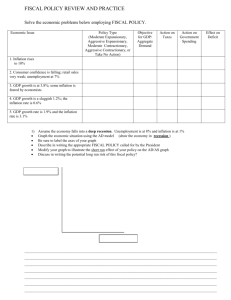

Fiscal Policy

advertisement

Fiscal Policy Questions: How can gov’t changes in taxes or expenditure influence AD? What is the difference between expansionary and contractionary fiscal policy? How does fiscal policy influence both demand- and supply-side models? Fiscal policy—government changes to its own expenditures and taxes to influence the level of aggregate demand – Purposeful, so it is discretionary policy Components of AD: C+I+G+(X-M) Fiscal policy can affect the first three: o G: through making changes in politics o I: gov’t changes taxes on business profits o C: gov’t changes income tax, which influences level of disposable income At any given PL: • An increase in gov’t spending or in transfer payments: increases real GDP • An increase in taxes decreases real GDP Automatic stabilizers are enhanced by discretionary fiscal policy Where did it come from? Fiscal policy was the brain child of economist __________________________________________ during the 1930s in an attempt to understand the Great Depression • Keynes advocated ______________________ government expenditures and ______________ taxes to stimulate demand and pull the global economy out of the Depression. – concept that optimal economic performance could be achieved by influencing aggregate demand through activist stabilization and economic intervention policies by the government (FISCAL POLICY) – Three tools: Taxes, gov’t spending, transfer payments Closing a contractionary gap • When the economy is in contraction or recession, the government will typically use ____________________ fiscal policy to “expand” the economy • The government will increase spending and/or lower taxes, which has the effect of: – Increasing _________ (increased AD) – Lowering unemployment – Increasing disposable income/consumption when taxes are adjusted downward Closing an inflationary gap • When the economy is “overheating”, or is an expansion which results in high prices, the gov’t will use _________________________ fiscal policy to “contract” the economy • The government will decrease spending and/or increase taxes, which has the effect of: – Decreased AD, fall in real GDP – Could potentially increase unemployment – Taxes increased on firms and/or consumers The multiplier effect (HL) • Congress must be careful with the amount of taxes/spending adjusted, as it could create a multiplying (“snowball”) effect: – If the gov’t puts $10 billion into the economy, that money will affect GDP more than $10 bill. It may affect by $10.5 or even $12 billion, depending on responsiveness of economy to fiscal policy • Difficult to estimate; Effects of fiscal policy always multiply, which can cause Congress to stimulate the economy too much, causing high inflation What happens when there is too much economic stimulation? • Inaccurate estimations of potential output or natural rate of unemployment can cause an over-stimulation of the economy • This can cause AD to extend past potential output and cause increased GDP with increased prices • If this is not corrected, suppliers will not be able to maintain production with increased price and AS will decline, causing even higher high prices and decreased GDP (high unemployment) • This is also called _____________________ FP’s unintentional affect on supply of labor • If gov’t increases transfer payments (unemployment pay) too much during a contractionary period, expansionary policy will give the unemployed who benefit from increased transfer payments, have less incentive to find work • If gov’t decreases taxes too much during an expansionary period, contractionary policy will give workers, who find their wage reduced by the higher tax rates, less incentive to work • Both of these situations would reduce AS, causing high prices (inflation) and lower the GDP SCENARIOS: What would happen to consumption and aggregate demand if: 1. The government increases income tax? 2. The government lowers expenditure taxes (sales tax or VAT)? 3. The government increases its spending? Expanding Economy (Inflationary gap) Contracting Economy (Deflationary gap) Macro objectives High/stable growth Stable prices, such as low inflation rate High growth rate High or increasing inflation rate Low level of unemployment Low unemployment Falling growth rate or negative growth Low(-er) inflation rate, possibly deflation Increasing/high unemployment Trade balance (X=M) M often larger than X; trade deficit M falling; possible trade surplus Possible fiscal policies ΔT, ΔG/transfer payments ΔT &/or ΔG/ transfer payments Possible monetary policies Tight monetary policy; ΔSm, Δr Loose monetary policy; ΔSm, Δ –r Positive effects of policies Lower inflation, relieves pressure on tight labor market, possible improvement in trade balance Decrease in unemployment, increased output (or slower negative growth), societal benefits Negative effects of policies Growth rate falls back, lower investment can harm long run potential growth Inflationary pressure, increase in imports might cause trade deficit Assume the economy of Switzerland is experiencing a slump in aggregate demand, and output in the economy is thought to be $10 billion less than what would be produced at full employment. On the graph below, illustrate the Swiss economy at its current level of output. On the graph you drew, identify the recessionary gap. Assume that the Swiss government wishes to enact a fiscal policy that would return the economy’s output to its full employment level. Identify the options available to the Swiss government.