Rockefeller Group Readings

GROUP 1

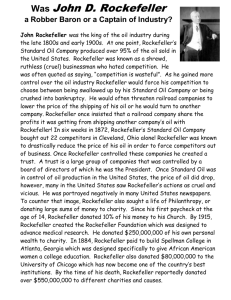

In 1865, Rockefeller borrowed money to buy out some of his partners and take control of the refinery, which had become the largest in Cleveland. Over the next few years, he acquired new partners and expanded his business interests in the growing oil industry. At the time, kerosene, derived from petroleum and used in lamps, was becoming an economic staple. In 1870,

Rockefeller formed the Standard Oil Company of Ohio, along with his younger brother William (1841-1922), Henry Flagler (1830-1913) and a group of other men. John Rockefeller was its president and largest shareholder.

Standard Oil gained a monopoly in the oil industry by buying rival refineries

(horizontal integration) and developing companies for distributing and marketing its products around the globe (vertical integration). In 1882, these various companies were combined into the Standard Oil Trust, which would control some 90 percent of the nation’s refineries and pipelines. In order to exploit economies of scale, Standard Oil did everything from build its own oil barrels to employ scientists to figure out new uses for petroleum by-products.

Rockefeller’s enormous wealth and success made him a target of muckraking journalists, reform politicians and others who viewed him as a symbol of co rporate greed and criticized the methods with which he’d built his empire.

As The New York Times reported in 1937: “He was accused of crushing out competition, getting rich on rebates from railroads, bribing men to spy on competing companies, of making secret agreements, of coercing rivals to join the Standard Oil Company under threat of being forced out of business, building up enormous fortunes on the ruins of other men, and so on.”

In 1890, the U.S. Congress passed the Sherman Antitrust Act, the first federal legislation prohibiting trusts and combinations that restrained trade. Two years later, the Ohio Supreme Court dissolved the Standard Oil Trust; however, the businesses within the trust soon became part of Standard Oil of New Jersey , which functioned as a holding company. In 1911, after years of litigation, the

U.S. Supreme Court ruled Standard Oil of New Jersey was in violation of antitrust laws and forced it to dismantle (it was broken up into more than 30 individual companies).

GROUP 2

Standard Oil of New Jersey

In 1879, John D. Rockefeller and a handful of associates founded Standard Oil of

New Jersey, the prototypical example of corporate consolidation and efficiency.

Rockefeller was so successful that at his death, his personal fortune was estimated at

$815,647,796.89, not to mention the $40 million in profits that the Standard Oil trust averaged every year. However, his methods of persuading small companies to join his trust were often less admirable than we might expect of an American folk hero.

Although Rockefeller often gained control by purchasing smaller companies in public, he also seized power privately or through proxy to hide the fact that his behemoth trust would soon destroy the smaller company. Moreover, if buying stock proved too arduous, Rockefeller sometimes hired armed Pinkerton Agents to "persuade" his competition to relinquish control. The Pinkerton Agents were famed for their clubwielding ability, and many a small business owner became familiar with the wrong end of those clubs.

____________________________________________________________________

Rockefeller demanded REBATES , or discounted rates, from the railroads. He used all these methods to reduce the price of oil to his consumers. His profits soared and his competitors were crushed one by one. Rockefeller forced smaller companies to surrender their stock to his control.

Rockefeller planned to buy out as many other oil refineries as he could. To do this, he often used hardball tactics. In 1874, Standard started acquiring new oil pipeline networks. This enabled the company to cut off the flow of crude oil to refineries Rockefeller wanted to buy. When a rival company attempted to build a competing pipeline across Pennsylvania, Standard Oil bought up land along the way to block it. Rockefeller also resorted to outright bribery of Pennsylvania legislators. In the end, Rockefeller made a deal with the other company, which gave Standard Oil ownership of nearly all the oil pipelines in the nation.

GROUP 3

Resource 1: Rockefeller retired from day-to-day business operations of

Standard Oil in the mid-1890s. Inspired in part by fellow Gilded Age tycoon Andrew Carnegie (1835-1919), who made a vast fortune in the steel industry then became a philanthropist and gave away the bulk of his money,

Rockefeller donated more than half a billion dollars to various educational, religious and scientific causes. Among his activities, he funded the establishment of the University of Chicago and the Rockefeller Institute for

Medical Research (now Rockefeller University).

Resource 2: http://www.pbs.org/wgbh/americanexperience/features/map-widget/titans-map/

Resource 3:

GROUP 4

By 1880, Standard Oil owned or controlled 90 percent of the U.S. oil refining business, making it the first great industrial monopoly in the world.

But in achieving this position, Standard violated its Ohio charter, which prohibited the company from doing business outside the state. Rockefeller and his associates decided to move Standard Oil from Cleveland to New

York City and to form a new type of business organization called a "trust."

Under the new arrangement (done in secret), nine men, including

Rockefeller, held "in trust" stock in Standard Oil of Ohio and 40 other companies that it wholly or partly owned. The trustees directed the management of the entire enterprise and distributed dividends (profits) to all stockholders.

When the Standard Oil Trust was formed in 1882, it produced most of the world's lamp kerosene, owned 4,000 miles of pipelines, and employed

100,000 workers. Rockefeller often paid above-average wages to his employees, but he strongly opposed any attempt by them to join labor unions. Rockefeller himself owned one-third of Standard Oil's stock, worth about $20 million.