topics outline - Rockhurst University

advertisement

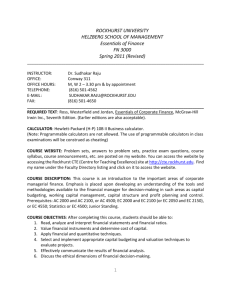

ROCKHURST UNIVERSITY HELZBERG SCHOOL OF MANAGEMENT Financial Statements Analysis FN 6450 Spring 2009 ________________________________________________________________________ INSTRUCTOR : Dr. Sudhakar Raju OFFICE : Conway 311 OFFICE HOURS : M, Th 1.30 - 3 pm & by appointment TELEPHONE : (816) 501-4562 E-MAIL : SUDHAKAR.RAJU@ROCKHURST.EDU FAX : (816) 501-4650 ________________________________________________________________________ TEXT: There is no primary textbook for this course. Readings are drawn from a number of different textbooks that are on reserve at the library. Course material is drawn from the following books: Financial Statements Analysis: A Valuation Approach, L. Soffer & R. Soffer, First Edition, Prentice-Hall Fundamentals of Corporate Finance, Ross, Westerfield & Jordan, 7th Edition, Mc-Graw Hill Irwin Analysis of Equity Investments: Valuation, J. Stowe, T. Robinson, J. Pinto & D. McLeavey. Published by the Association for Investment Management and Research (AIMR) for the Chartered Financial Analyst (CFA) Program. Financial Institutions Management: A Risk Management Approach, A. Saunders & M. Cornett, 6th Edition, Mc-Graw Hill Irwin. FINANCIAL CALCULATOR: Hewlett-Packard (H-P) 10B II Business calculator. (Note: Programmable calculators are not allowed in class examinations) COURSE WEBSITE: Problem sets, answers to problem sets, course syllabus, course announcements, etc. are posted on my website. The exact website address is: http://cte.rockhurst.edu/faculty.aspx?pgID=1584 You can also access the above site by accessing the Rockhurst CTE (Centre for Teaching Excellence) site at http://cte.rockhurst.edu . Find my name under the faculty listing and click on it to access my website. 1 COURSE DESCRIPTION: Financial Statements Analysis addresses the analysis and interpretation of financial information, its role in the valuation of financial instruments (stocks, bonds and derivatives) and the valuation of companies. The course also addresses the increasingly critical role of “off-balance sheet items” (options, futures, swaps, mortgage backed securities, asset backed securities, credit default swaps, collateralized debt obligations, etc.) in financial management. Topics include analysis and interpretation of financial ratios, measures for investment and company management and the current credit crisis. A considerable emphasis is placed on the causes and consequences of the current credit crisis. LEARNING OBJECTIVES: After completing the course, students should be able to: Read, analyze and interpret financial statements and ratios Forecast financial statements Value stocks using the dividend discount model Understand the impact of “off-balance sheet items” on firm value Develop a broad understanding of the valuation of “off-balance sheet” derivative instruments Explain a corporation’s capital structure COURSE REQUIREMENTS: A previous course in Finance (such as FN 6100: Financial Policy) Some knowledge of EXCEL. EVALUATION In Class Exams Projects, Cases, Papers = 60% = 40% The course grade is determined according to the following scale: A = 91 - 100% B+ = 85 - 90% B = 76 - 84% C = 60 - 75% F = Less than 60% 2 COURSE POLICIES 1. ASSIGNMENTS: You will get the most from the lectures if you get the required reading done before you come to class. I will also hand out problem sets periodically. 2. ATTENDANCE: You are required to come to all classes. If you are absent from a class you should get notes from a classmate and you are, of course, responsible for any tests or assignments missed. Excessive absences will result in a semester grade of DF. The college policy on attendance is contained in the Rockhurst University Catalog. 3. MAKE-UP EXAMS: In case you are required to travel for work related purposes during a scheduled mid-term examination date, please inform me at least a week ahead of time. Requests for make-up exams will be considered on a case by case basis. If you are given permission to take a make-up exam, the make-up exam must be taken within a week of the regularly scheduled exam date. Please call Lynn Ross at (816) 501-4200 to schedule the make-up exam. You will generally not be allowed more than one make-up exam over the course. Mid-term exams that are missed for any other reason will require you to take a comprehensive, essay based exam at the end of the semester to substitute for the missed exam. The HSOM follows the University’s policy and schedule regarding make up final exams in accordance with the final exam schedule published by the Office of the Registrar. Make up exams will only be administered by the HSOM on the dates and times indicated by the registrar. In addition, a $20 dollar fee will be collected from the student per university policy. 4. STUDENTS WITH DISABILITIES: Rockhurst University is committed to providing reasonable accommodations for students with disabilities. Please contact Sandy Waddell Director, Access Office (Massman Hall, Room 7, (816) 501-4689, sandy.waddell@rockhurst.edu) to provide documentation and request accommodations. If the Access Office has already approved accommodations, please communicate with the instructor(s) of this course regarding these arrangements by the second week of class in order to coordinate receipt of services. 5. RU OFFICIAL POLICY REGARDING STUDENT CONTACT INFORMATION: Student contact information must be kept current in order to receive important notices from Rockhurst University. Your contact information is online via your Banner Web account. Please check your local address, local phone number, and emergency contact information on Banner Web and revise as needed. All important university notices will be sent only to your RU email address. Please check your RU email account in addition to any other email accounts you may have. Accounts are activated at the Computer Services Help Desk (Conway 413). 6. RU ACADEMIC HONESTY POLICY: RU does not tolerate plagiarism and cheating. The Rockhurst University Catalog provides examples of academic dishonesty and outlines the procedures, penalties, and due process accorded students involved in academic dishonesty. All infractions will be immediately referred to the Dean's office. In your research paper, make sure you provide citations for all ideas and information that are not your own. 7. CLASSROOM CONDUCT: RU expects students to convey themselves with decorum. Leaving in the middle of class, using cell phones and pagers during class, surfing the internet during lectures, talking with other students, etc. violates appropriate classroom conduct. I reserve the right to make any amendments to this syllabus. 3 TOPICS OUTLINE SECTION 1 Financial Statements, Taxes and Cash Flows Chapter 2 of Fundamentals of Corporate Finance by Ross, Westerfield and Jordan Debt versus Equity The Balance Sheet and Income Statement Market Value versus Book Value Cash Flow from Assets Cash Flow to Creditors and Stockholders Working with Financial Statements Chapter 3 of Fundamentals of Corporate Finance by Ross, Westerfield and Jordan Sources and Uses of Cash Ratio Analysis DuPont Analysis Problems with Financial Statement Analysis Long Term Financial Planning and Control Chapter 4 of Fundamentals of Corporate Finance by Ross, Westerfield and Jordan Financial Planning Models Percentage of Sales Approach Scenario Analysis External Financing and Growth The Internal Growth Rate & Sustainable Growth Rate Equity Valuation, Firm Valuation & Dividend Discount Models Discount Rates in Valuation – Chapter 7 of “Financial Statements Analysis” by L. Soffer and R. Soffer. The Dividend Discount and the Flows to Equity Models – Chapter 8 of “Financial Statements Analysis” by L. Soffer and R. Soffer. Equity Markets and Equity Valuation – Chapter 8 of Fundamentals of Corporate Finance by Ross, Westerfield and Jordan The Cost of Capital Bond Valuation Equity Valuation Dividend Discount Models (DDM’s) Firm Valuation EXCEL APPLICATIONS: Building Financial Models for Valuation; Case Study Thursday, February 26, 2009: Thursday, March 5, 2009: Friday, March 6, 2009: Exam 1 (Tentative) No Lecture: Research Class / Group Meetings Research Project 1 Due 4 SECTION 2 Firm Value, Debt Financing & Valuation Chapter 9 - The Free Cash Flow Model and Analysis Chapter 10 - Forecasting Free Cash Flows Chapter 11 - The Adjusted Present Value Model (All the above chapters are from “Financial Statements Analysis” by L. Soffer and R. Soffer). The Capital Asset Pricing Model (CAPM) Estimating the Equity Risk Premium Understanding & Estimating Beta The Weighted Average Cost of Capital (WACC) Does Debt Policy Matter? The Modigliani-Miller Propositions Financing and Valuation How Leverage Affects the Cost of Capital Balance Sheet Risk Management: Asset Liability Management (ALM) in Financial Institutions Chapter 9 - Interest Rate Risk –II from “Financial Institutions Management: A Risk Management Approach” by Saunders and Cornett. . The Concept of Duration Balance Sheet Risk Management Balance Sheet Duration Management Immunization & Regulatory Considerations The BIS Regulations on Capital Adequacy Difficulties in Applying the Duration Model EXCEL APPLICATIONS: Estimating Beta and WACC, Case Study Exam 2: To be determined 5 ____________________________________________________________________ SECTION 3 Off Balance Sheet Items (Derivatives); The Real Options Approach to Valuation On and Off Balance Sheet Items Derivatives: Futures and Options Basic Option Positions The Real Options Approach to Valuation Valuing companies using the Merton model CMOs, CLOs & CDOs Derivatives and Balance Sheet Effects Thursday, April 30: Thursday, May 7: Exam 3 (Tentative) Final Project Due ________________________________________________________________________ IMPORTANT DATES Helzberg Leadership Speaker Series: March 9-13: Monday, April 13: May 7-13: Thursday, February 19, 7 – 8.45 pm Spring Break Easter Break – No class Final Exams Week 6