use of a "limited risk" aggregate liability product. Additionally, the creditor placed insurance is also written at a lower margin as a result of its "limited risk" features. Also affecting pre-tax margins and underwriting results since 2001 have been unfavorable economic conditions resulting in increased loan defaults that adversely affected the vendor single interest program as well as the unemployment compensation program. Best's Rating: B++u Implication: Negative Old United Casualty Company (A.M. Best #: 10362 NAIC #: 37060) RATING RATIONALE Rating Rationale: This rating reflects Old United Casualty Company's sustained operating profitability and solid internal surplus generation supported by management's highly specialized underwriting expertise. These positive rating considerations are offset by the company's elevated unearned premium reserve leverage. Consistent with other automobile warranty writers, loss reserve development is not material, as the bulk of liabilities and risk is in the unearned premium reserves. These reserves are held by the company to fund latent warranty claims as they develop. Going forward, A.M. Best views the rating outlook as stable based on the expectation for continued strong core underwriting results, above average operating returns, declining underwriting leverage measures, and the company maintaining a level of capital that is supportive of its current rating. These rating factors are derived from Old United Casualty's favorable pre-tax operating returns over the past five years, modest expense ratio, and the synergies of being part of Van Enterprises, Inc. Over the years, Old United Casualty has specialized in providing automobile warranty insurance products to affiliated automobile dealerships that are owned by its ultimate parent, Van Enterprises, Inc. Through this affiliation, Old United Casualty benefits from the favorable operating synergies and efficient marketing and distribution platforms provided by its affiliated dealerships. The rating also recognizes the company's conservative balance sheet and extensive market knowledge within the auto warranty segment. Best's Rating: A Outlook: Stable Peak P & C Ins Corp (A.M. Best #: 11414 NAIC #: 18139) RATING RATIONALE The following text is derived from the report of Viking Insurance Company of Wisconsin. Under Review Rationale: The rating has been placed under review with negative implications as a result of management's ongoing plans to withdraw these companies from the pool to become direct and wholly owned subsidiaries of Royal Group Inc., the group's U.S. based holding company. Once depooled, the companies are expected to be recapitalized through support from the UK parent, through surplus notes, quota share reinsurance, or some combination of the two. As separately owned and capitalized entities, these companies would be independent of the RSAUSA pool and appropriately capitalized to continue writing their profitable book of non-standard automobile business. The Viking / Peak ratings will remain under review until management's plans, which are subject to regulatory approval, are implemented. A.M. Best fully anticipates a conclusion to this restructuring to occur early in the second quarter of 2005. The negative implications reflect the likelihood that the rating will not increase from its current level once the restructuring has been fully implemented. Rating Rationale: The rating applies to Viking Insurance Company of Wisconsin and its two fully reinsured affiliates, Peak Property and Casualty Insurance Corporation and Viking County Mutual Insurance Company. The rating reflects the solid operating performance exhibited in recent years as well as the group's adequate level of capitalization. Negative factors include the uncertainty regarding the numerous operating and legal challenges surrounding the remainder of Royal's U.S. operations. Furthermore, while capitalization is considered adequate at the current rating level, the group's operating leverage remains elevated. Best's Rating: B ru Implication: Negative Royal Surplus Lines Insurance Company (A.M. Best #: 01745 NAIC #: 41807) RATING RATIONALE Rating Rationale: The rating reflects the company's diminished market presence and financial flexibility as evidenced by the financial stress of the immediate parent, Royal Indemnity Company (the lead member of the Royal USA Insurance Pool). The company is ultimately owned by Royal Group, Inc., a subsidiary of Royal & SunAlliance Insurance Group plc. which, on September 4, 2003, announced a restructuring of its U.S. insurance operations. The restructuring included a significant reserve charge to the U.S. companies as well as an acceleration in the disposal of ongoing businesses at the pool level. The group successfully divested its excess and surplus lines operations ("Royal Specialty Underwriting, Inc.", a.k.a., "RSUI"), effective July 2003. Existing policyholder liabilities remain with the U.S. group. The rating outlook reflects A.M. Best belief that there remains a significant degree of uncertainty regarding the runoff of the pool's existing liabilities as well as the surplus lines business. Royal Surplus Lines' historically poor operating performance was derived from its high expense structure and a limited block of Florida nursing home business, adverse loss reserve development, and limited spread of risk as measured by RSL's probable maximum loss estimates. Heavy underwriting losses drove the rapid erosion in policyholders' surplus throughout 2000 and most of 2001. The strong 2002 operating performance was driven by improvement in the excess and surplus lines market in which the company operated as well as implementation of significant structural changes, including a number of reunderwriting and pricing initiatives. Results in 2003 were mixed with underwriting losses caused by the dramatic decline in net premium volume which accompanied the sale of the E&S operations, as well as additional adverse loss reserve development on discontinued nursing home business. With the transition into a run-off operation complete as of year end 2003, post-2003 earnings have been driven by investment earnings on the company's investment portfolio. Best's Rating: C++ Negative Outlook: Senior Citizens Mutual Insurance Co (A.M. Best #: 10835 NAIC #: 44172) RATING RATIONALE Under Review Rationale: The under review status reflects Senior Citizens Mutual Insurance Company's (SCMIC) results for 2004 coupled with the resultant decrease in capital sufficiency. Also precipitating the rating change is the sharp decrease in net written premium produced in 2004. Partially offsetting these negative rating factors, SCMIC's leverage measures have remained stable during 2004, when compared to the prior two years. Underwriting results decayed significantly during the Fourth Quarter of 2004, which produced a net loss of $1.8 million for the year. As such, SCMIC's capital position no longer supports a secure rating. The under review status will remain in effect pending additional information from the company during ongoing discussions with management. Rating Rationale: The rating reflects Senior Citizens Mutual Insurance Company's (SCMIC) decay in underwriting results which has led to a net loss of $1.8 million for the year ended December 31, 2004. The net loss posted in 2004 resulted in a decrease in capital by $ 1.5 million, or 22% by year end 2004. Also, of concern is the sharp decrease in net written premium booked for 2004 compared to 2003, with a decrease of $7.3 million or 57% for 2004. Finally, cash flow decreased almost $2.5 million during 2004 to $1.8 million at December 31, 2004. Partially offsetting these negative rating factors is SCMIC's stabilized leverage position which is due to the significant decrease in net written premium during 2004. SCMIC wrote a significant amount of new business during 2002 and 2003 to try to capitalize on current hard market conditions in the for-profit habitational insurance market. The expansion subjects SCMIC's capital to greater risk as additional sizeable decreases in surplus could result from greater claims severity and frequency. Management noted that there has been significant adverse development experienced during the Fourth Quarter of 2004 on 2003 and 2002 accident year reserves. Best's Rating: B- u Implication: Negative Sompo Japan Insurance Company of America (A.M. Best #: 03060 NAIC #: 11126) RATING RATIONALE Rating Rationale: The rating reflects Sompo Japan Insurance Company of America's (SJA) status as a strategic subsidiary of Sompo Japan Insurance Company (SJ) (Tokyo, Japan) and its excellent stand-alone capital position subsequent to a $100 million capital injection provided by SJ in November, 2004. An offsetting factor is the company's poor underwriting results over the past five years which led to a significant erosion of surplus. The outlook is negative. SJA's primary directive is to provide top quality service to its parent's clients who operate in the United States. This arrangement is essential from SJ's perspective, as these clients account for a significant portion of the group's consolidated earnings. SJA's high loss ratios stemmed primarily from a severely under-priced book of U.S. third-party business, which SJA stopped writing in 2001. These accounts were not related to its parent company's multinational clients. Going forward, SJA will only write the business of its parent's clients who maintain operations in the United States. While SJA's operating performance remains weak with above-average losses projected for 2005, A.M. Best recognizes management's efforts to reverse this trend through expense reduction strategies, enhanced underwriting discipline and continued parental support. However, A.M. Best remains concerned with SJA's ability to improve its underwriting performance during a period of softening market conditions. Stonington Insurance Company (A.M. Best #: 00175 NAIC #: 10340) RATING RATIONALE The following text is derived from the report of Glencoe Group. Under Review Rationale: A.M. Best Co. has placed the financial strength and debt ratings of the insurance and reinsurance subsidiaries of RenaissanceRe Holdings Ltd. under review with negative implications. This rating action follows an announcement by RenaissanceRe that as a result of an ongoing review, the company will be restating its financial statements for 2001, 2002 and 2003. While the currently proposed adjustments are not material to the financial condition of RenaissanceRe, the status of the review is ongoing and may cause a delay for the company in filing its audited financial statements. Should this review be completed without significant adjustments to RenaissanceRe's financial condition, A.M. Best will affirm the current ratings with a stable outlook. Rating Rationale: The rating reflects the group's excellent capitalization, favorable operating experience and strong risk management capabilities derived from its strategic role within the RenaissanceRe Holdings Ltd. group (RenaissanceRe). These strengths are offset by the group's limited operating history, significant growth and the inherent risk associated with the utilization of program managers which the group utilizes to underwrite a large amount of its business. However, A.M. Best believes that the group's affiliation with RenaissanceRe and the monitoring controls it has employed over the program managers, mitigates these risks. The rating outlook is stable. This rating applies to Glencoe Group Holdings Ltd. core affiliates which are collectively referred to as "the Glencoe group." The group consists of Glencoe Insurance Ltd. (Glencoe) and Stonington Insurance Company (Stonington), and Stonington's two reinsured affiliates, Stonington Lloyds Insurance Company (Stonington Lloyd's) and Lantana Insurance Ltd. (Lantana). RenaissanceRe provides the Glencoe group access to sophisticated pricing, underwriting, and risk modeling capabilities. In addition, RenaissanceRe has demonstrated its support through capital injections that have strengthened Glencoe's capital base to a level supportive of its rating. RenaissanceRe has also contributed capital to Stonington and Lantana. The group is strategically important to RenaissanceRe in that it allows it to participate in non-property catastrophe markets where it believes that pricing of the business is attractive. In addition to writing business through program managers, the group also writes business on a direct basis through brokers and through quota share reinsurance agreements. The group primarily underwrites exposures in the United States with significant deal flow and opportunities emanating from its affiliation with RenaissanceRe. As a focused catastrophe writer, RenaissanceRe provides significant management oversight emphasizing disciplined underwriting, conservative exposure accumulations and optimal capital allocation. Additionally, through the aforementioned capital infusions, RenaissanceRe has demonstrated its willingness and ability to utilize its own financial flexibility to support the Glencoe group's growth opportunities. A.M. Best will continue to actively monitor Glencoe and its group affiliates as its business continues to expand. Best's Rating: A gu Implication: Negative Yosemite Insurance Company (A.M. Best #: 03222 NAIC #: 26220) RATING RATIONALE Under Review Rationale: A.M. Best placed the financial strength ratings of member companies of American International Group, Inc. (NYSE: AIG) under review with negative implications following their announcement that the Chairman and CEO, Maurice Greenberg, will retire as CEO, although he remains non-executive Chairman. Mr. Greenberg will be succeeded by Martin J. Sullivan, who had been AIG's vice chairman and co-chief operating officer. The company additionally announced that the CFO, Howard Smith, has taken leave and that the filing of AIG's 2004 10-K has been delayed. Howard Smith will be succeeded by Steven J. Bensinger. The retirement of Mr. Greenberg follows concern over an increasing number of regulatory inquiries as well as queries from the New York Attorney General and the SEC. The vast majority of AIG's major insurance subsidiaries have held financial strength ratings of A++, A.M. Best's highest rating, for many years. There remain a number of unresolved issues with the potential for continued uncertainty. The ratings have been placed under review due to the delay in the filing, the premature retirement of two top senior executives, and the numerous regulatory inquiries. A.M. Best believes that the operating fundamentals within AIG are sound, there is significant management benchstrength among the leaders of the business segments, and barring any additional negative reports, the ability to generate historical earnings should continue. The ratings will remain under review pending A.M. Best's review of the filed 10-K as well as any further company developments. Rating Rationale: The rating reflects the company's strong capitalization, continued outstanding underwriting performance and consistently strong operating cash flows. The rating also acknowledges the synergies and benefits derived from its immediate parent, American General Finance Corporation (AGF), which is recognized as one of the larger consumer finance services organizations in the United States while also functioning as Yosemite's direct marketing arm. Historically, Yosemite outperforms its peers in terms of underwriting profitability and overall operating returns. The rating also recognizes the acquisition of American General Finance, Inc. (AGF's parent) by American International Group, Inc. (AIG) on August 29, 2001 and the benefits associated with being part of one of the largest insurance organizations in the world. The rating also takes into account the additional financial flexibility afforded by AIG. Somewhat offsetting these positive factors is the company's dependence on AGF as its sole distribution channel and source of business. In addition, the company's underwriting performance includes claim payments and settlements associated with asbestos and environmental (A&E) liabilities. Exposure to A&E claims stem from general liability coverage written and assumed in the 1970's. The company is engaged in an ongoing effort to commute all open A&E cases. Best's Rating: A u Implication: Negative