Finance stock project on Starbucks Corporation

advertisement

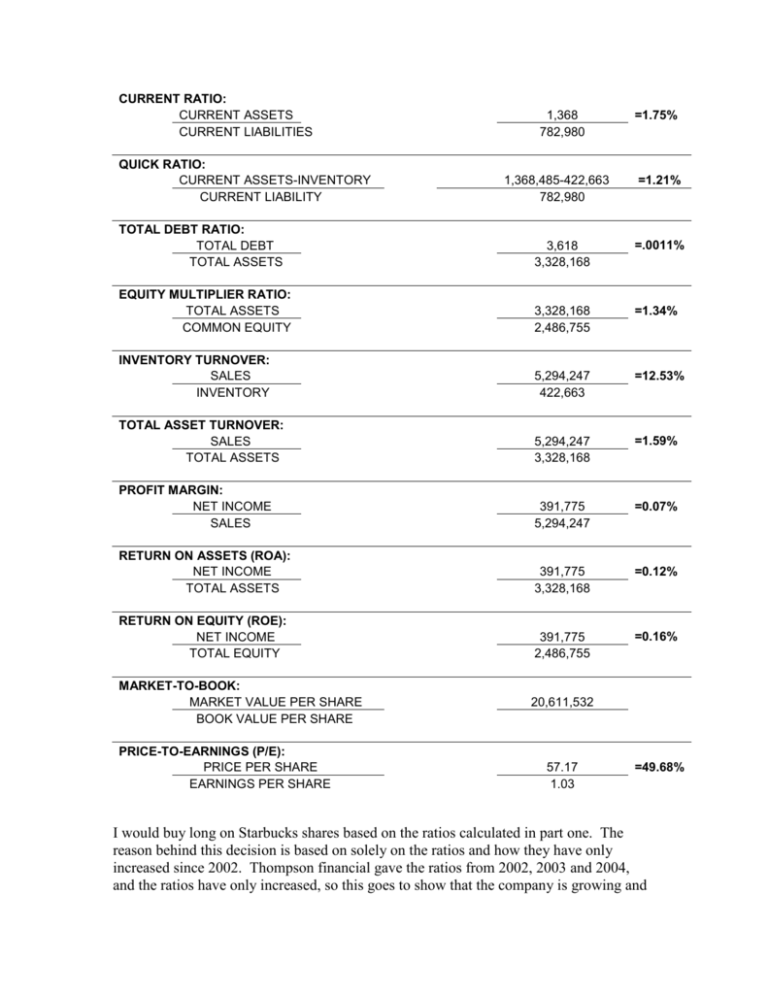

CURRENT RATIO: CURRENT ASSETS CURRENT LIABILITIES QUICK RATIO: CURRENT ASSETS-INVENTORY CURRENT LIABILITY 1,368 782,980 1,368,485-422,663 782,980 =1.75% =1.21% TOTAL DEBT RATIO: TOTAL DEBT TOTAL ASSETS 3,618 3,328,168 =.0011% EQUITY MULTIPLIER RATIO: TOTAL ASSETS COMMON EQUITY 3,328,168 2,486,755 =1.34% INVENTORY TURNOVER: SALES INVENTORY 5,294,247 422,663 =12.53% TOTAL ASSET TURNOVER: SALES TOTAL ASSETS 5,294,247 3,328,168 =1.59% PROFIT MARGIN: NET INCOME SALES 391,775 5,294,247 =0.07% RETURN ON ASSETS (ROA): NET INCOME TOTAL ASSETS 391,775 3,328,168 =0.12% RETURN ON EQUITY (ROE): NET INCOME TOTAL EQUITY 391,775 2,486,755 =0.16% MARKET-TO-BOOK: MARKET VALUE PER SHARE BOOK VALUE PER SHARE PRICE-TO-EARNINGS (P/E): PRICE PER SHARE EARNINGS PER SHARE 20,611,532 57.17 1.03 =49.68% I would buy long on Starbucks shares based on the ratios calculated in part one. The reason behind this decision is based on solely on the ratios and how they have only increased since 2002. Thompson financial gave the ratios from 2002, 2003 and 2004, and the ratios have only increased, so this goes to show that the company is growing and increasing. Starbucks seems to be a very stable company and doesn’t seem to be going down anytime soon. If you compare Starbucks to the industry, the ratio numbers and dividends are rather close to each other. So, when comparing, the industry could be looked at as the benchmark, and the company would be Starbucks. I definitely would buy long with Starbucks. Stock Project, Part #2 SML: Ki = Krf + ( Km – Krf ) bi Krf = 4.46 Km = 12.27 Bi = 0.71 Ki = 4.46 + ( 12.27 – 4.46 ) 0.71 Ki = 4.46 + ( 7.81 ) 0.71 Ki = 4.46 + 5.55 Ki = 10.01% Ks = ( D1 / P0 ) + g g = 20.6 Do = 1.75 D1 = Do ( 1 + g ) D1 = 1.75 (1 + .206 ) D1 = 1.75 ( 1.206 ) D1 = 2.11 D1 = 2.11 Po = 46.22 g = 20.6 Ks = ( 2.11 / 46.22 ) + .206 Ks = .0457 + .206 Ks = .2517 or 25.17% Starbucks SWOT Analysis Strengths -Excellent product diversification such as coffee, baked goods, CD’s, espresso machines, coffee machines, coffee cups, traveler cups, board games, stuffed animals, candy -Established logo, developed brand, copyrights, trademarks, websites, and patents -Company Operated Retail Stores, International Stores -High visibility locations to attract customers -Valued and motivated employees with a low employee turnover -Good relationships with coffee suppliers -Starbucks is not a franchise -Market leader in the coffee industry -Becoming much more globalized Weaknesses -Ever-increasing number of competitors in a growing market -Clustering of too many shops in a small area: self cannibalization -Cross functional management -Price of drinks rather expensive Opportunities -Expansion into retail operations -Technological advances, such as ordering drinks over the internet -Finding new distribution channels such as delivery -Launching new products -International market expansion -Distribution agreements -Starbucks brand name extension Threats -Competition such as restaurants, street carts, supermarkets, other coffee shops, and other caffeinated products -Coffee price volatility in developing countries -Poorly treated farmers struggling to make a living in those countries supplying the coffee beans, which is a negative publicity -Consumer trends toward more healthy ways of living and away from caffeine Conclusion Starbucks Corporation is a large multinational chain of coffee shops, often serving desserts, with a reputation in the US as a center for socializing, particularly among students and young urban professionals. I would definitely have to say that Starbucks Corporation is rather accurately priced. According to the Analyst Ratings from the CNBC website, Starbucks has the highest hold in every month but the strong buy is not far behind. Starbucks has always been a pretty stable corporation and their prices have never really fluctuated. Starbucks has many more strengths than weaknesses so that just goes to show that it is a rather firm corporation. As long as “students and young professionals” are going to be around, Starbucks Corporation is not going anywhere, and only going to increase in sales and revenue.