econHO7 GDP

advertisement

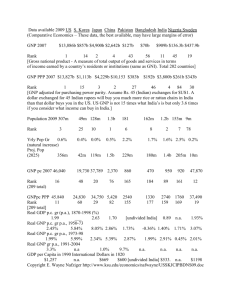

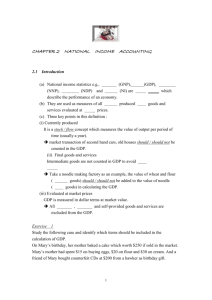

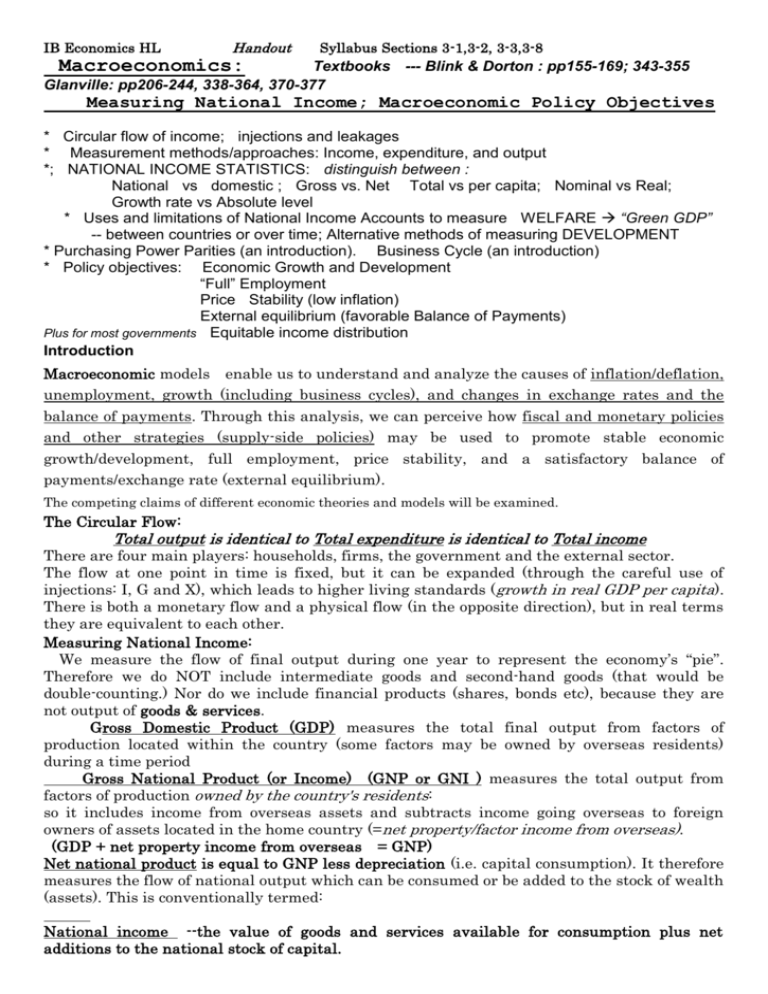

IB Economics HL Handout Syllabus Sections 3-1,3-2, 3-3,3-8 Macroeconomics: Textbooks --- Blink & Dorton : pp155-169; 343-355 Glanville: pp206-244, 338-364, 370-377 Measuring National Income; Macroeconomic Policy Objectives * Circular flow of income; injections and leakages * Measurement methods/approaches: Income, expenditure, and output *; NATIONAL INCOME STATISTICS: distinguish between : National vs domestic ; Gross vs. Net Total vs per capita; Nominal vs Real; Growth rate vs Absolute level * Uses and limitations of National Income Accounts to measure WELFARE “Green GDP” -- between countries or over time; Alternative methods of measuring DEVELOPMENT * Purchasing Power Parities (an introduction). Business Cycle (an introduction) * Policy objectives: Economic Growth and Development “Full” Employment Price Stability (low inflation) External equilibrium (favorable Balance of Payments) Plus for most governments Equitable income distribution Introduction Macroeconomic models enable us to understand and analyze the causes of inflation/deflation, unemployment, growth (including business cycles), and changes in exchange rates and the balance of payments. Through this analysis, we can perceive how fiscal and monetary policies and other strategies (supply-side policies) may be used to promote stable economic growth/development, full employment, price stability, and a satisfactory balance of payments/exchange rate (external equilibrium). The competing claims of different economic theories and models will be examined. The Circular Flow: Total output is identical to Total expenditure is identical to Total income There are four main players: households, firms, the government and the external sector. The flow at one point in time is fixed, but it can be expanded (through the careful use of injections: I, G and X), which leads to higher living standards (growth in real GDP per capita). There is both a monetary flow and a physical flow (in the opposite direction), but in real terms they are equivalent to each other. Measuring National Income: We measure the flow of final output during one year to represent the economy’s “pie”. Therefore we do NOT include intermediate goods and second-hand goods (that would be double-counting.) Nor do we include financial products (shares, bonds etc), because they are not output of goods & services. Gross Domestic Product (GDP) measures the total final output from factors of production located within the country (some factors may be owned by overseas residents) during a time period Gross National Product (or Income) (GNP or GNI ) measures the total output from factors of production owned by the country's residents: so it includes income from overseas assets and subtracts income going overseas to foreign owners of assets located in the home country (=net property/factor income from overseas). (GDP + net property income from overseas = GNP) Net national product is equal to GNP less depreciation (i.e. capital consumption). It therefore measures the flow of national output which can be consumed or be added to the stock of wealth (assets). This is conventionally termed: National income --the value of goods and services available for consumption plus net additions to the national stock of capital. (If measured by the expenditure method, it should be measured at factor cost:-- prices net of indirect taxes and subsidies) In practice, however, GNP or GDP figures are usually used as a rough measure of national income and thus of the country's economic performance. Note that GNP can be measured in three ways: outputs OR expenditures OR incomes We can obtain expenditure data (on consumption, investment etc.) more quickly and easily than output data. We can also use the income approach by adding up all wages , profits, rent and interest OR (more unusually), the output approach by finding the value-added by each firm in the economy. The effect of price changes (inflation) can be eliminated by dividing nominal GDP (at market prices) by a price index (the implicit price deflator or the Consumer Price Index ) and multiply by 100 Real GDP (i.e. at constant prices) Per capita GDP = GDP/population Problems with GDP figures: i.e. does an increase in GDP indicate an increase in WELFARE (i.e. standard of living/quality of life)? * The services of housewives, for example, do actually make a major contribution to national income, but this is not included in the GNP statistics because of measurement difficulties. Other economic activities that are omitted include criminal activities, subsistence farming and work for which the income is not declared in order to avoid paying taxes. * National income statistics are used to compare the standards of living between countries and over time, but there are problems in that the statistics may be misleading. For example, changes in GNP do not provide any information on changes in: the quality of goods, income distribution, population, the composition of total output, environmental conditions (social costs and benefits), civil liberties, amount of leisure time available etc. * International comparisons of absolute GNP figures usually use the current rate of exchange so that the figures have a common denominator (usually US $), but the information obtained in this way must be used with caution, because: foreign exchange rates may not be a good indicator of relative domestic purchasing powers of different currencies. Only the prices of goods and services which are traded internationally really affect the exchange rate, which is often usually significantly affected by capital movements and speculative activities. There should convert the different currencies using PPP (purchasing power parity) rates rather than exchange rates Main Economic Policy Objectives: (introduction to Section 3-3) A well-functioning macroeconomy is not troubled by either inflation/deflation or unemployment . But these problems persist, especially when seeking the long-term objective of steady economic growth/development. Unemployment (i.e. inside the ppf or below potential real GDP) Measured by the ratio: the number of those unemployed (seeking and able to work) the number in the labour force (employed and unemployed) But there are different causes & kinds so difficulty in measuring and providing appropriate policies . There is also “disguised” unemployment i.e. underemployment and discouraged workers (need better data e.g. on job openings to applications ratio) Inflationary/deflationay pressures Definition: Inflation is a sustained rise in the average price level Measured by % changes in the Consumer Price Index (CPI). (The Consumer or Retail Price Index measures the weighted average price of a set basket of goods).